markets & economy | May 14, 2024

What factors are driving U.S. exceptionalism, and will they last?

U.S. economic growth has outperformed other developed markets, and inflation has been stickier.

Key Insights

U.S. economic growth has outperformed and inflation has been stickier than that of other developed markets recently, leading to divergent monetary policy expectations.

A slowdown in U.S. GDP and employment growth could lead to narrowing outperformance and congruent monetary policy paths.

However, a strong labor market in the U.S., as well as fiscal and industrial policy, support longer-term divergence.

Blerina Uruçi

Chief U.S. Economist

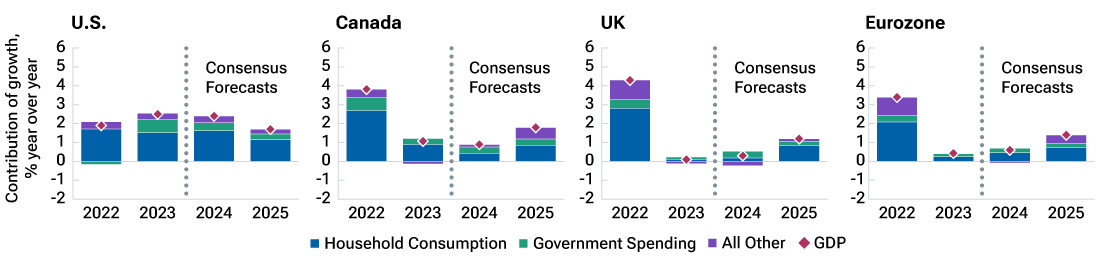

Economic growth in the U.S. has outperformed that of other developed markets recently. During 2023, U.S. gross domestic product (GDP) grew by 2.5%. At the same time, the Canadian economy expanded by less than half that pace, at 1.1%. The growth performance of the UK and euro area was even more lackluster by comparison.

Consumer and government spending support growth

The U.S. consumer has continued to drive growth, supported by a strong labor market. Job vacancies have remained high and labor turnover low as companies have held on to their workers after the extreme difficulties of hiring talent over the past two years. However, an underappreciated factor has been fiscal policy. Fiscal spending made up almost 30% of U.S. growth last year, with both federal- and state-level expenditures being quite punchy.

Consensus forecasts predict that the U.S. growth outperformance will continue over the medium term, driven by a similar cocktail of supportive private and government demand. The divergence with other economies is expected to moderate but remains notable, especially with respect to Europe.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Developed markets growth forecasts

(Fig. 1) U.S. growth forecasts exceed other developed markets

As of May 7, 2024.

As-of date reflects date of last update since Bloomberg consensus forecasts can change.

Stacked bars show contribution to GDP by each component.

Sources: Bureau of Economic Analysis (U.S.), Statistique Canada (Canada), Office of National Statistics (UK), Statistical Office of the European Communities (eurozone), Bloomberg Finance L.P. Analysis by T. Rowe Price.

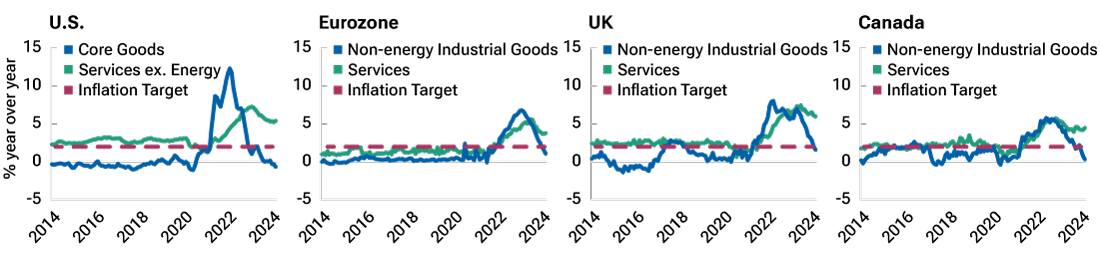

Annual inflation in developed markets

(Fig. 2) U.S. core services inflation has been sticky

As of May 7, 2024.

