August 2024 / ESG

Linking corporate profits with natural capital in the Amazon rainforest

Linking corporate profits with natural capital in the Amazon rainforest

Key Insights

- The planetary boundaries framework illustrates how deforestation can have a compounding effect on other ecosystem services, calling into question the long‑term viability of the natural capital inputs that have been underpinning corporate profits for beef producers in the Amazon.

- Exposure to Brazilian beef can be found in companies that are direct producers as well as the supply chains of many corporate issuers.

- Deforestation in the Amazon is an extremely complex issue. A combination of quantitative data, fundamental research, and stewardship activities has helped us assess the potential financial risks to companies with exposure to beef production in the Amazon.

The world is made up of a web of self-regenerative entities called “ecosystems.” The character and scale of an ecosystem can range widely. For example, an ecosystem could be as small as an animal’s gut or as large as a tropical rainforest. Due to their interrelatedness, degrading one ecosystem creates a likelihood that there will be a knock-on effect to other ecosystems. As the corporate, sovereign, and other issuers in which we invest derive various economic benefits from the natural world, the health of this web of ecosystems is a relevant investment issue. These ecosystem benefits come from two main sources—firstly, the provisioning of goods (i.e., food, timber, freshwater, etc.) and, secondly, the ecosystem services that allow for regeneration and stability (i.e., climate regulation, water filtration, flood management, etc.).

Land system change and corporate profits

A good investor will be keen to understand the long-term availability of whatever natural goods are being procured as well as any knock-on effects their removal could have on the ecosystem services that allow for this natural good to be available. For example, if a company repurposes a mangrove swamp in order to set up a shrimp farm, an investor will want to understand the management practices in place that will impact cost structure and the longevity of the farm (i.e., what is the trade‑off in the costs of applying sustainable management practices versus the extendable life of the farm) as well as how the presence of this farm may impact the ecosystem services that allow it to be productive (i.e., storm protection, water filtration, etc.).

Assessing the relationship between financial outcomes and a nature- or biodiversity-related system change tends to require qualitative analysis. In the case of climate change, or more specifically, greenhouse gas (GHG) emissions, it is relatively easy for an investor to discreetly measure an issuer’s exposure and apply a carbon tax (or their assessment of future carbon taxes). When we look at a topic like land system change, it generally requires more fundamental or qualitative analysis to translate into a discreet line in a financial model or valuation assessment.

There can be a perception among investors that the systemic change is an uncertain event or something that is so many years away it is beyond a reasonable investment time horizon or that it should be viewed as a binary risk. We think the combination of increased scientific data, regulatory action, and, in some cases, changing customer preferences makes this perception outdated. Understanding the natural capital inputs of a business and the factors that may cause them to change (i.e., continued availability or cost structure) can help investors identify investment risks and opportunities.

Deforestation in Brazil and the bottom line

Thanks to higher demand from rising population and higher global incomes, global beef production rose 38% from 1990 to 2022. During this same period, Brazilian beef production rose 152%, moving the country from a 7.4% market share in 1990 to a 13.6% market share in 2022.1 The surge in beef production helped drive Brazilian gross domestic product (GDP) and created a favorable investment environment. This was partly catalyzed by the government’s intent to create national champions in the agribusinesses, but another important factor was the low cost of beef production in Brazil, driven in large part by ample access to grazing pasture in the Amazonian states.

The economic megatrend Brazil enjoyed as it became a dominant beef producer was underpinned by cheap grazing pasture. Thanks to the availability of land, Brazilian ranchers could be competitive despite low productivity. Brazil’s cattle herd is 2.4 times the size of the U.S. herd; however, its beef production is only 60% of that of the United States.2 The productivity shortfall is attributed to cattle ranchers doing relatively little to manage soil fertility, which has meant pastures quickly become unproductive. This issue is seen to be most acute in the Amazonian states, which have accounted for 94% of the increase in Brazil’s cattle herd.2

