Fixed Income

Understanding the Roles of Fixed Income

Over the past few years, we’ve faced market volatility, soaring interest rates, and recession risks. Despite these shifts, the role of fixed income remains the same. Here are ways it can help you achieve your goals, both today and long term.

Dependable income

Income, including the tax-free income potential that certain fixed income strategies afford, is essential to fixed income returns. In fact, income has been the primary driver of total returns for several fixed income categories.

INCOME—NOT PRICE—DROVE FIXED INCOME RETURNS1

Income Returns Versus Price Returns (12/31/07 to 12/31/23)

Past performance is not a reliable indicator of future performance. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

Tax-free income is the income received that is not subject to federal income taxes. Some income may be subject to state and local taxes and the federal alternative minimum tax.

*Bank loan index data are only available from 12/31/2014 through 12/31/2023.

Sources: S&P and Bloomberg.

Portfolio stability

To limit the impact of equity volatility and help buffer equity downturns, investors can choose core fixed income strategies that track the Bloomberg U.S. Aggregate Bond Index or flexible multi-sector strategies with slightly higher risk.

CORE FIXED INCOME HAS HELPED BUFFER EQUITY VOLATILITY1

U.S. bond correlations amid major equity downturns (12/31/03 to 12/31/23)

Past performance is not a reliable indicator of future performance.

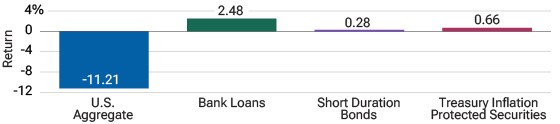

Hedges against interest rates and inflation

Mitigate the impacts of inflation and rising interest rates with the help of fixed income. Inflation-linked bonds are designed to help protect against inflation. Bank loans, short duration bonds, and Treasury inflation protected securities have helped protect portfolios during rising rate environments, especially when core bonds significantly underperform.

CERTAIN SECTORS DELIVERED POSITIVE RETURNS1

Unprecedented period of sustained inflation and rising interest rates (3/31/21–11/30/22)

Past performance is not a reliable indicator of future performance.

Cumulative performance from 3/31/21 through 11/30/22 when headline inflation and 10-year Treasury yields were both positive year over year.

1 Sources: T. Rowe Price; “Emerging Markets” represents the J.P. Morgan Corporate Emerging Market Bond Index Broad Diversified Index; “U.S. Aggregate.” represents the Bloomberg U.S. Aggregate Bond Index. “Global Aggregate” represents the Bloomberg Global Aggregate Index. “Municipals” represents the Bloomberg Municipal Bond Index. “U.S. Treasury” represents the Bloomberg U.S. Treasury Index. “U.S. High Yield” represents the Bloomberg U.S. High Yield Index. “Bank Loans” represents the S&P/LSTA Performing Loan Index. “Treasury inflation protected securities” (TIPS) represents the Bloomberg U.S. TIPS Index. “Short Duration Bonds” represents the Bloomberg 1–3 Year U.S. Government/Credit Bond Index. “Global High Yield” represents the ICE BofAML Global High Yield Index Hedged to USD.

Important Information:

Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk. As interest rates rise, bond prices generally fall. Index performance is for illustrative purposes only and is not indicative of any specific investment. Its performance does not reflect the expenses associated with the active management of an actual portfolio. It is not possible to invest directly in an index.

Additional Disclosures:

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE Data, its affiliates and their respective third-party suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any data included in, related to, or derived therefrom. Neither ICE Data, its affiliates nor their respective third-party suppliers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices or the index data or any component thereof, and the indices and index data and all components thereof are provided on an “as is” basis and your use is at your own risk. ICE Data, its affiliates and their respective third-party suppliers do not sponsor, endorse, or recommend T. Rowe Price or any of its products or services.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Bloomberg Index Services Limited.

This material being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial, and tax advice before making any investment decision. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested. Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. T. Rowe Price Investment Services, Inc.

Investment products are:

NOT FDIC-INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

202404-3481483