asset allocation | july 10, 2024

The inflation roller coaster

Diverging trends in goods and services prices complicate the inflation outlook.

6:41

Key Insights

Inflation is key for the Federal Reserve and interest rates, but the direction is not clear. Goods inflation has cooled, but services inflation remains sticky.

T. Rowe Price’s Asset Allocation Committee is maintaining overweight positions in assets that historically have benefited in periods of rising prices.

So far in 2024, the direction of inflation has been unclear. While reports for January through March brought unwelcome upside surprises, April and May results were more favorable. This has left many investors wondering what will come next for Fed policy and interest rates.

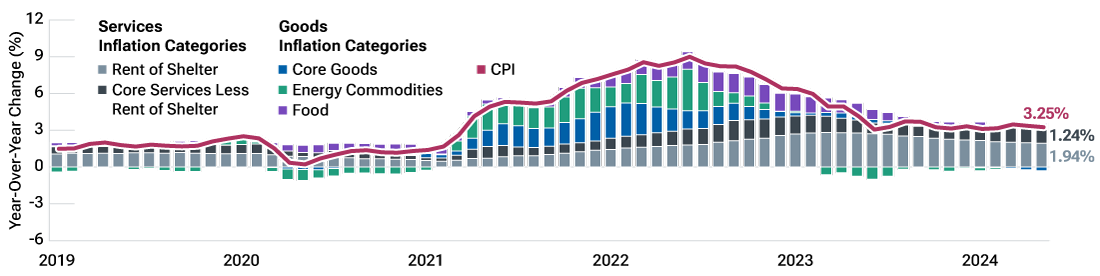

The initial surge in inflation following the COVID pandemic largely was driven by goods prices. In 2023, that dynamic shifted and goods inflation slowed sharply. Services inflation, on the other hand, remained stubbornly high and is now driving almost all of the rise in the U.S. consumer price index (Figure 1).

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

The transition from goods to services inflation

(Fig. 1) Contribution to the U.S. consumer price index (CPI)

January 2019 to May 2024

Source: U.S. Bureau of Labor Statistics/Haver Analytics.

Past results are not a reliable indicator of future results.

This pattern raises two big questions: When will services inflation ease? And will goods inflation remain benign?

When will services inflation ease?

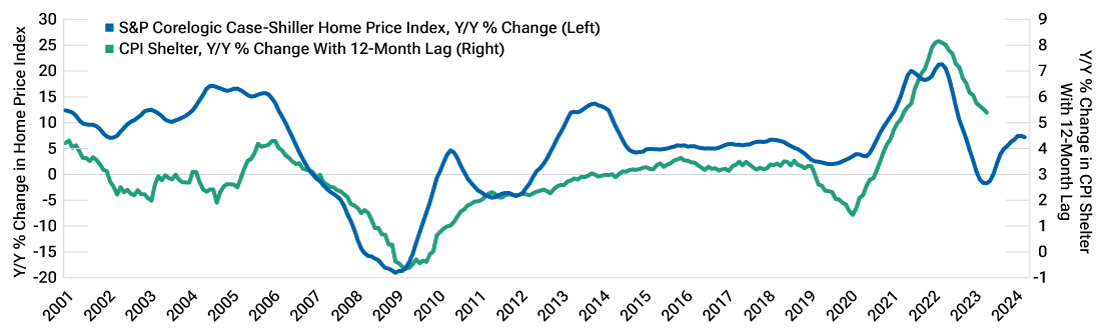

Services inflation also comes in two broad categories: shelter and non-shelter. Shelter inflation has tended to move in the same direction as home prices, but with a 12‑ to 18-month lag. While still high, shelter inflation has been trending lower for more than a year—in line with what home prices were doing one year ago (Figure 2). However, home prices bottomed in May 2023 and rose over the following 12 months. We think shelter inflation is likely to move higher over the coming 12 months.

Inflation in non-shelter services tends to track wage growth, which has been gradually slowing. We think it is reasonable to assume that downward trend will continue in the near to medium term. We expect non-shelter services inflation to trend downward as well.

With shelter pulling upward and non-shelter services potentially trending downward, we expect overall services inflation to move sideways until housing prices start to slow again.

Shelter inflation may be stubborn

(Fig. 2) Home prices vs. shelter component of U.S. CPI

January 2001 to May 2024

Sources: U.S. Bureau of Labor Statistics, S&P CoreLogic Case-Shiller Home Price Index / Haver Analytics.

Past results are not a reliable indicator of future results.

Will goods inflation remain benign?

Goods inflation can be affected by a wide variety of economic and geopolitical factors, making it hard to predict. Over the past year, goods prices have risen modestly. This may remain the case in the near term. Over the longer run, however, deglobalization, decarbonization, and artificial intelligence could boost demand for key commodities, resulting in persistently higher goods inflation.

Conclusion

Services inflation remains elevated and is unlikely to decline rapidly over the next year. Goods inflation has been benign but could resurface at any time. Given these risks, our Asset Allocation Committee currently holds overweight positions in asset classes that have tended to benefit in rising inflation environments.

Additional information

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

The S&P CoreLogic Case-Shiller Home Price Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price’s Products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P indexes.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of July 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any forward‑looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. As interest rates rise, bond prices generally fall. In periods of no or low inflation, other types of bonds may perform better than Treasury Inflation Protected Securities. Investments in certain industries that involve activities related to real assets may be more susceptible to adverse developments affecting those industries and may perform poorly during a downturn in any of those industries. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

202407-3685329

Next Steps

Get strategies and tips for today’s market conditions.

Contact a Financial Consultant at 1-800-401-1819.