- On Retirement

- Market Setbacks Don’t Need to Set Back Retirement Plans

- Workers not nearing retirement can and mostly do stay the course

- 2022-09-22 16:31

- Key Insights

-

- We believe that the current volatility in securities markets and lower expected returns in the midterm do not warrant a change in our suggested retirement saving strategies.

- Workers over 50 might consider increasing their saving rate, however.

- Plan sponsors can help participants navigate market volatility by increasing adoption of target date funds in their plan lineup and providing emergency savings vehicles.

Late last year, in our 2022 U.S. Retirement Market Outlook, we expressed our concern that investment returns might be lower over the next several years than they have been historically. Little did we know that our concerns would materialize so fast. In the first half of 2022, the S&P 500 Index dropped 21%. For those of us involved in retirement planning, the recent volatility begs the question of whether—and how—retirement savers should react?

We address this question by revisiting our retirement saving guidance, particularly our suggested saving rate of 15% (including employer contributions) and age‑ and income‑specific savings benchmarks. Using collective, anonymized data from T. Rowe Price’s recordkeeping system, we also analyze the behavior of 401(k) participants during the first half of 2022 to see if they have changed course. Finally, we outline possible strategies for workers, retirees, and plan sponsors to adapt to the current market conditions.

Do Retirement Savers Need to Change Course?

To track the progress of retirement savers, T. Rowe Price publishes age‑ and income‑specific savings benchmarks.1 These are approximations of how much someone should have saved by a given age and level of income to have sustainable replacement income in retirement. For the calculation of these savings benchmarks, we assume an average annual return of 7%. This assumption is based on historical returns of different asset classes and age‑based portfolio allocations.

Our Retirement Savings Benchmarks Remain Mostly Unchanged

(Fig. 1) Savings benchmarks by age—as a multiple of income

The chart is for illustrative purposes only and does not predict or project returns or represent actual results. There is no assurance that any objective will be met. Changing the assumptions may result in different outcomes and actual results may vary. Actual returns and outcomes may differ materially. All investments are subject to risk, including the possible loss of principal.

Source: T. Rowe Price.

Key Assumptions: Benchmarks are based on a target multiple at retirement age and a savings trajectory over time consistent with that target and the savings rate needed to achieve it. Household income grows at 5% until age 45 and 3% (the assumed inflation rate) thereafter. Investment returns before retirement are before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets (a rate intended to support steady inflation-adjusted spending over a 30-year retirement). Savings benchmark ranges are based on individuals or couples with current household income approximately between $75,000 and $250,000. Target multiples at retirement reflect estimated spending needs in retirement (including a 5% reduction from preretirement levels); Social Security benefits (using the SSA.gov Quick Calculator, assuming claiming at full retirement ages, and the Social Security Administration’s assumed earnings history pattern); state taxes (4% of income, excluding Social Security benefits); and federal taxes. We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2022, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Approximate midpoints for age 35 and older are rounded up to a whole number within the range and therefore do not vary between the two scenarios.

But in lower expected return environments, should those saving for retirement assume lower returns and save more? To answer this question, we explored a hypothetical alternative. The hypothetical alternative savings benchmark assumes 4% returns for five-years, which we consider the mid‑term, and then reverts to 7% after that.

Over 95% of 401(k) participants have not made any investment exchanges during the first half of 2022.

Under the lower mid‑term return assumptions, our age‑specific savings benchmarks are unchanged for workers under age 50. In our view, these workers have enough time left to recover from any short- to mid‑term market turmoil and need not focus on short-term market returns if they are on track to reach these benchmarks.

For those between ages 50 and 65, there are slight increases in the benchmarks (as highlighted above). Because these savers have a shorter investment horizon left, they have less time to recoup lower returns. Also, by the nature of compounding, the final years before retirement usually yield the highest portfolio returns in absolute (or dollar) terms (and not necessarily on a percentage basis). If returns are muted during this period, then savers will need to make up that ground by increasing their savings.

