equities | june 26, 2024

Investment implications of generative artificial intelligence

Reasons why investors should embrace AI as a long-term investment theme.

Key Insights

We believe there are compelling reasons why investors should embrace artificial intelligence (AI) as a long‑term investment theme.

We retain our positive view on the sector for 2024—not just for AI but also for the broader technology sector in general.

Many of the global tech stocks that we cover are experiencing accelerating organic earnings growth and operating margin expansion.

Rahul Ghosh

Portfolio Specialist, Global Equity

There are some compelling reasons, in our view, why investors should embrace artificial intelligence (AI) as a long‑term investment theme, even if some popular AI stocks may appear a little frothy in the short term.

2023: An exceptional year for global tech

Looking back, 12 months ago, our global equity managers held an optimistic view of global tech in 2023. We retain our positive view on the sector for 2024—not just for AI but also for the broader technology sector in general. Many of the global tech stocks that our analysts cover are experiencing accelerating organic earnings growth and operating margin expansion, which appears set to continue in 2024. AI has been and may continue to be cyclical, yet we believe that its S‑curve trajectory1 has likely been underestimated by the market.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Generative AI constitutes a huge breakthrough

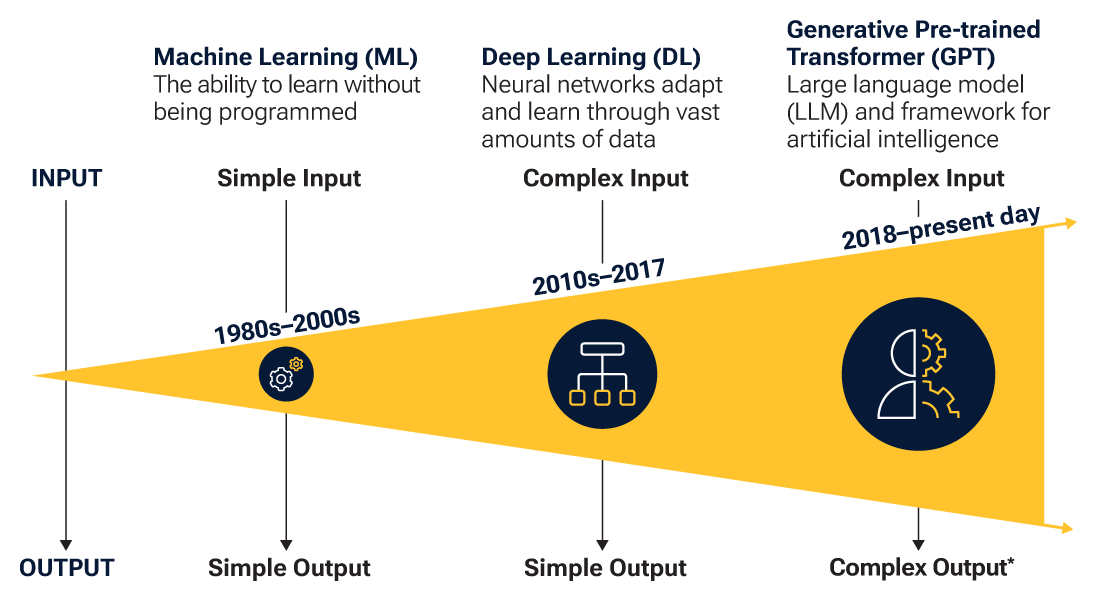

(Fig. 1) Rapid jump from machine learning to deep learning to ChatGPT

As of December 2023.

*Creative, New, Visual, Analytical, Goal‑Seeking.

Source: Analysis by T. Rowe Price. For illustrative purposes only.

Three key facts that define the AI boom

- Generative AI is not a bubble. It is a genuine breakthrough (as depicted in Figure 1), and a business upcycle due to AI is already underway.

