July 2024 / EQUITY

Market concentration: Facts versus opinions

Market concentration in U.S. and technology stocks a concern for clients.

Key Insights

- The degree of market concentration in U.S. and technology stocks has become a concern for clients, though concentration is not confined to the U.S. stock market.

- U.S. equities have performed well over the past decade as a result of the increasing dominance of the U.S. economy and companies on the global scene.

- Market concentration is real but may be less of an issue when it is driven by improvements in returns and earnings that are recognized by the stock market.

The degree of market concentration in U.S. and technology stocks is something of a hot topic currently. We have received many questions from clients and wanted to share our thoughts on an issue that is clearly causing some discomfort and anxiety for investors.

A high level of concentration in U.S. equities is viewed as a significant risk, a “problem” that must be dealt with. The concern seems to be that a high level of concentration, especially in tech stocks, draws capital away from other sectors and, in a global context, away from other regions. And that cannot be good! Given that the universal assumption seems to be that high market concentration is a problem, I thought it worth a closer look to see (1) if the problem is real and (2) what is the best way to deal with it from an investor’s point of view.

U.S. dominance of global markets is not new

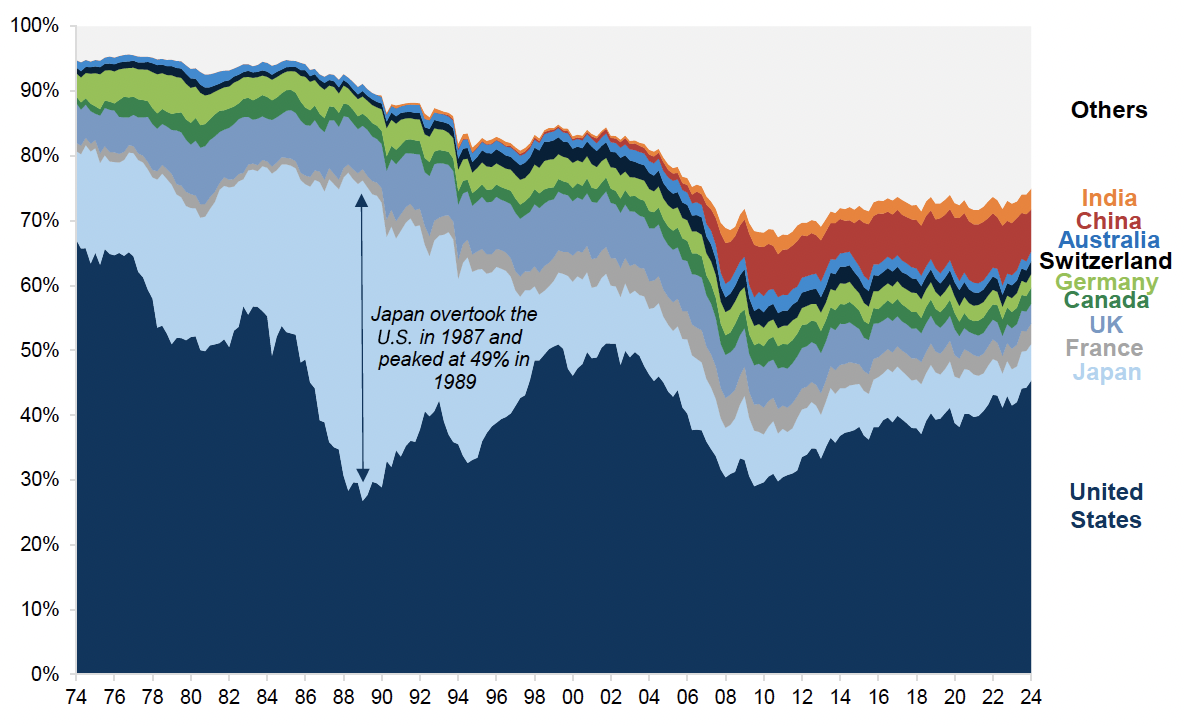

U.S. equities have performed well over the past decade, trouncing other major markets and taking their share of the global equity market to around 45% (Figure 1). It is worth noting that we have been here before when it comes to concentration worries, albeit we have to go back quite a bit of time.

