The Blue Economy – Making Waves

T. Rowe Price and the International Finance Corporation (part of the World Bank Group) are partnering to grow the blue bond market to address the planetary and societal risks posed by the current underfunding of the blue economy.

The Blue Economy – Where Opportunity Meets Impact

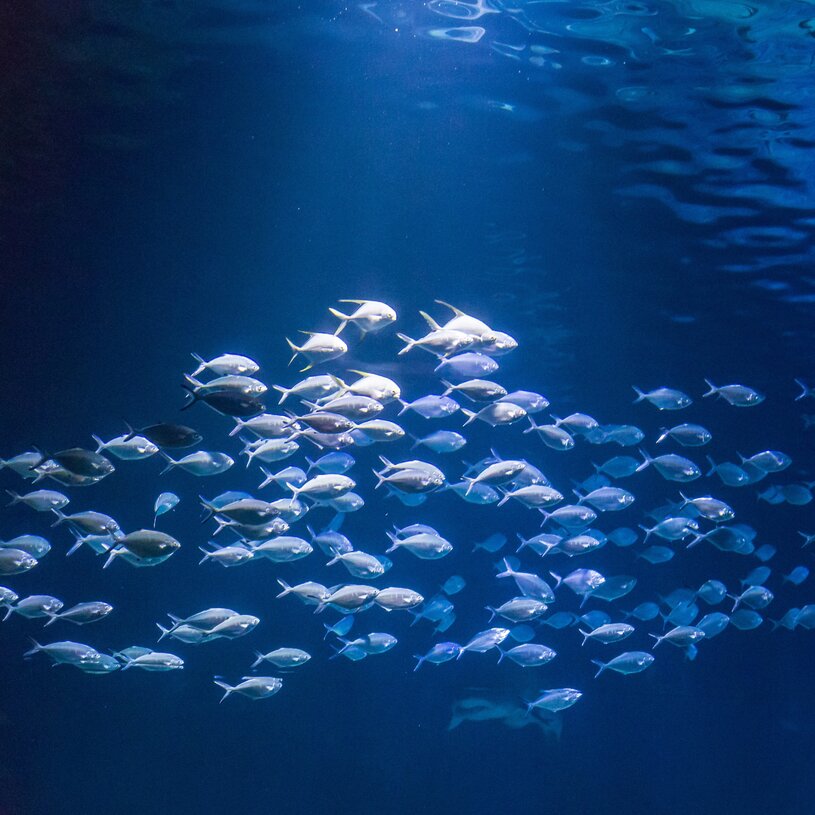

The economic potential of the world’s oceans and water resources is immense, but under threat from multiple environmental and social factors. Innovations in blue financing can play an important part in creating a protected and sustainable water economy.

The blue economy represents a diverse and growing investment opportunity, spanning multiple industries from tourism to marine transport. The OECD expects the blue economy to double to US$3 trillion by 2030 versus 20101. At the same time, oceans and water resources are under threat from climate change, pollution, overfishing, and habitat damage, among a host of other pressures. Blue bonds recently emerged as a crucial tool to help support the blue economy and play a part in tackling the threats to the world’s water resources.

T. Rowe Price launches Blue Bond Emerging Markets Strategy to help catalyze finance for a sustainable blue economy

Case Study: Emirates NBD

In January 2026, Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, completed a landmark transaction with the largest dual-tranche blue-green bond issued by a financial institution globally. T. Rowe Price played an instrumental role for this transaction by leveraging our experience in sustainable finance, providing guidance on use of proceeds and KPIs, and by aligning the issuance of the bond with industry standards such as IFC guidelines.

Case Study: Sabesp

In July 2025, Sabesp completed its first blue bond issuance, its first international bond issuance in two decades. T. Rowe Price played a pivotal role supporting this transaction, not only through its role as an anchor investor, but also through engaging with the company providing valuable input in strengthening the Blue Sustainable Finance Framework and the deal structure.

Case Study: DP World

In December 2024, DP World issued their inaugural blue bond and became the first Middle Eastern corporate to issue a blue bond. T. Rowe Price played a key role supporting this innovative transaction, from introductory meetings at a third-party sustainability conference, to supporting the framework and offering suggestions around terms, and finally being an anchor investor in the primary issuance.

Charting progress: As bond issuance climbs, what’s next for the blue economy?

While blue bonds are still a relatively nascent type of sustainable debt, the market is evolving. Increased corporate issuance and the emergence of blue bond frameworks across different sectors are signaling a sea change for this asset type and for the blue economy in general.

