- From the Field

- Markets appear optimistic about another Trump presidency. But inflation could spoil the party.

- Key Insights

-

- Investors appear to expect Trump’s new term to be positive for U.S. stocks thanks to improved business confidence, deregulation, and stronger merger activity.

- Trump’s tariff and immigration proposals could offset those benefits by pushing up inflation, forcing the U.S. Federal Reserve to stop cutting interest rates.

What will a second Trump presidency mean for markets?

Donald Trump’s 2024 presidential election victory has had a profound impact on financial markets.

From early October—when political betting markets turned heavily in Trump’s favor—through mid-November, U.S. small-cap stocks outperformed U.S. large caps, U.S. stocks outgained non-U.S. stocks, and U.S. bonds underperformed relative to U.S. stocks.

Some of the reasons behind these trends are obvious. Concerns about the trade tariffs that Trump has promised to impose hurt non-U.S. stocks. U.S. bonds sold off because higher tariffs likely would mean higher import prices, potentially fueling inflation. Stricter immigration policies could tighten U.S. labor markets, also putting upward pressure on wages and prices.

Will the election release pent-up economic activity?

(Fig. 1) Historical trends in small business optimism and business activity

January 2000 to October 2024.

Source: Macrobond/National Federation of Independent Business.

Inflation could spoil the party

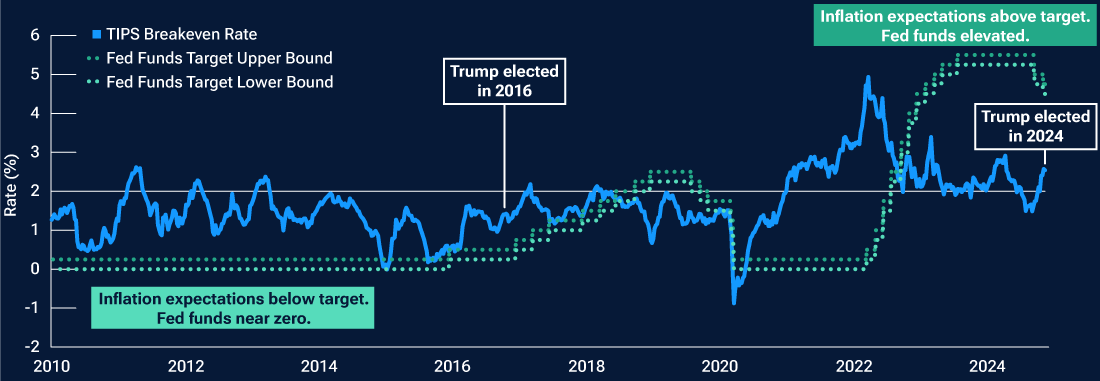

(Fig. 2) Two-year inflation expectations and the federal funds rate target1

Weekly, January 1, 2010, to November 15, 2024.

Source: Bloomberg Finance L.P. Data analysis by T. Rowe Price.

1Two-year inflation expectations = breakeven yield on the 2-year Treasury inflation protected security (TIPS).

Pent-up economic activity could be released

Despite these risks, markets appear to believe that pent-up economic activity could boost U.S. growth now that election uncertainty has been lifted.

Survey data from the National Federation of Independent Business (NFIB) suggest that small business optimism could rise, stimulating capital spending and inventories. The last time the NFIB’s optimism index rose sharply was from September 2016 to December 2016, when Trump was first elected (Figure 1). Many investors appear to anticipate a similar improvement in coming months.

Regulatory policies should be business friendly

Trump’s first term also suggests that regulatory burdens will be reduced, cutting business costs. After his first election, the number of pages in the Federal Register, which tracks the flow of government regulations, fell sharply, from over 97,000 in 2016 to under 62,000 in 2017.

Less regulation could make merger and acquisition deals easier and less costly. Such deals are often an important driver of small-cap stock performance.

Finally, there is a chance that U.S. corporate tax rates will be lowered, as they were in Trump’s first term. However, there is more skepticism about this possibility, given the huge federal budget deficit.

Inflation concerns

Despite the potential positives, optimism for U.S. stocks could be upended by rising inflation concerns.

When Trump first took office in 2017, inflation expectations were low and the U.S. Federal Reserve’s target for its key federal funds rate had been held near zero since December 2008 (Figure 2).

That’s hardly the case now. Inflation is still elevated, and the fed funds target is over 4.5%. Many investors, businesses, and consumers are hoping that Fed rate cuts will bring further relief well into 2026. But an inflation resurgence could lead Fed officials to stop cutting—or even raise rates. Such a scenario could generate significant market volatility.

Conclusion

The market optimism engendered by Trump’s election victory is supported by the potential impacts on business activity, particularly small business. However, Trump’s policies carry the risk of reigniting inflation concerns.

Given the positive near-term outlook, our Asset Allocation Committee is maintaining an overweight position in stocks. However, the committee is also keeping an overweight position in real assets equities, which historically have been an effective hedge against rising inflation.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to global market outlook.

-

Additional Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

-

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of December and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202411-4069591