August 2024 / ESG

How say-on-pay voting is shaping trends in executive compensation

Some 15+ years after the introduction of say-on-pay voting, we assess its impact on the executive compensation landscape

Key Insights

- It has been more than 15 years since regulators in major markets began requiring companies to seek shareholder approval of their executive compensation plans via so-called say‑on‑pay votes.

- Recently, a shift of power has been evident in the U.S. and UK markets, with company compensation committees more willing to make decisions they know will be unpopular in the say‑on‑pay vote.

- In assessing compensation matters, we place high expectations on companies in our portfolios to maintain a strong connection between pay and performance, understanding there may be nuances and exceptions along the way.

More than 15 years have passed since regulators in major markets began requiring companies to seek shareholder approval of their executive compensation arrangements. These votes, which take various forms, are referred to as say‑on‑pay votes. In most markets where say‑on‑pay votes exist, the analysis of executive pay has an annual cadence. This short‑term focus creates a structure for investors to remain informed about the pay-related decisions that these corporations’ compensation committees make on our behalf each year.

However, it is also important to step back periodically and examine the long‑term trends evident within the executive incentive landscape. Accordingly, the purpose of this paper is to assess the compensation environment in two major markets—the U.S. and the UK—some 15+ years after say‑on‑pay voting was introduced.

We believe that the combination of these positive and negative after‑effects of say‑on‑pay has seen a new dynamic emerge in investor‑issuer dialogue on compensation—namely, resistance. We observe a nascent shifting of power taking place in these key markets, with frustrated compensation committee members more willing to make decisions they know will prove unpopular in the say‑on‑pay vote but that are, from their perspective, necessary to further the interests of the company. While the drivers of this trend are similar, the effects are playing out differently in the UK and the U.S. Given these different impacts, each environment warrants more detailed exploration.