The following chart from Goldman Sachs (Figure 1) shows the evolution of global market capitalization shares by country. It is clear that the U.S. stock market has been the leading market globally for most of the period since the 1970s, a result of the increasing dominance of the U.S. economy and companies on the global scene. Add to this the fact that many overseas companies choose to list in the U.S. to take advantage of the market’s depth, liquidity, and sophisticated investor base, and U.S. dominance can be seen not as an anomaly but the result of a natural sequence of events.

U.S. share of global equity market is rising

(Fig. 1) Country shares of global equity markets

As of March 11, 2024.

Source: Goldman Sachs Global Investment Research.

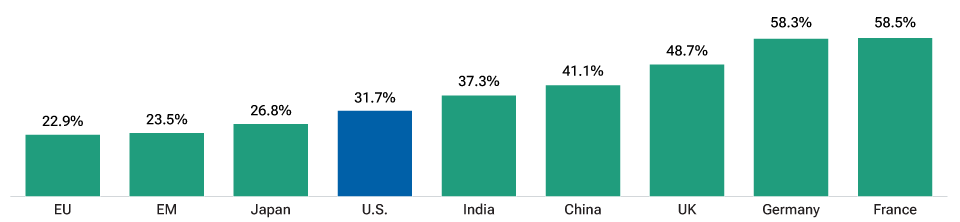

Market concentration is not just a U.S. issue

The first thing to note is that market concentration is real. In the MSCI All Country World Index (MSCI ACWI), the top five stocks make up 14.8% of the index. And if one looks at just the U.S., the top five names in the MSCI U.S. Index account for just over 23% of total market cap.1 It is interesting to note that compared with other major developed and emerging markets, the U.S. is not the worst offender when it comes to index concentration. Figure 2 compares the percentage of the market accounted by the top 10 stocks, using MSCI country equity indices.

The U.S. is not the most concentrated stock market (I)

(Fig. 2) Weight of top 10 stocks in MSCI country equity indices

As of March 22, 2024.

Source: Bloomberg Finance LP. T. Rowe Price calculations.

It may be tempting to look at the above chart and assume that markets less concentrated than the U.S., such as the European Union (EU), emerging markets (EM), or Japan, are currently “better” markets for an investor to diversify into. But it turns out that when one looks with a bit more granularity, other issues with concentration emerge.

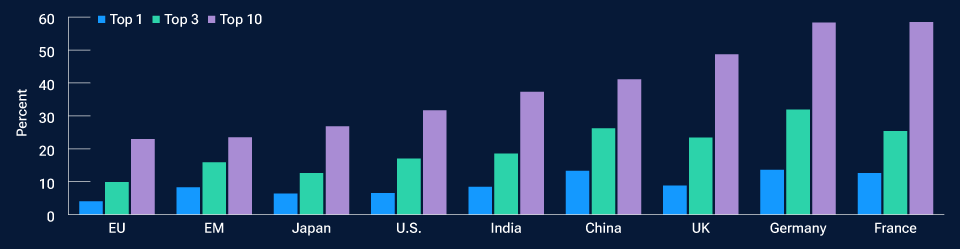

Figure 3 looks at the percentage of each index that comprises the top one, three, and 10 stocks. One can see that in EM, while the overall index may seem more diversified, the largest stock in that index (Taiwan Semiconductor Manufacturing Co. or TSMC) accounts for around 8% of the total, a much larger figure than Microsoft’s 6.5% in the U.S. Similarly in Japan, while the share of the largest stock, Toyota, is similar to that of Microsoft in the U.S., the companies may not be viewed as similar investments.

The U.S. is not the most concentrated stock market (II)

(Fig. 3) Weight of top one, three, and 10 stocks in MSCI country equity indices

As of March 22, 2024.

Source: Bloomberg Finance LP. T. Rowe Price calculations.

