June 2024 / MULTI-ASSET

A new era for commodities?

We may be on the cusp of another period of strong commodity returns

This is a modal window.

Playback Denied: Unavailable

Key Insights

- Commodities generally have underperformed U.S. stocks over the past several decades. Some investors may feel these assets have no place in a diversified portfolio.

- Major macro factors—deglobalization, decarbonization, and energy-hungry artificial intelligence applications—could reverse this trend in the next decade.

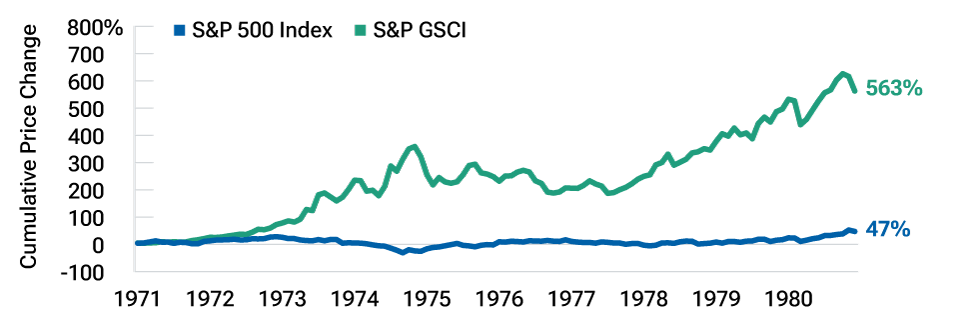

Commodities have significantly underperformed stocks in recent years, particularly since the end of the 2008–2009 global financial crisis. From January 1, 1981, through April 30, 2024, the price of the S&P 500 Index rose more than 3,600%, cumulatively, while the S&P GSCI, an index of commodity prices, gained just 390%.

This lopsided result may have led some investors to conclude that commodities no longer have a place in a diversified investment portfolio. However, there have been long periods where commodities outgained stocks—most notably the inflationary decade of the 1970s (Figure 1).

Commodities outperformed in the inflationary ʼ70s

(Fig. 1) S&P 500 Index vs. S&P GSCI

January 1971 through December 1980. Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P.

Macro trends could favor commodities

There are reasons to believe we may be on the cusp of another period of strong commodity returns, thanks to three emerging “megatrends.”

- Deglobalization: Rising trade barriers, combined with the supply chain disruptions seen during the COVID pandemic, have led to a partial reversal of globalization, pushing up inflation.

- Decarbonization: The push toward green energy means that older, carbon-heavy fuels will need to be replaced. Energy supplies are likely to become tighter.

- Artificial Intelligence: AI applications require enormous computer processing power, which could drive energy demand.

Tailwinds are emerging

We can already see evidence of tailwinds for commodity prices. Copper and natural gas futures have risen sharply in recent months. Meanwhile, peaking U.S. oil productivity has the potential to boost energy prices.

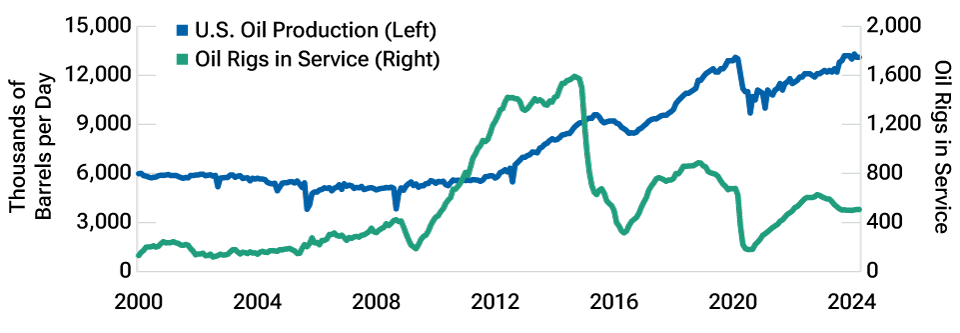

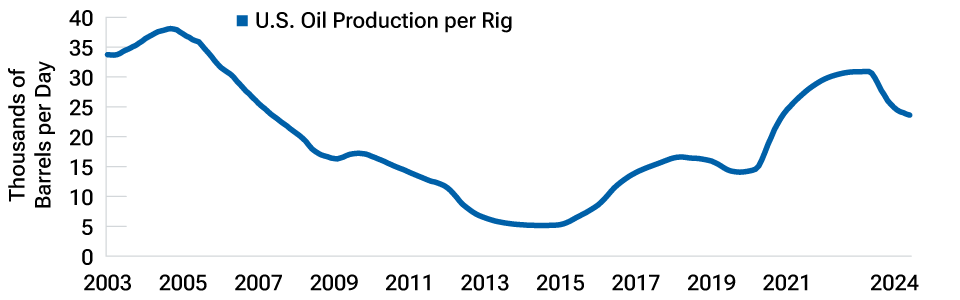

Advancements in shale technology have allowed oil companies to extract more oil even as the number of oil rigs in service has declined sharply. However, key measures of oil productivity have fallen steadily over the past year (Figure 2).

Oil productivity may be peaking

(Fig. 2) Key measures of U.S. oil production

Oil Production vs. Oil Rigs in Service

January 2000 through April 2024

Oil Production per Rig

Trailing three-year monthly average

January 2003 through April 2024

Source: Bloomberg Finance L.P.

Conclusion

Commodity price gains have been relatively modest for a long period of time, but we may now be facing a new environment. As a result, our Asset Allocation Committee currently holds an overweight position in real assets equities.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2024 / EQUITY