Target Date Fund Participants More Likely to Stay the Course

(Fig. 2) Percent of participants who made an investment exchange

| Q1 2021 | Q2 2021 | Q1 2022 | Q2 2022 | |

|---|---|---|---|---|

| Active* Participants With 100% of Account Invested in a TDF | 0.9% | 0.5% | 0.4% | 0.2% |

| Active* Participants With 0% of Account Invested in a TDF | 8.2 | 6.3 | 7.3 | 6.4 |

| Active* Participants With Some of Account Invested in a TDF | 4.3 | 3.2 | 3.3 | 2.5 |

As of June 30, 2022.

Data for the period January 1–June 30 from 401(k) plans with approximate assets>$25m and served by

T. Rowe Price Retirement Plan Services.

*Non-terminated participants

For those close to retirement but unable to meet the adjusted benchmarks, there may be other options to consider. They might consider delaying retirement for a year or two, taking up some part‑time work in retirement, or making some spending adjustments.

Participants Making Investment Exchanges Mostly Moved to Lower-Risk Assets

(Fig. 3) Weekly exchanges (in USD millions) by asset class during the first and second quarters of 2022

As of June 30, 2022.

Data for the period January 1–June 30 from 401(k) plans with approximate assets>$25m and served by T. Rowe Price Retirement Plan Services.

Chart indicates what asset class participants moved into.

We suggest these individuals work with their financial professional to assess options and craft a plan that works best for their personal situation.

We continue to suggest that workers save at least 15% (including any employer contribution) of their annual salary for retirement. This is a rule of thumb; in practice, the suggested savings rate will vary from person to person, usually increasing for people with higher incomes.

Are Retirement Savers Actually Changing Course?

To answer this question, we looked at the behavior of 401(k) participants during the first half of 2022 (January 1–June 30) from T. Rowe Price’s recordkeeping data. We analyzed their exchange activity (switching between investments) and changes in their deferral rates during this volatile period.

In general, 401(k) participants have been staying on the course. Based on our research, over 95% of 401(k) participants have not made any investment exchanges during the first half of 2022. But underlying that are some noticeable trends.

First, participants who are invested solely in a target date fund (TDF) are less likely to make an exchange compared with those who have no investments in TDFs. This gap has not increased significantly in the first half of 2022; indeed, exchange activity has been slightly lower during the first half of 2022 compared with the same period in 2021.

Second, a small group has reacted to the market’s downturn by taking money out of stocks and target date investments and putting it into less volatile alternatives, such as money market and stable value funds. The largest spike in exchange activity happened during the week ended on February 25, the week Russia invaded Ukraine.

What seems to be a cautious move in the short term may prove to be a risky one over the longer periods relevant to many retirement savers. Moving to conservative assets during high‑volatility periods could lock in losses permanently, and it will be very hard for investors to decide when to move these assets back into the market. Essentially, this strategy involves timing the market correctly twice—a nearly impossible task for any investor.

Average Deferral Rate Has Remained Stable

(Fig. 4) Weekly average deferral rate (as a percentage of salary) during the first and second quarters of 2022

As of July 1, 2022.

Source: T. Rowe Price.

Data for the period January 1–June 30 from 401(k) plans with approximate assets>$25m and served by T. Rowe Price Retirement Plan Services.

Nearly 20% of 401(k) Participants Have Increased Deferral Rates First Half of 2022

(Fig. 5) Weekly percentages of 401(k) participants who increased or decreased their deferral rate during the first and second quarters of 2022

As of July 1, 2022.

Source: T. Rowe Price.

Data for the period January 1–June 30 from 401(k) plans with approximate assets>$25m and served by T. Rowe Price Retirement Plan Services.

