July 2024 / EQUITY

South Korea value-up: Lessons from Japan

South Korea’s “Corporate Value-Up Program” is modeled after similar reforms in Japan.

Key Insights

- South Korea recently unveiled a “Corporate Value-Up Program” to boost domestic stock valuations, modeled after similar reforms in Japan.

- Lessons from Japan can be instructive, but several unique characteristics of the Korean market may pose challenges to the effectiveness of Korea’s efforts.

- Corporate reform in Korea will likely be a multiyear journey, which means that focusing on fundamentals to identify the right companies remains important.

In February 2024, the South Korean government announced a highly anticipated “Corporate Value-Up Program,” aimed at boosting valuations of the domestic stock market. The program encompasses three pillars:

- Incentives, such as tax benefits, for listed companies to voluntarily enhance corporate value and improve communication of their plans;

- Support for investors’ ability to assess company performance, including the creation of a new “Korea Value-Up Index,” and

- The establishment of a support system for medium- and long‑term implementation.

Subsequently, in May 2024, the regulator followed up with guidelines calling on firms to voluntarily set long-term targets for shareholder value enhancement and provide progress updates annually.

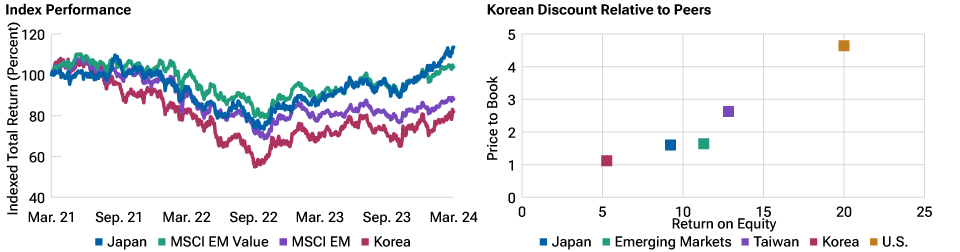

The intended goal of the Corporate Value‑Up Program is to bring down the so‑called Korea Discount, referring to Korean equities’ historically lower valuations, relative to both developed and emerging market peers. In unveiling the plan, the government and other relevant Korean authorities hope to emulate the success of similar efforts taken by Japan since 2013.

This article considers the prospects and challenges of Korea’s Value-Up Program by comparing it with Japan’s experience. It will also outline areas of the market that we think may be well placed to implement reforms and enhance shareholder value.

A decade of corporate governance reform in Japan

Structural reform, including of corporate governance, was a major plank of “Abenomics,” the signature economic policies of then‑President Shinzo Abe. The Japanese Stewardship Code, which T. Rowe Price is a signatory to, was launched in 2014, while the Japanese Corporate Governance Code was unveiled the year after that. Meanwhile, Japan’s Government Pension Investment Fund (GPIF), the world’s largest pension investor, encouraged asset managers to adopt its Stewardship Principles and promoted the merits of corporate governance via an annual report of companies that provide excellent disclosure.

In the ensuing years, there was incremental progress in terms of board composition, most notably with increased appointments of independent and female directors. The number of shareholder resolutions also gradually increased as Japan became more of a focus market for activists. However, other issues, such as unwinding companies’ cross-shareholdings, proved more difficult to address.

Korea Discount

(Fig. 1) South Korean stocks trade at lower valuations relative to peers

Past performance is not a reliable indicator of future performance.

As of March 22, 2024 (left chart), and as of December 31, 2023 (right chart).

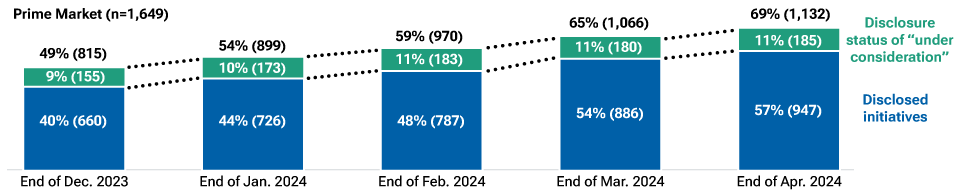

The pace of reform accelerated when the Tokyo Stock Exchange (TSE) adopted more stringent listing criteria in 2022. Notably, the bourse proposed that companies on its “Prime” section—the top-tier listing category—that do not meet the revised rules by March 2025 would be given a one-year improvement period or face delisting. This momentum continued when the TSE announced it would publicly name companies that had complied with a request to publish plans to improve capital efficiency from January 2024. Later, it revised listing rules again to mandate English language disclosures of key information for Prime-section companies.

The TSE’s efforts appear to be yielding results, with nearly 60% of Prime-listed companies disclosing their plans as of the end of April 2024, up from just 40% at the end of 2023. Investor confidence toward Japan’s corporate governance efforts seems to be increasing, too, and has been cited as a key factor behind the recent bull run that lifted Japan’s Nikkei 225 stock index to record highs. 1

What the experience of the past decade illustrates is that the drivers of success were sustained pressure from the government, the financial regulator, and the TSE, as well as the influence of major domestic and international institutional investors. Similar concerted efforts from Korean agencies will be crucial for success of the Korean Value-Up Program as well.