Sources: Bureau of Labor Statistics (U.S), Eurostat (eurozone), Office for National Statistics (UK), Statistique Canada (Canada).

Inflation target = 2%.

Inflation lingering for longer

A corollary of growth outperformance has been slower progress on taming inflation than in other economies. While both core goods and services inflation have come down significantly from their peaks, core services components in the U.S. have been stubbornly sticky. Strong consumer demand has allowed firms to continue to pass on higher input costs while protecting profit margins. In addition, the rising cost of living has, to some extent, driven workers to successfully negotiate higher wages (recent union wage gains are a prime example) or quit for better prospects elsewhere. The result is strong aggregate wage growth, although the cumulative rise in wages since the pandemic continues to lag the rise in consumer prices.

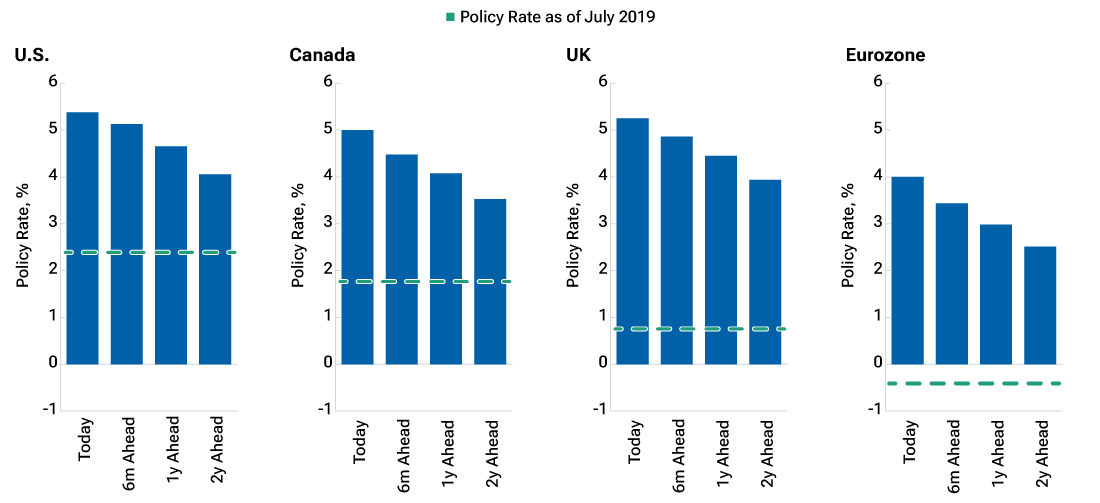

Annual inflation in developed markets

(Fig. 3) Developed markets rates expected to decline, remain elevated

As of May 7, 2024. Actual outcomes may differ materially from forward estimates.

Source: Bloomberg Finance L.P.

Differing monetary policy expectations…

Driven by the divergences in both the growth and inflation outlooks, markets have priced very different monetary policy paths in the U.S. than elsewhere. The U.S. Federal Reserve is not expected to cut interest rates until the fourth quarter 2024, and the weighted probability of various interest rate paths points to fewer than two cuts for 2024. By comparison, markets expect the European Central Bank to start easing policy in June, the Bank of Canada in July, and the Bank of England in August. While some of these divergences may be justified by very recent data, the current market narrative hangs on a very fragile equilibrium.