Video with Sector Portfolio Manager

Willem Visser discusses the trajectory for blue bonds and how the establishment of clear guidelines is making a difference.

How wildfires highlight the links between marine and terrestrial ecosystems

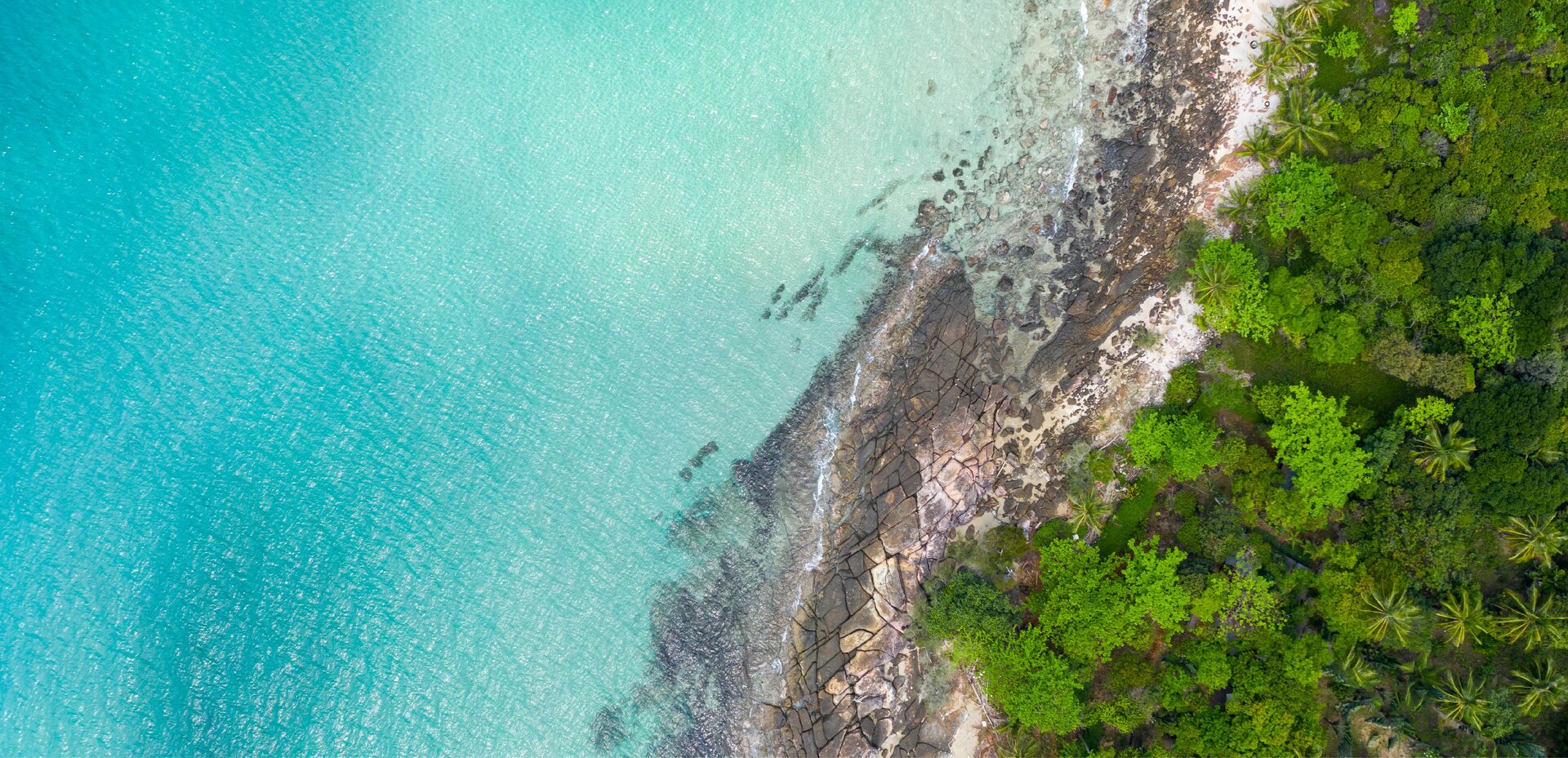

Wildfires might seem like a landlocked problem, but their impact also stretches to the seas. The blue economy, which encompasses industries such as fisheries, tourism, and marine biodiversity conservation, is particularly vulnerable to the dual threats posed by wildfires and climate change.

