Target Date Solutions

Feel retirement certain

At a Glance

years of shaping retirement futures

target date investment professionals

USD of target date AUM*

We believe only outstanding is good enough.

That’s why our approach to target date solutions is grounded in three principles.

Putting your needs first

Because we understand your needs and the impact change can have on retirement, we offer a choice of target date solutions to address a range of goals and real-life objectives—so that you can feel retirement certain.

Uncompromising on risk

Our people-centric approach to managing risk is centered on one thing: helping achieve retirement goals. We look at the full retirement picture to manage the many risks and opportunities that arise over a lifetime of investing.

Quality and innovation, as standard

You want a target date solution that keeps up with the times. So do we. Our advanced analytics go beyond the average—digging deeper on real-world spending and savings behaviors, market trends, and more to help us deliberately evolve to anticipate and respond to change.

Our thoughts on the issues that matter to you.

Asset Allocation Viewpoints

In the current investing environment, discover how our Asset Allocation Committee is positioning its portfolios.

How We Design a Blend Solution for Target Date Investors

Mixing active and passive investments in a target date solution.

A New Way to Calculate Retirement Healthcare Costs

Separating premiums and out-of-pocket costs makes it easier to plan for expenses.

CONFIDENT CONVERSATIONS® on Retirement Podcast

How much do you know about Target Date Solutions? Join us as we unpack the world of Target Date Solutions, one of the most popular investment vehicles designed to simplify the path to retirement.

Our Retirement Funds beat passive peers 100% of the time.

At T. Rowe Price, we know that better investment returns can lead to better retirement years. Our Retirement Funds have delivered higher returns than comparable passive funds in every 10-year monthly rolling periods over the last twenty years. On average, our funds outperformed by 1.11% annually. This kind of extra return can compound over time and may lead to higher retirement balances.

Compared with combined portfolios of passive target date funds over 10-year monthly periods over the last twenty years through 12/31/24.

The performance data shown is past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance, visit troweprice.com.

View standardized returns and other information about the funds in this analysis. More information on the methodology of the analysis.

Wyatt Lee, CFA®

Portfolio Manager, Multi-Asset

Wyatt Lee, CFA®

Portfolio Manager, Multi-Asset

Our dedicated team of highly skilled experts are committed to helping meet retirement goals, whatever they may be.

Wyatt Lee, CFA®

Portfolio Manager, Multi-Asset

Wyatt Lee, CFA®

Portfolio Manager, Multi-Asset

Wyatt Lee is the head of Target Date Strategies in the Global Multi-Asset Division. He is co-manager of target date portfolios. Wyatt also is a member of the firm's Asset Allocation and Multi-Asset Steering Committees. Wyatt is a vice president of T. Rowe Price Group, Inc., T. Rowe Price Trust Company, and T. Rowe Price Associates, Inc.

Kim DeDominicis

Portfolio Manager

Kim DeDominicis

Portfolio Manager

Kim DeDominicis is a portfolio manager of the target date strategies in the Multi-Asset Division. She also leads the U.S. College Savings Plan investment efforts. Kim is a vice president of T. Rowe Price Group, Inc., T. Rowe Price Trust Company, and T. Rowe Price Associates, Inc.

Andrew Jacobs Van Merlen, CFA®

Portfolio Manager

Andrew Jacobs Van Merlen, CFA®

Portfolio Manager

Andrew Jacobs van Merlen is a portfolio manager and co-portfolio manager for the target date strategies in the Multi-Asset Division. Andrew is a vice president of T. Rowe Price Group, Inc., T. Rowe Price Trust Company, T. Rowe Price Associates, Inc., and T. Rowe Price International Ltd.

Contact us — we're here to help.

A broad range of solutions designed to help meet your retirement needs.

A solution for every path

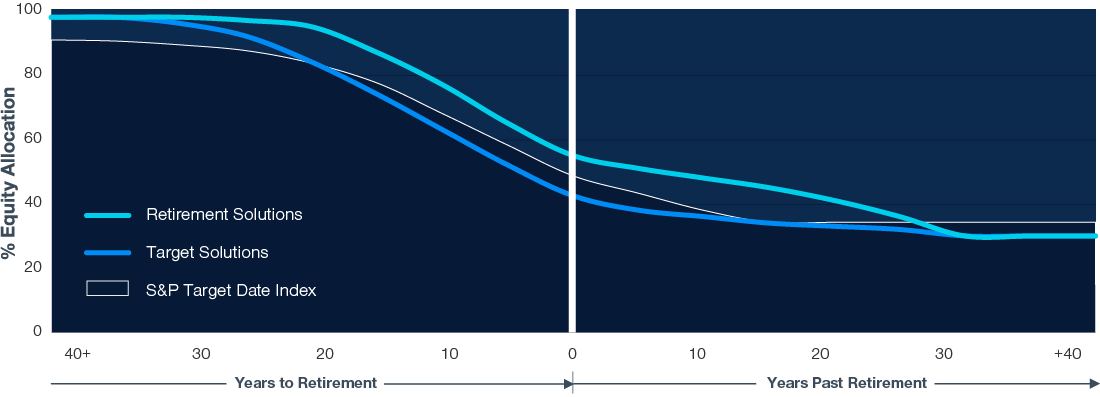

Retirement journeys can last for decades. That’s why we offer a choice of outcome-based glide paths, designed to help address differing retirement objectives leading up to, at the point of, and into retirement.

