January 2024 / ASSET ALLOCATION

Asset Allocation Considerations for Public Defined Benefit Plans

Are your fixed income allocations positioned for yesterday, today, or tomorrow?

Key Insights

- Higher interest rates have raised return potential in both core and non‑core fixed income sectors. In our view, this shift may be structural, not temporary.

- For the first time in years, expected fixed income returns are more aligned with the typical public defined benefit (DB) plan’s objectives. An allocation review may be in order.

- Public fixed income allocations in the average public DB plan’s portfolio have fallen sharply since 2002, potentially exposing them to downside risk in a traditional flight to quality.

- Dynamic, actively managed strategies may help mitigate downside risk, particularly in market environments where equity‑bond correlations are uncertain.

In the wake of the 2008–2009 global financial crisis (GFC), public defined benefit plan sponsors, like other investors, were forced to grapple for more than a decade with an economic backdrop marked by zero or near‑zero interest rates in the U.S. and most other major developed markets.

Since 2021, however, a sharp turn toward restrictive monetary policy by the U.S. Federal Reserve and other major central banks has pushed cash rates dramatically higher. Expected returns for many asset classes have risen accordingly, broadening the option set for investors. For the first time since 2008, public fixed income markets offer the potential to generate returns that are aligned with the typical DB plan’s expected return on assets (EROA).

This sea change raises a question: Are current fixed income allocations for public DB plans still appropriate, given the interest rate environment and plan sponsors’ return objectives? To find an answer to this question, many public DB plans are reviewing their strategic asset allocation policies with their investment teams, board, and consultants.

In early 2023, T. Rowe Price conducted a proprietary survey of public DB plan policymakers to focus on key trends in their investment philosophies and anticipated asset allocation changes.1 The insights we gained from this survey were consistent with the trends in the historical data—in particular, a greater willingness among plan sponsors post‑GFC to increase exposure to equity and liquidity risk.

We also learned that the top concern for public DB plan respondents heading into 2023 was a perceived need to evaluate and modify broad asset allocation targets at the highest level. Specifically, we found significant plan sponsor interest in flexible fixed income mandates that would help them navigate a more volatile macro environment.

Stated simply, many public DB plan sponsors are considering whether to increase plan exposure to publicly traded fixed income, including traditional core and core‑plus mandates, investment‑grade corporates, high yield, and emerging market (EM) debt. In today’s markets, these sectors appear to offer a broader, more attractive opportunity set.

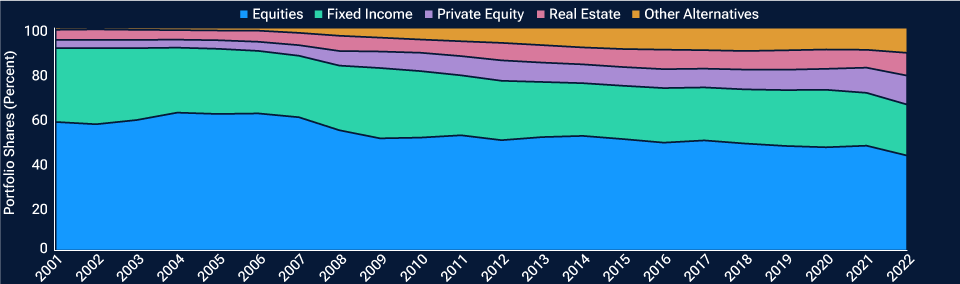

Evolution of public DB plan allocations

The interest rate environment in the years following the global financial crisis created a yield‑starved environment for public DB plans. Asset allocators were forced to address the impact of near‑zero rates across their portfolios. For many public DB plan sponsors, this prompted a shift from publicly traded fixed income toward private equity, private credit, and other alternatives (Figure 1). Some of the results:

- Public fixed income allocations were sharply reduced, falling from 34% of the average DB public plan’s portfolio in 2002 to 29% in 2008 and less than 23% by 2022.

- Duration exposure declined even more as some traded fixed income assets were redeployed in private credit, where the underlying securities are loans with little to no duration.

- Since most public DB plans benchmarked their remaining traded fixed income assets to the Bloomberg U.S. Aggregate Index, dollar duration declined even more.

The evolution of public DB asset allocation

(Fig. 1) Average asset allocation of state and local pension plans.

