2024 Global Market Outlook Midyear Update

How central bank policy could impact your portfolio

The key factors shaping the path of rate cuts in the second half of 2024

All eyes on central banks

We are pleased to share our outlook for global economies and markets for the second half of 2024.

In the six months since we published our 2024 Global Market Outlook, the market environment has changed in many ways. Consensus expectations for central bank policy, in particular, are markedly different. Prices of interest rate futures reflect expectations for far fewer interest rate cuts from global central banks than seemed likely in December 2023. Equity and fixed income markets are readjusting accordingly.

The European Central Bank (ECB) kicked off the cycle of lowering rates by the major developed market central banks at its June policy meeting. But the path and magnitude of easing by the world’s rate setters for the rest of the year is far from certain. This outlook details the factors shaping that path for the Federal Reserve (Fed) and other key central banks.

For the global economy, we anticipate broadening growth. While the U.S. remains strong, leading indicators elsewhere suggest that the narrative of U.S. economic exceptionalism may abate.

What does this backdrop mean for markets and asset classes? We expect a broadening in U.S. equity market performance and see attractive value in some international stock markets. Investors seeking to move out of cash may find attractive opportunities in shorter‑term bonds, as well as equities.

Most importantly, we believe the ongoing transition from the low rates that prevailed after the 2008–2009 financial crisis to an environment characterised by structurally higher interest rates will present favourable conditions for active managers to outperform.

Economy

Broadening global growth, resurgent inflation define outlook

Six months ago, the consensus outlook for the global economy in late 2024 featured steadily falling inflation amid a slide toward recession that would trigger aggressive central bank rate cuts. The best outcome would be a “soft landing” slowdown that dodged a recession thanks to central bank action. Investor hopes for this scenario led to simultaneous rallies in equities, high‑quality government bonds, and bonds with credit risk. What a difference a few months make: Consensus now expects continued expansion, resurgent inflation pressures, and limited easing from central banks. We’re not quite as sanguine on growth as this “no landing” scenario, but it looks like recession is off the table for at least the next six months.

Broadening of global growth

The consensus also still involves U.S. exceptionalism, with U.S. expansion easily outpacing anemic growth in other developed markets. But U.S. first‑quarter growth disappointed. With leading indicators in the eurozone moving smartly higher, we could easily see an overall broadening of global growth, undercutting the U.S. exceptionalism narrative.

“...recession is off the table for at least the next six months.”

Nikolaj Schmidt, Chief Global Economist

More growth, more U.S. inflation

(Fig. 1) How consensus forecasts have shifted since the end of last year

As of April 30, 2024.

Source: Bloomberg Finance L.P.

There is no guarantee that any forecasts made will come to pass. The consensus forecasts are for full-year 2024 GDP and CPI figures, taken at the end of December and the end of April, respectively.

The European Central Bank at its June meeting became the first major developed market central bank to cut interest rates. The Bank of England (BoE) looks poised to be the next to ease ahead of the UK general election on July 4, followed by the Federal Reserve. Because of the weaker starting point for the eurozone economy, we think the ECB will cut the most in 2024, with sticky inflation keeping the Fed to only one or possibly two rate reductions of 25 basis points each.

Which way for monetary policy in 2025?

The overarching question is: Where will this bring monetary policy in 2025? Even modest rate cuts this year could easily lead to reaccelerating growth—and inflation that would force the Fed to raise rates next year, with other major central banks following close behind. This could mean that central banks will be tightening policy as the labor market weakens going into the next recession. In this unusual scenario, we would expect more divergence in returns as investors sort through the implications for sectors and individual securities. Active portfolio management, with a focus on fundamental analysis and relative value, would be vital in this environment.

