April 2024 / EQUITY

T. Rowe Price Integrated Equity Quarterly Newsletter

Compelling Opportunities Among High-Quality Small-Cap Stocks

Quarterly factor returns

(Fig. 1) January 1, 2024—March 31, 2024

| Index | Total Return | Valuation | Growth | Momentum | Quality | Profitability | Risk | Size |

|---|---|---|---|---|---|---|---|---|

| Russell 1000 Growth | 11.41% | 2.62% | 2.07% | 13.79% | 0.53% | 10.65% | 2.90% | 3.84% |

| MSCI Japan | 11.16 | 8.07 | 3.14 | 18.11 | -5.16 | 1.85 | 6.58 | 15.49 |

| Russell 1000 | 10.30 | 0.39 | 3.43 | 14.01 | 3.01 | 10.80 | 0.57 | 7.74 |

| Russell 1000 Value | 8.99 | 2.20 | 2.84 | 15.26 | 3.48 | 10.31 | -0.71 | 7.93 |

| Russell 2500 | 6.92 | -4.15 | 0.43 | 5.34 | -0.51 | 3.05 | -4.13 | 5.94 |

| MSCI Europe | 5.39 | -1.53 | 7.54 | 6.43 | -0.83 | 8.28 | 0.31 | 9.02 |

| MSCI Emerging Markets | 2.44 | 9.44 | 3.03 | 14.28 | 4.38 | 8.43 | -5.81 | 6.01 |

| MSCI Pacific ex-Japan | -1.71 | -4.44 | 6.50 | 17.19 | 4.78 | 6.03 | -7.71 | 5.64 |

Past performance is not a reliable indicator of future performance.

Sources: Refinitiv/IDC data, Compustat, Worldscope, Russell, MSCI. Analysis by T. Rowe Price. See Additional Disclosures. Total return data are in U.S. dollars. Factor returns are calculated as equal-weighted quintile spreads. Please see Appendix for more details on the factors.

The first quarter of 2024 was marked by continued interest in artificial intelligence (AI)-related stocks, alongside growing signs of an economic soft landing, leading to debate over the number and timing of possible Federal Reserve interest rate cuts. Against this backdrop, we highlight three key themes:

- Momentum experienced historic returns: Momentum had exceptionally strong returns this quarter, representing a top 5% quarter based on quarterly returns dating to January 1, 1990, within the large-cap Russell 1000 Index. Generally, momentum captured high-quality, profitable, and larger-cap stocks with strong growth. Low momentum generally captured the opposite and, in particular, high leverage, as the market penalized firms at risk in a rising rate environment. Digging deeper, common themes within momentum include stocks expected to benefit from the AI capex cycle and adoption, stocks with cryptocurrency exposure in light of the first bitcoin-related exchange-traded funds (ETFs), and higher-quality stocks that have been able to withstand higher‑for-longer costs of capital.

- This was a broad global effect—not just the so-called Magnificent Seven: Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. It’s convenient to equate the momentum outperformance to outsized winners in AI. However, we emphasize that this is an overly simplistic view, as momentum experienced outsized returns across geographies, styles, and market capitalizations (Figure 1). Larger, profitable companies outperformed everywhere. This reflects the advantages these stocks have had in a higher cost-of-capital economic environment and a preference for quality as various regions and sectors emerge from rolling recessions.

- Our outlook on momentum is nuanced: Many investors have asked for our views on momentum. Having studied this extensively over the years, this is an atypically complicated environment. Historically, the largest momentum corrections have occurred after periods of economic weakness, where deeply discounted (negative momentum) stocks rebounded coming out of a recession (e.g., 2003 and 2009–2010). Smaller momentum corrections have occurred as periods of froth have unwound (e.g., 2000). Notably, the larger momentum corrections were driven by prior losers outperforming, and smaller corrections were driven by prior winners underperforming.

In some ways, momentum looks primed for a correction: It has had outsized recent performance, and we see signs of froth in some areas (e.g., AI and bitcoin) with post-recessionary conditions in others (e.g., real estate and some industrials), and momentum was highly correlated with quality in the first quarter, a common precursor to momentum corrections.

In other ways, momentum does not look traditionally risky. It does not appear overly concentrated in certain sectors or industries; our research shows it is not expensive; many of the high-momentum stocks have very strong fundamentals such that stock performance has been driven by earnings growth rather than by multiple expansion; and markets are at all-time highs, unlike the conditions in which quality and momentum correlations would normally be concerning.

