Helping investors thrive in an evolving world

With our dynamic perspective and meaningful partnership, we instill investor confidence.

Watch this video to learn how our principles guide us in providing value to our clients and our communities.

Today’s investors want a partner.

One who can help deliver the solutions, insights, and thought leadershipto help them navigate change, and meet their financial needs.

Since 1937, T. Rowe Price has been there…guiding clients, seeking to stay ahead of what’s next, and staying true to our purpose…to identify and actively investin opportunities to help people thrivein an evolving world.

We champion an active, independent approach… with investment professionals working together to uncover opportunities.

They are guided by curiosity…going out in the field, and asking better questions, to seek better solutions for our clients.

We pursue performance with principle… balancing risk and opportunity to go after strong long-term investing results, in any market environment.

We drive deliberate innovation.

Pioneering solutions in retirement and Target Date investing,active ETFs,investing in the blue economy, and more,to meet clients’ evolving needs.

And we build meaningful partnerships…with individual investors, financial advisors, retirement plan sponsors, and institutional clients, in more than 50 countries.

Our commitment to partnership extends to our communities,through direct grants from the T. Rowe Price Foundation,and our associates volunteering tens of thousands of hours each year.

With our dynamic perspective, and meaningful partnerships,we instill investor confidence. Learn more about how we provide value to our clients, and our communities.

Visit troweprice.com

Championing an active, independent approach

We’re independent thinkers, united behind an active and rigorous approach, collaborating to identify market risks and opportunities that can give our clients sharper insights and an investment edge.

Firsthand, rigorous research is at the heart of what we do.

We meet regularly with the management teams of the companies we invest in: on-site visits, face-to-face and virtual discussions and attendance at industry and investment conferences. The results: deep relationships that can lead to timely, actionable insights and strong long-term returns for our clients.

We are in the field and on the lookout. Our embedded experts in 17 markets worldwide access firsthand insights from companies, suppliers and regulators. This means we uncover opportunities that others might miss.

$1.57 trillion assets under management1

With our time-tested investing approach and assets under management, we are one of the top 25 asset management firms in the world.2

In turbulent markets, we have you covered.

Our portfolio managers have navigated tough markets, including the tech bubble, the global financial crisis and the coronavirus crisis. That time-tested experience stays with the firm: 57% of our current managers worked in investment roles at T. Rowe Price during the global financial crisis.

Our active management approach takes us beyond the numbers. Over 520 of our investment professionals go out in the field around the world to help us get the answers we need.

Ziad / Health Sciences

Imagine that your disease is going to kill you in less than a year, but a company develops a way to genetically engineer your own blood and your own immune cells to actually recognize the cancer and attack it. Instead of poisoning the cancer cells with toxic chemicals that wreak havoc on the immune system, you tweak the patient’s blood and let the body’s natural immune defense take care of the rest. After medical school in the UK, I worked as an emergency room doctor. What drew me to capital allocation in health sciences was the potential to help many people for years to come through investments that help fund medical innovation. My team and I often choose to invest at the very early stages of human trials, and sometimes when it’s just a concept. It’s exciting to see innovations shift from concept to reality. The human body is made up of proteins. Any disease caused by too much of a bad protein can be controlled or cured by blocking protein production at the cellular level. It’s a priority of mine to go out into the field so I can see firsthand if this is something real. Making the right investment decision is important not only for our investors but for mankind in general—because today’s treatment, which took years to develop, can have long-term future benefits for generations to come. Investing lets me use everything I’ve learned as a doctor, to help make a positive impact on the world. So that’s why I go beyond the numbers.

Risks: All investments are subject to risks, including the possible loss of principal. Health Science stocks face special risks, including adverse legal or regulatory developments, patent expirations, market competition, and rapidly changing industry dynamics.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested. The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction. Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. Australia - Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000, Australia. Canada - Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services. DIFC - Issued in the Dubai International Financial Centre by T. Rowe Price International Ltd which is regulated by the Dubai Financial Services Authority as a Representative Office. EEA - Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. Hong Kong - Issued by T. Rowe Price Hong Kong Limited, 6/F, Chater House, 8 Connaught Road Central, Hong Kong. T. Rowe Price Hong Kong Limited is licensed and regulated by the Securities & Futures Commission. New Zealand - Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000, Australia. No Interests are offered to the public. Accordingly, the Interests may not, directly or indirectly, be offered, sold or delivered in New Zealand, nor may any offering document or advertisement in relation to any offer of the Interests be distributed in New Zealand, other than in circumstances where there is no contravention of the Financial Markets Conduct Act 2013. Singapore - Issued by T. Rowe Price Singapore Private Ltd. (UEN: 201021137E), No. 501 Orchard Rd, #10-02 Wheelock Place, Singapore 238880. T. Rowe Price Singapore Private Ltd. is licensed and regulated by the Monetary Authority of Singapore. Switzerland - Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. UK - This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. USA - Issued in the USA by T. Rowe Price Associates, Inc., and T. Rowe Price Investment Services, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which are regulated by the US Securities and Exchange Commission and Financial Industry Regulatory Authority, Inc., respectively. © 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.