US Rates

Murky environment to challenge Fed policymakers

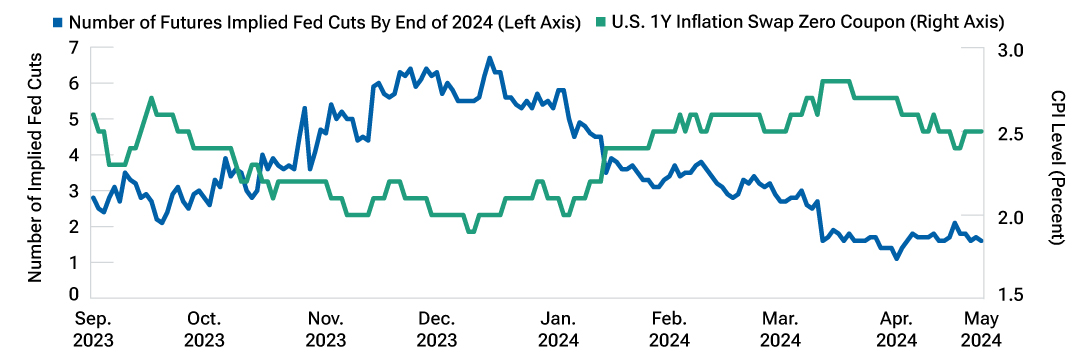

Investors have steadily ratcheted back their expectations for Federal Reserve rate cuts in 2024. In most previous economic cycles, the Fed has been the first to ease, but the ECB was the first mover this time. We still see a slight possibility of a Fed cut this summer followed by the central bank cutting 25 basis points at its December policy meeting, after the November elections are out of the way.

Fed policymakers seem eager to implement an “insurance cut” or two in 2024 to preempt a slowdown—assuming that inflation moderates. The Fed believes that monetary policy is tight, so it would only take modest softening in the labor market to convince the central bank to cut.

The Fed wants to avoid any sign that it is influenced or motivated by politics, so will not act at the September or November Federal Open Market Committee (FOMC) meetings. In fact, a July rate reduction might be earlier than the Fed would act if it were not an election year.

Elevated potential for Fed surprises

The potential for surprises from the Fed is much greater than in a typical late‑business‑cycle environment. There’s an increasing chance that a lack of progress on getting annual core inflation to 2% will prompt the Fed to keep rates steady for an extended period. Stepping back for a broader view, we are more likely to see the Fed surprise with fewer cuts than with more. Preempting the question on whether it is possible that resurgent inflation could prompt the Fed to raise rates later this year, we place less than 20% odds on that outcome.

The outlook for Fed easing in 2025 is even murkier. Two to three cuts in 2025 are priced in now, which appears too dovish. One or two rate reductions next year seems more realistic. And there is a risk that “insurance cuts” by the Fed could allow inflation to fester and raise the chances of the Fed moving back to a hiking bias in 2025.

Rate cut expectations have fallen steadily in 2024

(Fig. 2) Rising inflation concerns have dampened anticipation of significant easing

As of May 22, 2024.

Source: Bloomberg Finance L.P.

Actual outcomes may differ materially from any expectations made.

Global Rates

ECB and BoE to cut as BoJ remains an outlier

For all developed market central banks (excluding the Bank of Japan (BoJ), which is an outlier), monetary policy is quite tight. They will want to avoid tipping their economies into recession. Consequently, these central banks can cut while preserving a tight monetary policy stance. In fact, they will probably ease proactively if inflation allows—if they wait until economic activity craters before cutting, they will be far behind the curve because it will be a long way back to neutral.1

Persistent wage growth will make ECB cautious over easing

(Fig. 3) The eurozone economy could be susceptible to an abrupt labor market slowdown

As of May 24, 2024.

Sources: ECB, European Commission.

As of May 24, 2024.

Sources: European Commission, Eurostat

Fears of labour market cracks lead ECB to act

Eurozone inflation has fallen to the extent that the ECB was able to cut rates in June. ECB policymakers think that eurozone employers have been hoarding labor over the past 12 months. This makes the region’s economy susceptible to an abrupt labour market downturn if corporate profit margins come under pressure amid softer final demand.

The big questions are: When will the ECB ease after June, and how large will the cuts be? The number of expected cuts has been steadily dropping, but we believe the ECB will likely cut twice before the end of 2024— however, it could be as few as once or as many as three times.

BoE likely to follow in the third quarter

There have been hopes that the BoE would follow fast on the heels of the ECB by cutting rates later in June, but we believe it may be a little later than that. With tentative signs that the UK economy is recovering, the BoE may not feel it needs to rush in cutting rates and is likely to wait until the autumn before doing so.

Gradual tightening from the BoJ

Japan has also struggled with inflation—but the lack of it rather than prices rising too quickly. After finally moving away from its subzero rates policy earlier in 2024, we expect the BoJ to continue gradually tightening while sounding dovish enough that the market doesn’t undo its work in boosting inflation. By tightening policy, the BoJ would also support the yen, which has plumbed multi‑decade lows against other major currencies in 2024.