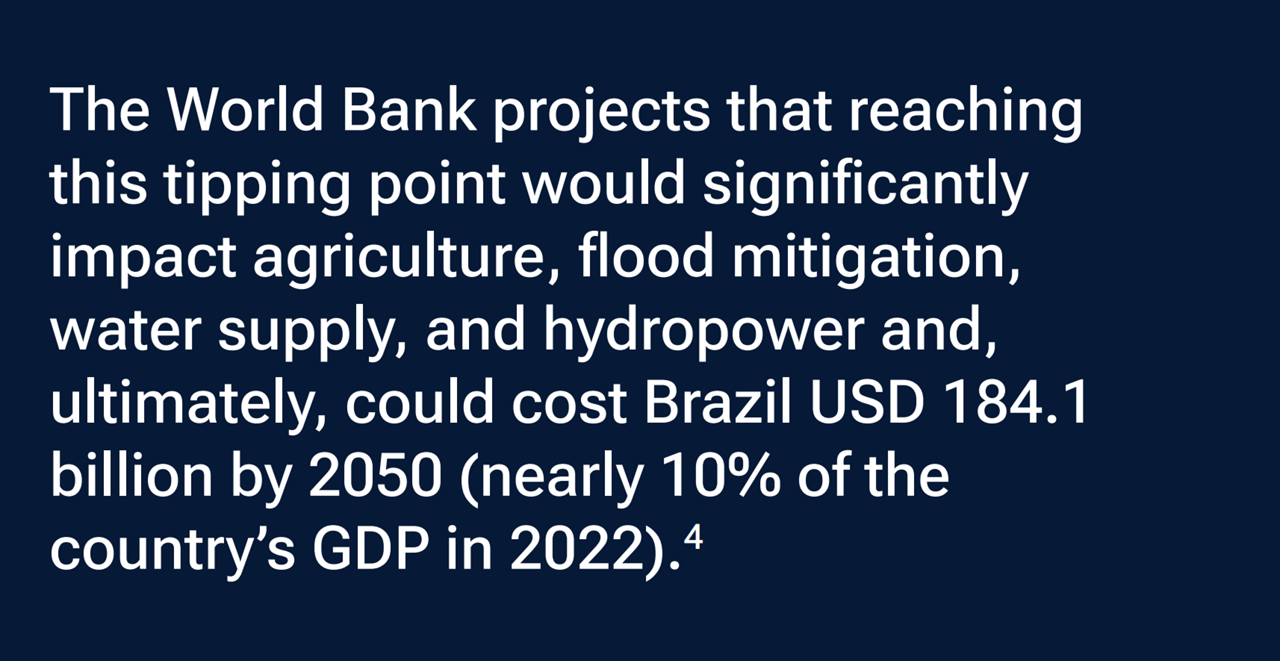

To date, around 20% of the Amazon has already been deforested and an additional 6% is highly degraded. Scientific studies suggest that the rainforest will hit a “tipping point” that will drive a dieback of significant portions of the Amazon if deforestation reaches 40%. Studies also suggest that the recent drying patterns experienced in the region could be the first warning signal.3 If this occurs, the free lunch that underpinned this Brazilian megatrend could be over. At best, the ranchers will need to invest to improve their competitiveness. At worst, the Amazon will be too degraded to provide the ecosystem services that have been supporting their business.

The loss of ecosystem services and corporate profitability

Given Brazil's dominant position as a producer and exporter, exposure to Brazilian beef can be found in companies that are direct producers as well as the supply chains of many corporate issuers. The view that these companies have benefited from the ecosystem services provided by the Amazon rainforest is broadly accepted. For investors focused on delivering financial returns, the key question is understanding how to navigate the potential loss of a key factor that has underpinned a long-term growth trend. This means taking a view on regulation that could step in to protect the Amazon as well as the effectiveness that changes to corporate practices could have on stabilizing these ecosystem services.

Evaluating the impact of ecosystem services on corporate profit and loss (P&L) is not as easy as feeding the impact of a carbon tax through a financial model. A combination of quantitative data, fundamental research, and stewardship activities have helped us assess the potential financial risks to companies with exposure to beef production in the Amazon.

Banking on better corporate practices to mitigate systemic risk

Three big meat companies make up around 10% of Brazil’s beef supply, with the rest being composed of smaller producers. Additionally, about 75% of beef is consumed locally. To date, smaller producers have tended toward poorer deforestation controls, and local consumers have had lower sustainability requirements than most export markets. This means that the business practices of large, global players will likely have only a limited impact on stemming the systemic risk of Amazon deforestation.

Furthermore, Brazil’s cattle supply chain is convoluted, with thousands of suppliers stretching over vast areas. It is common for cattle to be moved multiple times from ranch to ranch through the life cycle, which can obscure, or “launder” their connection to farms with deforestation. Many large meat companies in Brazil already enforce “no deforestation” policies with direct suppliers. However, traceability of indirect suppliers is a significant hurdle. It is through these ranchers lower down the cattle-fattening supply chain that most deforestation enters the beef supply chain today.

There is currently very little tracking of cattle from birth to slaughter in Brazil, making it hard for finishing farms to confirm the source of cattle. We have seen some companies adopt tools that aim to create traceability of monitoring by using specific databases, but legislative and data privacy constraints remain. Other companies have decided to look at how blockchain technology could create a database of cattle transactions that protects confidentiality and prevents data tampering. However, this relies on a voluntary supply of information from the ranchers.