Sources: Center for Retirement Research at Boston College, MissionSquare Research Institute, National Association of State Retirement Administrators, and the Government Finance Officers Association. Allocations sourced from public plans data, 2001–2022.

While many of these allocation shifts were rational and incrementally made, the net result was to increase exposure to equity risk—both directly and via the higher weight given to credit—and to reduce liquidity. Moreover, some plans may have over‑allocated to alternatives, in our view. That said, we recognize that the shift to greater risk taking by many public DB plans is unlikely to revert quickly. However, we believe it may be prudent to consider making incremental changes, including reconsidering both the role and the breadth of public fixed income exposures within a plan’s allocation.

Responding to the current market environment

Our survey found that many public DB plan sponsors are seeking a framework for evaluating the potential for fixed income to play a larger role in their portfolios. Among respondents who said their top concern was fixed income, the single‑most widely cited reason was uncertainty over whether their overall portfolio construction approach was appropriate in the current environment.

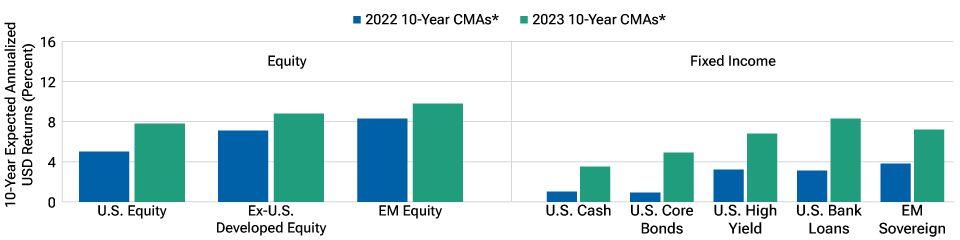

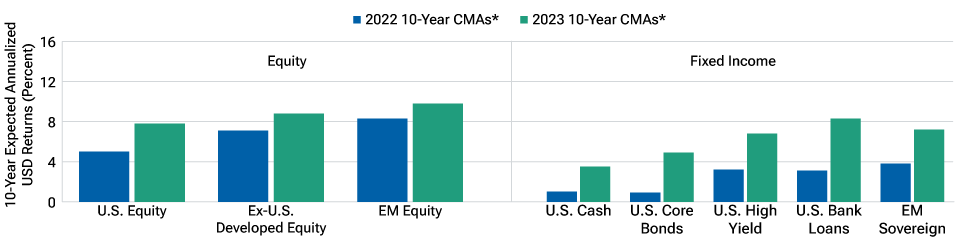

Capital market assumptions have increased

(Fig. 2) T. Rowe Price 10‑year capital market assumptions (CMAs).

As of February 2023.

T. Rowe Price 10‑year capital market assumption methodology is consistent with the 5‑year methodology with an extended horizon for valuation convergence.

Expected returns are shown for asset classes without consideration of fees and expenses.

*Source: T. Rowe Price. This information is not intended to be investment advice or a recommendation to take any particular investment action. Forecasts are based on subjective estimates about market environments that may never occur. See the Appendix for important information and a representative list of indexes.

In our view, a key element of this framework is the recognition that the capital market assumptions underlying many asset allocation models—including T. Rowe Price’s—have shifted as cash rates have risen. Forward‑looking return expectations for many fixed income assets are now meaningfully higher than they were just a year ago—and those increases have been proportionally larger than in key equity categories (Figure 2).

What is most notable is not that cash rates have risen, pushing real cash rates into positive territory, or that yields also have risen sharply, but that for the first time in many years, expected returns for many non‑core fixed income sectors are now higher than the median EROA for U.S. public DB plans. In our view, this leaves plan sponsors with greatly expanded allocation options. However, that same wealth of opportunities means that asset allocation decisions could become more challenging in the years ahead.

For now, while our survey indicated that some public DB plan sponsors are still holding to their current allocations, it appears that others intend to broaden their fixed income exposure going forward. As rates have moved higher and remained that way since our survey was conducted, our client conversations are increasingly focusing on strategic asset allocation considerations, indicating that some plan sponsors believe the higher interest rate environment may be here to stay.

