June 2024 / INVESTMENT INSIGHTS

The value of a multi-sector diversified income approach for fixed income

Diversified Income Bond Strategy seeks to provide high yield-like returns with investment-grade levels of risk

Key Insights

- Diversified Income Bond is an actively managed, “go anywhere” strategy, aiming to provide high yield‑like returns with investment‑grade levels of risks.

- Our approach seeks to diversify return sources and risks, integrating top‑down macro views with bottom‑up fixed income security research.

- Global bonds are well positioned in 2024, an attractive opportunity for diversification amid likely monetary policy divergence among central banks worldwide.

The past few months highlight how quickly the investment landscape can shift for fixed income investors. After a strong rally, global bonds began 2024 on the back foot as hopes for as many as six U.S. Federal Reserve (Fed) rate cuts receded. They recovered some ground on indications that the Fed might begin cutting in June but pulled back again when policymakers signaled that the timeline for easing may be delayed due to resilient U.S. growth and inflation. Going forward, it appears that economic data releases will continue to influence sentiment and trigger swings in financial markets.

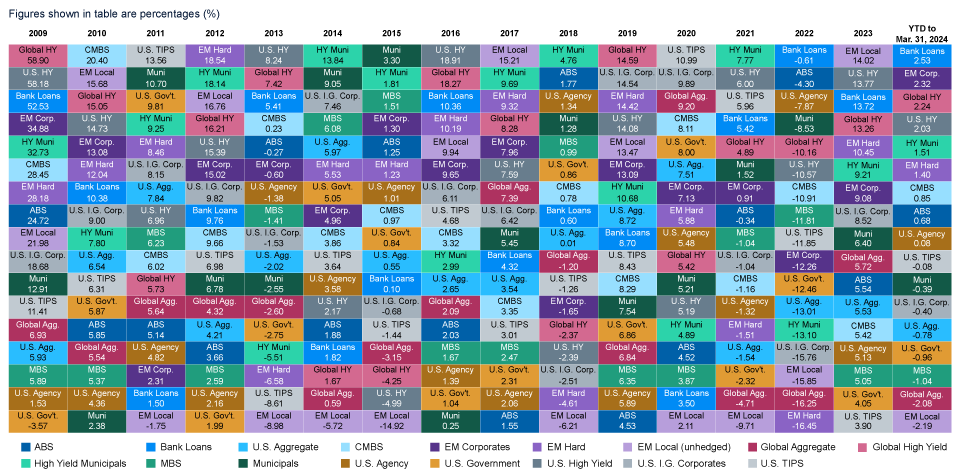

However, going beneath the headline numbers reveals that the returns of various underlying fixed income sectors year to date are far from uniform. Although high‑quality sovereigns and corporate credit declined, high yield corporate bonds produced gains. Dollar‑denominated emerging market (EM) debt has also performed well as credit spreads compressed meaningfully. Such variation in sector performance can be seen over longer time periods too (Figure 1), with changing market conditions favoring different bond sectors.

Dispersion in returns across fixed income sectors

(Fig. 1) Constant changes in market leadership support the case for active management

As of March 31, 2024.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price; “MBS” represents the Bloomberg MBS Index; “CMBS” represents the Bloomberg CMBS Index; “Emerging Markets Hard” represents the J.P. Morgan Emerging Markets Bond Global Index; “Global High Yield” represents the J.P. Morgan Global High Yield Index; “U.S. I.G. Corporates” represents the Bloomberg U.S. Corporate Investment Grade Bond Index; “ABS” represents the Bloomberg ABS Index; “Bank Loans” represents the S&P/LSTA Performing Loan Index; “Emerging Markets Local (unhedged)” represents the J.P. Morgan GBI‑EM Global Diversified Index; “U.S. Aggregate” represents the Bloomberg U.S. Aggregate Bond Index; “Emerging Market Corporates” represents the J.P. Morgan CEMBI Broad Diversified Index; “Global Aggregate” represents the Bloomberg Global Aggregate Index; “Municipals” represents the Bloomberg Municipal Bond Index Total Return Index Value Unhedged USD; “High Yield Municipals” represents the Bloomberg Municipals High Yield Index; “U.S. Agency” represents the Bloomberg US Agency Index; “U.S. Government” represents the Bloomberg U.S. Treasury Index; “U.S. High Yield” represents the J.P. Morgan Domestic High Yield Index; and “U.S. TIPS” represents the Bloomberg U.S. TIPS Index.Source for Bloomberg index data: Bloomberg Index Services Limited. Please see Additional Disclosures for more information about this Bloomberg information.

We believe that this divergence, alongside expectations for continued market fluctuations, speak to the importance of maintaining a globally diversified fixed income allocation. Investing across multiple fixed income sectors can help investors to generate more stable returns while also mitigating volatility, in our view. Here to discuss the outlook are Kenneth Orchard and Vincent Chung, who manage T. Rowe Price’s Diversified Income Bond Strategy.