Planetary boundaries and the Brazilian rainforest

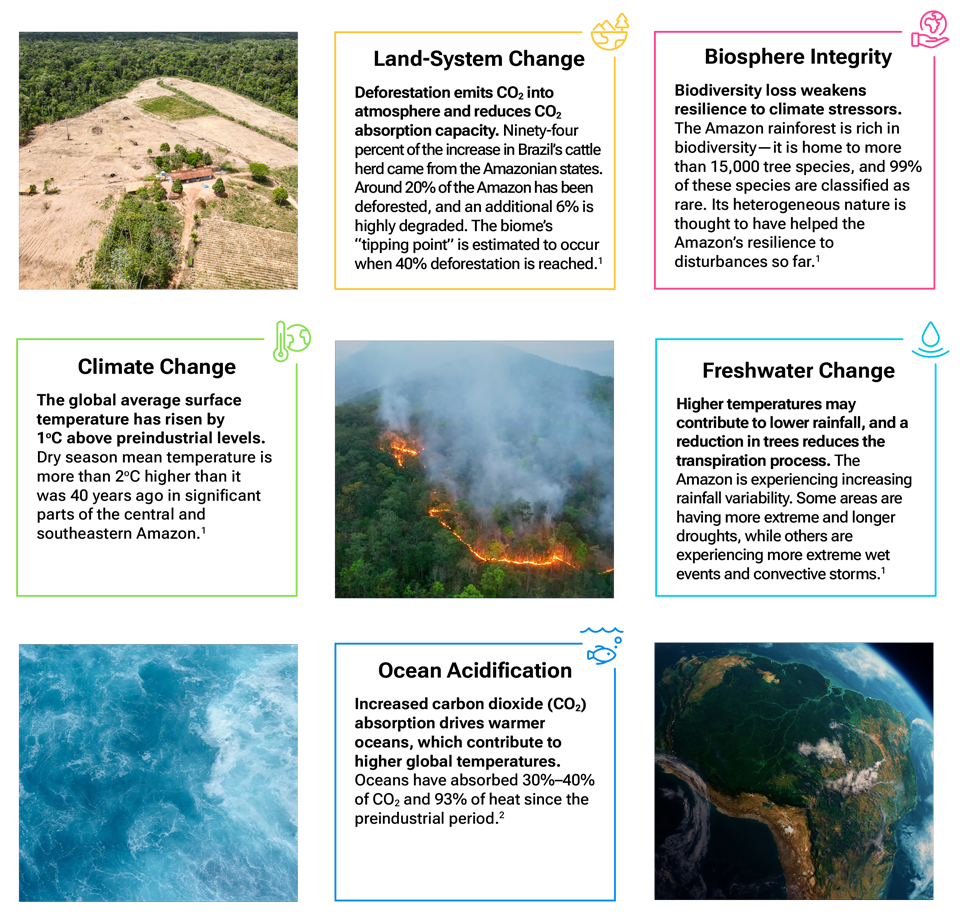

The planetary boundaries framework, which is tracked by the Stockholm Resilience Centre (Stockholm University), identifies nine planetary processes whose interplay can determine the stability of the biophysical Earth system and defines the critical threshold for each of these processes. Moving beyond the critical threshold represents the point at which the system can no longer persist or adapt to feedback loops and will transform into something entirely different. The Amazon rainforest is a good example of how several of the processes identified in the planetary boundaries framework interact to determine the path for climate stability—namely biosphere integrity, land‑system change, freshwater change, climate change, and ocean acidification.

In this case, land‑system change occurs on a significant scale as rainforest is converted into grazing land, which in turn reduces biosphere integrity as plant and animal species are degraded or lost. Freshwater change is being experienced in the form of increased rainfall variability—i.e., more frequent and extreme droughts in some regions of the Amazon and more extreme wet events in others. Furthermore, the tree loss reduces the natural cooling effect that comes from a forest. Rising temperatures are expected to increase thermal stress, potentially reducing forest productivity and carbon storage capacity,5 which further exacerbates climate change.

On a global scale, oceans play a role as they absorb much of the atmospheric heat generated from higher GHG emissions, and a portion of the increased carbon dioxide (CO2 ) emissions are dissolved into the oceans. This drives increased ocean acidification, which, in turn, reduces the resiliency of the ocean.