We expect it will take time for public DB plan sponsors to adjust to a higher interest rate environment—just as it took them time to respond to the zero‑rate period following the GFC. Much depends on whether plan sponsors believe the current rate environment is temporary, or, like us, view it as a structural shift to a new regime, one in which 3%–5% cash rates should be viewed as policy neutral. If sponsors conclude the latter scenario is correct, allocation changes could accelerate.

Are bonds back?

It would be easy to conclude from the above discussion that we fall firmly in the “bonds are back” camp. However, while our fixed income outlook is constructive, it comes with some caveats. As of late 2023, interest rates—not credit spreads—were driving volatility in global credit sectors. This being the case, returns over the shorter term likely depend on where the Fed stands in its policy cycle.

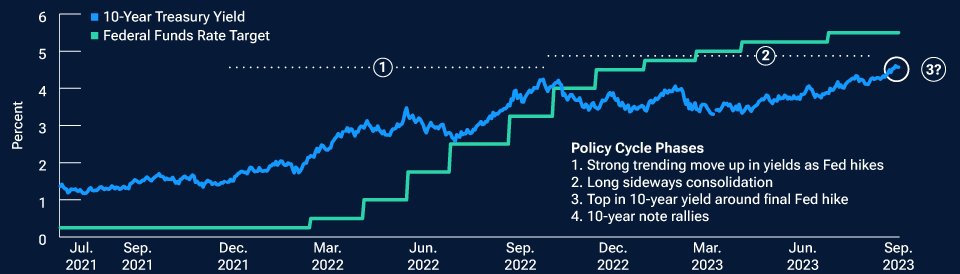

Where are we in the Fed’s policy cycle?

(Fig. 3) Federal funds rate and the 10‑year Treasury yield.

As of September 30, 2023.

Source: Bloomberg Finance L.P. Data analysis by T. Rowe Price.

In looking at the monetary cycle, we perceive that it typically passes through four phases (Figure 3):

- Phase 1: The period when the Fed is actively hiking rates. In this phase, yields tend to follow that upward trend higher.

- Phase 2: The market tries to guess the terminal rate level for the cycle. This can push yields into a sideways period of consolidation.

- Phase 3: Yields peak—typically within four months, plus or minus, of the final Fed hike. This can create opportunities to buy duration.

- Phase 4: The Fed often stays anchored on tamping down inflation, holding rates high despite the slowing data. This creates the risk of a policy mistake, in which case yields can fall dramatically.

As of November 2023, our view was that we were still in the transition period from Phase Two to Phase Three of this cycle, but closer to the latter. Accordingly, we are looking for rates to peak some time in the next few quarters. But this also means fixed income investors can generate potentially attractive returns in floating rate and/or short duration assets without taking on increased interest rate risk. Tactical caution may be advisable, in our view, until the timing of the transition from Phase Three to Phase Four becomes clearer.

Structural factors also pose risks

Alongside the increase in rate volatility associated with the Fed’s turn to restrictive monetary policy, there has been a commensurate rise in illiquidity in the U.S. Treasury market. About 80% of this increase can be explained by the surge in interest rate volatility, in our view. This has significantly impacted the market at a time when Treasury has ramped up issuance and demand from traditional buyers, such as U.S. banks and foreign investors, has been tepid.

Similarly, the growing popularity of passive investment strategies also has contributed to higher volatility in sovereign markets. For example, passive liability‑driven investment strategies contributed heavily to the crisis in the UK gilt market in the fall of 2022, during which the yield on the 10‑Year Gilt rose more than 275 basis points in less than two months.

Credit quality in the high yield and bank loan markets

(Fig. 4) Ratings composition of key indexes.*

As of September 30, 2023.

Sources: Credit Suisse and J.P. Morgan Chase (see Additional Disclosures).

*High yield market is represented by the Credit Suisse High Yield Index. Bank loan market is represented by the Credit Suisse Leveraged Loan Index.

Not all structural changes in fixed income markets have been detrimental for investors. In the high yield universe, for example, credit quality has improved considerably since the GFC. BB rated securities accounted for only 37% of the Credit Suisse High Yield Index in January 2007 but had risen to a 60% weight by mid‑2023 (Figure 4). However, credit quality in the floating rate sector deteriorated somewhat over that same period.