Expectations for value-up in Korea

Considering the lessons and experience from the Japan case can be instructive in assessing the likely effectiveness of South Korea’s efforts.

While initial announcements underwhelmed some analysts due to a lack of concrete details, we believe, at the very least, it has started discussions on what change might look like. Importantly, it appears that all the key stakeholders are supportive of the reforms, including the regulators (both the Financial Services Commission and the Financial Supervisory Service), the South Korean Exchange, as well as the National Pension Service (NPS). One key question is whether the NPS can play a similarly influential role as Japan’s GPIF did in driving change. In this regard, reports that the NPS is engaging with the exchange in the development of the Value-Up Index and plans to use it as a benchmark for external managers’ equity investments is encouraging.

Improving disclosures in Japan

(Fig. 2) More companies responding to the TSE’s requests to disclose plans to increase corporate value

Source: Tokyo Stock Exchange.

That said, it is important to remember that there are significant differences between the South Korean and Japanese markets.

Most notably, the South Korean market is dominated by large, family-owned conglomerates, or chaebol, that historically have favored controlling interests over minority shareholders. The concentration of power within family-led chaebol also raises doubts about whether voluntarily naming and shaming poor performers, similar to the TSE’s actions in Japan, will be as effective in Korea.

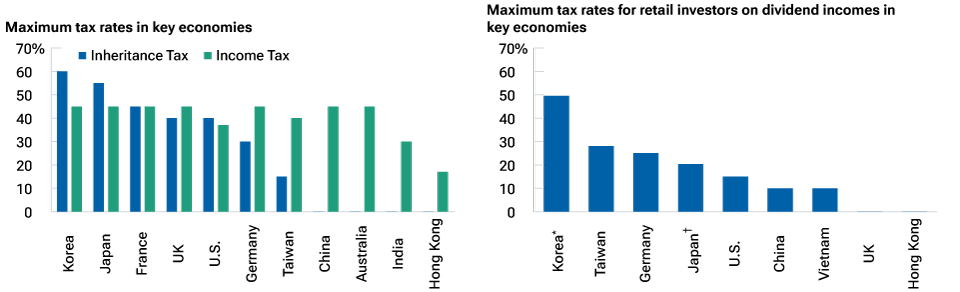

South Korean tax rates

(Fig. 3) South Korea has among the highest inheritance tax and dividend income tax rates among peers

Source: Goldman Sachs Global Investment Research.

* Dividend incomes

taxed as part of comprehensive income if annual financial investment income

over KRW 20 million (USD 15,000), otherwise separate tax rate is 15.4%.

† Separate tax rate of 20.315%; for large shareholders (≥3% share) or for special related parties, dividend incomes taxed as part of comprehensive income.

In our view, attempting to align the interests of the government, chaebol, and investors may be a good first step. For instance, as Korea Corporate Governance Forum chairman and reform expert Namuh Rhee noted, listed companies can take several easy actions, such as reducing balance sheet inefficiencies and improving shareholder returns, that should immediately bolster their valuations. He added that the government can do its part by lowering the punitive inheritance tax rates, seen as a key impediment that discourages chaebol management to adopt more investor-friendly policies.

Meanwhile, political uncertainty may be another stumbling block to durable reform. The resounding victory of the left-leaning opposition Democratic Party in recent legislative elections may dampen momentum as the left-dominant parliament is expected to be more wary about providing anticipated tax incentives.

Focus on fundamentals still critical

While we feel there is genuine intent to push for corporate reforms in South Korea, the persistence of deep-rooted challenges indicates it will be a multiyear journey, similar to Japan. This suggests that the Value-Up Program will not be a tide that lifts all boats. Rather, it will be a tailwind for select companies that are further along in their reform journeys.

That said, we do see pockets of opportunities. For instance, within the financials sector, South Korean banks are attractively valued as share prices have been cyclically depressed for some time amid asset quality concerns. That said, several lenders have built up a consistent track record of improving capital returns, such as better payout ratios and share buybacks. Given that most banks still have excess capital, a brightening macroeconomic outlook and easing asset quality stress position them to drive further shareholder returns.

Meanwhile, we’ve also observed some interesting developments in the telecommunications space. Companies in this segment seemed open to progressive moves such as share buybacks and cancellation of treasury shares amid a wider emphasis on shareholder returns. Likewise, a number of South Korean auto companies had already started allocating capital better in the past few years, and their ample cash levels should provide the firepower needed for further improvements. The potential unwinding of circular ownership structures could provide a further boost.

Ultimately, we believe that maintaining a disciplined, bottom‑up approach to stock selection in the South Korean market is still essential. We want to identify companies that are truly embracing and executing on meaningful long-term reforms alongside sound business fundamentals. This aligns nicely with our time-tested philosophy and focus on forgotten or out-of-favor stocks that are positioned to benefit from identifiable fundamental change.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

July 2024 / FIXED INCOME