May 2024 / FIXED INCOME

No green without blue: How blue bonds could support climate goals

Earth’s oceans capture the majority of the global CO2 produced by humans.

Key Insights

- Supporting ocean resources that are under stress from a variety of sources is critical to addressing carbon reduction goals.

- Earth’s oceans capture the majority of the global CO2 produced by humans, but their capacity to absorb that carbon is deteriorating.

- As a developing source of support, blue financing could provide funding for ocean-friendly projects spanning regions and sectors.

Water and the pivotal role it plays in absorbing atmospheric carbon dioxide (CO2)—the Earth’s most abundant greenhouse gas (GHG)—cannot be ignored in our journey to achieve net zero1 by 2050. As the famous American marine biologist, Sylvia Earle, would say, “No blue, no green.” Over 70% of the Earth’s surface is covered by water, adding to its role as a driver for planetary health.

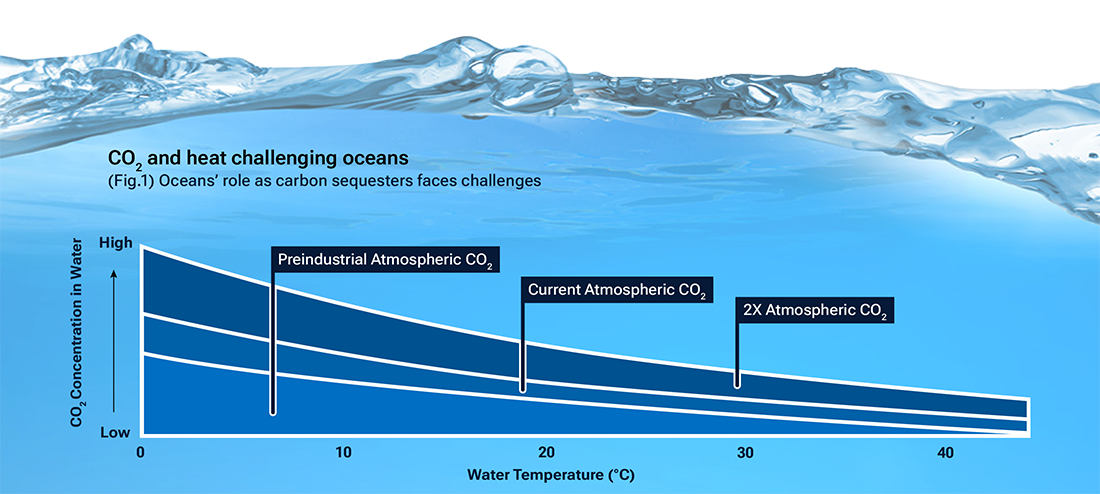

CO2 and heat challenging oceans

(Fig.1) Oceans’ role as carbon sequesters faces challenges

Source: Original diagram sourced from Robert Simmon, NASA’s Earth Observatory, published July2008. The diagram is reproduced by T. Rowe Price. This diagram is a simplified image showing that as atmospheric CO2 increases from preindustrial levels to double (2X) preindustrial levels, the concentration of CO2 in water increases. However, as water temperatures increase, the oceans’ ability to absorb carbon diminishes.

The oceans’ ability to capture carbon…

Earth’s oceans capture nearly one-third of the global CO2 produced by humans.2 Phytoplankton—tiny, microscopic plants that live in the upper centimeter of the global oceans—absorb atmospheric CO2 to use in photosynthesis to provide food for themselves and release oxygen back into the atmosphere. Since preindustrial times, the amount of carbon that oceans have needed to take up has increased exponentially as the oceans have worked to maintain a balance with the increased CO2 levels in the atmosphere. Distressingly, the ocean’s capacity to absorb that carbon is deteriorating due to the chemical changes that increased carbon is causing in seawater. Exacerbating the diminishing capacity of the oceans to absorb atmospheric carbon is increasing temperatures.

Figure 1 depicts the concentration of CO2 that the oceans can maintain depending on the relationship between atmospheric CO2 and temperature. As atmospheric CO2 increases, so does the concentration of CO2 in the ocean; however, at higher temperatures, the ability to absorb carbon is diminished.