Synthesizing our views, we suggest investors monitor and manage their momentum exposures, analyze whether their momentum is coming from concentrated versus broad drivers, and consider the long and short legs separately (e.g., overweight AI stocks versus underweight cyclical stocks). However, we do not have the evidence or conviction yet to sound a broad alarm on momentum.

Market insight—What we’re monitoring

Given the underperformance of small-cap stocks and lofty valuations among large-caps, investors are increasingly asking about small-cap opportunities at what appear to be attractive relative valuations. It is important to note that when referencing small-cap valuations, much of the commentary refers exclusively to those companies with positive earnings. We think it’s important to analyze the difference between a passive investment approach, which evaluates the entire universe, including money-losing companies, and an active approach that focuses on the more attractive subsets of the small-cap universe.

In this newsletter, we assess the valuation of small-caps using both approaches. We also lay out important compositional changes over the last 20 years in the large- versus small-cap universes, as we think it’s necessary to consider relative fundamentals in any discussion of relative valuation. We share four key findings:

- Small-caps appear to be attractively valued relative to large-caps.

- Compositional changes and weaker fundamentals explain much of the difference in relative valuation at the index level.

- Macroeconomic forces have posed a cyclical headwind for small-caps and are a potential catalyst for reversal.

- When we synthesize all these factors, we do not believe there is a strong valuation opportunity for a passive overweight to small‑caps, including negative earners. However, we do believe that there is a compelling opportunity for active small‑cap investors due to attractive valuations within higher‑quality small-caps, greater dispersion of returns for active stock picking, and the ability to benefit from a potentially improving economic backdrop.

Attractive valuations

For the purposes of this newsletter, we focus on the Russell 2000 Index as a reference class for small-caps and the Russell 1000 Index for large-caps. The performance of small-cap stocks has lagged large‑caps by 666 basis points on an average annual basis over the last five years (as of March 31, 2024), and, more recently, extremely narrow markets (see our second-quarter 2023 newsletter) have amplified the valuation disparity.