202309- 3094347

Pursuing performance with principle

We’re committed to our clients’ success. That’s why we maintain a long-term view as we aim to deliver consistently strong performance for investors in up and down markets.

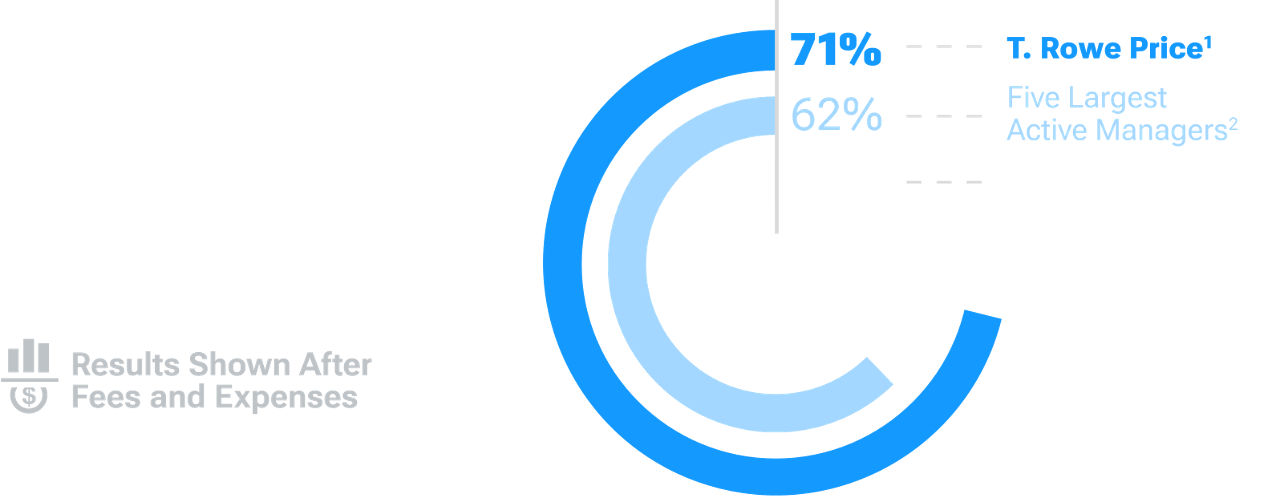

T. Rowe Price funds beat passive peers more frequently—and with higher average returns—than the average of all active managers, including the largest ones.

10-year trailing periods, rolling monthly. Period analyzed is 20 years ended 12/31/24.

Our funds delivered an average of 0.78% more return than comparable passive funds across all periods analyzed over 20 years and showed higher returns in 71% of those periods.

For institutional investors: Information about T. Rowe Price's strategy outperformance can be found here.

View standardized returns and other information about the funds in this analysis.

For more information on the methodology of this analysis, please visit troweprice.com/complete-performance-study.

Mutual Funds delivered under T. Rowe Price Investment Services, Inc., broker-dealer.

1 115 funds covering 9,303 rolling 10-year periods.

2 579 funds covering 48,375 rolling 10-year periods. The active assets under management (AUM) as of 12/31/24 across all funds considered in the analysis are aggregated and those funds offered at any point in the analysis period by the largest five active fund managers by AUM, identified by Morningstar, other than T. Rowe Price are grouped together here. Source: Morningstar.

3 5,562 funds covering 393,259 rolling 10-year periods, excluding T. Rowe Price.

We were founded on a client-first mindset.

From the moment we began, our clients came first. When he founded the company in 1937, Thomas Rowe Price, Jr., resolved that integrity would be the firm’s guiding principle.

We’ve managed investments through all kinds of markets. We know that identifying risks is as important as identifying opportunities.

97% retention rate

Our portfolio managers average 23 years in the industry, with a 97% retention rate. Clients can rely on us for deep knowledge and experience.

Samy Muaddi, CFA®

Head of Emerging Markets

Samy Muaddi, CFA®

Head of Emerging Markets

Building meaningful partnerships

We create deep partnerships. By understanding clients’ needs and delivering timely, actionable insights and solutions, we help them navigate change and achieve better outcomes.

Helping investors thrive in retirement and in life

We've learned from helping millions of retirement plan participants prepare for the future, building those insights into our retirement investment solutions and thought leadership.

We were the first company to develop target date solutions that continue to adjust 30 years beyond the investor’s retirement year. That’s because we understand the evolving needs of individuals throughout longer retirements.

Diversity, equity, and inclusion are not just values but business priorities.

