Market Volatility

Resisting Short-Term Bias

We believe that consistently achieving extraordinary investment results requires a long- term perspective. If you focus on the short term, it’s tempting to let emotions influence your investment decisions.

Help mitigate portfolio volatility and unlock greater growth potential by holding stocks for the long term.

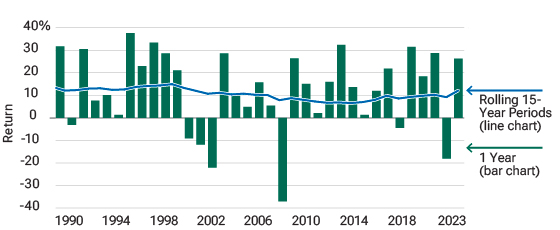

Don’t let short-term upsets dampen your potential for long-term growth. While market downturns can lead to short-term losses, the picture changes with a long-term perspective. The chart below demonstrates the direct correlation between long holding periods and reduced portfolio volatility.

Bottom line: Remaining invested through downturns and corrections may allow you to take advantage of long-term growth potential.

ROLLING 15-YEAR PERIODS DELIVER POSITIVE RETURNS, DESPITE YEARLY MARKET FLUCTUATIONS

S&P 500 Index

As of December 2023

Even as individual years experience losses in the market, staying invested over the long run has historically generated positive returns--as demonstrated here in rolling 15-year periods.

Sources: T. Rowe Price, created with Zephyr StyleADVISOR, and S&P. See Additional Disclosures below. Price return calculations include dividends and capital gains. Annual returns beginning in calendar year 1970.

Rolling 15-year data beginning in 1970. Past performance cannot guarantee future results. It is not possible to invest directly in an index. Chart is for illustrative purposes only.

The stock market has delivered positive returns for every rolling 15-year period covered in our analysis. Exiting the market early could cost you positive returns in the future. As this chart indicates, the market trends upward over long periods of time, despite what's happening on a year-by-year basis.

Reduce volatility, focus on growth

While they can be nerve-wracking, downturns and corrections are normal parts of the market cycle. By maintaining a disciplined approach and staying invested despite these fluctuations, your portfolio is in a better position to achieve positive returns over time.

Additional Disclosures

S&P — Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

FTSE — London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

T. Rowe Price Investment Services, Inc.

202404-3451842