June 2024 / EQUITY

Assessing the potential impacts on U.S. health care in an election year

A number of key US health care issues will continue to be a primary focus for the next US president

Key Insights

- While health care historically has been one of the hottest political potatoes in the lead‑up to a U.S. presidential election, discussions this campaign have been more subdued.

- Perhaps the biggest issue at stake is in relation to the future of the Affordable Care Act, aka Obamacare, with potentially binary impacts depending on the election outcome.

- Both leading candidates have voiced concerns about rampant health care cost inflation, and each appears committed to reducing the high cost of prescription drugs.

The 2024 U.S. presidential election campaign has been noteworthy for the lack of big‑ticket issues or policies from either leading candidate. Health care, for example, historically has been one of the hottest of all political potatoes during election years, given the scope for impactful change, but it has featured much less prominently in either candidate’s campaigning in this election cycle. This low‑key focus has been less disruptive for the health care sector than in recent election year campaigns, a fact duly reflected on the markets, with the sector posting positive returns in 2024 to date, albeit trailing the broader equity market’s rally.

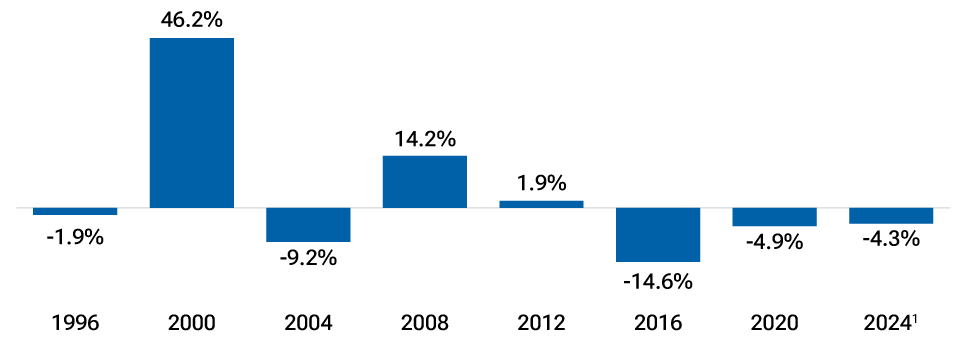

By way of comparison, recent election years show the health care sector performing inconsistently, delivering an array of negative and positive annual returns in different election years (Fig. 1). This erratic track record has much to do with how central a topic health care has been in each election campaign and how significant the proposed changes to the U.S. health care system have been in the lead‑up to each election. One only needs to look back to the 2019–2020 campaign trail, when Democrat candidates proposed wholesale change in the form of “Medicare for All,” a single‑payer health system, to understand the pivotal role that health care can play in an election campaign.

Health care returns have been inconsistent in election years

(Fig. 1) Annual relative returns in U.S. election years (S&P health care sector vs. S&P 500)

As of May 15, 2024. Annual total returns.

Past performance is not a reliable indicator of future performance.

Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

1Year to date as of May 15, 2024.

Source: Refinitiv Eikon. © 2024 Refinitiv. All rights reserved. Analysis by T. Rowe Price.

With health care not being central to either candidate’s campaign talking points in 2024, the biggest impact on the sector is likely to come from which candidate ultimately wins and what this might mean for key health care issues. In this paper, we delve deeper into some of these contentious health care areas and consider the potential impacts depending upon who is elected come November.

U.S. managed care could see binary impacts

One of the most divisive—and decisive—areas of U.S. health care is the managed care industry, where ideology sees each candidate diametrically opposed in their view of, and approach to, providing health care to the American population.

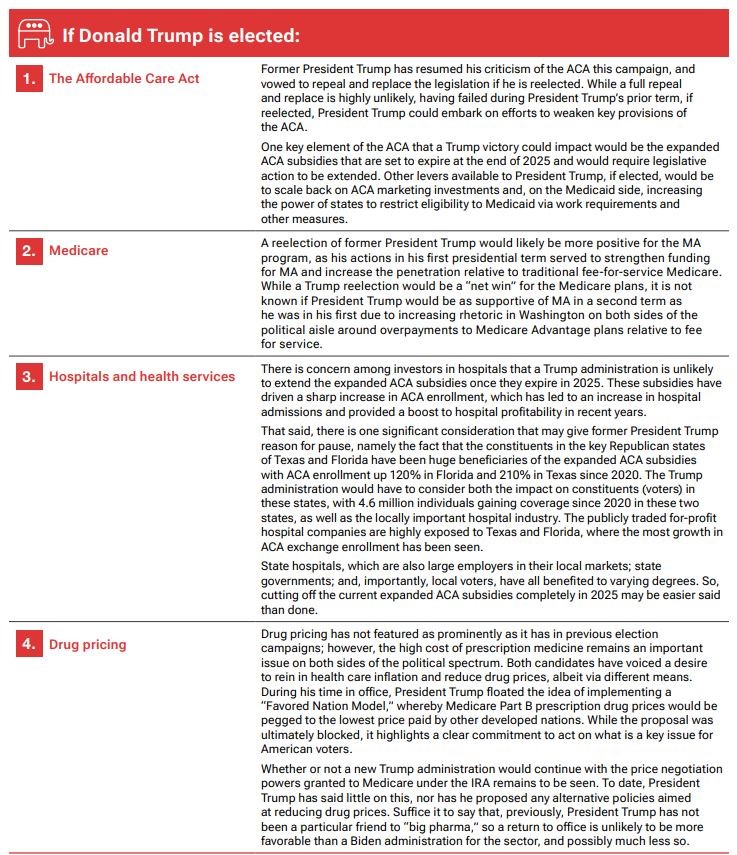

Drilling down into the broad managed care landscape, we see four key topics that are likely to be central areas of focus for both candidates but that could see very different impacts, depending on who is ultimately elected the next U.S. president. We consider each of these below, from both sides of the political aisle.

1KFF—independent provider of U.S. health policy polling and research. As of January 24, 2024.

Health care spending will continue to rise, but beneficiaries will differ

Whoever ultimately is elected the next U.S. president in November, we would expect health care spending to continue rising under either a Biden or a Trump administration. Even though both candidates have voiced a desire to bring down medical inflation, and specifically to rein in high drug prices, total spending will continue to be driven higher by patient demand, an aging population, and the cost of medical services and innovation. Our expectation, should President Biden win, is for total health care expenditure to increase, with public spending outpacing private. An early budgetary port of call for a new Biden administration is likely to be an extension to the expanded ACA subsidies. In contrast, if President Trump is reelected, we anticipate that he will move to reduce or eliminate the expanded federal subsidies, as well as reduce funding for several health programs, including Medicaid. While any attempts to overturn Obamacare fully are unlikely to succeed, weakening the ACA could ultimately see higher costs and reduced coverage for lower‑income Americans. In the event of a Trump victory, we would anticipate increased private health expenditure, at the expense of public programs, while pharmaceutical companies could also be better off, should a new Trump administration revoke Medicare’s power to negotiate drug prices directly.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been verified. Forecasts are based on subjective estimates about market environments that may never occur. Any forward‑looking statements speak only as of the date they are made. T. Rowe Price assumes no duty to, and does not undertake to, update forward‑looking statements.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.