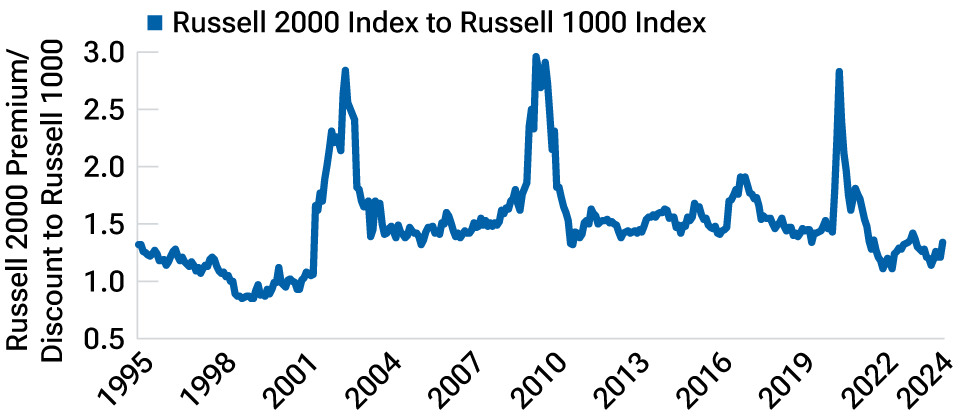

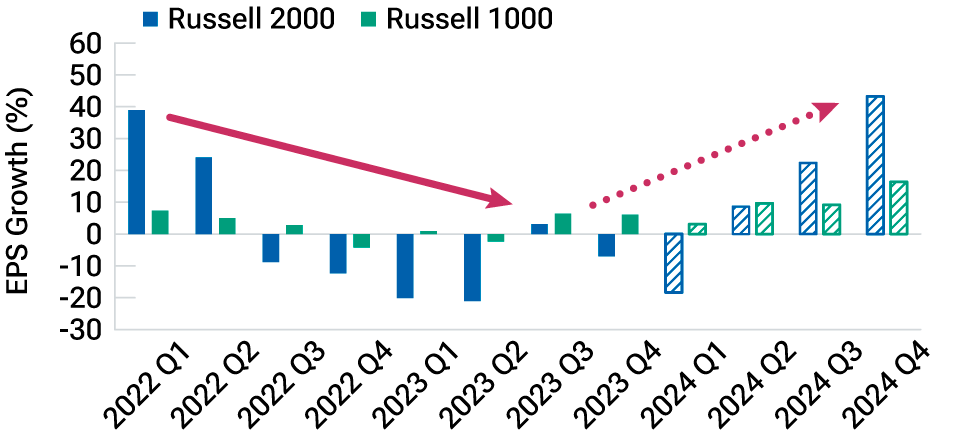

Profitable names trading at historical discount

(Fig. 2) Premium/discount in 12-month forward price/earnings (January 31, 1995—March 31, 2024)

Sources: Russell, IDC data/Refinitiv, Compustat, Thomson/IBES, MSCI. Analysis by T. Rowe Price. See Additional Disclosures. Valuation measurement is based on aggregated 12-month forward price‑to‑earnings ratio, excluding real estate and substituting with trailing 12-month earnings when next 12-month earnings are not available. For this calculation, we defined non-earners as companies with negative 12-month forward earnings; as for those without forward earnings numbers, we defined negative earners by negative trailing 12-month earnings. Actual outcomes may differ materially from estimates.

Today, the small-cap stock universe (including companies with negative earnings) is trading at a small premium to the large-cap universe based on 12-month forward price/earnings ratios, but after adjusting for their historical relationship, this represents a 10% discount (Figure 2). We note that this relationship can be noisy due to the inclusion of negative earners, which is why many analysts exclude them. However, we feel it is important to include companies with negative earnings because traditional passive approaches buy the aggregate earnings of all index components and pays for the aggregate market capitalization. From this perspective, the valuation opportunity is mixed.

However, when removing negative earners—to reflect a higher‑quality subset of the small-cap universe—the valuation opportunity becomes much more compelling, with a discount of 25% relative to the historical relationship (Figure 2).

Fundamentals

To understand why relative valuations have changed, we need to understand fundamental changes in the things being valued. We look at relative differences in fundamentals between small- and large-cap stocks over the same period where valuations diverged. A mistake analysts can make when comparing different universes of stocks through time is failing to account for changes in composition between the two things being compared, which can distort results. We highlight three material compositional changes in the small-cap universe compared with large-caps: lower relative profitability, lower relative growth, and changes in relative sector weights.

Change #1: Companies choosing private over public markets limits attractive small-cap stock opportunities

Pool of U.S.-listed companies has been shrinking, resulting in lower-quality names entering index

(Fig. 3) Number of U.S.-listed stocks (December 31, 1995—December 31, 2023)

Sources: Russell, Northfield, FactSet. Analysis by T. Rowe Price. See Additional Disclosures. Analysis based on Russell 3000 and Northfield U.S. Indexes, excluding REITs, ADRs, preferred stocks, SPACs, and non‑U.S.-listed stocks.

Percentage of negative earners among small-caps has been increasing

(Fig. 4) Percentage of negative small-cap earners(January 31, 1995—March 31, 2024)

Sources: Russell, Thomson/IBES. Analysis by T. Rowe Price. See Additional Disclosures. Analysis shows percentage of Russell 2000 Index with an available next 12-month earnings per share (EPS) estimate. For this calculation, we defined non-earners as companies with negative 12-month forward earnings. We specifically excluded companies without forward earnings numbers.

In the past, companies like Microsoft and Intel went public as small-caps and graduated into the large-cap space. Today, more companies choose to stay private until they are already large-cap. This reflects the growth of private equity markets and founders’ desire to forgo the complexities and oversight of public markets. As a result, the universe of public equities has shrunk from over 7,000 in 1996 to over 4,000 today. This means the small-cap universe has lost some of its historically attractive members, and index construction rules imply that passive benchmarks must go deeper into the pool of publicly traded stocks (Figure 3). As a result, the percentage of small-cap companies with negative earnings has risen from about 5% in the mid-1990s to approximately 30% today (Figure 4).