Ecological resistance and the Amazon rainforest

(Fig. 1) How the planetary boundaries interact to determine the path for climate stability

1 Critical Transitions in the Amazon (Nature Vol 626), February 2024.

2 The Physical Science Basis, Intergovernmental Panel on Climate Change (IPCC), 2021.

Government action to mitigate Amazon deforestation

The Amazon rainforest biome is spread across multiple countries—Brazil holds 60% of it, but the rest is shared with its neighbors. While the regulation may sit across multiple countries, the ecosystem impact does not. For example, the Amazonian territories of Bolivia, Colombia, Ecuador, and Peru are dependent on water originating from Brazil’s portion of the rainforest.

Under Jair Bolsonaro's presidency, deforestation of the Amazon surged as economic growth was prioritized. When Luiz Inácio Lula da Silva took office in 2023, he pledged to end deforestation by 2030 and placed a renewed focus on environmental law enforcement. According to the country’s National Space Research Institute (INPE),6 around 5,000 square kilometers of the Amazon were cleared in 2023 versus around 10,000 square kilometers cleared in 2022.

Increased regulation outside of South America will play a role, as well. For example, the European Union (EU) has enacted two new laws that encompass deforestation. The EU Deforestation Regulation forbids imports of commodities produced on deforested land starting in 2024 and the Corporate Sustainability Due Diligence rules force companies to scrutinize their supply chains for environmental damage. As a result, there will likely be smaller markets for higher deforestation-risk commodities in the future, and companies that have adopted traceability monitoring and tools will be in better stead to adapt to new regulations.

Ultimately, there is a chance that stricter regulations may increase the price of commodities for the EU, with less impact on deforestation than hoped. The EU’s "do no significant harm" (DNSH) test, which forms part of the EU’s sustainable finance rules, asks investors to demonstrate that they are not supporting or carrying out economic activities that do significant harm to any sustainable objectives. So, without a feasible solution to ensure robust traceability of cattle from birth to slaughter, investors could be forced to consider failing companies on DNSH.

Assessing deforestation risk

Our Responsible Investing team supports our equity and credit portfolio managers and analysts by undertaking in-depth analysis at a corporate level to assess exposure to deforestation in the Amazon. Our Responsible Investing Indicator Model (RIIM)7 utilizes environmental, social, and governance (ESG) datasets to help identify companies with elevated exposure in either their own operations and/or supply chains. For select issuers, our analysis will be enhanced with fundamental research.

ESG considerations such as deforestation form part of our overall investment decision making process alongside other factors to identify investment opportunities and manage investment risk. At T. Rowe Price this is known as ESG integration.

Engagement plays a role as well. It helps us understand how companies are managing their exposure and how it fits into their corporate strategy. It also helps us impart our view on best practices that we believe will ultimately yield a better long-term financial outcome for our clients.

Countries step up commitments to address deforestation

(Fig. 2) Increased regulation outside of South America will play an important role.

As of May 2024.

Sources: T. Rowe Price, United Nations, European Commission, Kunming-Montreal Global Biodiversity Framework, The Bonn Challenge.

When we engage with meat buyers, such as large quick-service restaurants (QSRs), we look at whether indirect supplier monitoring is taking place or considered within the process. Some of the biggest risks that we consider relate to supply chain and raw material sourcing. There are some players demonstrating more advanced efforts than others on their sourcing processes, and therefore presenting lower risk of controversy or reputational damage. That said, our knowledge of the complexities around Latin American beef supply chains lends to our conservative approach when scoring major beef consumers and QSRs in our proprietary RIIM.

Bilateral and collective engagements with meat companies give us the opportunity to discuss indirect supply chain monitoring. This can include:

- Engaging protein producers in discussions about ESG issues that investors and policy experts consider material.

- Providing companies with a forum to not only communicate policy intentions and actions to the investment community but also to receive feedback on them.

- Highlighting issues that act as hurdles to the implementation of best practices, such as government data transparency.

- Discussing the impact of government policy.

Conclusion

While we see shortcomings in companies’ ESG preparedness for deforestation, it is important to consider the progress made—including a significant uptick in their ambitions and investments into tools that can support traceability. We believe that corporates that take reasonable steps to prepare for tightening regulations and focus on minimizing their exposure to deforestation risk in their supply chains will be better placed to weather future changes. Investors need to bear in mind that deforestation in the Amazon is an extremely complex issue and cannot be solved by company action alone. A combination of quantitative and qualitative inputs and fundamental research is essential for investors looking to evaluate meat companies’ deforestation risks. Crucially, constructive engagement aimed at improving shareholder value is one of the most effective tools to creating positive change in this area.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

August 2024 / ESG

August 2024 / FIXED INCOME