September 2024 / RETIREMENT

Make it personal: The next chapter for target date solutions

Technology advances now allow personalization that could help address dispersions in savings.

Key Insights

- Target date solutions have helped to improve the outlook for retirement savers, but there is an opportunity to address dispersions in savings as participants age by introducing personalization.

- Personalization is a capability that can be integrated into the target date investment process to help improve outcomes, particularly as participants near retirement.

- A consistent investment methodology and access to the same investment building blocks are key as participants transition from a target date investment to a personalized solution.

Target date strategies have emerged as the de facto investment vehicle for U.S. employees saving for retirement in defined contribution (DC) plans. Designated by regulators as acceptable qualified default investment alternatives (QDIAs), target date solutions dominate the U.S. retirement landscape with 98% of T. Rowe Price’s DC recordkeeping clients offering them in 2023.1 Their status as an eligible QDIA and inherent simplicity—they automatically adjust portfolio risk based on a targeted retirement date—have made target dates the most prevalent investment option in DC plans and most commonly used by retirement savers.

More recently, DC plan sponsors and their consultants and advisors are contemplating the value of offering participants investment solutions that are personalized. The growing interest in personalization is evident in the increasing adoption of managed account solutions in DC plans and the emergence of target date solutions that have the ability to be further personalized beyond expected retirement age.

If it ain’t broke, don’t fix it

Target date solutions are working! They are undoubtedly very popular, and we believe that they support more successful outcomes for retirement savers. Their focus on growth-oriented assets early in one’s retirement savings journey positions savers to benefit from a potentially higher compound rate of return over time.

Rather than static asset allocation mixes, investors experience automatic rebalancing out of stocks and into bonds as they age, reflecting their changing needs and risk tolerance. Further, our research has found that target date investors tend to embrace the strategy’s long‑term approach.2

In periods of volatility, investors in riskier assets may be prompted to sell at the worst possible time. Similarly, in periods of market excess, it can be tempting for individuals to buy speculative assets at their peak values. By contrast, target date investors have typically stayed the course.3

Make it personal

In our 2024 U.S. Retirement Market Outlook, we discussed how consumers increasingly expect personalization in all aspects of their lives.4 And, while the benefits of target dates have been well documented, there is growing interest in the DC industry around personalization, as well as general acceptance that personalized strategies that incorporate an individual’s financial realities can offer value and potentially improve outcomes.

Retirement savings are dispersed, even within the same age group

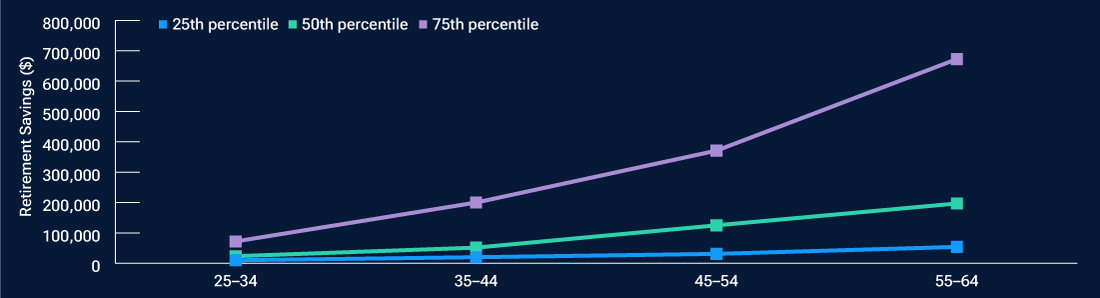

(Fig. 1) Percentile of retirement savings by age group, based on current participation in a defined contribution plan

Source: T. Rowe Price estimates from Federal Reserve’s Survey of Consumer Finances, 2022.

Employee populations are diverse, and people often have very different career paths and varying capacities to save for retirement. As a result, the disparity in savings tends to grow over time and retirement preparation varies widely as they approach retirement. This dynamic is shown in our analysis of data from the Federal Reserve’s most recent Survey of Consumer Finances (SCF)—specifically families who currently participate in a DC plan. We found striking differences in overall retirement savings5 amounts among families in the same age group (Figure 1).

For example, within the age 55–64 cohort, families in the 25th percentile reported retirement savings that were, on average, approximately 0.3x the median savings (represented by families in the 50th percentile). Meanwhile, retirement savings for individuals in the 75th percentile were almost 3.5x the median amount.

