August 2024 / ESG

Could GLP-1s help rebalance the food trilemma?

Anti-obesity medications could play a key role in balancing the food trilemma

Key Insights

- The global food system is closely tied to seven of the nine processes within the planetary boundaries framework.

- We see signs of environmental and health tipping points in global food due to the clear shift in global diets from “food poor” to “food rich” issues.

- Anti-obesity medications could play a key role in balancing the food trilemma but may also have broad implications that alter public attitudes toward food and obesity, potentially leading to healthier and more productive societies.

The clear shift in global diets from “food poor” to “food rich” issues has highlighted signs of environmental and health tipping points in global food. This raises the possibility of a meaningful change in consumer attitudes and government policy on food. While both health and environment are contributing to the “hidden costs” within our food system, we believe there may be more catalysts for change from a health perspective due to the escalating pressure of health care costs on national budgets, reduced workforce productivity, and the emergence of glucagon-like peptide-1 (GLP-1) drugs and other anti-obesity medications.

Balancing health, diet, and environment

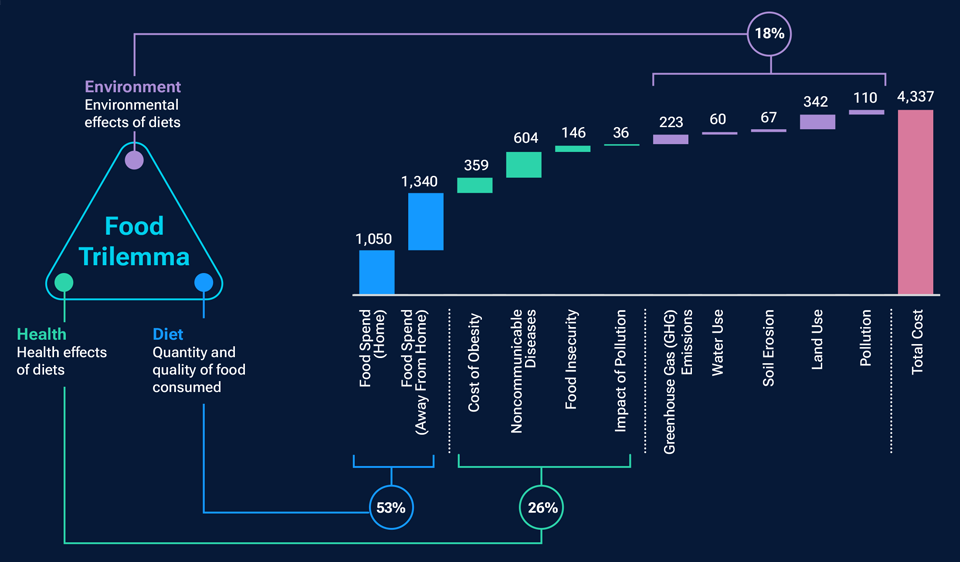

(Fig. 1) Diet, health, and environmental costs as a proportion of the total cost of U.S. food

Costs are in USD bn. % figures show diet, health, and environmental costs as a proportion of the total cost of U.S. food. Total may not sum due to rounding.

Note: The cost of purchasing food accounts for around 50% of the total cost of food in this trilemma. For a food system to be sustainable it has to address the total cost of food to society.

Sources: Analysis by T. Rowe Price; health and environmental cost estimates are sourced from the Rockefeller Foundation (as of July 2021), food spend is sourced from the U.S Department of Agriculture, as of February 14, 2024.

The food trilemma and the planetary boundaries

Over the past 50 years, a dramatic shift in diets has had wide‑ranging consequences for the environment and human health. Growing affluence and urbanization has driven calorie consumption higher, with global diets now including more ultra‑processed food and animal products. Looking at this shift through the lens of the food trilemma, we see that changes in global diets have been negatively impacting human health (due to food quality and quantity) and the environment (due to increased agricultural activity). Consumers only pay for around half of the total societal cost of food—the rest is borne by broader society as governments are forced to remediate the environmental and health costs associated with today’s diets.

