2024 Global Market Outlook Midyear Update

2024 Global Market Outlook Midyear Update

How central bank policy could impact your portfolio

At midyear, expectations for rate cuts have been pushed out further, with far fewer anticipated, and markets have repriced accordingly. We anticipate growth in the global economy. We see continued market broadening, with select equity and fixed income opportunities. Most importantly, the ongoing transition from the low-rate post-GFC environment to one characterised by higher interest rates may provide favorable conditions for active managers to outperform.

A 2-minute summary with Ritu Vohora

T. Rowe Price’s Investment Specialist of Capital Markets, Ritu Vohora provides a summary of the key themes covered in the 2024 Global Market Outlook Midyear Update webinar.

Key factors shaping our midyear market outlook

Higher for longer has become the consensus

Most developed market central banks are walking a tightrope amid reaccelerating inflation. Our view is that the U.S. Federal Reserve (Fed) is likely to make fewer cuts, while we believe the European Central Bank will cut between 1–3 times. We expect Japan to gradually tighten its monetary policy.

Key takeaway

The Fed is more likely to surprise with fewer cuts than with more.

Opportunities broaden beyond the “Magnificent Seven”

We believe artificial intelligence will create long-term winners, but stock selection is key as performance of the mega-cap tech stocks begins to fragment. We anticipate a continued expansion of opportunities and believe that value—and possibly small-cap—stocks may begin to challenge the dominance of large-cap growth stocks.

Key takeaway

Now may be the time to diversify into areas that have valuation support and robust fundamentals, such as value stocks.

Value stocks look poised for earnings resurgence

Estimated earnings per share of value stocks set to outstrip growth stocks later this year

As of May 13, 2024

Source: FTSE Russell (see Additional Disclosures)

Actual outcomes may differ materially from estimates. Each time period shows the estimated year-over-year change in quarterly earnings for growth and value stocks for each quarter this year.

Rising capital expenditure should benefit value sectors

In contrast to the U.S. market’s heavy exposure to growth stocks, the international market is more exposed to value-oriented sectors, including financials, materials, industrials, and energy. Supply chain diversification, infrastructure rebuild, defense spending, and the likelihood of higher energy prices should favor traditional value sectors as capital spending accelerates.

Key takeaway

We continue to favor Japan and see select opportunities in emerging markets, such as South Korea and Vietnam.

Uncertain environment favors short duration bonds

Short-term bonds are highly valued during uncertain periods—such as the present—because they are less exposed to interest rate changes than longer-maturity bonds. They also provide the potential for higher returns than cash while being almost as liquid, which can be useful during periods of economic uncertainty.

Key takeaway

We have a preference for short duration bonds. While credit spreads are tight, we are currently overweight high yield and emerging market debt.

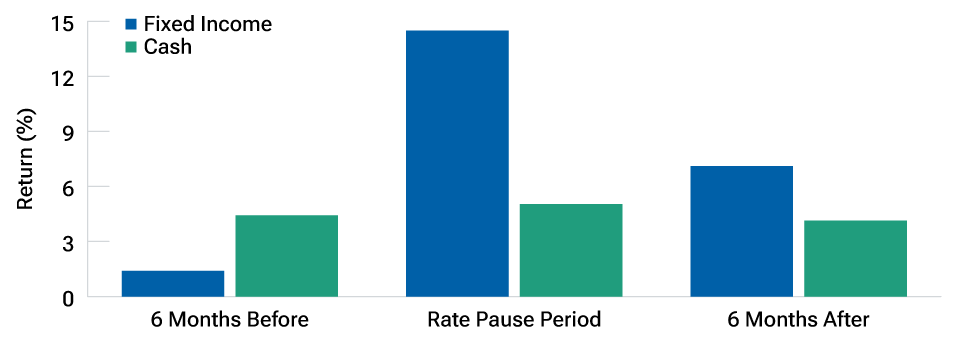

Bonds have tended to outperform cash during rate pause periods

As of April 30, 2024.

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

This is not representative of actual investments and does not reflect any fees and expenses associated with investing. Indexes cannot be invested in directly. Cash is represented by the Bloomberg U.S. Treasury Bills 1-3 Month Index, and bonds is represented by the Bloomberg U.S. Aggregate Bond Index. Historical average performance in the 6 months leading up to the last Federal Reserve rate hike, the rate pause period (between the last rate hike and first cut), and the 6 months after the first cut. Dates used for the last rate hike of a cycle are: 02/01/1995, 03/25/1997, 05/16/2000, 06/29/2006. Dates used for the first rate cut are: 07/06/1995, 09/29/1998, 09/18/2007, 08/01/2019.

Source: Bloomberg Finance L.P. Data analysis by T. Rowe Price.

Energy stocks and commodities could help hedge against inflation

Energy sector stocks have historically performed quite well during periods of very high inflation. This suggests that one way to hedge against inflation risk would be to tilt portfolios toward stocks in the energy sector and other commodity-oriented equities.

Key takeaway

Sticky inflation could inflect higher as global growth broadens. Commodity-oriented equities may offer an effective way to navigate inflation risk.

2024 Global Market Outlook Midyear Update

Hosted by Ritu Vohora, hear what’s shaping our markets from T. Rowe Price’s thought leaders: Sebastien Page, Head of Global Multi-Asset and Chief Investment Officer; Kenneth Orchard, Head of International Fixed Income and Portfolio Manager; Peter Bates, Portfolio Manager, Global Concentrated Strategy, and Blerina Uruci, Chief U.S. Economist.

Additional insights

202406-3644999