- It is the maturity of past information technology (IT) innovation in terms of decentralized, superfast computing via the Cloud, powerful smartphones, etc., that has enabled the great leap forward in AI that we are currently witnessing.

- AI requires a robust combination of computing power, talented software and hardware engineers, vast troves of data, and hordes of new customers. In the IT sector, this has benefited existing mega‑scale internet platform companies. This means that AI, at least initially, is not a “disruptive” technology.

Source: T. Rowe Price.

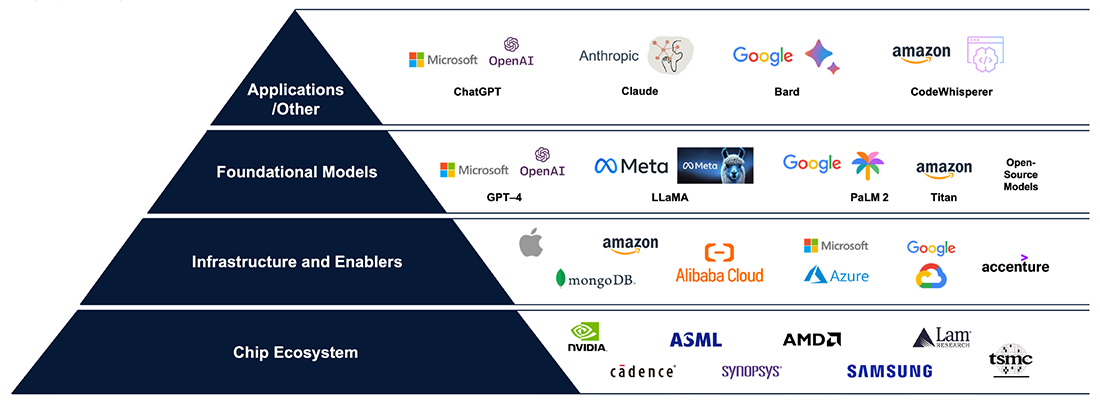

The AI pyramid

Generative AI is incredibly semiconductor intensive due to its immense parallel processing requirements. One of the best ways to visualize this is in Figure 2, which represents AI graphically as a pyramid with four different levels. Among the first that benefited, forming the base of the pyramid, are the companies involved in the chip ecosystem for advanced semiconductors and semiconductor capex, such as NVIDIA, TSMC, ASML, Lam Research, etc.

The second layer of the pyramid is composed of the AI infrastructure providers (Amazon, Apple, Alibaba Cloud, etc.) and AI enablers (IT services companies such as Accenture and Microsoft Azure). At the third pyramid level are the foundational large language models like Open AI’s GPT‑4 or Meta’s LLaMA. Finally, at the top of the pyramid are the customized AI applications.

While the adoption of AI is still in its early stages, it appears to be exceptionally rapid compared with previous IT booms such as PCs and smartphones, thanks in part to generative AI and large language models (LLMs), which have encouraged tech and non‑tech companies in many industries and sectors to experiment with early adoption, driven more by the recognition of potentially large efficiency gains than by FOMO (fear of missing out).

…AI S‑curve trajectory has likely been underestimated by the market.

…AI S‑curve trajectory has likely been underestimated by the market.

Visualizing AI as a pyramid

(Fig. 2) The layers of AI

As of December 2023.

The trademarks shown are the property of their respective owners. Use does not imply endorsement, sponsorship, or affiliation of T. Rowe Price with any of the trademark owners.

The specific securities identified and described are for informational purposes only and do not represent recommendations to buy or sell any security.

This is provided for illustrative purposes only and does not represent the performance of any security nor is any indication being provided as to whether an investment in a specific security was or will be profitable.

Global tech opportunities in 2024

Globally, the outlook for technology in 2024 appears quite robust, with continued growth expected in generative AI and a cyclical rebound in the broader‑based semiconductor market, including PCs, smartphones, etc. Of course, this favorable view of tech has to be balanced against broader macro risks and concerns, such as a potential slowing in U.S. consumer demand, the slow Chinese economic recovery, and escalating geopolitical uncertainties in the Middle East, Ukraine, and other regions.