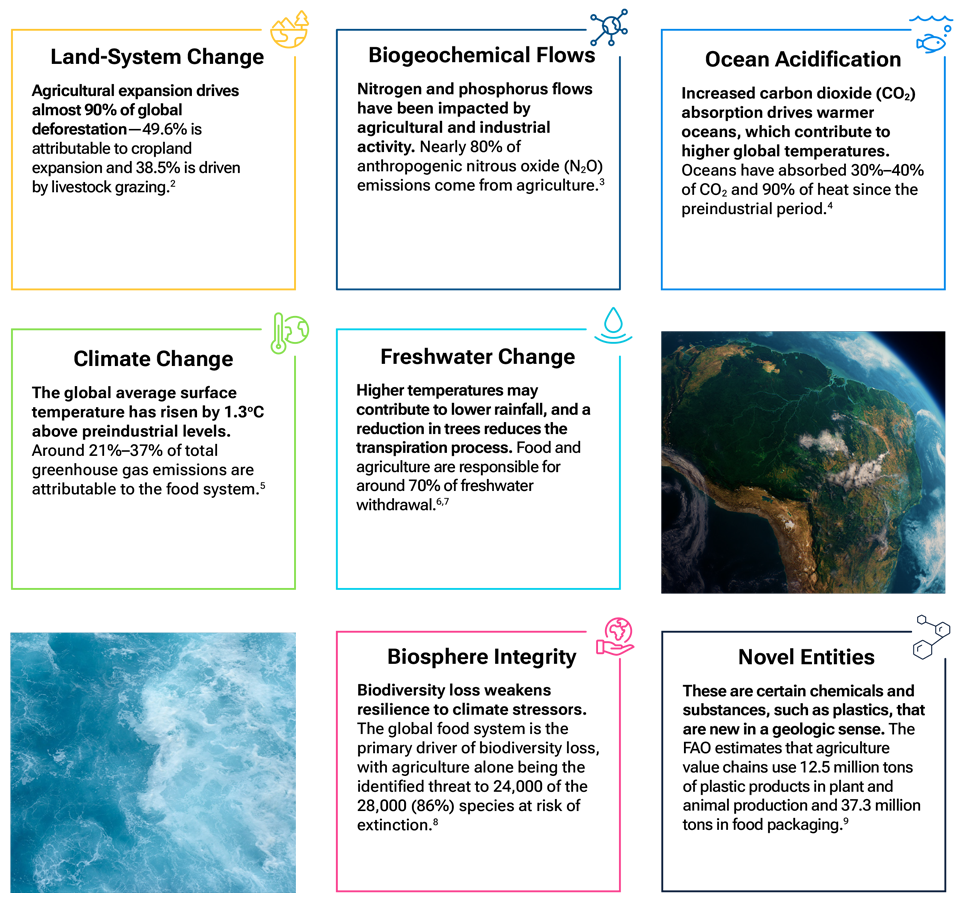

The global food system is closely tied to seven of the nine processes within the planetary boundaries framework1—namely biosphere integrity, land-system change, freshwater change, climate change, novel entities, biogeochemical flows, and ocean acidification. With agriculture contributing around a quarter of GHG emissions, tackling the environmental impact of the food system is critical to achieving net zero.2 However, with cost‑of‑living pressures being experienced around the world, the political will to enact new regulation on farmers is limited.

The global food system and the interaction of planetary boundaries

(Fig. 2) How different processes interact to determine the path for climate stability1

1 The other two planetary boundaries not featured in this graphic are Atmospheric Aerosol Loading and Stratospheric Ozone Depletion.