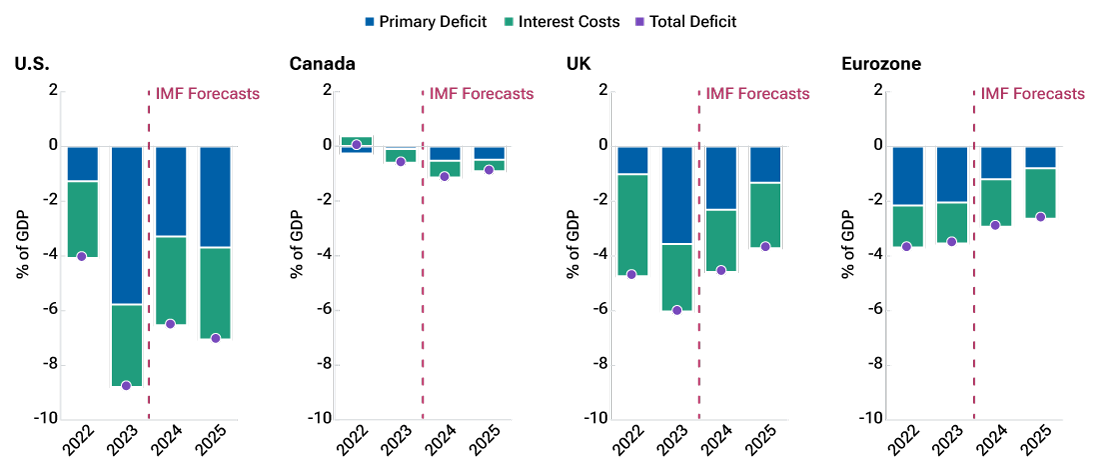

Developed markets fiscal deficits

(Fig. 4) Larger U.S. fiscal deficits could support higher rates

As of May 7, 2024. Actual outcomes may differ materially from forward estimates.

Source: IMF World Economic Outlook, April 2024.

…could change quickly

The recent slowing in U.S. GDP and employment growth suggests that the outperformance of the U.S. could taper off. It is also possible that U.S. data beyond employment growth may have been boosted by favorable seasonal elements in the first quarter—meaning that inflation may also moderate in the near term. This could quickly shift the market narrative toward a more dovish outcome for U.S. monetary policy, closing some of the market pricing divergence with other developed markets. It is also possible that the apparent stalling in U.S. inflation during the first quarter could play out in other economies later this year. The UK economy stands out as being a possible candidate of stickier services inflation given the tightness of the labor market in large part due to a lack of labor supply.

Markets may continue to price a shallower cutting path for the U.S., but there is a common factor across all four economies that is likely to persist. The predicted level of interest rates in two years’ time is significantly higher than the prevailing rates before the pandemic. Higher rates for longer has become the consensus, likely driven by a combination of resilient growth and stronger inflation in light of the sharp rise in interest rates since 2022. If this prediction is correct, central banks are less apt to be stuck at the zero lower bound in the next recession and could use balance sheet policy less enthusiastically.

Over the medium term, U.S. exceptionalism appears likely to persist.

Over the medium term, U.S. exceptionalism appears likely to persist.

- Blerina Uruçi, Chief U.S. Economist

Longer-term divergence could be here to stay

Over the medium term, U.S. exceptionalism appears likely to persist. Labor market dynamism driven by a recent rebound in the supply of prime wage workers will potentially be one factor. A positive labor supply side shock of this magnitude will likely pay dividends through stronger aggregate demand for both goods and services while alleviating some of the acute labor market bottlenecks that built up during the pandemic.

Another factor supporting the outlook for U.S. growth is the persistence of fiscal and industrial policy. The U.S. primary deficit as a share of GDP will be much larger according to International Monetary Fund (IMF) estimates. This combined with stronger investment growth and advancements in artificial intelligence (AI) could boost not only output, but also productivity, which has been disappointing in the U.S. for over a decade. While the market narrative in the near term may shift toward a less favorable tilt for the U.S. economy, over the medium term, U.S. growth appears set to be stronger than other developed markets for structural reasons, including strong labor supply and investment in tech manufacturing and green energy, as well as AI.

As a result, higher interest rates for longer are also likely to be not only appropriate, but also sustainable. A larger fiscal deficit may contribute to higher interest rates in the U.S. through increased term premia,1 as investors require greater compensation given heightened uncertainty around the outlook for future debt loads and inflation implied by large fiscal deficits.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been verified. Forecasts are based on subjective estimates about market environments that may never occur. Any forward‑looking statements speak only as of the date they are made. T. Rowe Price assumes no duty to, and does not undertake to, update forward‑looking statements.

1The risk premia that investors require to hold a long‑term bond to maturity.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

202405-3568456

Next Steps

Get strategies and tips for today’s market conditions.

Contact a Financial Consultant at 1-800-401-1819.