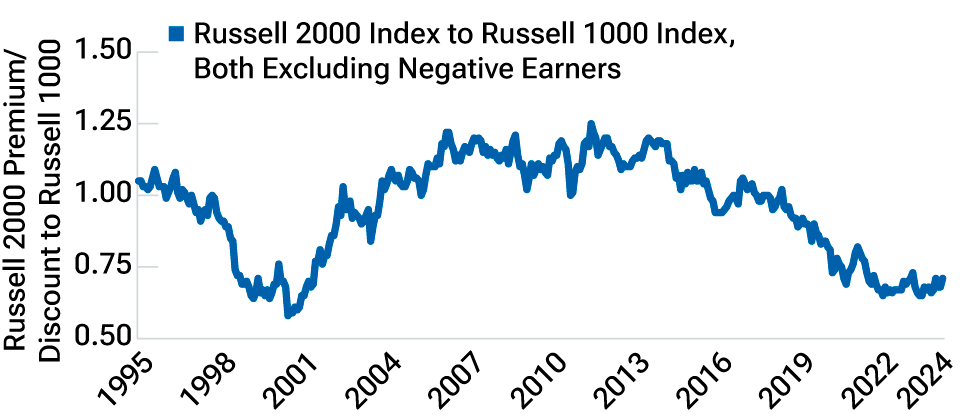

Declining relative profitability among small-caps

(Fig. 5) Relative median profitability in small-caps versus large‑caps (January 31, 1995—March 31, 2024)

Past performance is not a reliable indicator of future performance.

Sources: Russell, Compustat. Analysis by T. Rowe Price. See Additional Disclosures. This chart measures differences between Russell 2000 and Russell 1000 (both excluding real estate) median return on equity and median gross margin, where charted factors are available. Data reflect trailing gross margins and return on equity.

The shrinking public equity universe is not the only driver of profitability differences between large- and small-caps. Technology and regulations have increased the economies of scale in many industries, globalization has provided a tailwind to large multinational companies, and large companies have taken advantage of lower interest rates and taxes in the last two decades to boost margins. There has also been a sectoral composition change that we will discuss shortly. All these factors have led to large-caps showing significant improvement in gross margins and profitability that small-caps have been unable to match (Figure 5).

Change #2: The growth advantage of small-caps has deteriorated

As a result of growth companies staying private longer, in tandem with the unprecedented and sustained growth of mega-cap platform companies, the growth of small-caps relative to large-caps has declined. Historically, investors viewed the small-cap universe as a source of superior earnings growth, but our data today suggest that this advantage has dissipated to about parity.

Change #3: Sector composition

Russell 2000 Index has less tech and more energy compared with Russell 1000 Index

(Fig. 6) Relative weight of technology and energy in Russell indexes (January 31, 1995—March 31, 2024)

Sources: Russell, MSCI. Analysis by T. Rowe Price. See Additional Disclosures. This chart measures total weight differences between the Russell 2000 and Russell 1000 for energy and broader technology (information technology plus communication services).

With the advantages of scale in technology and platform companies, there has been a migration of information technology stocks from the small- to the large-cap universe. Meanwhile, “old economy” companies with slower growth and greater cyclicality have migrated to the small-cap space. An illustrative example is the energy sector, where concerns over terminal values have led to declining investor interest—and market capitalization—in these stocks (Figure 6). This compositional mix partially explains relative valuations. Information technology and communication services have gone from a 4% overweight in small-caps in 2007 to a 22% underweight. This is a huge 26% shift in sector composition from peak to trough over the last 30 years.

We emphasize that, while there are still many quality companies in the small-cap space, these differences in fundamentals are part of the mosaic through which we must interpret relative valuation opportunities.

Macroeconomic influences

In contrast to secular fundamental changes, we also highlight temporary macroeconomic forces that have introduced cyclical headwinds.

Post-COVID rate hikes have been a significant driver of large- versus small-cap relative performance

(Fig. 7) Relative return of small- to large-cap stock returns vs. 10-year U.S. Treasury yield (January 3, 2023—March 31, 2024)

Past performance is not a reliable indicator of future performance.

Sources: Federal Reserve Bank of St. Louis, Russell, IDC data/Refinitiv. Analysis by T. Rowe Price. See Additional Disclosures. This chart measures the cumulative daily Russell 2000 Index performance relative to the Russell 1000 Index and compares it with the inverted 10-year U.S. Treasury yield. Co-movement of Russell 2000 outperformance and decrease of U.S. 10‑year yield demonstrates the impact of interest rates to small versus large relative performance. Performance indexed to 100 at the close of December 31, 2022.