Retirement savings are dispersed, even relative to income

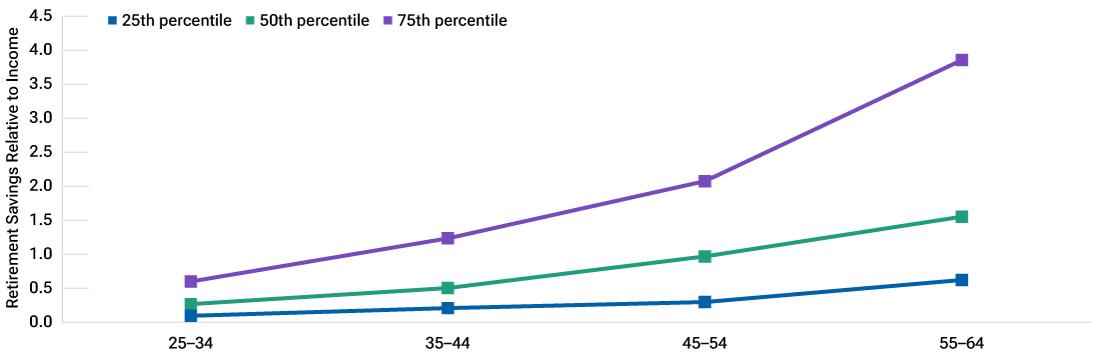

(Fig. 2) Percentile of retirement savings relative to income by age group, based on current participation in a defined contribution plan

Source: T. Rowe Price estimates from Federal Reserve’s Survey of Consumer Finances, 2022.

The difference is stark. Often, varying income levels is cited as the most likely cause for such disparity in savings, i.e., people with higher income will have higher balances, which suggests further personalization is not needed if savings relative to income is similar for all workers. To challenge this assumption, we dug deeper into the data and examined how much families had saved relative to their annual income across the various age groups. Interestingly, we found similar disparities in the level of retirement savings within the age groups, regardless of income (Figure 2).

Again, the dispersion in savings widened as people aged. For savers between ages 55 and 64, families in the 25th percentile had saved, on average, only about 0.6x their annual income, while families in the 75th percentile had saved almost 3.9x their annual income.

Personal circumstances vary within similar age groups

(Fig. 3) Demographic information for families between ages 50 and 54

| Bottom 50th Percentile (Retirement savings <$137,000) |

Top 50th Percentile (Retirement savings ≥$137,000) |

|

|---|---|---|

| Married households | 60% | 87% |

| Median income | $88,600 | $200,000 |

| Median debt-to-income ratio | 1.29 | 0.89 |

| Median net worth | $156,400 | $1,208,000 |

Source: T. Rowe Price estimates from Federal Reserve’s Survey of Consumer Finances, 2022.

A further review of demographic and personal factors for savers between ages 50 and 54, such as marital status, income, debt-to-income ratios, and net worth, among others, showed that the financial circumstances of savers in this age group vary widely (Figure 3).

Capabilities are evolving with advances in technology

As outlined in the prior section, there is much to laud about the effectiveness of target date solutions in transforming the U.S. retirement landscape, but our analysis suggests that there is an opportunity for target dates to evolve to better recognize the unique circumstances and needs of the individual investor. At T. Rowe Price, we have progressively refined and enhanced glide path methodology and portfolio construction. We believe that iterative innovation and continuous retesting is key to building successful retirement solutions.

As recordkeeping technology continues to evolve to allow communication and integration across various platforms and vendors, there is increasingly more opportunity for target date strategies to become more personalized in an efficient and cost-effective manner than in the past. As demographic characteristics widen with age, along with increasing financial complexity and emerging differences in retirement goals, we can incorporate the benefits of personalization as an extension of the target date experience and better refine asset allocation.

In a recently published study in the Journal of Portfolio Management titled Personalized Target Date Funds, our colleagues explained how personal information can be used to create optimal asset allocations at the individual level.6 Based on Monte Carlo simulation, they estimate that such improvements can add to additional risk-adjusted spending.

Target dates AND personalization (not OR)

“Personalization” can be added to the ever‑growing list of terms in the DC industry that can mean different things to different people. At T. Rowe Price, we think of personalization as an additional tool in the toolbox to help drive positive outcomes, not as a standalone investment option. In our view, personalization is a capability that can be integrated into the target date investment process, i.e., it is an evolution of target date capabilities.

