personal finance | march 4, 2025

Mutual Funds vs. ETFs: Which is best for your investment strategy?

Understanding the differences between these two types of funds can help you decide which one may best align with your goals.

Key Insights

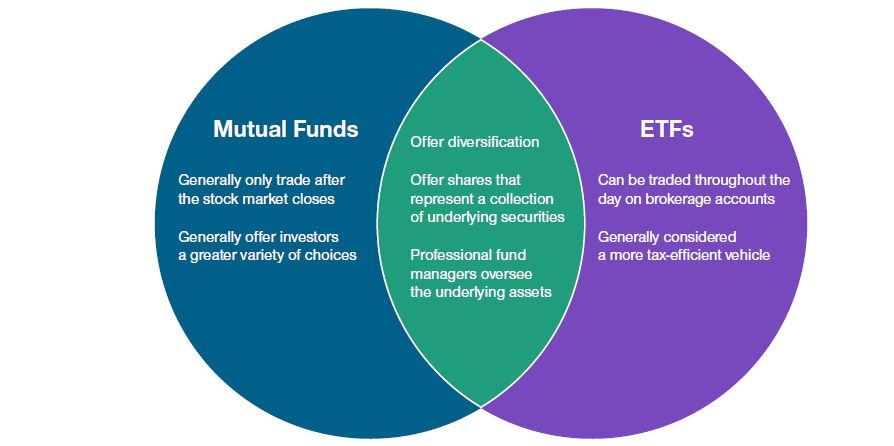

Mutual funds and exchange-traded funds (ETFs) both offer diversification and professional investment management.

ETFs can be traded throughout the day in brokerage accounts, while mutual funds only trade once per day at that day’s net asset value when the stock market closes.

ETFs are generally considered a more tax-efficient vehicle than mutual funds.

The right product for a given individual depends on their strategy and risk tolerance.

Mutual funds and exchange-traded funds (ETFs) have many similarities. Both offer exposure to professionally managed portfolios designed to support a variety of investment strategies.

There is a significant difference between the two in the way shares are bought and sold:

Mutual fund shares usually can only be bought at the end of the day’s net asset value (NAV) price. A customer can submit an order to buy or sell at any time of the day, but it will not be executed until the market closes later that day, or the following day if submitted after hours.

An ETF, on the other hand, trades like a stock and offers continuous pricing that makes it possible to buy and sell them throughout the day.

The distinction means that ETFs can sometimes offer greater flexibility and control to investors, as there is more transparency around price as well as the ability to execute immediately. The other key benefits of ETFs include tax efficiency, as they generate fewer taxable events than mutual funds, as well as lower costs.

Understanding how the characteristics of these two types of funds differ can help when you’re deciding which one best aligns with your investment objectives and preferences.

Why now is the right time to review your portfolio.

Market uncertainty, major life events, and the rising cost of living can impact your investment strategy.

Get a free portfolio review:

How are mutual funds and ETFs similar?

Investors have a wide variety of mutual funds and ETFs from which to choose. In general, however, the two types of investment vehicles share a set of underlying traits that offer relatively easy diversification; professional investment management; and explicit investment strategies, such as growth or value.

Both mutual funds and ETFs generally offer shares that represent a collection of underlying securities. For investors, both can provide an opportunity to increase diversification, which is an important part of any investment strategy. Investing in a portfolio that includes a variety of assets helps mitigate market risks related to a single company, geographic region, or industry.

Professional fund managers oversee the underlying assets in both mutual funds and ETFs. However, their level of involvement with daily changes to those underlying assets varies depending on the fund’s strategy.

Passive strategies typically strategies are designed to mirror index performance, such as the S&P 500 Index or the Dow Jones Industrial Average. These strategies require relatively little intervention from fund managers after construction. Passive funds simply adjust their holdings to match the stocks or bonds of the companies listed on the index. Because these strategies require less buying and selling of the underlying securities in the fund, they emphasize tax efficiency.

Active strategies typically seek to generate higher returns by finding opportunities to buy low and sell high as a direct result of the research and experience of the investment professionals managing them. These investments require a hands-on approach in which fund managers handpick investments with the intention of outperforming a benchmark index. They are required to do so within the confines of a specified investment strategy, such as long-term growth or medium-term income, and achieve that objective by uncovering opportunities within the market. ETFs offering active strategies have become more common in recent years. (See T. Rowe Price Investment Options.)

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

T. ROWE PRICE INVESTMENT OPTIONS

Investment solutions guided by our strategic investing approach.