Most importantly, rising interest rates have been a double whammy for small-caps. First, small-cap stocks tend to be longer-duration assets, as a greater percentage of their earnings typically lie in the future. As a result, rising rates have had a more significant impact on their justified valuations. Second, small-caps tend to have more floating rate debt, so they are more immediately sensitive to interest rate changes than large-caps. Relatedly, small‑caps have a larger portion of debt maturing in 2024 and 2025, creating a near-term headwind from financing costs. As a result, small-caps have been particularly interest rate sensitive during the recent monetary policy tightening cycle (Figure 7).

In addition, small-caps have underperformed due to concerns about their cyclicality. While many economists predicted a recession that has yet to materialize, beneath the surface we have observed “rolling recessions,” with different industries experiencing growth slowdowns at different times. As small-cap stocks tend to be more cyclical, historically they have struggled more during growth slowdowns but have recovered more strongly afterward.

Looking forward, the market is pricing in some Federal Reserve interest rate cuts this year, as well as a broadening earnings growth recovery. We believe these dynamics will present an eventual tailwind for small-caps when they materialize.

The opportunities in small-caps

Given these offsetting dynamics, our research suggests that there are significant, yet nuanced, opportunities within small-caps. Importantly, these opportunities appear more available to active investors than to passive investors, and we, therefore, have a higher conviction level today in active small-cap management than we do a passive investment mirroring the small-cap index. The three opportunities we will discuss are:

- An attractive macroeconomic setup

- Greater dispersion of returns

- An outsized valuation opportunity in quality small-caps

First, a more attractive macroeconomic backdrop would be a tailwind for small-cap stocks. The market has increasingly adjusted expectations for an economic soft landing (or no landing) alongside measured interest rate cuts, which, historically, has been a positive environment for small-caps. We believe that, if markets are wrong and a recession materializes, falling rates could be a material headwind for small-caps.

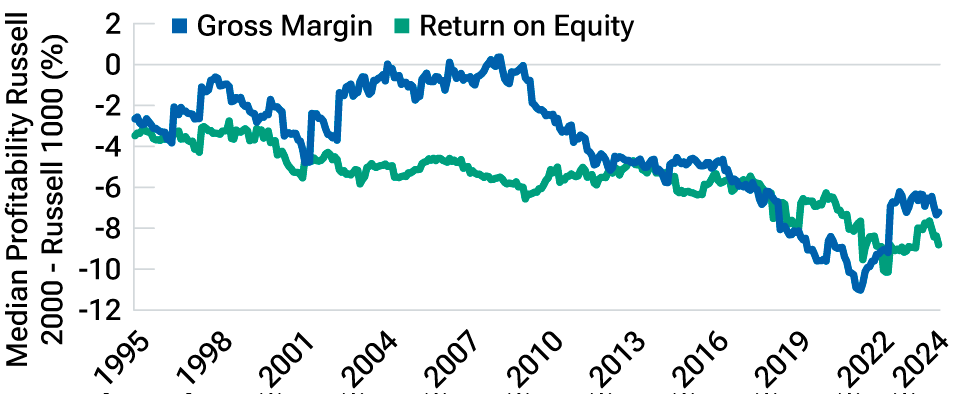

Small-cap earnings per share (EPS) growth expected to recover after large-caps

(Fig. 8) Quarterly year-over-year EPS growth, realized andconsensus, first quarter of 2022 to fourth quarter of 2024.As of March 31, 2024.

Past performance is not a reliable indicator of future performance.

Actual future outcomes may differ materially from estimates. Sources: Compustat, Thomson/IBES, FactSet. See Additional Disclosures. This chart shows the realized (Q4 2023 and prior) and expected (Q1 2024 and after) quarterly year‑over‑year earnings growth rate as of March 31, 2024.

Our data, however, support the optimistic view. We have observed a de-synchronized earnings recession in the U.S. by sector and by size. Large-caps started seeing positive earnings growth in the third quarter of 2023, whereas small-caps are projected to see positive growth and acceleration in the second quarter of 2024. Per consensus expectations, the second half of 2024 should see the more cyclical small-cap stocks in the Russell 2000 Index outgrow their large-cap counterparts (Figure 8).