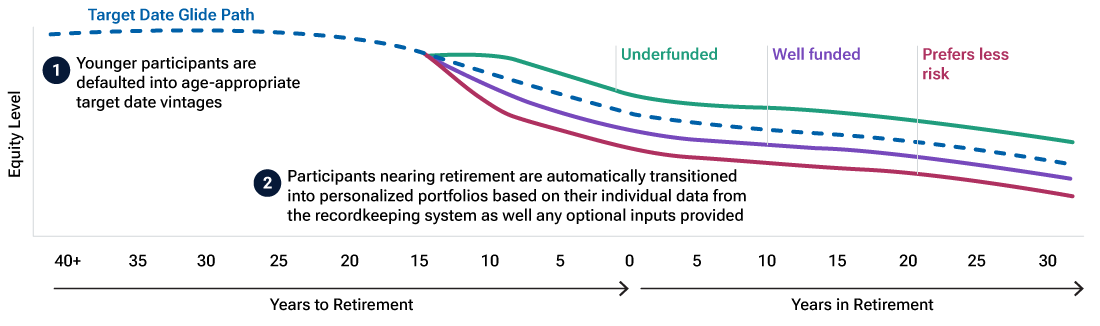

Today, most DC plans use a target date solution as their QDIA. Participants are mapped into a target date vintage based on age, and all participants within a respective age group follow the same glide path. By incorporating personalization as an additional capability within a target date solution, plan sponsors can use the traditional target date experience for younger participants who are in the early stages of their career and then introduce personalization for participants who are nearing retirement.

Introducing personalization into a target date solution is ideal for plan sponsors who have high conviction in their target date offering and are interested in providing participants the opportunity to personalize their investing experience. We don’t see it as a target date OR personalization scenario. Instead, we encourage adopting a target date AND personalization approach.

Common questions from plan sponsors:

1. Do all plan participants need personalization?

Our experience in building life-cycle/target date glide path models tells us that in early to mid-careers, the opportunity to incorporate personalization is less compelling. Populations tend to look more homogenous, and portfolio advice in these years will be similar. This does not mean that participants do not experience different opportunities and life events in these stages, but the optimal portfolio for most during this period will be one that emphasizes growth. Said another way, these participants are unlikely to get a meaningful change in allocation from personalization at this stage.

This shifts as participants age, as illustrated in Figures 1, 2, and 3. Demographic characteristics typically widen, financial complexity increases, and differences in retirement goals emerge.

Evolving the QDIA target date experience to deliver more tailored outcomes

(Fig. 4) Introducing personalization to target date solutions

For illustrative purposes only. Not representative of any T. Rowe Price product or actual investment

A dynamic or dual QDIA can be used to facilitate the introduction of personalization. In this structure, participants are defaulted into the target date vintage designed for their age, and then around 15 years prior to their expected retirement date, they are either automatically defaulted again or offered the opportunity to opt into personalized portfolios (Figure 4).

2. Could offering target dates and managed accounts lead to an inconsistent glide path?

Currently, employers wishing to offer personalized experiences are most likely forced to mix and match providers. Perhaps target date strategies can be offered for younger participants from provider X and managed accounts for older participants from provider Y.

This can lead to a disconnected experience for both plan sponsors and participants, given that they are moving between portfolios based on different asset allocation methodologies, capital market views, investment building blocks, and cost structures. Such a transition could, potentially, change the asset allocation of a participant for reasons unrelated to their personal circumstances.

By implementing a target date and personalized solution that build on the same research process, analytical models, and investment building blocks, plan sponsors can serve a more diverse set of participant journeys in plan while using a consistent framework.

Options for implementation and potential costs

Key challenges to the greater utilization of solutions in the traditional personalized advice and/or managed account services category have been (1) the burden put on the individual to engage and provide their detailed information and (2) high, multi‑layered, and complex pricing structures. New designs that intentionally support both defaulted participants as well as those who want to engage is critical to the next generation of in-plan solutions.

Today, a participant’s asset allocation can be personalized using “default” factors that are available in the recordkeeping system, such as balance, deferral rate, and income, which do not require the participant to engage with the service. From there, the participant has the opportunity to provide additional data elements that the recordkeeper does not have—retirement goals, a spouse or partner’s assets, household assets outside the plan, and other relevant factors—that could influence their asset allocation.

Implementation options

(Fig. 5) A personalized target date solution can be implemented as follows:

Dynamic QDIA

In the dynamic QDIA version, a possible eligibility criterion might be participants that reach a certain age (e.g., age 50)

— Younger participants are defaulted into an age‑appropriate target date portfolio

— Participants nearing retirement (e.g., age 50+) are (re) defaulted into the personalized/dynamic QDIA

and/or

Opt-In Service

In the opt-in version, the sponsor makes the personalized service available in the plan for all participants

— The sponsor may choose to educate likely participants through tailored communications and promotional messages

In both versions, personalization factors are sourced from data made available from the plan and from participants who choose to provide additional information

For illustrative purposes only. Not representative of an actual product, nor is this investment advice.

