August 2024 / MULTI-ASSET

How do U.S. elections affect stock market performance?

It’s the economy that matters for U.S. presidential elections and stocks.

Key Insights

- The health of the U.S. economy appears to have played an important role in whether the incumbent party retained the presidency in an election year.

- In turn, whether the incumbent party won the White House seemed to influence trends in market volatility before and after past elections.

- We believe that investment decisions should be based on longer‑term fundamentals, not near‑term political outcomes.

The U.S. presidential election cycle is ramping up. So is media coverage and a barrage of political advertising.

The contest—and its implications—looms large in the minds of investors both in the U.S. and abroad.

Let’s explore the historical relationship between U.S. presidential elections and the performance of the broader U.S. equity market.

Correlations exist in varying degrees, but clients should focus on what ultimately matters over the longer term: the economy and business fundamentals.

Know the data’s limits

The market performance data used in this study go all the way back to 1927. However, only 24 presidential elections have occurred over this period, so it’s difficult to draw statistically significant conclusions about how those elections impacted stock market returns.

Moreover, we would caution against focusing on a single variable that ignores the many other factors that historically have driven market returns.

Some of the elections in our sample occurred in years when major economic developments—not the elections themselves—had an outsized influence on equity markets.

Examples include the Great Depression (1932), World War II (1940 and 1944), the bursting of the technology bubble (2000), the global financial crisis (2008), and the COVID‑19 pandemic (2020).

Has the timing of U.S. presidential elections mattered for stock market returns?

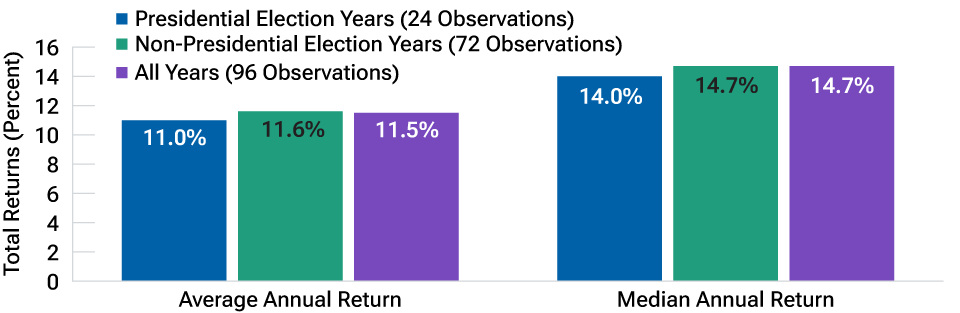

Average and median total returns for the S&P 500 Index were modestly lower in presidential election years compared with both non‑election years and with the long‑term average for the past 96 years of market performance (Figure 1).

S&P 500 has posted lower total returns in presidential election years

(Fig. 1) Average and median calendar year returns

December 31, 1927, to December 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

Total returns include gross dividends. We use average and median average annual returns to see if an outlier data point might be skewing the results. Conclusions are stronger when the average and median returns are either both positive or both negative.

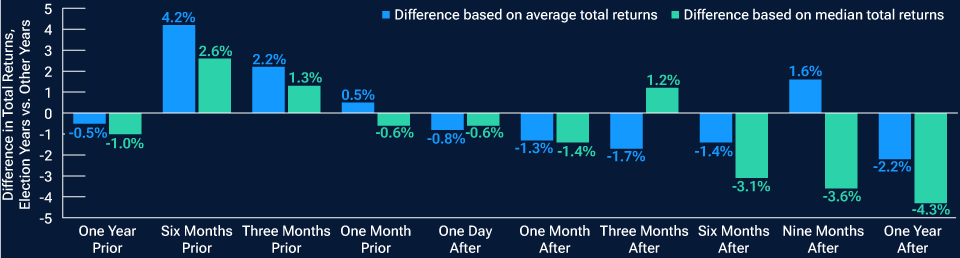

What happens when we examine average and median total returns for the S&P 500 over various time frames during and around U.S. presidential election years? How do they stack up to comparable periods for other years?

- Figure 2 shows that S&P 500 returns were generally higher in the runup to a presidential election than in non‑election years.

- After election day, however, stock market returns over the 1-, 6-, and 12‑month periods were meaningfully lower than in corresponding periods for years without a presidential election.