Inflation

Reaccelerating inflation to make central banks walk tightrope

Inflation is notoriously difficult to predict, and it has continued to baffle most forecasters since the onset of the pandemic in 2020. However, it’s becoming clear that inflation isn’t going away, and we see a meaningful risk that it will reaccelerate as U.S. exceptionalism moderates and global growth broadens.

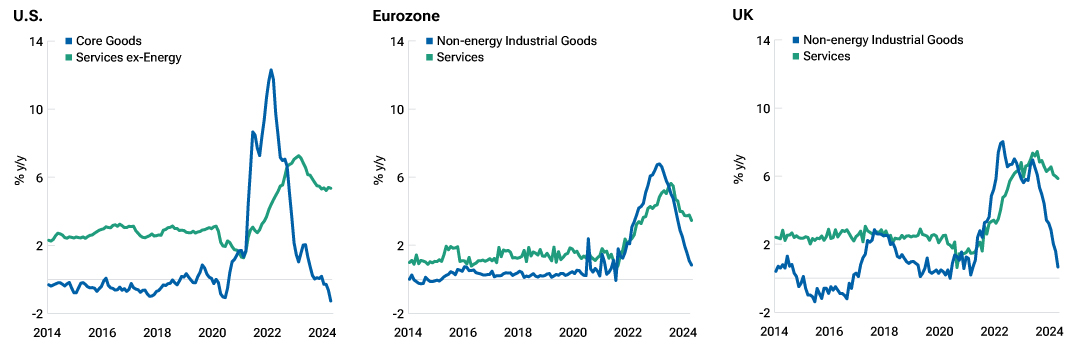

Developed market services inflation is proving sticky

(Fig. 4) Goods inflation is falling much faster

As of April 30, 2024.

y/y=year-over-year.

Source: U.S. Bureau of Labor Statistics, EU Statistical Office of European Communities, UK Office for National Statistics/Haver Analytics.

Several factors drive risk of reaccelerating inflation

The big decrease in global inflation from 2022 to 2023 was due to goods disinflation, which is the easy part of taming inflation. Now services inflation, which is sticky, needs to fall. But for this to happen, the labour market must have space to adjust—wage pressures drive services inflation, and higher unemployment is required to control wage pressures. Artificial intelligence (AI) is one countervailing force that could help tame services sector wage growth, but AI will take time (and expense) to implement, making it a longer‑term factor.

Fiscal spending in an election year will also put upward pressure on inflation, and energy prices—which have been a headline inflation tailwind since surging in 2022 following Russia’s invasion of Ukraine—are a wildcard that could easily spike again if conflict in the Middle East escalates or other geopolitical hot spots erupt.

These factors would, of course, make central banks’ difficult balancing act between supporting growth and restraining inflation that much harder.

Because we see renewed upward pressure on inflation, investors may benefit from exposure to real assets such as commodities—including gold and silver—and real estate or to inflation protected government bonds. Real assets tend to hold up well in inflationary environments, while inflation-protected government debt has principal and interest payments that adjust based on inflation data.

US Equities

U.S. stocks face a broadening, not a rotation

In recent years, the U.S. stock market has been dominated by the “Magnificent Seven” technology stocks, but there are signs this once‑monolithic group of large‑cap growth firms is beginning to fragment. The outperformance of the Magnificent Seven propelled the S&P 500 to new highs earlier this year and resulted in the index becoming concentrated to an unprecedented degree.

Performance within the group is now diverging, however— as of late May, NVIDIA, Meta, Microsoft, and Amazon have continued to outpace the market, while Apple, Alphabet, and Tesla have begun to lag. As the benefits of AI technology are unlikely to be evenly spread among the members of the Magnificent Seven, further dispersion within the group can be expected.

Fewer cuts should favour value stocks

Meanwhile, value stocks could be primed for a come back as investors seek to diversify their exposure beyond the Magnificent Seven, particularly given growing expectations that the higher rate environment will persist. If the Fed only makes a few cuts or does not cut at all, value companies should benefit as they have tended to be more rate-sensitive and have typically fared better in a world where interest rates remained higher for longer. And while value stocks have begun to perform better in recent months, they continue to trade at a significant discount to growth stocks. If conditions continue to favor value stocks—as we believe they will—the dominance ofgrowth stocks may start to fade.

Past performance is not a reliable indicator of future performance and is subject to change.