Then it becomes a question of how and when a plan sponsor wants to offer personalization. In our view, a personalized solution can be optimally implemented as a (default) dynamic QDIA and/or as an opt-in solution (Figure 5). In this structure, we introduce personalization at the point during a participant’s retirement savings journey when it can add the most value. A dynamic QDIA gives an employer the opportunity to automatically (re)default participants into a personalized portfolio, with age and sometimes balance, triggering the transition as participants approach retirement. An ideal dynamic QDIA structure can remove friction in the design, help deliver improved value for cost, and also make any incremental fee, if applicable, easier and more transparent to communicate.

Things plan sponsors should know

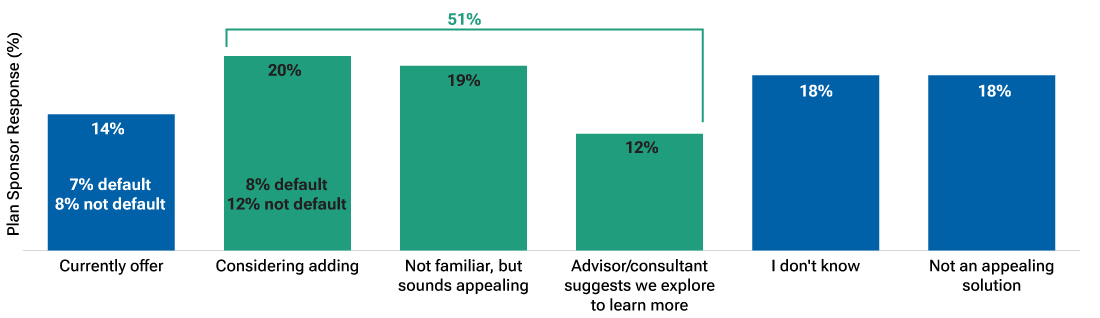

1. Interest in dynamic or dual solutions is growing—Data from our recent plan sponsor survey show that 14% of plan sponsors currently offer dynamic solutions that transition from a traditional target date investment to a more personalized strategy as participants near retirement. Another 51% are either actively considering or interested in exploring them (Figure 6).

Potential for the best of both worlds?

(Fig. 6) Plan sponsor views on introducing a personalized investment strategy for participants nearing retirement

Source:T. Rowe Price, 2024 DC Plan Sponsor Considerations and Actions on Retirement Income Study. The survey was fielded November 14, 2023, through December 22, 2023. Data reflects responses from 119 plan sponsors. Totals may not add up due to rounding.

Q26. “What is your view on dynamic or dual solutions that transition from a traditional target date investment to a more personalized strategy (e.g., a managed account) as participants get closer to retirement?”

2. Maintaining a consistent investment methodology is key—The investment philosophy and methodology of the personalized target date solution should not deviate from the plan’s target date offering. Such deviations can happen if the personalized solution uses a different underlying model/engine from the target date. This is equivalent to moving participants to a different glide path at the identified cutoff age but with no consideration of individual circumstances.

3. Underlying building blocks matter—Participants invested in target date strategies and in the personalized solution should have access to the same set of multi-asset building blocks for investments to maintain a consistent experience. In other words, moving to a personalized solution should not change or limit the investment opportunities. This can happen if the personalized solution uses a different set of building blocks from the target date.

Conclusion

There is no doubt that target date solutions have contributed meaningfully to the health of the DC retirement savings system. Their simplicity and default status are powerful. Given advances in technology and our ability to harness and leverage data, we now believe that there is an opportunity to build on target date solutions by introducing personalization. Furthermore, it no longer needs to be target date solutions or personalization—it can be both!

Target Date Investing Risks: The principal value of target date strategies is not guaranteed at any time, including at or after the target date, which is the approximate date when investors plan to retire (assumed to be age 65). A particular level of income is not guaranteed.

These products typically invest in a broad range of underlying asset classes such as stocks, bonds, and short-term investments and are subject to the risks of different areas of the market. A substantial allocation to equities both prior to and after the target date can result in greater volatility over short term horizons. In addition, the objectives of target date investments typically change over time to become more conservative.

Where noted, conclusions derived from Monte Carlo simulations- Monte Carlo models future uncertainty. In contrast to tools generating average outcomes, Monte Carlo analyses produce outcome ranges based on probability thus incorporating future uncertainty. The projections are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. The simulations are based on assumptions and present only a range of possible outcomes.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein.

Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal.

All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

September 2024 / RETIREMENT

September 2024 / TARGET DATE INVESTING