Apart from exchanges, 401(k) participants can also change their deferral rates in response to market conditions, but other factors may also be at work. Based on our data, for most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, though the changes are very small. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Leaving aside automatic increases in deferral rates, during the first half of 2022, nearly 20% of 401(k) participants have increased their deferral rates. That’s the good news. But about 11% of all 401(k) participants decreased their deferral rates during this period. Interestingly, the peak of increased deferral activity occurred during the first two weeks of the year before the current stretch of market volatility started. This might be related to a “new year effect” and highlights the impact of behavioral factors in shaping these key saving metrics.

What Can Investors Do to Adapt to Market Turmoil?

Review Their Spending Expectations

Our research2 indicates that a conservative withdrawal approach is an important way to navigate an uncertain market environment, especially at the onset of retirement. To gain insight on portfolio sustainability, we tested the 4% rule of thumb in three past market environments, each starting with a bear market at the onset of retirement. The 4% rule of thumb suggests that an individual withdraw 4% of their retirement portfolio in the first year of retirement. That amount is assumed to increase with inflation each year over the retirement horizon.

We assumed a beginning balance of $500,000 and an initial withdrawal amount of $20,000 in the first year (4% of the portfolio). We considered three historical time periods that begin with significant market sell‑offs: retirements beginning in 1973, 2000, and 2008. In each scenario, we considered the historical performance of a portfolio consisting of 60% stocks and 40% bonds using index data and increased the initial withdrawal amount by the actual inflation rate3 at that time to maintain purchasing power.

A Conservative Withdrawal Approach Is Part of a Sustainable Spending Plan

(Fig. 6) Hypothetical portfolio balances over three retirement horizons beginning with a bear market

As of March 31, 2022.

Source: T. Rowe Price.

The hypothetical examples above are based on the past performance of the S&P 500 Index, which tracks the performance of 500 large-company stocks, and the Bloomberg Government/Credit U.S. Bond Index for the period 1973-1975 and the Bloomberg U.S. Aggregate Bond Index, which tracks domestic investment-grade bonds, including corporate, government, and mortgage-backed securities, from 1975 to present. We assume monthly rebalancing. Indexes are unmanaged, and it is not possible to invest directly in an index. These hypothetical examples are meant for illustrative purposes only and do not reflect an actual investment, nor do they account for the effects of taxes or any investment expenses. Investment returns are not guaranteed, cannot be predicted, and will fluctuate. All investments are subject to risk, including the possible loss of the money invested.

We found each scenario was able to support portfolio withdrawals and projected withdrawal amounts throughout each retirement horizon. Additionally, in all three scenarios, the remaining portfolio balance was above the starting portfolio balance ($500,000) as of the latest available date and age profile. So, a conservative spending approach can not only make the portfolio sustainable but may also preserve assets, which is generally a key financial goal for retirees.

While this analysis is encouraging and the 4% initial withdrawal guideline may be a reasonable rule of thumb for those years away from retirement, investors closer to and in retirement need to consider their specific circumstances and retirement budget.

We have also examined actual spending patterns in retirement4 and found that, on average, inflation‑adjusted spending declines by 2% annually after age 65. Additionally, we found that retirees adapt their nondiscretionary spending to their level of guaranteed income in retirement. Understanding specific spending needs to determine which expenses are essential and which are discretionary may help retirees modify their withdrawal approach.

Build Up Cash Reserves

Most people are aware of the importance of having an emergency fund in place to help them get through periods of financial shock, whether a loss of income or a large, unexpected expense. For workers, we suggest an amount that could cover three to six months of expenses. Having this money accessible outside of retirement accounts can help workers maintain control and weather periods of uncertainty without adding to their credit card debt or raiding their retirement savings.

"When heading into retirement, we suggest a cash buffer that could cover one to two years of spending needs."