In the Spotlight

Water is the New Gold - Addressing the Global Water Crisis and Climate Change

The global water crisis is an urgent issue that demands immediate and sustained action and investment.

More than Shipping - Shipbuilders are key enablers of the decarbonisation of marine shipping

Cutting CO2 emissions in half is a complex, multifaceted challenge that requires a combination of technological innovation, regulatory measures, economic incentives, and collaborative efforts.

Turning the Tide Together: Building the Blue Economy

In September, T. Rowe Price held its inaugural Blue Economy Summit in New York, where stakeholders from financial institutions, scientists, and policymakers discussed how innovation, collaboration, and financial solutions can address the challenges of protecting ocean ecosystems while fostering sustainable economic growth.

Articles

The power of additionality: Blue bonds could boost sustainability

Issuance of sustainable debt has exploded over the past 10 years as many investors seek to allocate capital to sustainability efforts while pursuing investment returns. But the amount of annual investment required to achieve the United Nations Sustainable Development Goals (UN SDGs) continues to grow, while the time available to achieve them diminishes.

From Pollution to Solution – Are We There Yet?

The history of plastic is full of important inventions that have changed many parts of our lives. From everyday convenience to a danger to the planet, it is a material that continues to shape our world. In this article, we look at the threat of global plastic pollution, the impact it is having on marine life and the potential plan of action to tackle this issue.

No green without blue: How blue bonds could support climate goals

Earth’s oceans capture the majority of the global CO2 produced by humans, but their capacity to absorb that carbon is deteriorating. Achieving carbon reduction goals will likely require supporting ocean resources that are under stress from a variety of sources.

Investing in the blue economy: An ocean of impact potential

The global economy and ecology depend on thriving oceans and clean water resources. Yet, the blue economy is faced with ever increasing challenges. In this article, we discuss the importance of the blue economy and why investment in this area is critical.

Unlocking the enormous impact potential of battling the water crisis

Many countries struggle with water pollution and deficient access to clean water. Governments and companies are working on solutions through innovation, renewable energy, and recycling. In this article, we look at how investors can unlock significant positive environmental and social change by providing much-needed capital.

Solving the water crisis requires a booming blue bond market

Emerging markets face an uphill battle against issues such as water scarcity, droughts, and polluted oceans. In this article, we examine how blue bonds could offer a sound investment instrument to help fund solutions.

The Blue Economy – Making Waves

In our inaugural season of The Angle from T. Rowe Price, we dive into the world of the blue economy. The economic contribution of the world's oceans and water resources is immense, including areas such as transportation, renewable energy, aquaculture, and utilities. At the same time, oceans and other water resources are under threat from climate change, pollution, overfishing, and habitat damage, among a host of other pressures. Can innovations in blue financing help create a more protected and sustainable water economy?

Listen and subscribe now wherever you get your podcasts.

Measuring Impact in Blue Bonds

Like other sustainable bonds, blue bonds need to be evaluated differently. Our investment team identify the important features to consider when evaluating and measuring the impact of a blue bond.

The blue economy are activities associated with preserving the health of the world's oceans and using those activities in a sustainable way that develops economies, supports the environment, and improves livelihoods.

An increasingly important environmental pressure point that we're contending with though is the declining health of the world's oceans.

Let's recall for a second the very important role that oceans play. They generate half our oxygen, absorb 90% of excess heat that's produced by human activity, as well as act as hosts to vital ecosystems.

Yet our oceans are under threat from issues such as climate change, pollution, overfishing, as well as habitat damage, among a host of other pressures.

And this is why governments, policymakers, companies, and communities are collectively seeking ways to support and mobilize investment into the blue economy.

And blue bonds have emerged as an exciting and innovative tool that could potentially help attract and bring forward some of that much needed investment into the ocean economy.

Blue bonds are debt instruments where proceeds are utilized to finance initiatives, such as providing access to clean water and sanitation, as well as promoting marine conservation and biodiversity to support the health of the world's oceans.

Blue bonds are an exciting and innovative component within the broader sustainable bond market.

Other areas of the sustainable bond market that you might be familiar with would include green bonds, social bonds, sustainability bonds, as well as sustainability-linked bonds.

It is early days, but we see momentum and interest increasingly building for blue bonds across the capital markets.

And blue bonds are important for three reasons: One, issues such as climate change, sustainability, and ocean health are intertwined. And blue bonds have the ability to provide investment to address these pressure points.