What are the key features of the Diversified Income Bond Strategy?

Kenneth Orchard: The Diversified Income Bond Strategy is an actively managed, flexible “go‑anywhere” core bond strategy that aims to provide investors high yield‑like returns, with investment‑grade levels of risk (Figure 2). To do so, we leverage the full breadth and depth of T. Rowe Price Associates, Inc’s (TRPA’s) fixed income capabilities and integrate the best income ideas from our global research platform into a single high‑quality portfolio.

Diversified Income Bond Strategy

(Fig. 2) Seeking to build an optimal global fixed income portfolio

1 The majority of the currency exposure will be hedged back to the U.S. dollar.

We have the flexibility to invest across the broad fixed income universe, spanning more than 15 major fixed income sectors, 80 countries, and 40 currencies, to help us identify the most attractive opportunities. We believe that opening up the global bond opportunity set in this way allows us to seek higher yields and better risk‑adjusted returns.

More importantly, diversifying return and income sources from various higher‑yielding sectors also allows the strategy to take on different types of risks that may be unrelated or even negatively correlated. This helps to lower overall portfolio volatility, better positioning it to pursue consistent long‑term returns.

What solution does the strategy provide to investors? Who might consider the strategy?

Kenneth Orchard: The Diversified Income Bond Strategy really offers a “one‑stop shop” for investors’ fixed income allocations. Not only do we seek diversified exposure across the full global fixed income opportunity set, we also tactically adjust sector, duration, and currency exposures depending on the insights from our research platform on market developments, valuations, and the stage of the economic cycle, to name a few examples. This flexible process helps to relieve the burden of investors having to worry about what to buy or when to make reallocation decisions.

Therefore, we believe the strategy is a good fit for all types of investors. In particular, it may be helpful for those who seek consistent income streams in a more prudent manner and without taking on excessive risk. A more stable potential income stream may also provide a cushion during periods of market stress.

What are the key differentiators of T. Rowe Price’s approach?

Vincent Chung: One of the strategy’s major distinguishing features is its truly global nature. This is distinct from other fixed income solutions that may have heavier tilts toward specific sectors, such as U.S. core bonds or securitized credit. In contrast, we prefer not to focus on geographies or sectors to avoid concentrations in a single sector or interest rate cycle. Instead, we utilize the full global opportunity set, including government, corporate, and securitized debt, both investment‑grade and high yield issues across developed and emerging markets. We are also able to invest in nonmainstream sectors, such as mortgage‑backed securities and convertible bonds.

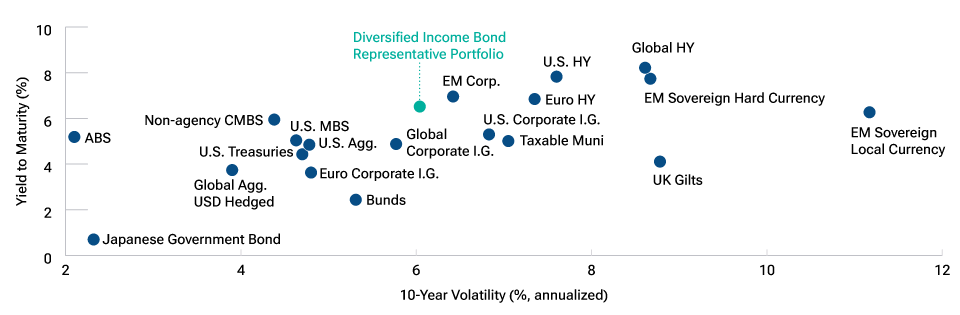

We view access to such a wide fixed income investment universe as crucial because it gives the strategy more sectors, issuers, and interest rate exposures to choose from, enabling us to pursue geographically and sectorally diversified sources of total return and income (Figure 3). This, in turn, also means we are harvesting a variety of risk premiums. Our portfolios are well diversified across global duration, currencies, credit, emerging markets, and structured and liquidity risks, rather than being excessively exposed to any one factor. It is this combination that enables the strategy to capture attractive yield and return opportunities with lower levels of volatility.

Casting a wider net for bond opportunities

(Fig. 3) Diversification of return sources and risks

As of March 31, 2024.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P., T.Rowe Price, and J.P. Morgan Chase. Indexes used: U.S. Treasuries: Bloomberg U.S. Treasury; U.S. Agg.: Bloomberg U.S. Aggregate; U.S. Corporate I.G.: Bloomberg U.S. Corp. I.G.; U.S. HY: Bloomberg U.S. High Yield; EM Sovereign Hard Currency: J.P. Morgan Emerging Market Global Diversified Bond; EM Corp: J.P. Morgan CEMBI Broad Diversified; EM Sovereign Local Currency: J.P. Morgan GBI EM GD; Global Corporate I.G.: Bloomberg Global Aggregate ex‑U.S.; Global Agg.: Bloomberg Global Aggregate (USD Hedged); Euro HY: Bloomberg Pan‑European High Yield; Japanese Government Bond: Bloomberg Asian Pacific Japan; Bunds: Bloomberg Global Treasury Germany; UK Gilts: Bloomberg Global Treasury UK; Global HY: Bloomberg Global High Yield; Euro Corporates I.G.: Bloomberg Euro Aggregate Corporate; U.S. MBS: Bloomberg U.S. MBS; ABS: Bloomberg ABS; Non‑agency CMBS: Bloomberg Non‑Agency CMBS US Agg Eligible; Taxable Muni: Bloomberg Taxable Municipal Bond. Please see the Additional Disclosures page for additional legal notices and disclaimers.The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy. GIPS® Composite Report is available upon request.