Higher S&P 500 returns before elections vs. other years, lower returns after

(Fig. 2) Difference in average and median total returns

December 31, 1927, to December 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

Total returns include gross dividends and are cumulative for the specified period before and after the election. We used the first Tuesday of November (election day in the U.S.) as the cutoff date in all other years to account for seasonality. The one‑year return prior to the 1928 election was excluded from the sample because of a lack of available data.

Do newly elected presidents have much influence on stock market returns? Perhaps the market took their campaign promises for granted and was disappointed by what ultimately came to pass in the 12 months following the election.

Expanding the scope of analysis beyond elections and historical stock market performance suggests another possible explanation for relatively poor stock market performance.

When it comes to the health of economy, presidents have been unlucky during their first year in office:

- More than half (54%) of the 12‑month periods following the 24 presidential elections in our study overlapped an official U.S. recession, as identified by the National Bureau of Economic Research (NBER).

- This rate of recession occurrence was meaningfully higher than the averages for the other years of a president’s term: 29% for the second year in office, 17% in the third year, and 25% in the election year.

In other words, the stock market may have anticipated or responded to weaker economic conditions near the end of a presidential election year, given the higher likelihood of a recession in the following 12 months.

Presidential elections and market volatility

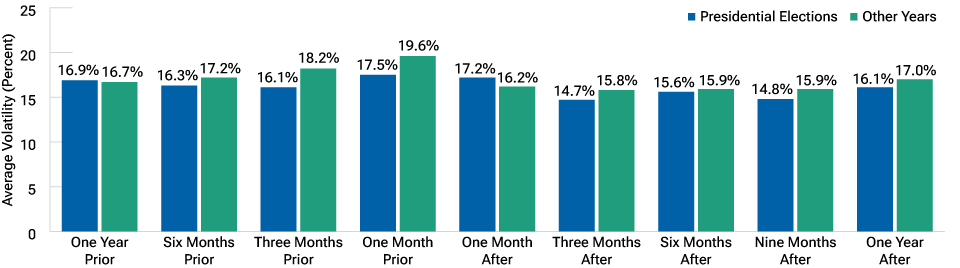

Except for the 12 months before and the month immediately following the vote, the S&P 500 experienced less volatility, on average, in and around election years compared with similar periods in non‑election years (Figure 3).

These historical volatility trends may come as a bit of a surprise given the higher occurrence of recession in the years following elections.

We’d also highlight that the historical data in Figure 3 suggest that the market has experienced similar seasonal affects in both presidential election years and other years.

Average S&P 500 volatility around presidential elections and other years

(Fig. 3) Periods before and after election day

December 31, 1927, to December 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

We used the first Tuesday of November (election day in the U.S.) as the cutoff date in all other years to account for seasonality. Volatility for the one year prior to the 1928 election was excluded from the sample because of lack of available data. Volatility is the standard deviation in daily S&P 500 returns for the specified period. Standard deviation measures the amount of variation or dispersion in a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set; a high standard deviation indicates that the values are spread out over a wider range.

In both election and non‑election years, volatility was generally higher in the lead‑up to the first Tuesday in November (the date of U.S. presidential elections) than in the corresponding periods after the vote.

And in presidential election years, the average level of market volatility was at its highest in the one month and three months prior to voting day.

The economy has mattered for presidential election results

The incumbent party was victorious in 13 of the 24 presidential elections in our study. A closer look at this admittedly small sample suggests that the health of the economy played a critical role in whether the party in the White House was able to renew its mandate:

- Only once did the incumbent party win when the election took place in a recession year. That happened in 1948, when the recession started in November.

- In more than 70% of election losses for the incumbent party, the economy had been in a recession that year or slipped into one during the following 12 months.1

If the incumbent party’s history of losses in U.S. presidential elections is any guide, the voting public has been well attuned to economic weakness.

What has it meant for stocks when the incumbent party won or lost?

