2024 Global Market Outlook Midyear Update

Broadening global growth, resurgent inflation define outlook

Economy

Six months ago, the consensus outlook for the global economy in late 2024 featured steadily falling inflation amid a slide toward recession that would trigger aggressive central bank rate cuts. The best outcome would be a “soft landing” slowdown that dodged a recession thanks to central bank action. Investor hopes for this scenario led to simultaneous rallies in equities, high‑quality government bonds, and bonds with credit risk. What a difference a few months make: Consensus now expects continued expansion, resurgent inflation pressures, and limited easing from central banks. We’re not quite as sanguine on growth as this “no landing” scenario, but it looks like recession is off the table for at least the next six months.

Broadening of global growth

The consensus also still involves U.S. exceptionalism, with U.S. expansion easily outpacing anemic growth in other developed markets. But U.S. first‑quarter growth disappointed. With leading indicators in the eurozone moving smartly higher, we could easily see an overall broadening of global growth, undercutting the U.S. exceptionalism narrative.

“...recession is off the table for at least the next six months.”

Nikolaj Schmidt, Chief Global Economist

More growth, more U.S. inflation

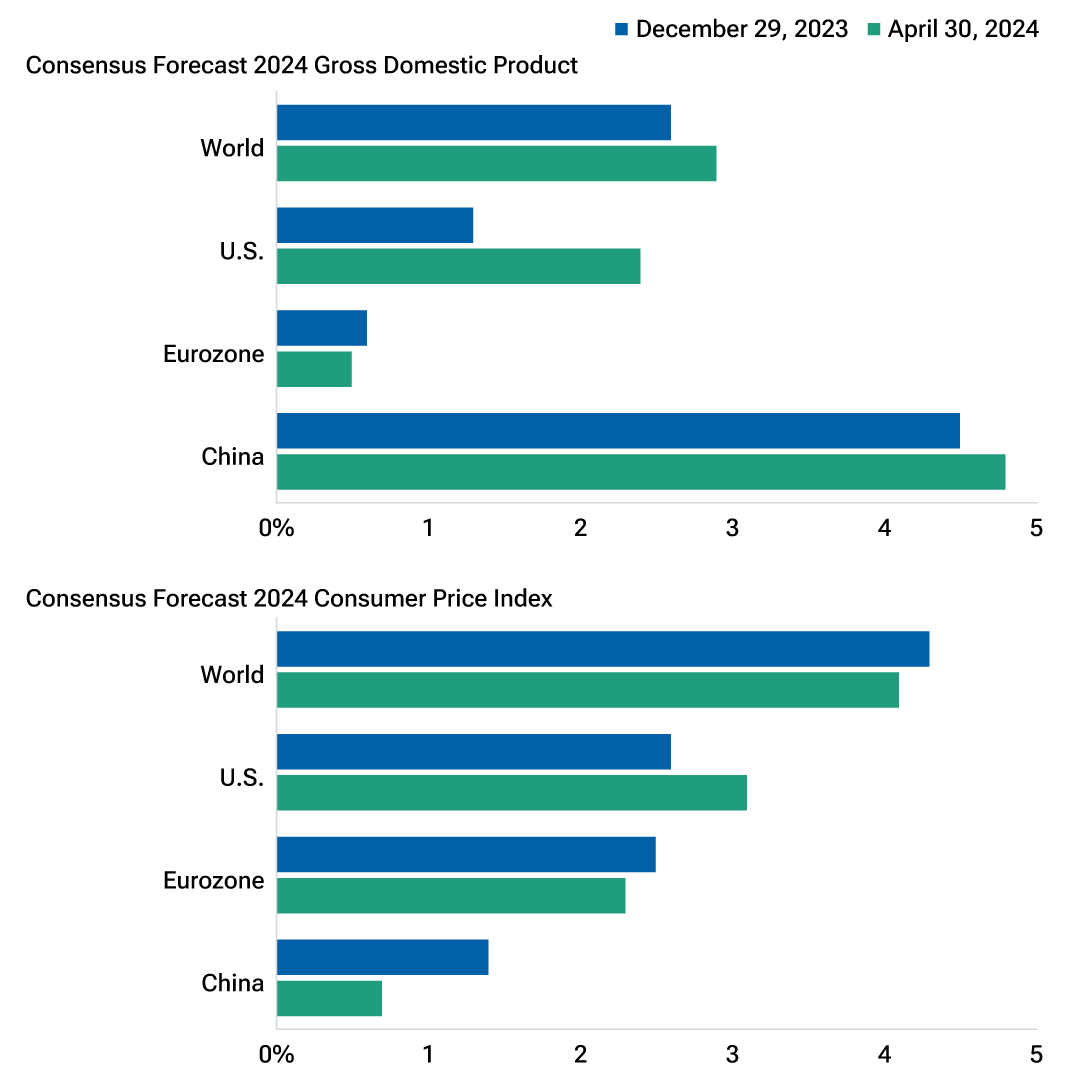

(Fig. 1) How consensus forecasts have shifted since the end of last year

As of April 30, 2024.

Source: Bloomberg Finance L.P.

There is no guarantee that any forecasts made will come to pass. The consensus forecasts are for full-year 2024 GDP and CPI figures, taken at the end of December and the end of April, respectively.

The European Central Bank at its June meeting became the first major developed market central bank to cut interest rates. The Bank of England (BoE) looks poised to be the next to ease ahead of the UK general election on July 4, followed by the Federal Reserve. Because of the weaker starting point for the eurozone economy, we think the ECB will cut the most in 2024, with sticky inflation keeping the Fed to only one or possibly two rate reductions of 25 basis points each.

Which way for monetary policy in 2025?

The overarching question is: Where will this bring monetary policy in 2025? Even modest rate cuts this year could easily lead to reaccelerating growth—and inflation that would force the Fed to raise rates next year, with other major central banks following close behind. This could mean that central banks will be tightening policy as the labor market weakens going into the next recession. In this unusual scenario, we would expect more divergence in returns as investors sort through the implications for sectors and individual securities. Active portfolio management, with a focus on fundamental analysis and relative value, would be vital in this environment.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differmaterially from those anticipated in estimates and forward-looking statements, and future results could differ materially from any historical performance. The information presented herein isshown for illustrative, informational purposes only. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have notbeen independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements.Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024.All rights in the FTSE Russell indexes or data vest in the relevant LSE Group companywhich owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained inthis communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor orendorse the content of this communication.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® areregistered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Thisproduct is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing insuch product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respectto any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, orproduced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended toconstitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Global Market Outlook Midyear Update insights

How central bank policy could impact your portfolio

Murky environment to challenge Fed policymakers

ECB and BoE to cut as BoJ remains an outlier

Sign up to receive our weekly market recap every Monday at 9am BST

Our Multi-Asset Solutions team produce a weekly market recap which aims to summarise the previous week’s major events and developments that may impact markets.