NEXT WAVE OF ADVICE

Coaching Clients to Action by Unlocking Money Mental Blocks

Use GROW to build deeper connections with your clients

Have you ever put together a financial plan only to have it gather dust? Most financial advisors have. In fact, half of clients who pay for a financial plan implement fewer than 20% of the recommendations, and almost 20% of clients don’t implement any of their financial plan, according to an industry survey.1 But your clients’ inability to follow through may have little to do with the credibility or effectiveness of the plan itself. More likely, it’s about their relationship with money. In other words...it’s not you, it’s them. Often, clients fail to find a path forward because emotional factors are blocking them from acting: it may be the result of a negative childhood money memory or an irrational fear of putting their wealth at risk.

Put another way: how often does market volatility derail a financial plan? How often does the behavior of the client put the financial plan on hold?

Finding ways to resolve these behavioral barriers isn’t about advisors doing more work, taking on laborious new tasks, or becoming a therapist. It’s about being a coach and helping clients become more aware of how their emotions, beliefs, and attitudes about money impact their financial security.

Embrace your role as coach

Whipping up a winning financial plan with the help of technology isn’t enough. The best financial advisors go beyond the numbers. What sets one financial advisor apart from another is connecting with clients in a way an algorithm can’t.

Clients often don’t act on the advice of their financial advisor

Source: Wealth Professional, “When formal financial plans are a poor fit”

To get beyond the numbers and forge a better path forward, you need to learn what makes your client tick when it comes to money. To do that requires a different tactical approach. Shift the focus in meetings away from a “show and tell” approach and toward one of “ask and listen.”

This client-led approach is less about highlighting your financial knowledge and more about empowering the client. It means letting the client do most of the talking (you should be listening 80% of the time) and allowing them to identify their own behavioral biases getting in the way of making sound financial decisions.

Your goal: Ask better questions and listen more intently. In short, pivot from financial advisor to financial advisor/coach. That means mimicking the qualities of a great coach so you can help your clients overcome behavioral challenges, think differently about money, and perform better financially. That’s the essence of coaching. To get them to act, you must probe to identify what’s holding them back to unlock and unleash new proactive behaviors.

The upside for you as a financial advisor? Coaching deepens client relationships, builds greater trust, and demonstrates your value beyond portfolio performance.

Integrate GROW into your coaching strategy

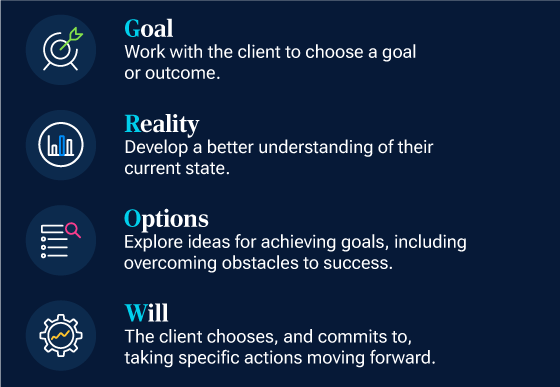

Getting your clients to open up about their money fears is a good starting point. To foster better advice conversations, guide your clients through the four-step GROW coaching process. GROW is a client-led coaching strategy designed to help the client establish goals, explore ways to overcome obstacles and achieve results, and ultimately to nudge them toward taking specific actions to move forward.

Putting GROW to work for clients

Source: Permission to use the GROW Model granted by Performance Consultants International.

Your goal with GROW is to increase client self-awareness and connect their current financial reality to future goals. There’s a simple way to help clients get to where they want to go: Ask questions that focus on their goals. You’ll learn a lot by asking questions like: What is the specific outcome you want to accomplish in the next year? Why is this goal important to you? What roadblocks are you facing now? What steps have you taken to achieve your goal?

Here’s how GROW might look in real time:

- Goal: At the outset of a meeting, ask what they’re hoping to get out of the meeting and how accomplishing that goal will make them feel.

- Reality: You can gain a better understanding of their current financial reality and weigh the best path forward by asking open-ended questions that explore why they relate to money the way they do. But taking the lead in establishing goals and presenting options for your client may not have the desired result. Instead, help the client better understand their current situation from their own perspective—how they got there and how it has affected their relationship with money—which will usually allow the client to figure out a path forward for themselves.

- Options (and obstacles): A good way to determine their best options is to ask questions that dig deep to find out what obstacles are derailing their financial success. The endgame? Help clients transport themselves from where they are now, financially, to where they want to be.

- Will: Address the client’s ability to act by getting a sense of what’s ahead—and whether that could motivate action or stall decision-making. Simply ask, “What could we do to help you move forward?”

Asking the right questions can unleash your client

You’ll need to ask the right questions to get the answers you’re looking for, however. Asking your client traditional questions about their feelings about risk and what lifestyle they want to lead in retirement won’t help them identify the beliefs about money that are holding them back. You’ll gain more insights by asking: What makes you feel so uncomfortable with the windfall you received from your family inheritance? What’s a healthier way to deal with your fear of running out of money? Imagine you finally decided to splurge on a vacation; how would that make you feel?

Now’s when you shift your focus to the “3 C’s” of coaching. You want to ask questions with a streak of curiosity to help your client dig deeper for answers, such as the roots of their behaviors, beliefs, and feelings around money. You need courage to ask the tough questions, such as, “What’s driving you to make so many impulse purchases?” “Are you open to adopting more healthy habits if it lessened your angst about affording health care in retirement?” And, of course, deliver your message with compassion to show that you have your client’s best interests at heart. Click here for “Understanding the “3 C’s” of Coaching.”

Use the 3 C’s to help your client reframe their views of money and give them the confidence to think and act differently. Some examples of thought-provoking, open-ended questions: What does financial security mean to you? What did you learn from your parents about money?

You want to draw your client out and allow them the space to identify the issues causing their unhealthy relationship with money. And when a problematic issue arises, you have the opening to ask what’s driving the behavior and whether they’re willing to work on it with you.

Measuring success of client-led relationships

Stop talking about just the numbers. You won’t necessarily be measuring success based on portfolio returns compared to the S&P 500. Instead, a sign of success would be a client who was on the sidelines finally adopting the financial plan you recommended. That could be financially lucrative for both them and you over time.

Why is that? Deepening your relationship with your client by acting as their coach will also improve client satisfaction and retention, which can lead to a more motivated client who achieves better financial results, not to mention greater share of wallet and more assets under management over time for you.

To improve the chances that your client moves forward with the financial plan you’ve built for them, embrace the qualities and processes of exceptional coaches that allow the client to lead the way forward. The goal: Let the client see for themselves how the way they view money is often the biggest threat to their financial well-being. A more satisfied client is the key to a lifelong client.

RELATED RESOURCES

See all of our coaching resources

Help clients bridge the gap between good intentions and tangible actions with these tools and insights.

202407-3582371