As previously mentioned, interest rate volatility can have strong spillover effects in credit markets. Likewise, illiquidity‑driven volatility in sovereign debt markets also can drive credit performance, skewing what otherwise might be the normal expected pattern of returns.

Interest rate volatility can skew credit performance

(Fig. 5) Three‑year returns on BBB rated credits.*

| Date | Prior 3‑Year Return (Annualized) | Following 3‑Year Return (Annualized) |

|---|---|---|

| April 1931 | ‑0.36% | 5.76% |

| February 1957 | ‑0.09% | 1.02% |

| September 1966 | ‑0.48% | ‑1.84% |

| June 1967 | ‑0.44% | ‑6.02% |

| August 1971 | ‑0.40% | 3.92% |

| October 1974 | ‑0.40% | 18.05% |

| November 1979 | ‑2.74% | 2.82% |

| October 2008 | ‑5.35% | 23.45% |

| June 2022 | ‑0.35% | ? |

As of September 30, 2023.

Source: Bloomberg Finance L.P. and Moody’s Investor Services (see Additional Disclosures). Data analysis by T. Rowe Price.

*BBB returns represented by the Bloomberg U.S. Investment Grade Corporate Bond BBB‑Rated Index and data from Moody’s Investor Services prior to the index’s inception.

Past performance is not a reliable indicator of future performance.

For example, one typically would expect an extended period of strongly negative credit performance to be followed by a period of positive performance. However, when we looked at historical returns on BBB rated credits (Figure 5), we found this hasn’t always been the case. While some negative three‑year performance periods were followed by strongly positive returns (1931–1934, 1974–1977, and 2008–2011), in some other cases (1967–1970 and 1979–1982) subsequent returns were quite low or even remained negative. Much of that variation was associated with the underlying interest rate environment. This means that public DB plan investors need to think about the duration risk as well as the credit risk.

Benefits of a flexible, active strategy

In our DB plan survey, we asked respondents for their views on the benefits of active fixed income management. The top benefit they identified was the potential for active management to diversify potential sources of return.

Active duration, curve, and sector positioning also can have a meaningful impact on returns relative to benchmark. As noted above, duration positioning has been especially important over the past three years. But while many credit portfolio managers have the ability to actively manage credit risk, they’re not always so active in their management of duration exposure. Given that returns on most fixed rate credit instruments have been close to zero, or negative, over the past three years—chiefly due to interest rate volatility—its clear that a passive approach to duration management can be a handicap for credit investors.

Having a forward‑looking view on correlations is equally essential. The recent bond bear market saw a dramatic swing to positive correlations between equity and credit, on the one hand, and interest rates on the other. This forced many public DB plan allocators to revisit their prior investment assumptions.

In our own Dynamic Credit Strategy, we constantly evaluate the correlation of interest rate risk and credit risk. In 2022, for example, we were largely positioned correctly because we saw on a forward‑looking basis that correlations had fundamentally changed.

Optimizing return‑seeking allocations

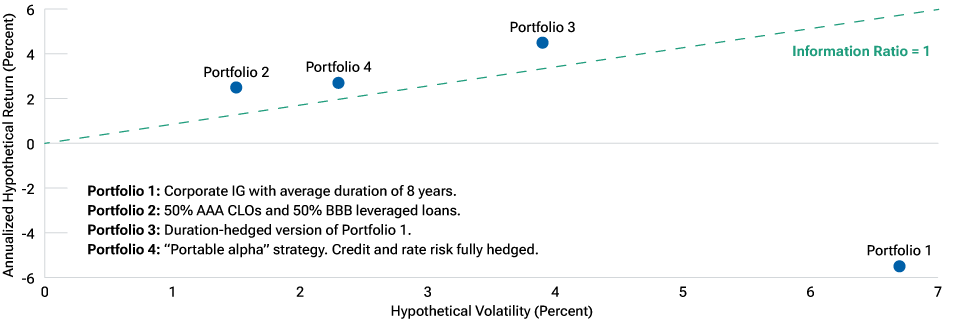

(Fig. 6) Performance of hypothetical fixed income portfolios.

January 2021 through July 2023.

Source: J.P. Morgan (see Additional Disclosures). Data analysis by T. Rowe Price.