Of course, the effectiveness of our approach stems primarily from our strength in security and sector selection, which is underpinned by our extensive global research resources. Our seasoned fixed income portfolio managers are supported by dedicated credit and sovereign analysts who cover all major sectors. Further setting our capabilities apart is a culture of true cross‑asset class collaboration. Fixed income analysts often work closely with their equity counterparts, sharing fundamental research and attending joint meetings with companies. This strong relationship gives access to corporate fundamentals that are not typically afforded to credit researchers.

How do you identify opportunities and determine sector allocations? Do you take a top‑down or bottom‑up approach?

Vincent Chung: In managing the strategy, we take a holistic approach that synthesizes top‑down macro views with bottom‑up fundamental research. The goal is to build an optimal fixed income portfolio, drawing on the best ideas from across our research platform.

Kenneth and I have primary oversight of the Diversified Income Bond Strategy. We are responsible for setting sector allocation targets, as well as making decisions on exposures to global rates and currencies. We also work with a team of experienced sector portfolio managers, who are all experts in their respective market areas. The sector portfolio managers, in coordination with their respective teams of credit analysts and traders, contribute high‑conviction ideas for security selection.

Our credit analysts conduct bottom‑up, fundamental, technical, and relative value analysis on securities that they cover, including assessment of environmental, social, and governance factors.1 Their recommendations, expressed via proprietary credit ratings and conviction scores, are key to helping us uncover promising investment opportunities while avoiding issues with deteriorating fundamentals.

What is your outlook for the rest of 2024? How might the Diversified Income Bond Strategy add value for investors in this environment?

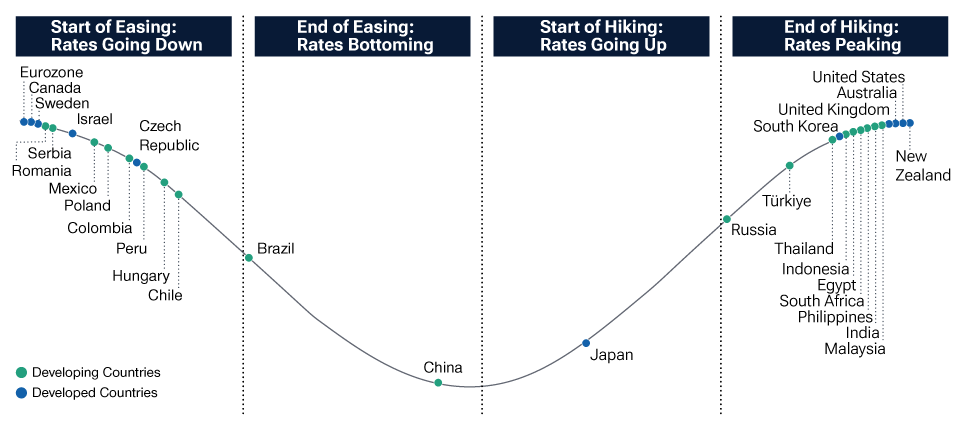

Kenneth Orchard: Continued U.S. economic exceptionalism, relative to the rest of the world, raises the likelihood of monetary policy divergence from major central banks. We think this may present an appealing opportunity for fixed income investors to increase exposure to global bonds, which could be well positioned to benefit from falling interest rates outside the U.S. (Figure 4).

Global monetary policy divergence

(Fig. 4) Rate cuts have begun in emerging markets, waiting for developed markets

As of March 31, 2024.

For illustrative purposes only.

Source: IMF; analysis by T. Rowe Price.

Meanwhile, all‑in yields remain attractive, while improving macroeconomic conditions should continue to be supportive for risk assets. That said, credit spreads have tightened considerably, leaving limited buffer should conditions suddenly deteriorate. This underscores the importance of maintaining a selective and diversified approach to manage downside risks.

Ultimately, the T. Rowe Price Diversified Income Bond Strategy’s active management style and robust risk controls help it to minimize volatility through different market cycles. We can adjust risk positions, hedges and liquidity, and are able to take more defensive or opportunistic positions as market conditions evolve. It is this flexibility that helps the strategy achieve its value proposition—giving investors a smoother ride through market volatility while still pursuing consistent returns and income.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2024 / INVESTMENT INSIGHTS