At T. Rowe Price, we recognize that investors have different needs across a range of investment objectives and vehicles, so we offer choices in the way they access T. Rowe Price investments—whether they prefer mutual funds, ETFs, or a mix of both.

Whatever your investment objectives, T. Rowe Price offers a diverse selection of more than 400 mutual funds to meet your investment goals. In addition to stock, bond, money market, and index funds, we also offer target date and asset allocation funds constructed to suit a wide range of investment strategies.

ETFs are a way to access the expert portfolio managers and strategies behind T. Rowe Price funds. You can have the trading control and potential tax advantages of an ETF—including no investment minimums—as well as the same benefits you get with our respected lineup of active mutual funds:

T. Rowe Price Blue Chip Growth ETF (TCHP)*

T. Rowe Price Capital Appreciation Equity ETF (TCAF)

T. Rowe Price Dividend Growth ETF (TDVG)*

T. Rowe Price Equity Income ETF (TEQI)*

T. Rowe Price Floating Rate ETF (TFLR)

T. Rowe Price Growth ETF (TGRT)

T. Rowe Price Growth Stock ETF (TGRW)*

T. Rowe Price International Equity ETF (TOUS)

T. Rowe Price QM U.S. Bond ETF (TAGG)

T. Rowe Price Small-Mid Cap ETF (TMSL)

T. Rowe Price Total Return ETF (TOTR)

T. Rowe Price U.S. Equity Research ETF (TSPA)*

T. Rowe Price U.S. High Yield ETF (THYF)

T. Rowe Price Ultra Short-Term Bond ETF (TBUX)

T. Rowe Price Value ETF (TVAL)

Since 1937, we have focused on strategic investing, driven by independent thinking and rigorous research. Our investment professionals systematically share unique insights with one another that help us spot and manage risk while identifying long-term opportunities. Investors can expect direct access to our knowledge, experience, and insights through a variety of investment solutions—all designed with their needs in mind.

*This ETF is different from traditional ETFs.

Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment.

For example:

You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared with other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The ETF will publish on its website each day a “Proxy Portfolio” designed to help trading in shares of the ETF. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the ETF’s actual portfolio.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF secret, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF’s performance. If other traders are able to copy or predict the ETF’s investment strategy, however, this may hurt the ETF’s performance.

For additional information regarding the unique attributes and risks of the ETF, please see the Important Information section below.

What are the advantages of mutual funds?

Because mutual funds have been around significantly longer than ETFs, they generally offer investors a greater variety of choices. The first modern mutual funds were launched in 1924, whereas the first ETF was issued almost 70 years later, in 1993. As a result, more assets are invested in a larger number of mutual funds than ETFs. However, there are a growing number of opportunities to invest in ETFs across passive and active investment strategies. In 2023, mutual funds held over $25 trillion in net assets in the United States compared with more than $8 trillion for ETFs.1

The large number of mutual funds available may make it easier for some investors with specific strategic requirements to find a fund that closely matches their time horizon and risk profile.

Mutual funds are generally priced once a day, based on the net asset value of the assets they hold. At that time, investors can buy or sell shares.

What are the advantages of ETFs?

Unlike mutual funds, which trade only once a day, ETFs trade at stock market prices whenever exchanges are open, like individual stocks. This structure offers advantages to some investors.

As with stocks, the minimum investment in an ETF is typically a single share (though some brokerage firms also allow investors to buy fractional shares). As a result, investors have flexibility in terms of when they buy and sell shares and at what price they choose to do so.

Trading ETF shares through a brokerage may allow investors to use some of the advanced trading techniques related to stocks, such as limit orders, short selling, and margin trades.

ETF investors are generally free to sell shares whenever they want, incurring no short-term redemption fees associated with many mutual funds.

When an investor redeems shares of a mutual fund, the underlying investments are sold, which can create capital gain distributions for all remaining shareholders. In an ETF, the process is different as ETFs can leverage an in-kind redemption process. While both are subject to capital gains tax, this process generally makes ETFs more tax-efficient and gives investors better control over tax implications.

Is it better to invest in mutual funds or ETFs?

When it comes to choosing between a mutual fund and an ETF, ultimately the decision depends on an investor’s strategic goals. For example, the larger number of actively managed mutual funds available could make it easier to match a fund’s strategy to your specific needs than you could via any of the ETFs available on the market.

Where overlap exists, the differences between ETFs and mutual funds, such as costs, taxes, and availability, can tip the balance one way or another. For instance, actively managed mutual funds and ETFs may offer similar strategies with similar investment exposures. In those cases, comparing fund expenses and considering whether you might need access to the increased flexibility provided by an ETF may make the better choice clearer.

