Investing During Transition

2025 Global Market Outlook

The world is transitioning at a pace and scale rarely seen before. Radical innovations in AI and healthcare. Elevated geopolitical tensions, including the raised possibility of tariffs following the US election. A potential slowdown in global growth. Times like these demand actionable insights and the skill of active management. Here’s what to know to navigate the shifts and opportunities ahead.

Mapping the path from slowdown to recovery

There is strong potential for a slowdown in global growth in early 2025. But central banks are poised to respond with rapid rate cuts, paving the way for a fast recovery. We expect a shift from services to manufacturing—the result of a global push towards renewable energy and the rise of AI. These factors are, in part, fueling infrastructure spending.

Key takeaway

A recovery in the second half of the year will likely hasten the transition to manufacturing-led growth.

US exceptionalism has not run out of steam

The US economy is set for another year of growth, bolstered by investments in AI. Fiscal policies and coordinated monetary easing support this outlook. Job creation will likely slow as companies have front-loaded hiring, but unemployment is expected to remain low. Improving productivity should also provide another boost to growth.

Key takeaway

Despite a slowing jobs market, supportive monetary policy and improving productivity should keep the US economy out of recession.

Read the full Global Market Outlook end of year update

Investing during transition

Join host Ritu Vohora on this special edition of “The Angle” as we focus on our 2025 Global Market Outlook. In this first episode, our experts discuss the macroeconomic outlook for 2025. They examine global fiscal and monetary policy, what impact the Trump presidency could have on the global economy, and potential developments in China.

Value and small caps could power international equities

As we emerge from a period dominated by U.S. tech, international equities may offer breadth and room for growth. Diversifying into areas that have valuation support and robust fundamentals, such as value and small cap stocks, seems prudent. Japan, Korea, and the United Kingdom could also benefit from structural changes.

Key takeaway

We anticipate a broadening opportunity set that favors international markets, particularly value and small cap stocks.

International small‑cap and large‑cap valuations have converged

Rate cuts provide opportunities for US small caps and financials

Themes driving the bulk of U.S. equity returns in 2024 may unwind in 2025. Bottom line: We see a broadening opportunity set in equity markets. Small caps should benefit from further interest rate cuts and any signs of an improving economy. Underappreciated sectors like energy, financials, and industrials could also offer opportunities, signaling a stock-pickers' market.

Key takeaway

Trends that dominated U.S. equities in 2024 may fade in 2025, but this will likely expand the opportunity set.