2 Food and Agriculture Organization of the United Nations (FAO), 2020.

3 Source: United Nations environment, FRONTIERS 2018/19—Emerging Issues of Environmental Concern, March, 2019.

4 Intergovernmental Panel on Climate Change (IPCC), 2021.

5 IPCC, 2019.

6 FAO, 2020.

7 Freshwater withdrawal refers to freshwater taken from ground or surface water sources.

8 United Nations Environment Programme, 2021.

9 FAO, 2021.

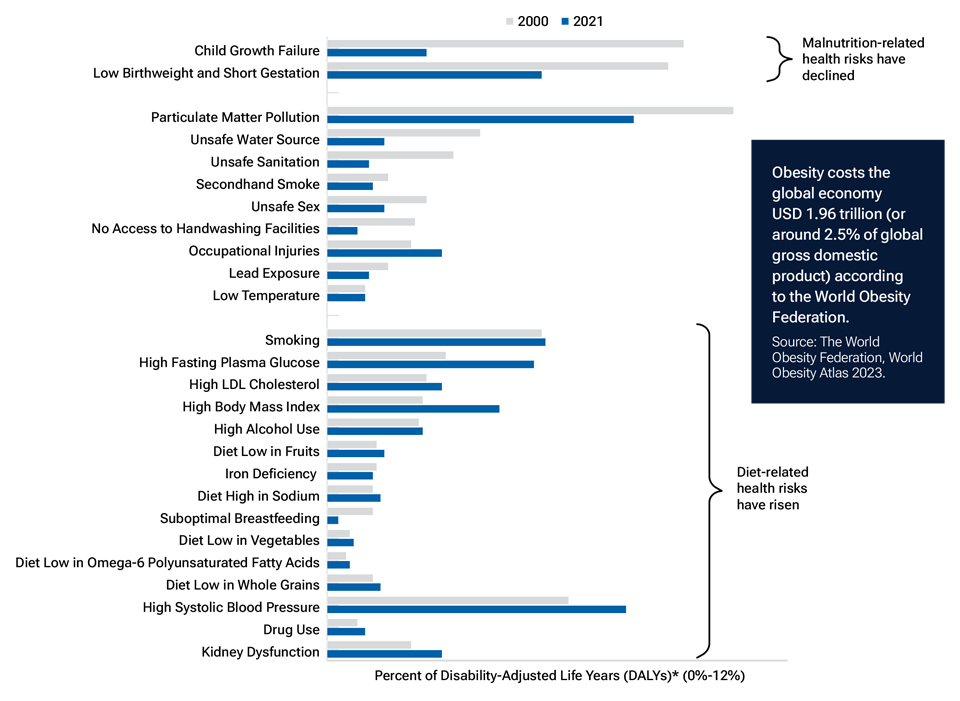

The rising costs of diet‑related diseases

Obesity is an increasingly common byproduct of the food system in almost all countries. In contrast to the outdated view of Western economies with “too much” food and emerging market economies with “not enough” food, obesity is now dominant in almost all countries. According to the World Health Organization (WHO), 1 in 8 people in the world are obese.3 With the societal burden of obesity increasing so dramatically in the last four decades, the number of disability-adjusted life years (DALYs) lost due to excess body mass index (BMI) has doubled, representing a greater increase than any other leading health risk.4 Obesity and other metabolic risk factors are now the dominant drivers of disease globally.

Global diet-related health risks on the rise while malnutrition-related health risks have declined

(Fig. 3) Change in profile of leading health risks (2000 vs. 2021)

*DALYs: DALYs are the sum of years of life lost due to premature death and years lived with disability due to health conditions or diseases that affect a particular population. One DALY represents the equivalent of one year of healthy life lost due to premature death and disability.

Note: The 0%-12% of DALYs on the x-axis refers to the percent of the estimated global burden of disease, measured in disability adjusted life years, attributable to a given risk factor identified in the chart. The bars illustrated in this chart do not add to 100 as they show only the 25 most significant health risk factors.

Source: Global burden and strength of evidence for 88 risk factors in 204 countries and 811 subnational locations, 1990–2021: a systematic analysis for the Global Burden of Disease Study 2021. The Lancet (2024).