Similarities of and Differences Between Mutual Funds and ETFs

Mutual funds and ETFs are similar in many respects, with some important and notable differences.

Exploring the features, benefits, and trade-offs between mutual funds and exchange-traded funds.

| Mutual Funds | ETFs | |

|---|---|---|

| Professionally Managed | Combined assets and holdings professionally managed on behalf of all shareholders | Combined assets and holdings professionally managed on behalf of all shareholders |

| Minimum Investment | Relatively low minimum investment for some share classes | No minimums; can own as little as one share2 |

| Product Fees | Aside from management fees, expenses often include additional shareholder servicing costs; total expenses vary by share class | Expense ratios tend to have fewer layers of fees and no share classes; typically do not include shareholder servicing costs |

| Trading | Purchased and redeemed once per day at market close; short-term and/or excessive trading restrictions may apply | Trade at market prices whenever exchanges are open; no short-term and/or excessive trading restrictions |

| Tax Efficiency | Portfolio turnover may cause taxable gains in order to meet daily shareholder cash redemptions; capital gain distributions from manager transactions can also occur from manager activity within the portfolio | Shareholder activity generally has no role in capital gains because shares are typically created or redeemed through security delivery (rather than cash), but capital gains from manager transactions can still occur |

| Distributions and Reinvestment |

Distributions can be reinvested automatically on the fund’s ex-dividend date at NAV, including the purchase of partial/fractional shares | Distribution reinvestment and fractional share purchases generally require separate brokerage services bought at market prices (not NAV). Services are not always available and may not occur on the ex-dividend date of the underlying fund |

| Variety of Investment Strategies |

Wide variety of investment strategies with greater allowances for underlying holdings variability and breadth within portfolios | Wide variety of investment strategies but with more limitations on underlying holdings, which currently prevent some strategies from being offered as ETFs |

| How Do I Buy? | Can buy direct through a brokerage, a fund service, or a financial advisor/intermediary; also often available in retirement accounts like 401(k) plans | Bought on an exchange through a brokerage account, similar to stocks. Generally not used in 401(k)s unless an “in-plan” brokerage service is available |

2Brokerage fees may make this ineffective as an investment strategy.

Note: For educational purposes only; not intended as investment or tax advice. The table above is not a comprehensive list of investment vehicle features, benefits, or risks. Vehicle structures, portfolio strategies, investment objectives, and risks will vary. Consult your financial advisor or tax professional for more information.

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

12024 Investment Company Fact Book (PDF).

Diversification does not ensure a profit or protect against loss. Investments are subject to market risk, including possible loss of principal.

Important Information

Risks: All investments are subject to market risk, including the possible loss of principal. As with all equity investments, the share price can fall because of weakness in the broad market, a particular industry or specific holdings. Fixed income investing involves risks including, but not limited to, interest rate risk and credit risk. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Diversification cannot assure a profit or protect against loss in a declining market. Additional risks vary depending on the investment objectives and strategies. When applicable, please refer to a prospectus for more information.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

All T. Rowe Price ETFs: ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

T. Rowe Price Equity ETFs: T. Rowe Price active equity ETFs publish a daily Proxy Portfolio, a basket of securities designed to closely track the daily performance of the actual portfolio holdings. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the actual portfolio. Daily portfolio statistics will be provided as an indication of the similarities and differences between the Proxy Portfolio and the actual holdings. The Proxy Portfolio and other metrics, including Portfolio Overlap, are intended to provide investors and traders with enough information to encourage transactions that help keep the ETF’s market price close to its NAV. There is a risk that market prices will differ from the NAV. ETFs trading on the basis of a Proxy Portfolio may trade at a wider bid/ask spread than shares of ETFs that publish their portfolios on a daily basis, especially during periods of market disruption or volatility, and, therefore, may cost investors more to trade. The ETF’s daily Proxy Portfolio, Portfolio Overlap, and other tracking data are available at troweprice.com.

Although the ETF seeks to benefit from keeping its portfolio information confidential, others may attempt to use publicly available information to identify the ETF’s investment and trading strategy. If successful, these trading practices may have the potential to reduce the efficiency and performance of the ETF.

T. Rowe Price Investment Services, Inc., distributor, T. Rowe Price mutual funds and ETFs.

202406-3650462

Next Steps

Explore T. Rowe Price mutual funds and ETFs.

Contact a Financial Consultant at 1-800-401-1819.