…is facing challenges

Since industrialization, oceans have absorbed 90% of the excess heat resulting from anthropogenic (human-generated) climate change. Unfortunately, as oceans warm, they cannot take in as much CO2. The mission-critical roles of absorbing CO2 and excess heat underpin our belief that oceans and waterways are a critical part of the balancing act to achieve net zero and highlights the need to prioritize investments supporting the blue economy.

Potential new tools

Corporations that are active in the blue economy play a critical role in ensuring that the oceans continue to function as significant nature-based carbon sequesters and that providers of oxygen do not degrade. As their business activities are uniquely tied to healthy oceans, some corporations could seek to implement projects that support ocean health. Blue financing is an emerging area of sustainable finance, with growing interest from investors and issuers alike. A subset of green financing, blue bonds mobilize capital to ocean-friendly projects and critical clean water resource management projects, providing an excellent tool to fund corporate initiatives seeking to minimize adverse impact on planetary health.

Sector examples

Transportation

Ocean transportation accounts for 2.9% of global GHG emissions and could climb to 10% with an anticipated near tripling of maritime trade volumes by 2050.3 Moreover, the shipping industry is a large contributor to acidification of our waterways. By absorbing carbon from the atmosphere, the ocean is growing more acidic and directly harming marine life, which can lead to very significant ecosystem degradation. To counter the acidification, the International Maritime Organization (IMO) has set a 50% decarbonization target for the shipping industry by 2050. Additional incentives for maritime shippers to decarbonize come from large customers seeking to reduce their own carbon footprint. Blue bonds could serve as a key financing tool to help shipping and shipbuilding companies achieve this goal with investments toward manufacturing and purchase of new vessels with low (at least 60% emission reduction) or zero-emission ships. One can think of 100% electric ships as well as ships powered by green ammonia, green hydrogen, or green methanol. For existing vessels, investments could reduce emissions by at least 20% through retrofitting to improved ship designs; carbon capture; or sails, rotors, and kites.

Tackling plastic waste

A recent peer-reviewed study 4 shows that more than 171 trillion pieces of plastic are estimated to be floating in the world’s oceans. Over time, currents have transported debris to several “vortexes.” The plastic debris is dangerous to marine life that mistake it for food or get caught in it. Plastic kills fish and sea animals and is very harmful to marine biodiversity. But the trash vortexes also block sunlight from phytoplankton and algae, threatening entire food webs. Biodiversity and healthy phytoplankton are crucial for the ocean to maintain its function as a carbon sink and provider of oxygen.

Recycling or reusing plastics is fundamental to eliminating plastic pollution. Blue bonds could help provide an excellent source of funding to support the production and manufacturing of recycled plastics. These investments could not only help reduce the amount of plastics entering our waters, but they also would support lower energy consumption as recycled plastic resin cuts emissions up to 71% versus virgin material.5

Renewable energy

According to the United Nations, fossil fuels, such as coal, oil, and gas, contribute over 75% of global GHG emissions, including nearly 90% of CO2 emissions. Transitioning from fossil fuels to renewable energy sources could have a dramatic impact in reducing GHG emissions.

The blue economy is also a fertile ground for offshore renewable energy, on both our oceans and lakes. Offshore wind tends to benefit from stable wind streams, of which there is an abundance available in water environments without the competition from other stakeholders that exist on land. Sensitivities around disturbances to sea animals and biodiversity can be managed and mitigated; in fact, blue bond use of proceeds projects could finance the pursuit of nature net positive outcomes in the marine biosphere.

Blue bonds provide a natural tool to finance investments of offshore wind and solar projects.

United Nations Water argues that “climate change is primarily a water crisis,” an observation we agree with. As these sector examples show, water and oceans are a critical part of the decarbonization agenda and can’t be ignored if we want to meet the Paris Agreement goals.

Project spotlight highlighting blue financing in action

Transportation example:

The Ørsted inaugural blue bond is a good recent example. The proceeds in that instance will be deployed to scaling-up existing efforts on marine biodiversity and aims to support the transition to sustainable shipping.

Plastic Waste Example:

The World Bank’s innovative recent bond issue is intended to fund plastic waste reduction projects. The selected outcomes-based projects are located in Ghana and Indonesia.

The specific examples identified and described are provided for informational purposes only, and do not represent a recommendation of securities by T. Rowe Price.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.