July 2024 / INVESTMENT INSIGHTS

Artificial intelligence, health care, and energy transition: Three areas of focus for impact

How innovations in artificial intelligence, health care, and the energy transition can create value

Key Insights

- Artificial intelligence (AI) can assist in reaching the targets set by the United Nations for their Sustainable Development Goals.

- GLP‑1 drugs represent a watershed moment for the health care sector given their efficacy in treating both diabetes and obesity.

- Energy transition extends beyond renewables, with many diverse types of companies helping in the pursuit of a net zero emissions world.

Artificial intelligence (AI), health care, and the energy transition are key areas of focus for financial markets and impact investors. AI has been a significant talking point and market driver and a defining theme for investor returns given the narrowness of equity markets. Within health care, innovations in incretins have generated considerable excitement due to their potential to reshape health care provision. Meanwhile, the renewables sector has come under increased scrutiny as higher interest rates have raised concerns around financing. Here we review some of the key dynamics for each of these sectors.

Embracing the positive sides of AI, but also being cognizant of its energy demand and equality issues

While the adoption of AI is at an early stage, it appears to be exceptionally rapid compared with previous technology booms, such as PCs and smartphones. AI is essentially software that mimics and generates human‑like responses. It can scale collective cognitive abilities, giving it the potential to provide enhancements in areas such as health care, transport, education, agriculture, and other customer‑centric experiences. Of particular interest to impact investors is the potential to explore societal and environmental implications.

Used in the correct way, AI can assist in reaching the targets set by the United Nations for their Sustainable Development Goals (UN SDGs) at a quicker pace. AI’s analytical and predictive capabilities can help in fields such as power grid optimization and reliability, while in health care, its machine learning technologies are already helping in drug discovery and improving diagnostic processes that are leading to earlier detection of diseases.

However, it’s important to monitor and evaluate the risks that can be associated with AI adoption. The sheer energy demand required to run AI data centers 24 hours a day is putting huge pressure on resources. The International Energy Agency (IEA) estimates that global data centers total electricity consumption could exceed 1,000 terawatt‑hours (TWh) by 2026, up from 460 TWh in 2022.1 Companies that help manage data center infrastructure, including cooling solutions to help handle thermal loads and power management systems, that can help data centers run more efficiently will become ever more important.

Meanwhile, worries around employment, jobs, and careers are real. We should also be concerned by the information that feeds these AI systems being created in our current societal image. The fact that AI developers tend to be men can potentially lead to gender biases in AI outputs. This is why responsible and ethical AI matters, and it’s important to understand how companies disclose that information.

Innovations in health care are leading to increased market adoption and better outcomes for patients

The World Health Organization estimates that 422 million people worldwide struggle with diabetes, which links to 1.5 million deaths per year. Obesity and other metabolic risk factors are the dominant drivers of disease globally, costing the global economy approximately 2.5% of global gross domestic product, according to the World Obesity Foundation. Recent advances, however, in GLP‑1 drugs (a type of anti‑obesity medication) represent a watershed moment for the health care sector given their efficacy in treating both diabetes and obesity. These drugs, called “agonists,” mimic the action of the body’s naturally occurring GLP‑1, a hormone produced in the gut to aid digestion and keep blood sugar in check.

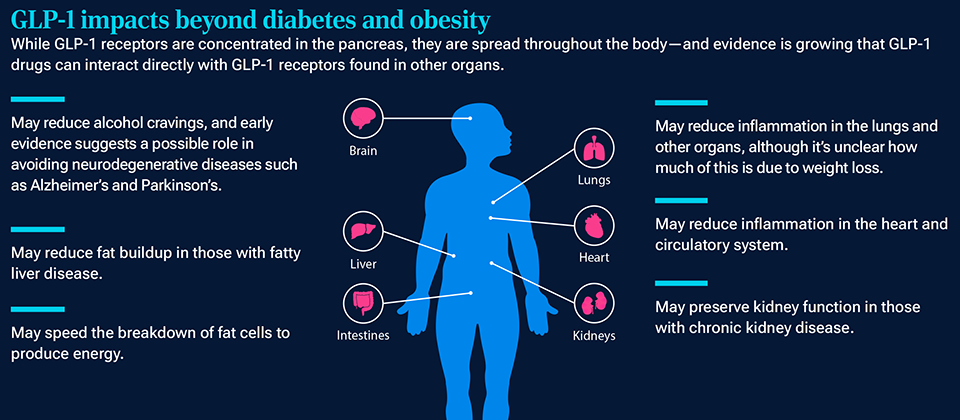

At the same time, health benefits from GLP‑1s will also have a knock‑on impact to the food and beverage industry as GLP‑1 users shift their eating habits to healthier ones. Also, given GLP‑1 receptors are found in other organs, GLP‑1 drugs can have positive impact beyond diabetes and obesity. For example, early research show that these drugs can reduce alcohol cravings and early evidence suggests a role in reducing sleep apnea.