When heading into retirement, we suggest a cash buffer that could cover one to two years of spending needs. Having an alternative and stable source available to fund expenses can be particularly helpful in a down market to give retirees cover until their investments rebound. They might consider holding these assets in a bank savings or money market account; short‑term bond funds; short‑term certificates of deposit; or, if in a high tax bracket, tax‑free short‑term bond or money market funds.5 This money provides retirees access to short‑term liquidity, so that they do not have to withdraw from their longer‑term investments.

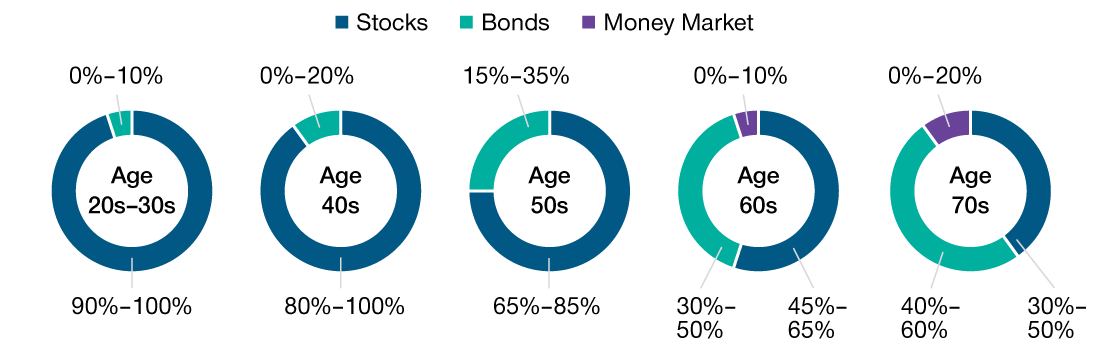

Sample Asset Allocation by Age for Retirement Savers

(Fig. 7) Ranges of stocks, bonds, and money market allocations

Source: T. Rowe Price.

These allocations are age-based only and do not take risk tolerance into account. Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed retirement age of 65 and a withdrawal horizon of 30 years. The model allocations are based on an analysis that seeks to balance long-term return potential with anticipated short-term volatility. The model allocations reflect our view of appropriate levels of trade-off between potential return and short-term volatility for investors of certain age ranges. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash.

Limitations: While the samples have been designed with reasonable assumptions and methods, the samples are hypothetical only and have certain limitations. The samples do not take into account individual circumstances or preferences, and the sample displayed for your age may not align with your accumulation time frame, withdrawal horizon, or view of the appropriate levels of trade-off between potential return and short-term volatility. Investing consistent with a sample allocation does not protect against losses or guarantee future results. Please be sure to take other assets, income, and investments into consideration when reviewing illustrations that do not incorporate that information. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

Maintain an Appropriate Asset Allocation for Long‑Term Success

Asset allocation is a key driver of a portfolio’s performance over time. An appropriate allocation can provide current income while also offering the growth potential necessary for a long retirement. In general, the longer the time horizon, the more of an investor’s portfolio should be allocated to stocks. Younger investors have the time to withstand short‑term volatility of stocks and benefit from compound growth, and stock returns have generally outpaced inflation over the long term.

As investors approach and move into retirement, adding bonds can help dampen short‑term ups and downs in the market while still providing growth opportunity. T. Rowe Price sample retirement portfolios offer a good starting point. These portfolios include ranges of the primary asset classes to accommodate investors’ risk preferences while considering allocations appropriate for various ages and time horizons.

"...investors concerned with inflation risk or seeking real (inflation-adjusted) growth could look for a combination of growth‑oriented and inflation‑sensitive investments..."

Diversifying within each asset category is also important. For example, investors concerned with inflation risk or seeking real (inflation-adjusted) growth could look for a combination of growth‑oriented and inflation‑sensitive investments in strategic allocations within their current mutual fund portfolios or might seek out funds with some of these underlying investments. Assets that have generally performed well in periods of unexpected or rising inflation include real assets equities, Treasury inflation protected securities (TIPS), and higher‑yielding bonds.