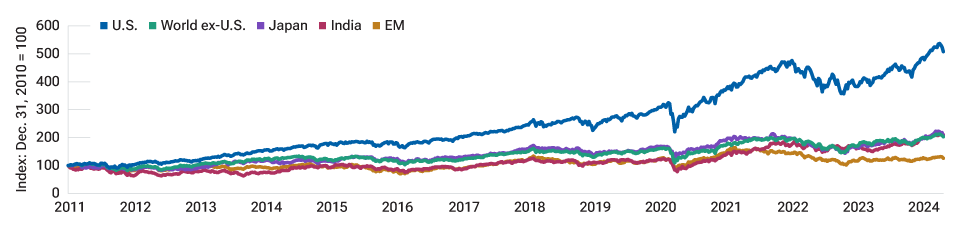

Market concentration is largely a function of past returns

I am a firm believer that, over time, stocks will tend to follow earnings and returns. In broad terms, this applies to markets as well. U.S. equities have performed well since the global financial crisis, especially compared with other major markets in U.S. dollar terms. They have returned more than twice as much as the MSCI World ex‑U.S. Index since 2011 (Figure 4).

The U.S. has strongly outperformed other major equity markets (I)

(Fig. 4) MSCI price returns indexed to December 31, 2010

As of March 22, 2024.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg L.P. T. Rowe Price calculations.

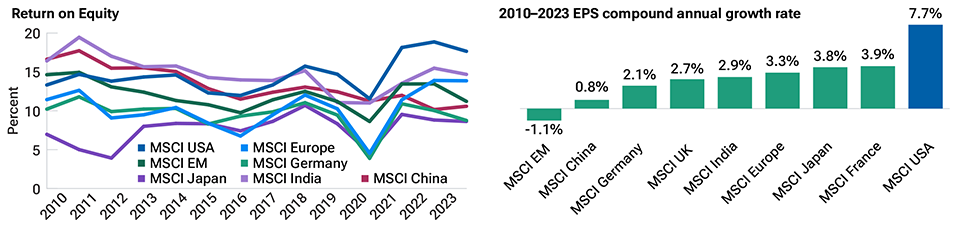

This largely reflects the fact that U.S. markets over this period have been more profitable and have grown faster than others. As the following charts (Figure 4 and Figure 5) show, the U.S. market is unique among major equity markets in having been able to maintain a high level of return on equity (ROE) relative to other markets and combine that with better earnings growth.

The U.S. has strongly outperformed other major equity markets (II)

(Fig. 5) MSCI price returns indexed to December 31, 2010

Market concentration: Facts versus opinions

Market concentration: Facts versus opinions

As of March 22, 2024.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P. T. Rowe Price calculations.

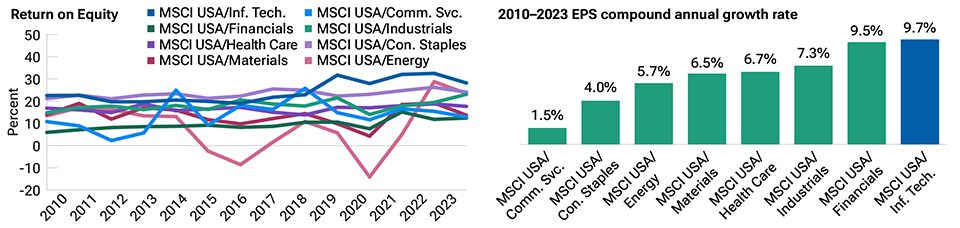

The dominance of technology largely follows a similar line of reasoning. The U.S. tech sector has been the dominant factor behind returns in the equity market overall. Looking again at the breakdown of earnings growth and ROEs over time, this time for key U.S. sectors (Figure 6), it is immediately apparent that the tech sector has been unique in being able to grow earnings while simultaneously improving the quality of returns over time, i.e., they have continually progressed in becoming more efficient, capital asset‑light businesses. This has been recognized in how the market values them.

