April 2024 / RETIREMENT INSIGHTS

Reference Point

Data can inspire solutions

This annual recordkeeping benchmark report reflects activity of over 2 million U.S. participants (referred to as plan members in Canada). We break down data from the previous year to:

- Provide benchmarking for plans

- Analyze key trends

- Share commentary from T. Rowe Price experts

Account balances rebounded but fell short of the 2021 high

Strong markets in 2023 helped account balances regain some losses experienced in 2022. The average account balance increased 14% to $115K.

Average account balances

Inflation worries didn’t scare off savers

The average participation rate held steady from 2022 to 2023 and even surpassed the national average.

| 7.8% National average1 | 8.4% T. Rowe Price average |

1Source: T. Rowe Price Retirement Savings and Spending Study, 2023.

Target date investors are less likely to change direction

And among the few target date investors who made a change in 2023, 62% moved money to an investment with a later target date.

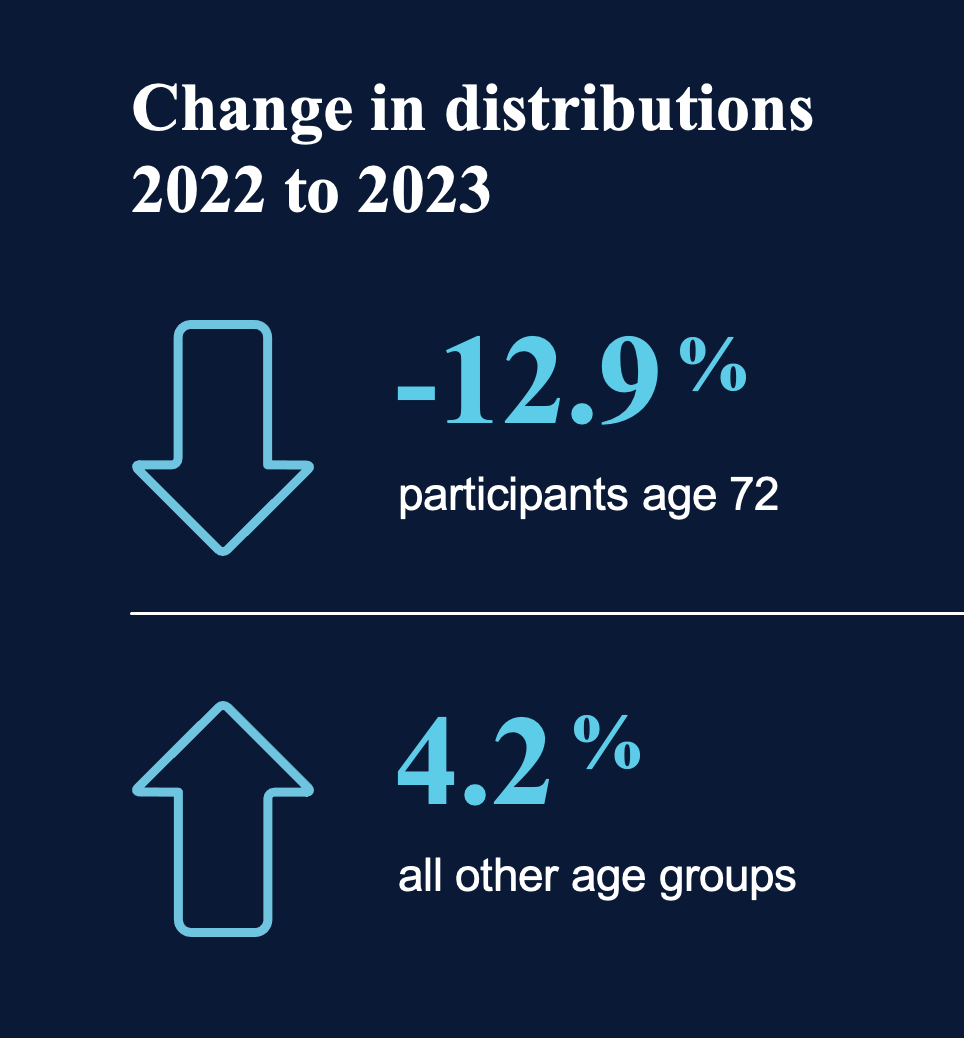

SECURE 2.0 could be contributing to a drop in distributions

Participants age 72+ took 12.9% fewer distributions in 2023 than in 2022, potentially related to the change in starting age for required minimum distributions from SECURE 2.0.

About the Report

Unless otherwise noted, all data included in this report are drawn from the following sources Data are based on the large-market, full-service universe—T. Rowe Price total—of T. Rowe Price Retirement Plan Services, Inc., retirement plans (401(k) and 457 plans) consisting of 660 plans and over 2 million participants.

For more information on this report or where you get additional industry-specific data to support your plan design discussions, please contact your T. Rowe Price representative.

March 2024 / RETIREMENT INSIGHTS

April 2024 / GLIDE PATH DESIGN