Say‑on‑Pay

UK

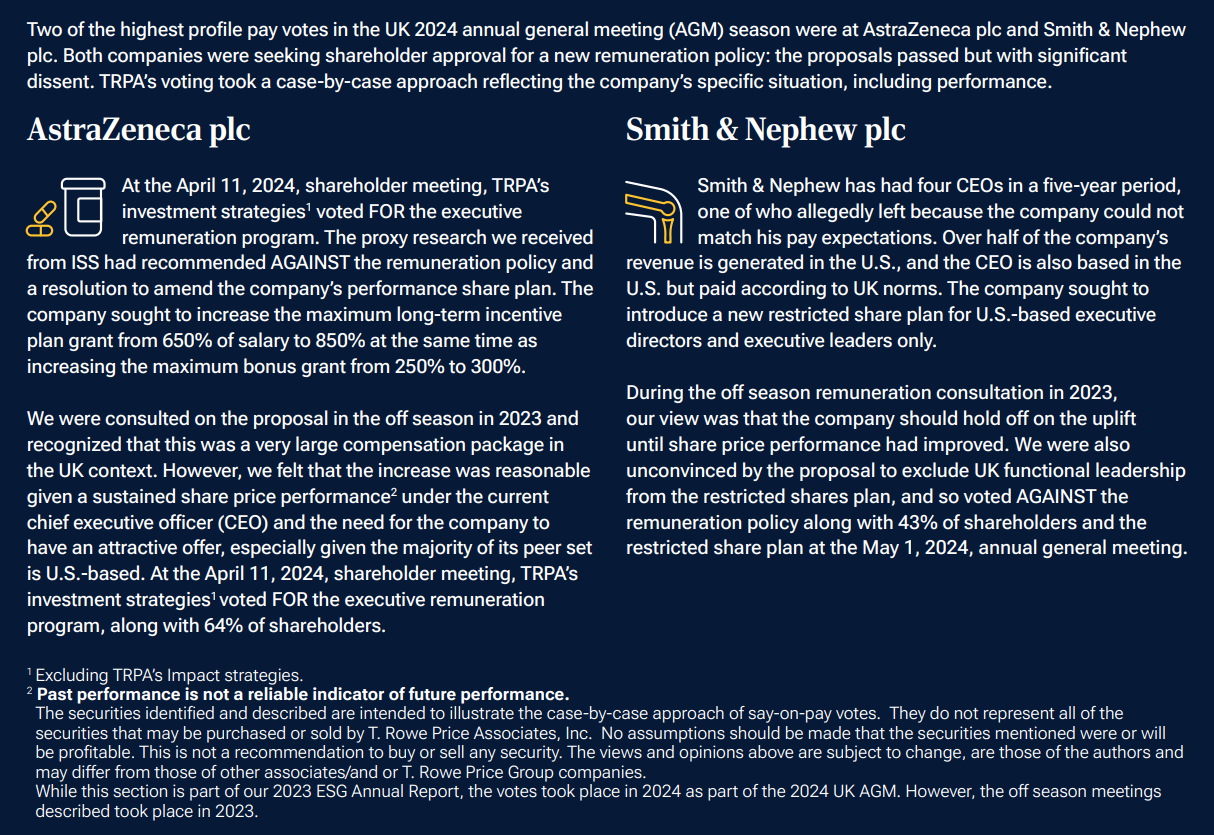

The UK market has both triennial forward-looking binding remuneration policy votes and annual backward-looking advisory votes on a company’s remuneration report. Companies seeking to increase the size of the pay envelope must get advance support through the remuneration policy vote. Investors expect that companies will consult in advance on any significant change to the remuneration policy, leading to robust dialogue between the chair of the remuneration committee and the company’s top investors before the meeting materials are published. This allows investors the opportunity to provide input to the company’s proposals, which the company hopes will lead its investors to support what is ultimately proposed at the annual meeting of shareholders.

The degree of consultation in the UK market is unusual compared with other markets. In recent years, this mechanism has allowed asset managers to encourage companies to show restraint in setting executive pay. UK policymakers and asset owners have also added weight to this push for restraint, given that they see social inequality as a growing systemic problem.

However, for the last 18 months, there has been a rising clamor from the corporate sector, questioning whether this focus on compensation restraint is inhibiting the global competitiveness of UK companies. Concerns have been raised by certain board chairs regarding the ability of UK companies to attract top talent from the U.S., which is a particular impediment if the company is UK incorporated but the bulk of its operations, customers, and revenues are U.S.-based. The concerns relate to total pay quantum as well as framework design. Much of the criticism, for example, centers on the outsized role that proxy advisors are thought to play in determining the vote outcome. However, a 2023 report from the UK Financial Reporting Council,1 the regulator that oversees the UK Stewardship Code, sought to build an evidence base on this contentious topic. It found that a vote of 20% or more against a resolution relating to director elections or remuneration occurred in only half of the cases where one or both of Institutional Shareholder Services (ISS) or Glass Lewis, the two largest proxy advisors, had made such a recommendation in 2022, although this increased to 77% of cases when both did so.

The debate on UK competitiveness is not restricted to pay. Other concerns expressed by company chairs include whether the UK Stewardship Code’s focus on reporting outcomes has fostered an adversarial tone to investor-company dialogue. And whether the UK corporate governance framework, which for a long time has been seen as an international gold standard, is overly restrictive to the point that it may be discouraging companies from listing in London.

TRPA casts proxy votes with the objective of best supporting the long‑term success of our investee companies. We take account of accepted UK good practice, but we are also open to supporting non‑standard plans offering a compelling rationale. To inform our case‑by‑case assessment of nonstandard pay practices, we expect to be consulted in advance by the companies where we have a significant holding.

U.S.

In the U.S., say‑on‑pay votes are generally held annually. They are backward-looking and advisory in nature. In essence, they serve as a shareholder referendum on the compensation committee’s decisions over the past year. Although they are non‑binding, our experience over the past 15 years has been that most companies that have not received strong support (generally, more than 80%) for their pay votes have been genuinely interested in seeking subsequent feedback directly from their largest shareholders. If the weak level of support indicated a serious concern with the terms or structure of the underlying plan, boards have generally been willing to address these in advance of the next vote.