Alongside the general increase in obesity prevalence in almost all countries, the prevalence of severe obesity (BMI ≥ 40 per the Centers for Disease Control and Prevention (CDC) definition) greatly increases the cost of obesity. At a BMI of 30–35, median survival is reduced by two to four years, but at a BMI of 40–45, median survival is reduced by eight to 10 years (comparable to the effects of smoking).5,6 From an economic perspective, while obese patients accrue around 30% higher direct medical costs on average, severe obesity results in significantly more direct expense. In the U.S., the CDC relies on an estimate of USD 173 billion in obesity-related medical costs. Over 30 units of BMI, each additional unit of BMI resulted in additional cost of USD 253 per person.7 This has contributed to a more than doubling of medical spending in the U.S. on obesity in the last 20 years.8

We expect that anti-obesity medications (AOMs) such as GLP-1s will play an unquestionable long-term role in balancing the food trilemma by directly addressing obesity as a key health pressure point and a dominant outcome of food systems. However, we also believe that their uptake, alongside other factors such as scrutiny of ultra-processed food, could have much broader implications for public attitudes toward food and obesity.

GLP-1s are amplifying the narrative that obesity is not a failure of individual willpower, but a byproduct of the food system and a disease. The advent of GLP-1s, alongside scrutiny of ultra‑processed food, could therefore increase public awareness of the science of food reward and health costs of contemporary diets. This raises the question of what (if any) measures will different societies take to address the underlying food system drivers of obesity.

Data suggest that GLP-1 treatment reduces food cravings and alters the types of food consumed.9,10 Rather than simply reducing the quantity of food consumed, patients substitute unhealthy food like sugary drinks, chocolate, and salty snacks with fresh produce, poultry, and fish.

While some patients are able to sustain weight loss by continuing healthier eating habits and other lifestyle changes, with currently available therapies, many patients regain weight after ceasing treatment.11,12 This reflects an underlying issue with food environments that promote weight gain. There are clearly several components to this, but a shift in diets toward ultra-processed food—especially in the U.S. and the UK—is a key driver. Ultra‑processed food consumption is also accelerating in emerging markets.

The science of food reward

In addition to physiological energy needs, food intake is driven by pathways involved in reward processing and reward-motivated behaviors. The palatability of food is a crucial determinant of the decision to eat; food today is often explicitly engineered to be hyper-palatable and create the visual cues associated with increased craving that can trigger food intake in the absence of physiological energy needs.

Obesity traditionally has been perceived as a failure of individual willpower, but this neglects both the physiology of excess BMI and how the food system contributes to its prevalence. The food system itself is designed in such a way that in many countries, energy-dense foods composed of refined grains, added sugars, or fats often represent the lowest-cost option for consumers.13

More scrutiny of food companies?

It is increasingly likely that food companies could face potentially more stringent regulatory regimes in individual markets due to closer scrutiny of their role in public health. On a much longer‑term time horizon, the scale of obesity as a global health issue also raises the (albeit now seemingly slim) prospect of international multilateral efforts to combat its spread. While both the United Nation’s 2000–2015 Millennium Development Goals and 2015–2030 Sustainable Development Goals have focused on hunger, perhaps the next round of goals could more specifically focus on reducing obesity.

At first glance, this draws similarities with tobacco—growing public awareness of health harms, stricter national regulation, and global initiatives (e.g., the WHO Framework on Tobacco Control treaty) also characterized efforts to combat the societal cost of smoking. However, we do not believe the food and tobacco sectors are directly comparable. First, nutritious food is a prerequisite for health—there is not the same clear existential threat from health concerns for food companies as those posed to cigarette smoking. Second, food companies can reformulate products to address health concerns, and health-focused product offerings are a significant strategic opportunity.

Environmental, social and governance (ESG) considerations such as the food trilemma form part of our overall investment decision‑making process alongside other factors to identify investment opportunities and manage investment risk. At T. Rowe Price this is known as ESG integration. ESG investors may adopt a more nuanced, stock-specific approach versus the exclusions‑oriented playbook applied to global tobacco when evaluating food and beverage companies. This would still be a departure from the positive ESG view of many food and beverage companies today. This approach may involve scrutinizing the nutrition characteristics of food portfolios, product labelling, advertising, and lobbying/influence in public health more than seen historically.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

August 2024 / VIDEO