Varying growth and inflation environments have tended to favor different asset classes, as shown below. Our investment professionals may consider these dynamics in their underlying allocations.

Investors managing their own retirement portfolios could check that their portfolio has exposure to a range of these investments. Many other investors may find it beneficial to use professionally managed investment products, such as target date strategies with underlying actively managed components, or to work with a financial advisor on a personalized investment plan. Of course, diversification cannot assure a profit or protect against loss in a declining market and the asset classes noted are subject to varying levels of risk.

What Can Plan Sponsors Do to Address Market Turmoil?

Plan sponsors can take several steps to help ensure that participants and retirees are not making fear‑driven mistakes, which could jeopardize their retirement.

Consider adding target date funds to their lineup

TDFs are designed to accumulate savings over the working career of a retirement saver. TDF glidepaths incorporate typical market risks over the long term in its assumptions, so savers invested in TDFs don’t need to change their investment in response to market volatility. Our research shows that TDF investors are unlikely to make investment changes during periods of market volatility. This allows investors to avoid market timing risks and can help them grow their retirement assets. Higher adoption of TDFs could have a calming effect on investors who would prefer to rely on professionals for asset allocation decisions.

Investment Performance Varies Across a Range of Economic Environments

Source: T. Rowe Price. The diagram above is for informational purposes only and does not represent any investment recommendations. Past performance is not a reliable indicator of future performance.

Message to prevent investment mistakes

Our research shows that a small number of retirement investors may respond to market volatility by moving their assets to safer alternatives. As noted, this is risky because to avoid any losses they need to time the market correctly twice—once when moving out of higher risk growth seeking investments and then again when moving back into those assets. Plan sponsors should communicate this to their plan participants. They might also consider communicating that research demonstrates that many plan participants are staying the course, which might help calm peers who are anxious about responding to market volatility.

Provide emergency savings vehicles

Emergency cash reserves can help participants weather emergencies without setting back their retirement goals by reducing deferral rates or relying on loans or hardship withdrawals. Plan sponsors can set up emergency cash accounts for workers that allow for automated deposits through the payroll system.

Provide retirement income planning tools

Having a clear understanding of their retirement income sources and their sustainability can help participants see through times of volatility. Plan sponsors should work toward providing their retiring participants with a variety of retirement income solutions and tools and help them choose the solutions that meet their individual needs.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to retirement.

-

Investment Risks:

Target date funds: The principal value of target date funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These funds typically invest in a broad range of underlying mutual funds that include stocks, bonds, and short‑term investments and are subject to the risks of different areas of the market. In addition, the objectives of target date funds typically change over time to become more conservative.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall.

Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities.

Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency.

Treasury Inflation Protected Securities: In periods of no or low inflation, other types of bonds, such as US Treasury Bonds, may perform better than Treasury Inflation Protected Securities.

Growth stocks are subject to the volatility inherent in common stock investing, and their share price may fluctuate more than that of a income-oriented stocks.

Small-cap stocks have generally been more volatile in price than the large-cap stocks.

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

1 Roger Young, “You’re Age 35, 50, or 60: How Much Should You Have Saved for Retirement by Now?,” T. Rowe Price, May 2022.

2 Judith Ward, “How to Make Your Savings Last When Retiring Into a Down Market?,” T. Rowe Price, July 2022.

3 Consumer price index, seasonally adjusted.

4 Sudipto Banerjee, “Decoding Retirement Spending,” T. Rowe Price, March 2021.

5 Mutual funds are not FDIC-insured (FDIC=Federal Deposit Insurance Corporation) and are subject to possible loss of principal. While money market funds typically seek to maintain a share price of $1.00, there is no guarantee they will do so. Tax-free funds may be subject to alternative minimum tax and state and local taxes. Capital gains taxes on sales may also apply.

-

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making.The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Please consider your own circumstances before making an investment decision. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

202209-2449062