However, we began to observe a shift in this stance after the outbreak of the coronavirus pandemic in 2020. In the two years that followed, the already complex environment for compensation design became, in many cases, unmanageable. Several economic sectors saw dramatic declines in market capitalization as investors predicted a prolonged period of consumer spending headwinds. The volatility in their stock process caused many companies’ performance‑based awards to become worthless (or at least their vesting became highly improbable) due to factors clearly outside the control of management teams. Faced with the unprecedented circumstances, and a pressing need to retain stability in key leadership positions, many U.S. compensation committees elected to implement stopgap measures. These included special retention awards and/or a resetting of the terms of executives’ original performance-based awards.

Given the uncertainty of the time, we observed considerable tolerance on the part of investors during the 2020 proxy voting season as companies put these stopgap measures into place. However, that same degree of flexibility from investors was extended to far fewer companies in the following two years. Nevertheless, the use of “special retention grants” suddenly became a common way for compensation committees to replace previous equity awards that lapsed unvested due to the pandemic or other factors. We have observed a distinct change in tone from companies using such awards over this time. In the past, companies were quite hesitant to make use of awards that they knew would be opposed by many of their shareholders. Currently, however, it seems U.S. compensation committees have little fear of say‑on‑pay backlash and will readily implement special awards if they deem them necessary.

Moving forward

Overall, our conclusion is that the current state of issuer-investor engagement on compensation matters is less constructive than originally hoped. While a general shift has been evident among issuers in recent years, leading to a deterioration in alignment with investors, issuers also argue that:

- Some investors are unnecessarily rigid in their expectations of pay programs and do not take company-specific circumstances into account

- Investors are overly focused on the absolute amount of executive pay and do not appreciate the intensity of competition for top executive talent

- Investors rely too much on the advice of proxy advisors on pay matters, although the Financial Reporting Council’s (FRC) research also found that 75% of investors who responded to the FRC’s questionnaire requested voting research based on the investor’s own in-house, customized, voting policies rather than a proxy advisor’s standard policies

- Investors are not forthcoming with their feedback and may oppose pay programs without any advance notice to the company, undercutting the spirit of engagement

We agree that some 15 years after the arrival of say‑on‑pay votes, there is still much room for improvement in executive pay practices, investors’ understanding of them, and overall alignment of executives’ and investors’ interests. However, we find the criticism coming from some issuers on this point is not fully supported by the facts, as highlighted in the FRC study cited above. Our engagement on compensation matters is continually aimed at reducing these areas of friction.

A particular area of focus for us in the U.S. this year is the use of performance-contingent equity. Performance stock units (PSUs) were designed expressly for the purpose of linking executive pay with specific performance goals. In theory, they should have improved the alignment of interests with investors. However, after a period of rapid adoption of PSU-based plans, frequent redesigns of the terms of the awards, and constant pressure from proxy advisors and compensation consultants to build incentive programs around PSU awards, our conclusion is that they are not working as originally intended.

Through engagement with many U.S. companies, we are encouraging compensation committees to take a more bespoke approach to plan design—one that meets the company’s specific challenges. In short, our observation is that PSUs are not the only way (or the best way) to construct a performance-based approach to pay.

TRPA Say‑on‑Pay Voting

(Fig. 1) Our approach is pragmatic, investment-centered, and independent.

Source: T. Rowe Price Associates, Inc.

Conclusion

Remuneration is only one topic within the array of corporate governance issues we follow at TRPA. However, it is a topic of heightened importance to corporate executives, board members, asset managers, and our clients. Incentives are clearly significant drivers of behavior and outcomes, which is why this subject area merits our time and focus.

We are proud of our pragmatic, investment-centered, and independent approach to compensation assessment of companies at TRPA. We do not rely on outside advisors for this analysis, and we do not outsource decision-making. We look at the context within which each company makes its pay decisions: its industry, life‑cycle stage, performance, competitive environment, and need for talent. We place high expectations on the companies in our portfolios to maintain a strong connection between pay and outcomes delivered to investors, but we also understand that exceptions and nuance may be necessary along the way.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.