Despite large-cap outperformance, the small-cap space had bigger winners in 2023

(Fig. 9) Calendar year 2023 stock returns

Past performance is not a reliable indicator of future performance.

Sources: Russell, IDC data/Refinitiv. Analysis by T. Rowe Price. See Additional Disclosures. This chart shows the distribution of 2023 calendar year returns of Russell 2000 and Russell 1000 constituents, capped between -100% and 300%.

Second, small-cap stocks have greater dispersion in their fundamentals and their total returns. Based on our analysis, the best- and worst‑performing stocks come from the small-cap space. In fact, even in a year dominated by mega-cap technology stocks, a disproportionate share of the highest stock returns in 2023 still came from the small-cap universe (Figure 9). We believe that active management can add significant value in small-cap stock selection, even when the index underperforms, if the skilled active manager is able to exploit this dispersion with outperforming stocks.

Finally, we think there is an extremely compelling valuation opportunity within quality small-caps.

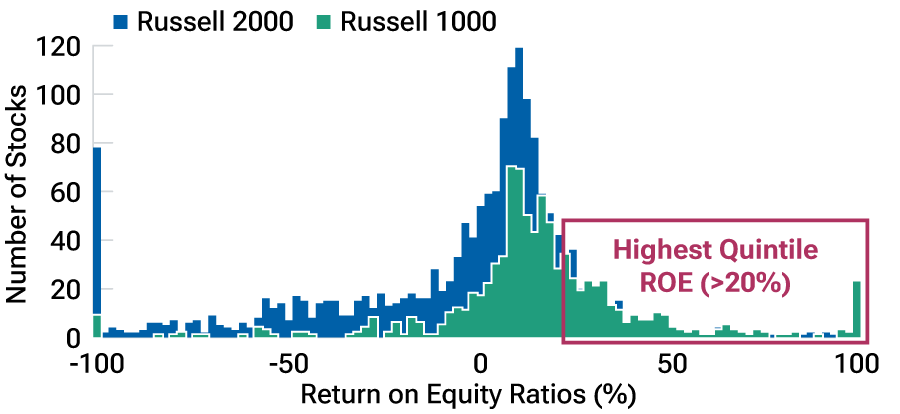

Large- and small-cap stocks with similar return on equity ratios enable consistent comparison

(Fig. 10) ROE distribution of large- and small-caps as of March 31, 2024

Past performance is not a reliable indicator of future performance.

Sources: Russell, IDC data/Refinitiv, Compustat, FactSet. Analysis by T. Rowe Price. See Additional Disclosures. This chart shows the distribution of ROE ratios of Russell 2000 and Russell 1000 constituents, excluding real estate, capped between -100% and 100%. ROE is calculated by dividing the last 12 months’ earnings of individual companies by the average of their book value.

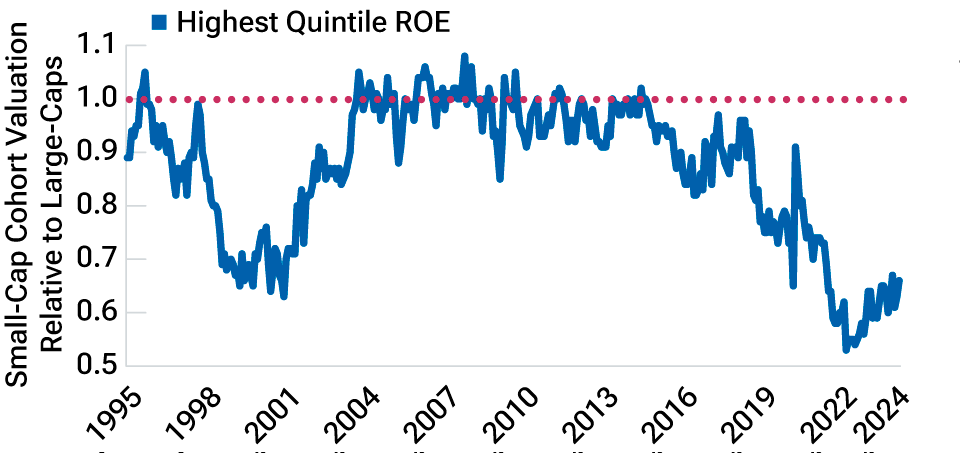

Small-caps with high ROEs trading more cheaply for similar attributes

(Fig. 11) Premium/discount in 12-month forward price/earnings (January 31, 1995—March 31, 2024)