The potential longer‑term medical benefits from GLP‑1s are potentially enormous, given obesity has been identified as an upstream driver of more than 200 different diseases. But we also have to be aware of their distribution. Due to variable insurance coverage, there is potential for a widening in health inequalities. Several proof points show that greater inequalities in obesity prevalence and health outcomes are a very likely a byproduct of GLP‑1 adoption. In the United States, research has found that the uptake of GLP‑1 therapies for use in treating diabetes is far reduced within the population living in socioeconomically disadvantaged areas, having low income and education levels, or belonging to racial/ethnic minorities.2 Broader distribution in time should theoretically address these inequalities, but this will require substantial engagement from employers, health care services, and pharmaceutical companies. T. Rowe Price has been engaging with producers of GLP‑1s to determine how this can be improved.

GLP‑1 impacts beyond diabetes and obesity

While GLP‑1 receptors are concentrated in the pancreas, they are spread throughout the body—and evidence is growing that GLP‑1 drugs can interact directly with GLP‑1 receptors found in other organs.

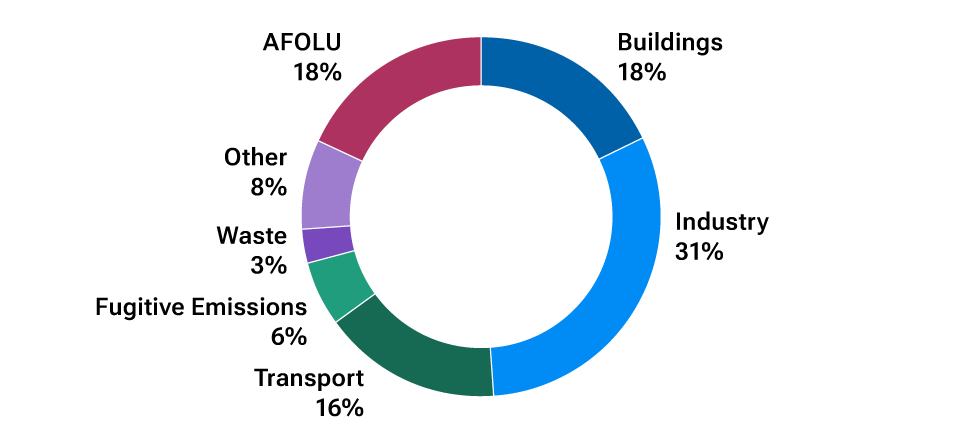

Investing in the energy transition: Beyond renewables

Investing in energy transition is more important than ever, given the urgency to keep global temperature rises below 1.5 degrees centigrade. The path to net zero, however, will be multidimensional given that greenhouse gas emissions come from a number of different areas (see chart). But, while decarbonization has been one of the most invested sustainability themes, some companies in the renewable energy ecosystem have faced challenges due to recent macroeconomic shifts. Supply chain disruptions, inflation, and higher interest rates have all provided headwinds for the sector.

The path to net zero is multidimensional

(Fig. 1) Share of global GHG emissions

As of December 31, 2023.

“AFOLU” is agriculture, forestry, and other land uses. Fugitive emissions are emissions of greenhouse gases not caught by a capture system and are often due to equipment leaks, evaporative processes, and windblown disturbances.

Source: World Resources Institute, T. Rowe Price analysis.

Energy transition extends beyond renewables, however. Companies that invest in green hydrogen can help with the decarbonization of heavy industries. Precision agriculture technology that helps improves crop productivity and reduces fertilizer use, while technologies that can limit waste in manufacturing chains, are all enablers of a net zero world.

As decarbonization of the global economy accelerates, there will also be a greater focus on what the International Labor Organization is calling “the Just Transition” in the coming years. This means greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent working opportunities, and leaving no one behind. This objective has the potential to generate investment opportunities in areas such as education and workforce training companies, where transitioning companies must re‑skill and up‑skill employees in new technologies. Occupational health and safety in resource‑heavy industries are also core components of a just transition, so companies that provide worker protection will come under the spotlight.

Commitments from public policies such as the Inflation Reduction Act (IRA) in the United States and the EU Just Transition Mechanism tool in Europe will help drive this dynamic. The Just Transition imperative is becoming increasingly central in the energy transition, and we expect to hear more about this theme going forward, and is a large part of our focus on “Impact Beyond the Obvious.”

Targeting financial returns alongside positive environmental or social impact

The backdrop for impact investing has been challenging in recent times with the power of the Magnificent Seven dominating markets and war in Europe pushing up fossil fuel prices. At the same time, the opportunity to find companies that can truly make an environmental and societal difference hasn’t waned.

But with the macroeconomic challenges remaining, it is important to focus on companies that can offer strong pricing power and preserve strong business moats and quality management teams that can demonstrate solid track records in capital allocation. Encouragingly, the global opportunity set available to active investors offers exciting opportunities to invest in companies that can drive impact and financial performance. From businesses that use AI to help in areas such as electrification, transportation, education, and agriculture to health care providers that use innovation to tackle diseases, we remain inspired by the continued potential to make a difference through investing in publicly listed companies.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

July 2024 / POLICY INSIGHTS