Our clients’ long-term success stems from the diversity of backgrounds, perspectives, and talents of our associates. As a result of our global DEI strategy and commitment to impact, 58% of our global workforce is diverse1, including 42% of senior leaders2. Visit our Diversity, Equity, and Inclusion page to learn more.

To learn more about our diverse U.S. associates, please view our diverse U.S. population.

1 Diverse is defined as female representation (globally) and/or varying ethnic groups (U.S. only).

2 Senior leaders are defined as people leaders and/or individual contributors with significant business or functional responsibility. Figures as of December 31, 2022.

We work with clients in over 50 countries, including individuals, financial advisors, institutions, and retirement plan sponsors.

32,000 associate volunteer hours in our communities

Our associates value the opportunity to partner with our communities and give back. Their efforts include: more than 32,000 associate hours volunteered globally, 368 associates serving on 440 nonprofit boards, and USD 15.3 million donated to communties.

Driving deliberate innovation

To meet the evolving needs of our clients, we create investment solutions and services in a way that’s forward-thinking and purposeful.

Today

Now and the future

We’re looking ahead, anticipating the emerging needs of today’s investors.

2021

Alternative credit markets

The 2021 acquisition of Oak Hill Advisors, L.P. (OHA), accelerates our expansion into alternative credit markets. The move reflects our deliberate, thoughtful approach to advancing our capabilities to drive value for our clients.

2020

Actively managed ETFs

We become an early provider of actively managed ETFs when we launched our first equity products in 2020. We continue to expand to meet our clients' needs, and now provide a suite across a range of equity and fixed income strategies.3

3 ETFs delivered under T. Rowe Price Investment Services, Inc., broker-dealer.

2017

Innovative data tools empower investment professionals

Our Technology Development Center (TDC) in New York City opens, attracting world-class talent with expertise in big data, machine learning and predictive analytics, dedicated to bringing data-driven insights to our investment professionals.

2002

Target date investing

We are among the target date investing pioneers. Our first set of target date solutions launches; two decades later, we continue to advance our offerings to remain a leader in the field.

1985

Emerging markets

We begin investing in emerging markets, more than 15 years before the launch of the MSCI Emerging Markets Index. Five years later, we launch our first dedicated emerging markets strategy in 1990.

1960

New Horizons Fund

The New Horizons Fund launches, pre-dating the Russell 2000. The fund invests in small, rapidly growing companies and many used it as a proxy to evaluate the broader small cap market.5

5 Mutual funds delivered under T. Rowe Price Investment Services, Inc., broker-dealer.

1950

Growth Stock Fund

We start one of the first US growth stock funds, stemming from our founder’s early emphasis on finding companies with strong, long-term earnings potential.6

6 Mutual funds delivered under T. Rowe Price Investment Services, Inc., broker-dealer.

1937

The firm launches

Thomas Rowe Price, Jr., sets out to create an organization “with a reputation for the highest character and the soundest investment philosophy.” Instead of charging clients commissions for investments, we charged fees based on assets—an approach that ensured the clients’ interests came first.

Read Form CRS for important information on our fees and services.

3271241

Important Information

The performance data shown is past performance and is no guarantee or reliable indicator of future results. All investments are subject to risk, including the possible loss of principal. Results from other time periods may differ. Active investing may have higher costs thanpassive investing and may underperform the broad market or passive peers with similar objectives. Passive investing may lag the performance ofactively managed peers as holdings are not reallocated based on changes in market conditions or outlooks on specific securities.

Analysis by T. Rowe Price. Comparable passive funds are (1) mutual funds and exchange-traded funds (ETFs) classified as an “index fund” in theMorningstar Direct database and (2) in the same Morningstar category as the active funds being analyzed. All Active Managers represents theactively managed (non-“index fund”) mutual funds and ETFs in the Morningstar Direct database, excluding those managed by T. Rowe Price. Theperformance of the T. Rowe Price active funds and the All Active Managers funds were compared against the comparable passive funds using 10-year rolling monthly periods from 1/1/05 to 12/31/24. The analysis was conducted at the Morningstar category level analyzing all open-end fundsand ETFs within U.S. Morningstar categories where passive funds are present. Oldest share class returns are used for analysis. Money marketfunds are excluded from the analysis.

All data as of 30 September 2024, unless otherwise noted. Firmwide assets under management include assets managed by T. Rowe Price Associates, Inc., and its investment advisory affiliates. All amounts shown in US dollars.

¹ Figure shown is as of March 31, 2025. Subject to adjustment.

² Top Asset Management Firms ranked by total AUM as of March 31, 2024, compiled by ADV Ratings (https://www.advratings.com/top-asset-management-firms)

³ As of 12/31/23. Sway Research, LLC, "The State of the Target-Date Market: 2024."