We think it is likely, however, that the AI boom has enough momentum to continue in 2024, outweighing broader macroeconomic worries, many of which are not new but were also present throughout 2023. We continue to see many interesting areas of opportunity for global technology in 2024, including the following:

Semiconductors overall could continue to be a source of strength. The demand for semiconductors is likely to stay strong, driven by potentially accelerating AI demand, as exemplified by AMD’s latest assessment of the global accelerator chip market being worth USD 400 billion by 2027. The company increased its market growth outlook from a 50% compound annual growth rate (CAGR) to a 70% CAGR from 2023 to 2027.2 We could also see a bottoming in other areas, such as industrial semiconductors by the second half of 2024.

Cloud computing and enterprise software are expected to continue to grow due to the increasing demand for flexible and scalable IT solutions. AI development is poised to give a further boost to this, so we think the outlook for data center spending is likely to stay strong. In particular, companies need to get their data “ready” for AI. This could mean more companies investing in middle‑office and back‑office software such as Workday, SAP, and ServiceNow.

Areas of Fintech could also be strong. E‑commerce has continued to accelerate post the pandemic reflation, and fintech companies are being more disciplined in their operating expenditure.

Rapidly growing global AI markets

(Fig. 3) Global AI chip and software markets in USD billion

e = estimates.

2023 and 2027 estimates for the AI Chip Total Addressable Market are industry forecasts taken from the first study mentioned in the sources below.

There is no guarantee that any forecasts (AMD forecast, December 2023.) made will come to pass and actual outcomes may differ materially from the estimates shown.

1AI compute = the computational resources required for artificial intelligence systems to perform tasks, such as processing data, training machine learning models, and making predictions.

Sources: AI Chip Market—AMD; Worldwide Semiannual Artificial Intelligence Tracker, 2H21.

Balancing risks and opportunities

With such powerful dynamics, we are cognizant of the risks of a potential bubble forming, resulting in excessive valuations for popular AI stocks. As asset managers, we believe it is our job to navigate the rapidly changing AI environment responsibly, as some AI stocks may turn out to have been “too hot” in hindsight.

We have to balance the opportunities against potential risks, which currently we see being linked more to broader macro concerns than to subsector‑specific issues within the technology space.

On the economic front, while the Fed seems to be managing a decent glide path in the U.S., there remains the risk of a slowdown, which—combined with the current weakness in the Chinese economy—could dampen global demand for technology products and services.

On geopolitics, while there has been some recent easing in U.S.‑China tensions, we have to be alive to the possibility of it flaring up again, with potential impacts on demand as well as the IT supply chain.

Finally, regulatory risk also remains a challenge for the industry. As governments try to adapt to the increased adoption of AI—and the broader availability of data—the risk to AI remains of increased government regulations around data privacy, antitrust issues, and national security concerns, as well as potential increases in compliance burdens and costs for technology companies.

Concluding thoughts

We continue to believe the AI story is bigger than many investors realize and could lead to exponentially greater returns and capital expenditures than the market is anticipating. This trend should, however, be navigated responsibly while also monitoring the wider technology landscape. Finding companies that sell linchpin (or indispensable) technology, innovating in secular growth markets, with improving fundamentals and reasonable valuations could be favorable.

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Technology stocks entail specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments.

1The adoption of a new technology is often held to follow an “S‑curve, proceeding slowly at first, followed by a phase of rapid growth that later tails off into slower growth as adoption of the new technology becomes widespread.

2Estimates are subject to change and actual outcomes may differ materially from estimates.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual outcomes may differ materially from any forward-looking statements made.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

202403‑3446896

Next Steps

Get strategies and tips for today’s market conditions.

Contact a Financial Consultant at 1-800-401-1819.