The information shows hypothetical results which are shown for Illustrative purposes only and are not indicative of realized past or future performance. Actual investment results may differ significantly. As the hypothetical portfolios are based on the performances of market indexes as described, performance does not incorporate fees, expenses, or any other costs associated with an actual investment. See appendix for important information regarding hypothetical performance.

Portfolio 1 represents a core bond allocation using the JP Morgan Corporate Bond Index (JULI) as a proxy. Portfolio 2 represents a passive allocation to the JPM Collateralized Loan Obligation Index (AAA CLO) and the JPM BBB Leveraged Loan Index. Portfolio 3 fully hedges the duration of the core bond portfolio in Portfolio 1 by using duration overlays with +/‑1.5 years bandwidth. For Portfolio 3 we assumed a duration neutral portfolio by neutralizing the existing portfolio via U.S. Treasury futures and interest rate swaps. These actions were all hypothetical to make the portfolio both curve and duration neutral. Portfolio 4 fully hedges both the duration (with +/‑1.5 years bandwidth) and the credit risk of the core bond allocation in Portfolio 1 using an active rates overlay and spread‑duration neutral relative value trades. Portfolio 4 assumptions were to make the portfolio both curve and duration neutral but also credit spread neutral. All actions were hypothetical. The assumed use of derivatives was not based on actual instruments trading at the time historically. We used regression analysis for Portfolio 1 to determine rate and spread sensitivities to help calculate the hypothetical returns for Portfolio 3 and Portfolio 4. The use of derivatives involves risks and it may not be possible to achieve a full hedge in a live portfolio. They can involve high fees. The hypothetical portfolios were not rebalanced over the life of the analysis. The Information Ratio shown is the line connecting a given amount of return on the Y axis with the same amount of risk on the X axis.

It’s important to understand that different portfolio construction approaches can produce radically different results in a positive correlation environment. A look at the hypothetical performance of some possible fixed income approaches over the more than two‑year period ended July 2023 illustrates this potential (Figure 6).

- Portfolio 1 is a benchmark‑aware approach tied to an investment‑grade benchmark. It potentially would have produced deeply negative returns during the recent bear market.

- Portfolio 2 strips out interest rate risk by holding floating rate assets, and potentially could have delivered positive returns over the same period.

- Portfolio 3 actively manages interest rate risk with hypothetical duration hedging. This potentially would have produced higher returns and a better Sharpe ratio over the period compared with Portfolio 2.

- Portfolio 4 hedges out both interest rate risk and credit risk, resulting in an alpha‑oriented hypothetical portfolio. Total return potential would still have been positive, but lower than for Portfolio 3.

By the same token, portfolio construction approaches that are relatively successful in a positive correlation environment could quickly run into trouble in a negative correlation regime. In the scenario above, for example, Portfolio 2 could have performed well by avoiding duration risk but would sacrifice return and diversification potential if correlations turned negative.

A dynamic approach

We believe a dynamic, multi‑sector credit portfolio construction approach can potentially smooth the ride for public DB plan investors by allowing portfolio managers to actively manage duration and sector exposures in response to changing market environments.

In our view, an approach combining elements from Portfolio 2 and Portfolio 3 in the hypothetical examples shown in Figure 6 could prove attractive in the current interest rate environment by focusing on excess return opportunities while retaining some of the return potential of duration exposure now that it has repriced to a more favorable level.

However, by allocating tactically across sectors and including a mix of diversification and hedging techniques, we think a dynamic approach has the ability to adapt quickly to changing market conditions without the need to revisit long‑term strategic asset allocations—while also making it possible to deliver returns comparable with an alternatives‑oriented strategy in a liquid vehicle.

Conclusions

The results of our public DB plan survey confirm that plan decision‑makers are concerned about mitigating downside risk in a traditional flight‑to‑quality scenario. Likewise, the responses show a heightened awareness of how much exposure some public DB plans now have to credit—particularly corporate credit—and to the equity risk embedded in those allocations.

A dynamic, actively managed portfolio approach can help public DB plans mitigate downside risk while still taking advantage of the expanded opportunities available in non‑core sectors. In volatile markets, active credit managers with deep research capabilities potentially can take advantage of temporarily dislocated valuations by providing liquidity to the market during risk‑off episodes.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

February 2024 / FIXED INCOME