Fixed Income

Why the Yield Curve Matters to Your Portfolio

If you’re looking for clues to where interest rates, the economy, and financial markets may be headed next— look no further than the yield curve, which shows the difference between short- and long-term interest rates on bonds such as U.S. Treasuries. The following primer will help you gain a better understanding of what a yield curve is and how its “shape” impacts the risk and performance of your investment holdings.

What is a yield curve?

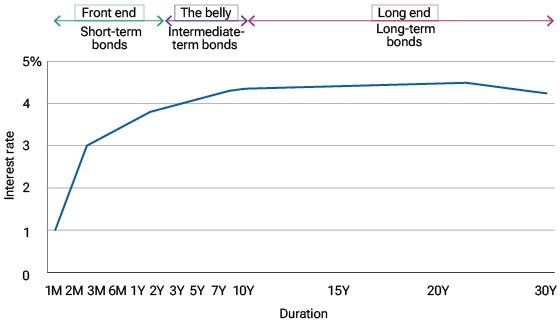

A yield curve offers a visual way for investors to see how the interest rates on bonds of the same quality are different based on their maturity dates, which for U.S. Treasuries range from one-month bills to 30-year bonds.

The yield curve shows how bonds with different maturities behave differently in response to economic trends and investor sentiment. It can also be used to gain insights into investors’ views of risk versus reward, the future direction of interest rates, and the outlook for the economy.

The shape of a "normal" yield curve

Under normal conditions, interest rates on short-term bonds are lower than long-term bonds.

Source: T. Rowe Price.

For illustrative purposes only.

Three types of yield curves

A normal yield curve, which tends to occur when the outlook for the economy is bright, slopes upward to the right since the rate for a longer-term bond is typically higher than that of a shorter-term bond. That’s because investors expect to get paid more for exposing their invested dollars to risks, such as interest rate fluctuations, inflation, and default, for longer periods.

A flat yield curve is when short- and long- term rates are about the same. This tends to occur during a transition from either an inverted yield curve or normal yield curve due to a change in the economic outlook and Federal Reserve interest rate policy.

An inverted yield curve, which develops when the economic outlook is more uncertain, is when short-term rates climb higher than long-term rates. An inverted yield curve has historically been associated with recession.

Considering the yield curve

Comparing the yields on bonds of different maturities at various points in the market cycle can assist investors in mapping out the right investment strategy and proper bond asset allocation. When the yield curve is normal and the interest rate on a 30-year bond is higher than a shorter-term bond, for example, the more willing an investor might be to accept the risk of owning a 30-year bond. Conversely, when the yield curve is inverted and short-term bonds are paying a higher interest rate than 10- or 30-year bonds, owning shorter-term bonds may present a better risk/reward option. Of course, there are investment opportunities when the yield curve is transitioning from either an inverted yield curve or a normal (steep) yield curve to a flat yield curve.

How can investors use the yield curve?

- Gain insights into the Fed’s thinking. The yield on the “front end” of the yield curve (e.g., short-term bonds) reflects expectations for the next moves of the Federal Reserve. For example, since March 2022 when the Fed began hiking rates from zero to a range of 5.25% to 5.5%, short-term bond yields moved in concert with the rate increases. Using that same logic, when the Fed starts to cut its key short-term interest rate, yields on shorter- term Treasuries should also begin to decline as investors anticipate additional Fed rate cuts.

- See higher-yielding parts of the bond market. The shape of the yield curve also impacts portfolio returns. When the yield curve is inverted, for example, and short-term bonds yield more than long-term bonds, investors can earn a bigger return owning a short-term bond.

- Find potential clues to the bond market’s next move. Of course, the yield curve can also highlight potential investment opportunities depending on its shape. For example, if the economy begins to decelerate and the Fed starts to cut rates or the market begins to price in expected rate cuts, owning longer-duration bonds that carry more interest rate risk could start to perform better as bond prices start to rise. Rates, which move in the inverse direction, fall.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. T. Rowe Price Investment Services, Inc.

Investment products are:

NOT FDIC-INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

202404-3481716