A recognized leader

Morningstar Medalist RatingTM

^The Retirement Trusts classes D, E, G, H, J, and K are Gold and the Retirement Trusts classes A, B, C, and F are Silver as of December 30, 2024.

I Class shares may not be available to all participants. Trusts are available only to certain types of retirement plans and may not be available to all participants.

Ratings for other share classes may differ. The Morningstar category for all vintages of the target date series is US Fund Target Date for mutual funds and Morningstar US SA Target Date for trusts.

See Morningstar Rating Disclosure for important information about the ratings.

Important Information

*Combined target date portfolios include assets managed by T. Rowe Price Associates, Inc. and its investment advisory affiliates as of December 31, 2024. T. Rowe Price Trust Company, as trustee for the T. Rowe Price Common Trust Funds (“Trusts”), has retained the services of T. Rowe Price Associates, Inc. and/or its investment advisory affiliates to assist it in the investment of assets of the Trusts. Figures above include Trusts’ assets.

1Average was time weighted based on the percentage of total rolling performance periods provided by each Retirement Fund.

Analysis by T. Rowe Price. Source: Morningstar. The target date funds included in the combined portfolios were (1) defined as passive by Morningstar as they were listed as "Index-Based" within their Morningstar Institutional Category, and (2) with Morningstar universe sharing the same target date as each Retirement Fund. Combined portfolios were equally weighted and based on the oldest share class of each competing passive target date fund. The Retirement 2005 Fund was excluded from the study, as it had a limited number of passive peer constituents in the Morningstar universe; the Retirement 2065 Fund was excluded due to lack of a 10-year track record.

Although in the same category, there may be material differences among target date funds, including fees, expenses, and the portfolio mix of investments. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Passive investing may lag the performance of actively managed peers as holdings are not reallocated based on changes in market conditions or outlooks on specific securities. Results for other time periods will differ.

The T. Rowe Price target date trusts, and their underlying trusts (the Trusts) are not mutual funds; rather the Trusts are operated and maintained so as to qualify for exemption from registration as mutual funds pursuant to Section 3(c)(11) of the Investment Company Act of 1940, as amended. The Trusts are established by T. Rowe Price Trust Company under Maryland banking law, and their units are exempt from registration under the Securities Act of 1933. Investments in the Trusts are not deposits or obligations of, or guaranteed by, the U.S. government or its agencies or T. Rowe Price Trust Company and are subject to investment risks, including possible loss of principal.

All investments are subject to market risk, including the possible loss of principal. The principal value of the target date funds is not guaranteed at any time, including, if applicable, at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65). Investments in other funds: The fund bears the risk that its underlying funds will fail to successfully employ their investment strategies. One or more underlying fund's underperformance or failure to meet its investment objective(s) as intended could cause the fund to underperform similarly managed funds. Interest rates: A rise in interest rates typically causes the price of a fixed rate debt instrument to fall and its yield to rise. Conversely, a decline in interest rates typically causes the price of a fixed rate debt instrument to rise and the yield to fall. International investing: Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. Emerging markets: Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and other developed markets. See the prospectus for more detail on the fund's principal risks.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Important Information About the Morningstar Ratings

The Morningstar Medalist RatingTM is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to global.morningstar.com/managerdisclosures/.

The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

©2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The above graphic shows a circular chart and bar chart demonstrating the amount and frequency with which T. Rowe Price Retirement Funds delivered better returns than passive peer funds over 10-year rolling monthly periods over the last twenty years through 12/31/24. The circular chart shows that the Retirement Funds delivered better returns in 100% of the 10-year rolling monthly periods analyzed. The bar chart shows 11 bars displaying the average additional annual return delivered by each of 10 Retirement Funds, plus the average of all 10 funds. The Retirement Funds are listed by their specific target retirement year. The average additional annual return for each Retirement Fund is listed as follows: 2010: 0.94%; 2015: 1.00%; 2020: 1.32%; 2025: 1.15%; 2030: 1.54%; 2035: 0.98%; 2040: 1.45%; 2045: 0.77%; 2050: 1.02%; 2055: 0.69%; 2060: 0.30; total average of additional returns: 1.11%. All results are shown after fees and expenses.

These glide paths outline how the mix of stocks, bonds, and other investments adjust over time to help savers achieve their desired retirement outcomes. Both our Retirement and Target glide paths emphasize growth during the early phases of retirement saving and become more conservative over time. The Retirement glide path is focused on delivering the full value of active management to grow retirement savings. At 30 or more years before retirement (assumed to be age 65), the Retirement glide path holds a 98% allocation to equity, which decreases to 55% at retirement and then to 30% at 30 years past retirement, where it remains steady. The Target glide path, which is focused on delivering the full value of active management and managing volatility around retirement, holds a 98% allocation to equity until 35 years before retirement, then decreases to 42.5% at retirement and to 30% at 30 years past retirement, where it remains steady.

202408-3801046