Value stocks look poised for earnings resurgence

(Fig. 5) Estimated earnings per share of value stocks set to outstrip growth stocks later this year

As of May 13, 2024.

Source: FTSE Russell (see Additional Disclosures).

Actual outcomes may differ materially from estimates.

Each time period shows the estimated year-over-year change in quarterly earnings for growth and value stocks for each quarter this year.

Small‑cap stocks are trading at a major discount to larger companies after struggling for several years against high inflation and a steep rise in borrowing costs. While the persistence of a higher rate environment could limit the upside of small‑cap stocks, the earnings of smaller firms should improve if rates come down.

A widening opportunity set

Although we believe that value—and possibly small‑cap—stocks may begin to challenge the dominance of large‑cap growth stocks, it is important to stress the difference between a broadening of the market’s opportunity set and arotation between market styles, sectors, or capitalisation. We are not predicting the imminent demise of the Magnificent Seven—rather, we anticipate a continued broadening of opportunities to include more companies and sectors across the market that may have lagged in recent years.

“...we anticipate a continued broadening of opportunities to include more companies and sectors across the market that may have lagged in recent years.”

Peter Bates, CFA, Portfolio Manager, Global Equities

International Equities

International stocks still appear to be good value

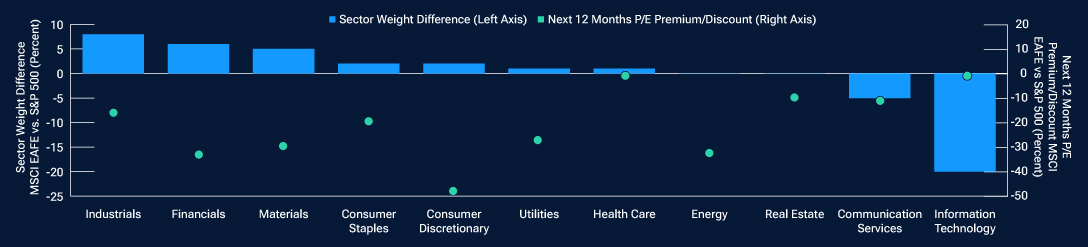

Fueled by the outperformance of growth technology stocks, U.S. equities reached all‑time highs earlier this year, pushing their premium versus international (i.e., non-U.S.) stocks to 20‑year wide levels. International stocks remain favourably valued but are fundamentally more attractive in the post-COVID environment, as demonstrated by improved earnings growth in recent years. This is because, in contrast to the U.S. market’s heavy exposure to growth stocks, the international market is more exposed to value‑oriented sectors such as financials, materials, industrials, and energy, where we see secular support in the years ahead. The S&P 500 Index, for example, has a very different sector composition from the MSCI EAFE Index.

Supply chain diversification, infrastructure rebuild, defense spending, and the likelihood of higher energy prices should favour traditional value sectors as capital spending accelerates. As these sectors arecurrently cheaper and, in some cases, have a lower earnings bar than their U.S. counterparts, investors seeking diversification from large‑cap tech growth stocks may seek to increase their exposure to select international markets.

The MSCI EAFE Index is not an ex-U.S. S&P 500 Index

(Fig. 6) Sector weightings and valuations contrast sharply between the two indices

As of April 30, 2024.

Source: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. Please see Additional Disclosures page for more information about this Standard & Poor’s information.

These statistics are not a projection of future results. Actual results may vary.

P/E= price-to-earnings.

Improving corporate governance is driving Japanese stock performance

Of the international markets, we continue to favour Japan. Improved corporate governance standards continue to have a tangible—and considerable—impact on company performance. Shareholders are now a much higher priority in Japan than they were in the past. While the BoJ recently ended its negative interest rate policy, it is not expected to embark on ahiking cycle that brings Japanese rates in line with those of other developed markets. This should keep the yen relatively weak and Japanese exports competitive. Valuations are reasonably attractive, too—although the Nikkei 225 has climbed to within reach of its record high, Japanese stocks continue to trade at a low price‑to‑book value. However, investors outside of Japan will need to consider how yen weakness relative to other currencies will impact the value of their returns.

South Korea and Vietnam the pick of emerging economies

South Korea has sought to emulate Japan’s success in boosting stock valuations with a corporate governance drive. Tax incentives have been offered to businesses that prioritise shareholder returns, while the new “Korea Value-up Index” will list firms that have improved capital efficiency. Vietnamese stocks also appear cheap despite a cyclical recovery, an expanding consumer economy, and a looming upgrade to emerging market status. With corporations seeking to diversify their supply chains beyond China, Vietnam appears well placed to attract manufacturing capacity.