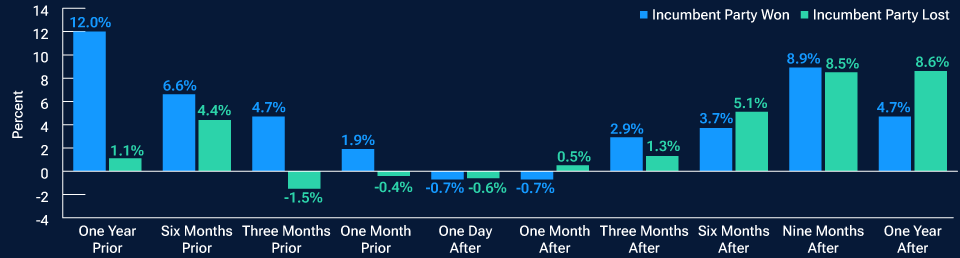

A trend emerges when we look at the average S&P 500 returns over various time frames before and after past presidential elections (Figure 4).

The stock market tended to be softer in the runup to presidential elections that the incumbent party lost, potentially reflecting the higher incidence of recessions in those periods. However, equity market performance in post‑election periods was mixed.

S&P 500 returns were softer before incumbent party losses

(Fig. 4) Average total returns before and after election day, 1928–2020

December 31, 1927, to November 3, 2021.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

Total returns include gross dividends and are cumulative for the specified period before and after the election. The one‑year return prior to the 1928 election was excluded from the sample because of a lack of available data.

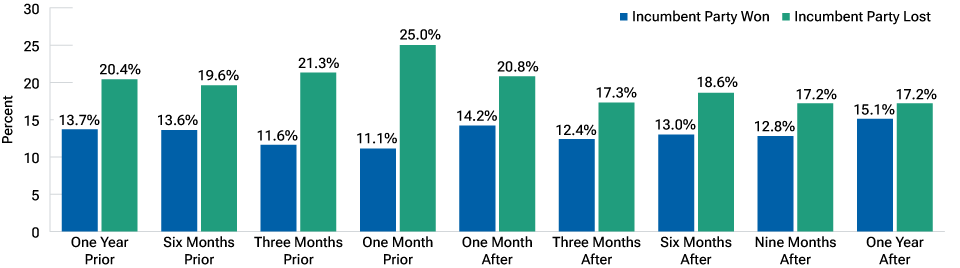

When the incumbent party failed to remain in the White House, the S&P 500, on average, experienced higher levels of volatility before the election and in subsequent months (Figure 5), perhaps reflecting the uncertainty created by likely policy changes. In these instances, the month prior to the vote exhibited the highest volatility.

Two other trends stand out:

- When the incumbent party retained the presidency, volatility declined, on average, before the election and ticked up modestly afterward.

- In presidential elections where the incumbent party lost, volatility increased significantly in the periods before the vote and then receded afterward.

Average S&P 500 volatility around U.S. presidential elections

(Fig. 5) Average total returns before and after election day, 1928–2020

December 31, 1927, to November 3, 2021.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

Volatility for the one year prior to the 1928 election was excluded from the sample because of lack of available data. Volatility is the standard deviation in daily S&P 500 returns for the specified period. Standard deviation measures the amount of variation or dispersion in a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set; a high standard deviation indicates that the values are spread out over a wider range.

Focus on the economy and fundamentals

Narratives highlighting correlations between the results of U.S. presidential elections and stock market performance often circulate in the runup to voting day.

Our quantitative analysis of historical data suggests that relationships do exist.

For example, average returns for the S&P 500 have been modestly lower in presidential election years relative to other years. Market volatility was also lower, on average, in many of the periods in and around past presidential elections. Whether the incumbent party retains the presidency also appears to have influenced trends in market volatility.

Economic conditions also seem to play an important role in whether the incumbent party remains in the White House or the challenger wins the presidency.

Still, past performance does not guarantee future results. We believe that investment decisions should be based on longer‑term fundamentals, not near‑term political outcomes. Trying to time the market based on short‑term dynamics, political or otherwise, is extraordinarily difficult.

Policy matters

In terms of the economy and industry‑level business fundamentals, government policy will matter to an extent, as will the makeup of Congress after the November elections.

When one party controls the White House and has majorities in the Senate and House of Representatives, the potential to pass meaningful legislative changes is greater. Divided government, on the other hand, usually makes it harder to push through sweeping changes.

This U.S. election season, as in the past, T. Rowe Price analysts will publish a steady stream of content exploring key policy issues for the U.S. and global economies, the financial markets, and specific industries. Stay tuned.

Additional Disclosure

The S&P 500 is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

August 2024 / MARKETS & ECONOMY