Technology has strongly outperformed other U.S. sectors

(Fig. 6) MSCI price returns indexed to December 31, 2010

As of March 22, 2024.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P. T. Rowe Price calculations.

So what should investors do?

If I adopted the persona of my old family physician, here’s how he would probably have put things.

“Embrace concentration…insofar as it is healthy.”

While arbitrary headlines on concentration “issues” make for good press, we should remind ourselves that fundamentals matter more. Concentration in one sense results from success and is a characteristic of market cap‑weighted indices. As long as the fundamentals of sales, earnings, and returns are strong, there’s no shame in embracing the concentration that has boosted equity returns.

“Embrace diversification…but sensibly.”

Almost daily, investors are faced with suggestions and advice to diversify away from U.S. technology—be it to value, emerging markets, or Japan. While I am a fan of “global exposure,” I also believe it is important for investors to understand their underlying portfolio exposures thoroughly and diversify appropriately—not just for the sake of index diversification alone.

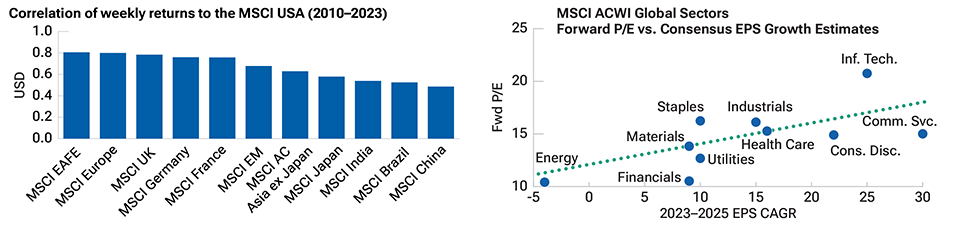

So, for example, while it may sound sensible to increase international exposure away from the U.S. and technology by adding, say, to Japan and/or Europe, the real question is whether that, in fact, is. Many stock markets today are very closely correlated to the U.S., and so diversification to international markets may not achieve the desired outcome (Figure 7).

International equities are closely tied to the U.S.

(Fig. 7)

As of March 22, 2024.

Past performance is not a reliable indicator of future performance.

These statistics are not a projection of future results. Estimates are subject to change. Actual results may vary significantly.

Source: Bloomberg Finance L.P. T. Rowe Price calculations.

Correspondingly, while Figure 7 may suggest that markets such as Japan or China are strong candidates for diversification, arbitrary portfolio allocations to those markets may end up with undesired outcomes, e.g., portfolios that are either increasingly sensitive to global auto markets (as in the case of Japan) or that may end up doubling down on tech exposure (given how Tencent, Alibaba, and PDD dominate the MSCI China Index, with a combined weight of 26%).2

“Let earnings be your North Star.”

In any global equity portfolio, I believe it is important to maintain exposure to earnings growth while trying to diversify the sources of that growth. So, for example, in Figure 7, when looking at two‑year forward multiples versus consensus earnings growth estimates across the different sectors in the MSCI ACWI, one can see how pockets of the market in areas such as industrials and health care can offer significant earnings growth potential at lower multiples than technology, and there may be good, underappreciated ideas to look at within those sectors.

“Hope is not a plan.”

I would argue that the focus on earnings and returns are even more important when looking at “value‑oriented” sectors such as energy and financials. While it’s all very well to buy cheap assets, the fundamental question that needs to be answered is: “What is going to make them less cheap?” And while we can wait, hope, or pray for a multiple rerating, that’s not really under anyone’s control (with the exception of perhaps the Fed), so one has to instead look for the value release of increased earnings and returns, whether that comes from internal restructuring or a cyclical upswing.

Conclusion

While concentration in the markets is real, it is likely less of an issue than most commentators make it out to be, as it is driven by real improvements in returns and earnings that are in turn recognized and rewarded by the stock market. As investors, it behooves us to be aware of the risks and to diversify portfolios appropriately. In this environment, there is an opportunity for good active managers to prove their worth in generating significant risk‑adjusted alpha.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

3 July 2024 / FIXED INCOME