July 2024 / MULTI-ASSET

The inflation roller coaster

Diverging trends in goods and services prices complicate the inflation outlook

Key Insights

- Inflation is key for the Federal Reserve and interest rates, but the direction is not clear. Goods inflation has cooled, but services inflation remains sticky.

- T. Rowe Price’s Asset Allocation Committee is maintaining overweight positions in assets that historically have benefited in periods of rising prices.

So far in 2024, the direction of inflation has been unclear. While reports for January through March brought unwelcome upside surprises, April and May results were more favorable. This has left many investors wondering what will come next for Fed policy and interest rates.

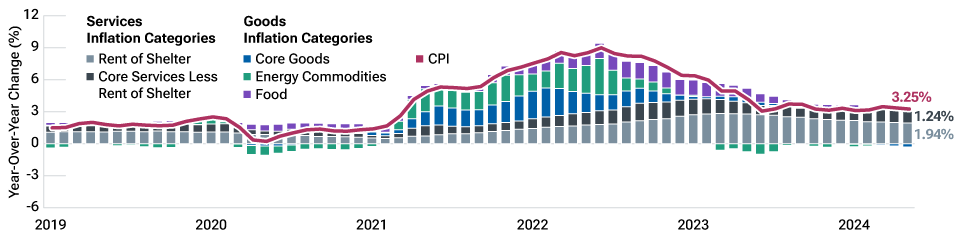

The initial surge in inflation following the COVID pandemic largely was driven by goods prices. In 2023, that dynamic shifted and goods inflation slowed sharply. Services inflation, on the other hand, remained stubbornly high and is now driving almost all of the rise in the U.S. consumer price index (Figure 1).

The transition from goods to services inflation

(Fig. 1) Contribution to the U.S. consumer price index (CPI)

January 2019 to May 2024

Source: U.S. Bureau of Labor Statistics/Haver Analytics.

Past results are not a reliable indicator of future results.

This pattern raises two big questions: When will services inflation ease? And will goods inflation remain benign?

When will services inflation ease?

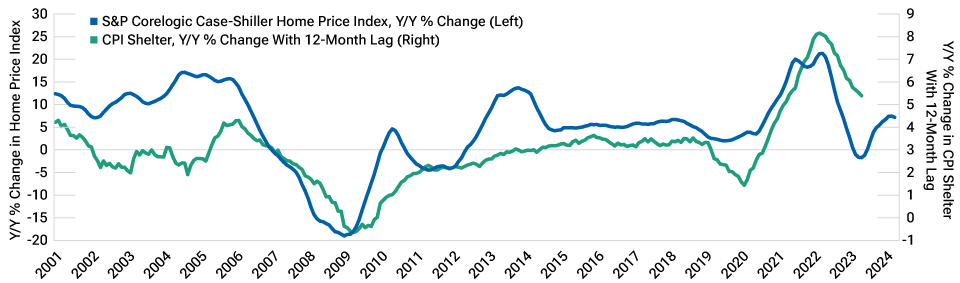

Services inflation also comes in two broad categories: shelter and non-shelter. Shelter inflation has tended to move in the same direction as home prices, but with a 12‑ to 18-month lag. While still high, shelter inflation has been trending lower for more than a year—in line with what home prices were doing one year ago (Figure 2). However, home prices bottomed in May 2023 and rose over the following 12 months. We think shelter inflation is likely to move higher over the coming 12 months.

Shelter inflation may be stubborn

(Fig. 2) Home prices vs. shelter component of U.S. CPI

January 2001 to May 2024

Sources: U.S. Bureau of Labor Statistics, S&P CoreLogic Case-Shiller Home Price Index / Haver Analytics.

Past results are not a reliable indicator of future results.

Inflation in non-shelter services tends to track wage growth, which has been gradually slowing. We think it is reasonable to assume that downward trend will continue in the near to medium term. We expect non-shelter services inflation to trend downward as well.

With shelter pulling upward and non-shelter services potentially trending downward, we expect overall services inflation to move sideways until housing prices start to slow again.

Will goods inflation remain benign?

Goods inflation can be affected by a wide variety of economic and geopolitical factors, making it hard to predict. Over the past year, goods prices have risen modestly. This may remain the case in the near term. Over the longer run, however, deglobalization, decarbonization, and artificial intelligence could boost demand for key commodities, resulting in persistently higher goods inflation.

Conclusion

Services inflation remains elevated and is unlikely to decline rapidly over the next year. Goods inflation has been benign but could resurface at any time. Given these risks, our Asset Allocation Committee currently holds overweight positions in asset classes that have tended to benefit in rising inflation environments.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

July 2024 / FIXED INCOME