Sources: Russell, IDC data/Refinitiv, Compustat, Thomson/IBES,MSCI. Analysis by T. Rowe Price. See Additional Disclosures. Valuation measurement is based on median 12-month forward price to earnings, where ROE and forward price to earnings are available, excluding realestate. This chart measures valuation differences between small‑cap stocks and large-cap stocks that rank in the first quintile of ROE in the Russell 3000 universe. Quintiles based on ROE are reconstituted monthly. ROE is calculated by dividing the last 12 months’ earnings of individual companies by the average of their book value.

Recalling Figure 2, there is a significant valuation opportunity among the small-caps with positive earnings that is much less compelling for the index as a whole. However, to do the analysis properly, we can’t just look at positive earners because the absolute levels of return on equity (ROE) may still be lower than those in large-caps. To get a true apples-to-apples analysis, we ranked all stocks in the Russell 3000 Index—a proxy for the entire U.S. equity market—by ROE (Figure 10). We note that the small-cap space has a long tail of negative ROE stocks, but both the Russell 1000 and Russell 2000 Indexes have a critical mass of positive earners with similar profitability. To understand the opportunity, we took large- and small-cap stocks with similarly high ROEs and compared their valuations (Figure 11).

The critical takeaway is that among stocks with similarly high ROEs, the small-cap universe is valued at a 34% discount. Why would this be the case? Our hypotheses are:

- The outsized interest in the so-called Magnificent Seven means that many quality businesses are being overlooked, including some of the most attractive stocks in the small-cap space.

- Investors have often—and, in our view, mistakenly—used traditional passive ETFs to invest in small-caps. These ETFs usually allocate capital according to market capitalization rather than according to fundamental attractiveness. The rise in passive management has increased neglect in high‑quality small-cap business models.

- By lumping all small-caps together, and by favoring large-caps over small-caps, investors may have inhibited price discovery among high-quality small-caps, creating an opportunity for active managers.

Extreme starting valuation has been correlated with higher subsequent long-term gains

(Fig. 12) Forward 10-year annualized returns vs. starting12-month forward P/E ratio (January 31, 1995—March 31, 2014(available forward 10-year returns*))

Past performance is not a reliable indicator of future performance.

Sources: Russell, IDC data/Refinitiv, Thomson/IBES, MSCI. Analysis by T. Rowe Price. See Additional Disclosures. 10-year forward return means the 10-year subsequent return. Relative valuation measurement is based on aggregated market cap to the next 12 months’ earnings, excluding real estate and negative earners, and substituting with trailing 12-month earnings when next 12-month earnings are not available. Relative 10-year annualized return measurement is the difference between Russell 2000 and Russell 1000 forward 10-year index returns.

* The arrow points to the current price-to-earnings ratio (0.71 as of March 31, 2024), where earnings are calculated by aggregating 12-month forward price-to-earnings ratios, excluding real estate and negative earners, substituting with trailing 12-month earnings when next 12-month earnings are not available. This is not to be considered a specific estimate of future returns and is for illustrative purposes only. Actual future outcomes may differ materially.

Based on our analysis, starting valuations have been proven to be highly correlated to long-term outsized returns (Figure 12). Current small-cap valuations provide, in our opinion, a great setup for potential long-term gains. Focusing on the high-quality cohort within small-caps should allow investors to gain from the market dislocation without assuming unwanted risks.

Summary and conclusion

Small-caps appear to be undervalued today relative to large‑caps. We think that the reality is more nuanced and requires a thoughtful analysis of valuation techniques (such as whether to include negative earners) and of the changing composition of small-caps versus large-caps. We conclude that the small-cap index as a whole may be slightly attractive, but it is not a high-conviction view: The index appears to be relatively cheaper than history versus large-caps, but also with weaker fundamentals. The optionality of the asset class is supported by potential macro tailwinds and a compelling starting valuation. However, we believe there is a higher probability and, thus, compelling opportunity for higher‑quality small-caps that have been left behind and are at a historically attractive valuation level compared with history. We believe the supportive macroeconomic backdrop, attractive valuations, and opportunity for outsized returns present a compelling opportunity for active small-cap allocations.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

April 2024 / FIXED INCOME