Asset Allocation

Investors moving out of cash may favor equities and short duration bonds

A vast amount of money is hanging over U.S. financial markets in money market funds and other short‑term liquid instruments. Evidence from past economic cycles suggests that this strong liquidity preference will ease at some point, especially if the U.S. avoids a deep recession.

As concerns over a hard landing for the U.S. economy have receded, focus has shifted from recession risk to inflation risk. This will impact where investors seek to allocate their money. Historically, bonds—particularly longer-dated bonds—have been an excellent hedge against recession but a poor hedge against inflation. During rare periods when inflation has turned negative due to sharp economic downturns, bonds have outperformed stocks.

U.S. investors are flush with liquidity (Fig. 7)

Money market fund assets are highly elevated

As of April 1, 2024.

Source: Investment Company Institute.

“Evidence from past economic cycles suggests that this strong liquidity preference will ease at some point, especially if the U.S. avoids a deep recession..”

Tim Murray, CFA, Capital Markets Strategist, Multi‑Asset Division

Energy stocks may offer best hedge against inflation

Stocks have tended to perform best during periods of low, moderate, or even slightly elevated inflation. But they have typically dipped sharply during recessions and have also weakened when inflation has moved to very high levels. However, energy sector stocks have historically performed quite well during periods of very high inflation. These patterns suggest that one way to hedge against inflation risk would be to tilt portfolios to stocks, with an emphasis on the energy sector and other commodity‑oriented equities.

Investors are also likely to turn to shorter‑term bonds given attractive yield levels available and the potential for price appreciation if yields move lower. Short‑term bonds are highly valued during uncertain periods—such as the present—as theyare less exposed to interest rate changes than longer‑dated bonds. They also provide the potential for higher returns than cash while being almost as flexible. This flexibility may be useful given uncertain economic and market conditions.

Active Investing

Shifting market conditions will favour active management

The investment environment is changing. The post‑GFC era of low rates and abundant liquidity is being replaced by one of higher rates, greater divergence of returns, and more volatile markets. We believe this period of transition will continue in the second half of 2024 and underpin conditions for active managers to outperform.

Challenging market conditions will requireinvestors to be more valuation‑sensitive than in recent times, when a rising tide lifted all boats. Traditional skills, such as identifying stock drivers and idiosyncratic risk, will continue to be essential, but investors will need to take into account wider macroeconomic, social, and geopolitical factors along with company fundamentals.

Active managers have performed well following periods of index concentration

Active managers tend to go beyond benchmarks and into factors that can be cyclical, such as small-cap and value stocks—both of which we believe may perform well in the period ahead. Top performing active managers have also historically performed well following periods of heavy index concentration—and markets recently have been concentrated to an unprecedented degree.2 Although it is difficult to predict when the current period of index concentration will recede meaningfully, there are already signs that the dominance of the Magnificent Seven is beginning to fade.

The end of the period of very low rates will also, we believe, lead to greater dispersion and heightened volatility in bond markets. Active investing can help with duration management, as well as managing country selection, curve positioning, and security selection.

These developments do not mean we expect passive investing to undergo amajor retreat. However, we believe that active management will be the better option for the period ahead, as it can offer better outcomes during periods of greater volatility and dispersion.

1 The neutral rate neither stimulates nor restrains economic growth

2 Based on eVestment U.S. large-cap manager performance and S&P 500 Index concentration analyzed from September 30, 1989 to December 31, 2023. Past performance is not a reliable indicator of future performance. As of April 30, 2024, the S&P 500 Index and Russell 1000 Growth Index both registered their highest levels of concentration in 20 years, as measured by the combined weighting of the 10 largest stocks in each index.

More Global Market Outlook Midyear Update insights

How central bank policy could impact your portfolio

Reaccelerating inflation to make central banks walk tightrope

US stocks face a broadening, not a rotation

Sign up to receive our monthly Global Asset Allocation Viewpoints from our Investment Committee

Each month, our Investment Committee prepare a report revealing the two market themes they are watching, their bull and bear views per region and their latest asset class over and underweights.

It has been designed to aid you in your decision making and client conversations.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward-looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® areregistered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Thisproduct is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing insuch product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.