Secondly, blue bonds have the capacity to address funding gaps. Take the United Nations (UN) Sustainable Development Goals for instance. These were 17 goals written by UN member countries designed to protect the planet, promote shared prosperity, and end poverty. And two of those goals, Sustainable Development Goals six and 14 are directly tied to water. And unfortunately, these are among the most underfunded of the 17 Sustainable Development Goals. So there is a material funding gap that blue bonds can help address.

And lastly, blue bonds have the capacity to drive economic growth on a global scale. The Organisation for Economic Co-operation and Development estimates that the ocean economy could potentially double in size to USD 3 trillion by 2030.

At T. Rowe Price we believe that, like sustainable bonds, blue bonds, which are, of course, a subset of sustainable bonds, require an additional element of evaluation and rigor.

There are four elements that we believe are important to consider in the evaluation and analysis of blue bonds.

So, the first one is the sustainable investing profile of the issuer itself. And that's absolutely critical because you need to see congruence with the issuer’s ambition, its targets, its overall goals, and the actual blue bond that it's issuing. That's the first element.

The second element has to do with industry standards. And here we're looking for real ambition, best-practice ambition, and alignment with industry standards.

And the third element has to do with bond credibility. And here, we are looking for clear evidence of ambition and credibility of the bond itself and the deployment of proceeds, and we're looking for it over the life of the bond.

The fourth and final element we'll talk about today is the post-issuance reporting. And here we are looking for very clear reporting around the actual distribution of capital into blue economy elements. And that's very important. In addition, we are looking for post-issuance impact reporting, and here would like to see quantifiable, tangible evidence of that coming through over the life of the bond.

So, if you think about the four elements we've talked about and why we focus on them at T. Rowe ([Price], one of the things we believe they will help us do is identify and potentially mitigate against greenwashing.

In the blue bond sphere, this is known as bluewashing, and this refers to a scenario where a financial product potentially overstates its own sustainability impact and outcomes and/or the issuer overstates — again focused on the blue economy — its own sustainability ambitions, targets and outcomes.

At T. Rowe Price, we're very excited about the potential opportunity for the blue bond market. We look at the parallel for the green bond market. And of course, blue bonds are a subset of green bonds. But we've seen the green bond market go from a very nascent asset class 10 to 15 years ago, to being well over USD 2 trillion*, and that's on data out of the Climate Bonds Initiative.

"Blue bonds have emerged as a crucial tool in the sustainable investing toolkit that can support the blue economy and play a part in tackling the threats to the world’s water resources."

Samy Muaddi

Head of Emerging Markets Fixed Income

Samy Muaddi is a Portfolio Manager in the International Fixed Income Division, focused on emerging markets.

In the Spotlight

Blue Bonds: A Growing Resource for Sustainability Financing

Issuance of sustainable debt has exploded over the past 10 years2 as investors seek investment returns by allocating capital towards sustainability efforts. Blue financing is an emerging area of sustainable finance, helping to support ocean-friendly or clean water projects that form a part of the blue economy. Projects span regions, sectors, and asset classes, offering possibilities for fixed income diversification.

Trash to Cash

T. Rowe Price’s Tongai Kunorubwe, Head of ESG Fixed Income contributed to the latest IFC Insights on the Marine Plastics Crisis in East Asia and the Pacific.

Interview with T. Rowe Price and the IFC: Without Blue There is No Green

Tongai Kunorubwe, Head of ESG, Fixed Income at T. Rowe Price and Tomasz Telma, Director at the IFC discuss what needs to be done to fill the finance gap in the blue economy.

Our ESG Approach

Our thinking on ESG

Impact Investing

1Source: https://www.oecd.org/ocean/topics/ocean-economy/

2Sources: BloombergNEF and Bloomberg L.P

Important Information

This webpage is for educational purposes only and for people interested in the development of the blue economy.

This webpage and material contained therein does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

All investments are subject to market risk, including the possible loss of principal. Blue bonds carry investment risks, which include credit risk and interest rate risk. Emerging markets are less established than developed markets and therefore involve higher risks.

This webpage and material contained therein does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The webpage and material contained therein have not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the webpage and are subject to change without notice. Under no circumstances should the webpage, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The webpage and material contained therein are not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.

Unless otherwise noted, the content appearing in this section of the T. Rowe Price website has been issued by T. Rowe Price Associates, Inc., T. Rowe Price Investment Management, Inc., and/or T. Rowe Price Investment Services, Inc.

202407-3716668