U.S. equity valuations are close to historic highs in many sectors

Read the full Global Market Outlook end of year update

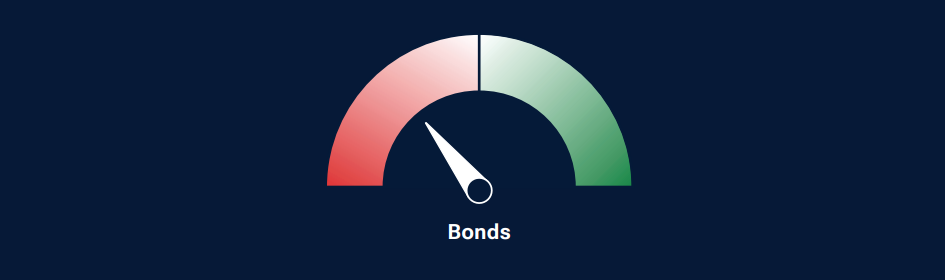

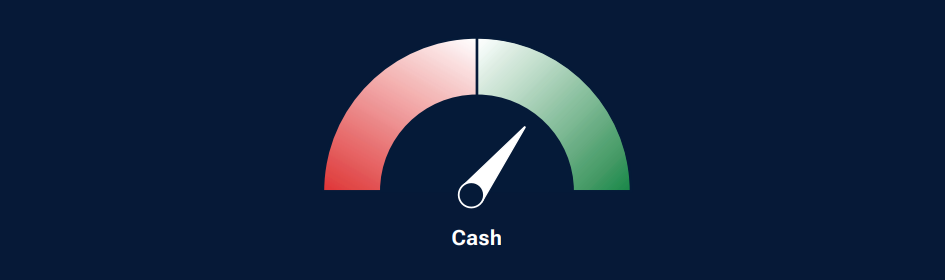

Finding income in high yield bonds, bank loans, and emerging markets

Bond yields have been on a roller coaster ride as markets have tried to anticipate shifts in central bank policies. Given current market pricing, this implies upside risk to yields. Where to focus: Cash yields remain attractive, but longer duration fixed income is vulnerable. High-yield bonds and bank loans are best positioned for yield, while emerging market bonds also present favorable income prospects.

Key takeaway

Noninvestment-grade sectors and emerging market bonds offer attractive yield opportunities even if government bond yields decrease.

Topics in Focus

Weaker growth, lower rates set to open up private markets

Evolving economic and market conditions could expand opportunities for private market investors. Private credit will cater to complex financing needs, while potential IPOs and increased M&A activity, driven by lower interest rates, may offer liquidity avenues for private equity investors.

Key takeaway

A more challenging economic environment and the Fed’s rate‑cutting cycle will open up opportunities for private market investors in 2025.

Radical innovations are driving a healthcare revolution

A wave of innovation is transforming the health care sector’s prospects. And not just in GLP-1s. Technological developments are leading breakthroughs in AI-led cancer screening and robotic surgery. Therapeutic breakthroughs could have major impacts. A return to lower rates and inventory normalization may also bring a timely boost for the sector.

Key takeaway

A new generation of treatments and technologies are paving the way for what could be a golden age in healthcare.

AI’s “easy money” era is over, but rich opportunities remain

The launch of ChatGPT ignited a surge in AI stocks. While the initial rapid growth phase may be over, AI remains a powerful productivity enhancer for the global economy. What does that mean for investors? Transitioning to AI’s next investment phase. Innovative “linchpin” companies—with strong fundamentals—offer strongest growth prospects.

Key takeaway

Investors seeking to navigate the next phase of the AI investment cycle should look for key tech firms that are innovating within growth markets.

2025 Tactical allocation views

As of 31 October, 2024

Investment professionals from the T. Rowe Price Multi-Asset Division presents their views on the relative attractiveness of asset classes and subclasses over next 6 to 18 months.

Despite elevated valuations, we see potential for broadening of earnings growth as developed market central banks cut rates. Questions remain around AI momentum, economic growth, and geopolitical tensions.

Sign up to receive our monthly Global Asset Allocation Viewpoints from our Investment Committee

Each month, our Investment Committee prepare a report revealing the two market themes they are watching, their bull and bear views per region and their latest asset class over and underweights.

It has been designed to aid you in your decision making and client conversations.

Additional Disclosures

Copyright © 2024, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

The Funds are sub-funds of the T. Rowe Price Funds SICAV, a Luxembourg investment company with variable capital which is registered with Commission de Surveillance du Secteur Financier and which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). Full details of the objectives, investment policies and risks are located in the prospectus which is available with the key investor information documents (KIID) and/or key information document (KID) in English and in an official language of the jurisdictions in which the Funds are registered for public sale, together with the articles of incorporation and the annual and semi-annual reports (together “Fund Documents”). Any decision to invest should be made on the basis of the Fund Documents which are available free of charge from the local representative, local information/paying agent or from authorised distributors. They can also be found along with a summary of investor rights in English at www.troweprice.com. The Management Company reserves the right to terminate marketing arrangements.

EEA – Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

Switzerland - Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. First Independent Fund Services Ltd, Klausstrasse 33, CH-8008 Zurich is Representative in Switzerland. Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zurich is the Paying Agent in Switzerland. For Qualified Investors only.

UK – This material is issued and approved by T. Rowe Price International Ltd, Warwick Court, 5 Paternoster Square, London EC4M 7DX which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.

4103883