2024 Global Market Outlook Midyear Update

Investors moving out of cash may favour equities and short duration bonds

Asset Allocation

A vast amount of money is hanging over U.S. financial markets in money market funds and other short‑term liquid instruments. Evidence from past economic cycles suggests that this strong liquidity preference will ease at some point, especially if the U.S. avoids a deep recession.

As concerns over a hard landing for the U.S. economy have receded, focus has shifted from recession risk to inflation risk. This will impact where investors seek to allocate their money. Historically, bonds—particularly longer-dated bonds—have been an excellent hedge against recession but a poor hedge against inflation. During rare periods when inflation has turned negative due to sharp economic downturns, bonds have outperformed stocks.

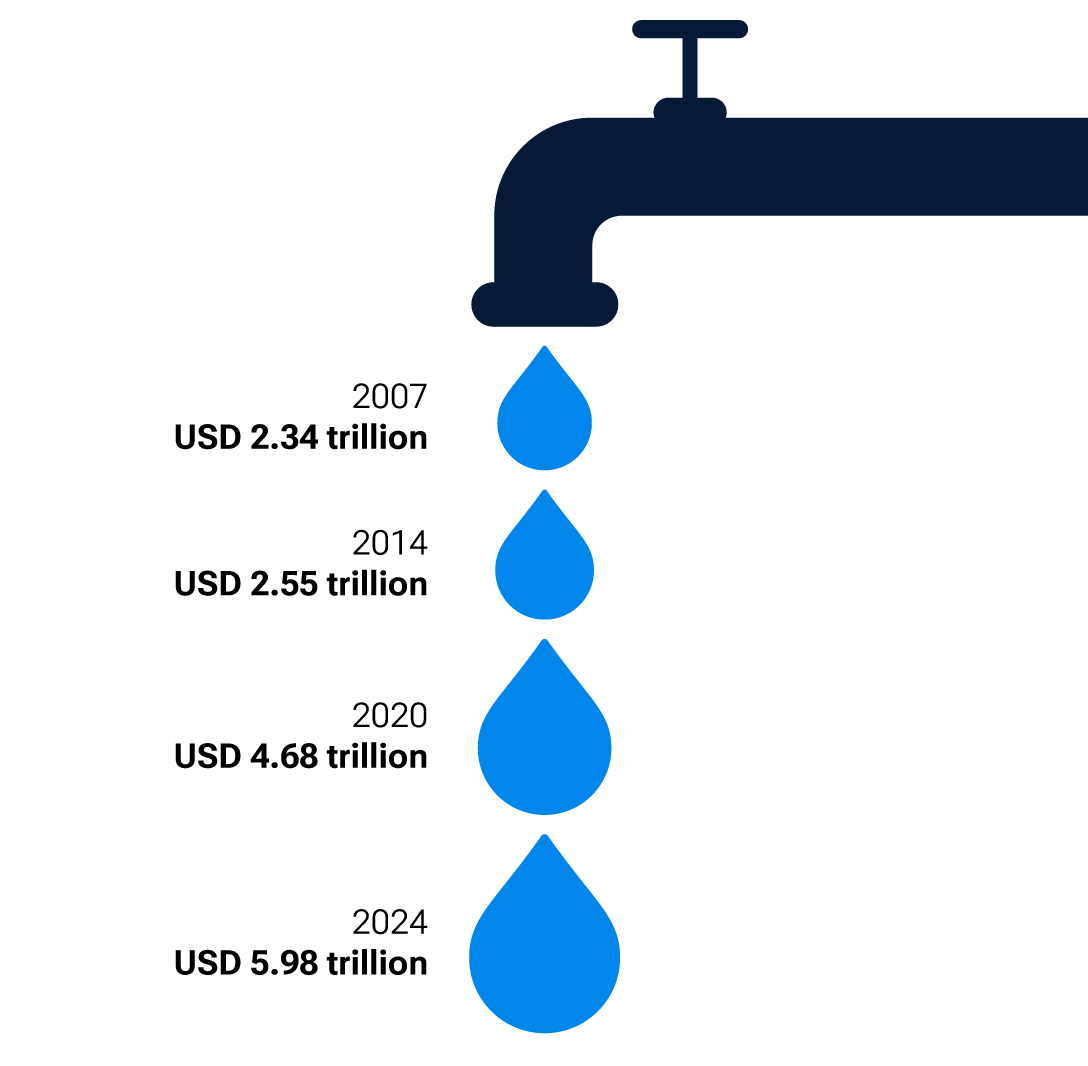

U.S. investors are flush with liquidity

Money market fund assets are highly elevated

As of April 1, 2024.

Source: Investment Company Institute.

“Evidence from past economic cycles suggests that this strong liquidity preference will ease at some point, especially if the U.S. avoids a deep recession..”

Tim Murray, CFA, Capital Markets Strategist,Multi‑Asset Division

Energy stocks may offer best hedge against inflation

Stocks have tended to perform best during periods of low, moderate, or even slightly elevated inflation. But they have typically dipped sharply during recessions and have also weakened when inflation has moved to very high levels. However, energy sector stocks have historically performed quite well during periods of very high inflation. These patterns suggest that one way to hedge against inflation risk would be to tilt portfolios to stocks, with an emphasis on the energy sector and other commodity‑oriented equities.

Investors are also likely to turn to shorter‑term bonds given attractive yield levels available and the potential for price appreciation if yields move lower. Short‑term bonds are highly valued during uncertain periods—such as the present—as they are less exposed to interest rate changes than longer‑dated bonds. They also provide the potential for higher returns than cash while being almost as flexible. This flexibility may be useful given uncertain economic and market conditions.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differmaterially from those anticipated in estimates and forward-looking statements, and future results could differ materially from any historical performance. The information presented herein isshown for illustrative, informational purposes only. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have notbeen independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements.Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024.All rights in the FTSE Russell indexes or data vest in the relevant LSE Group companywhich owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained inthis communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor orendorse the content of this communication.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® areregistered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Thisproduct is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing insuch product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respectto any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, orproduced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended toconstitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Global Market Outlook Midyear Update insights

How central bank policy could impact your portfolio

Shifting market conditions will favour active management

Expectations of central bank policy have shifted since the beginning of the year. What factors will shape the path of rate cuts in the second half of 2024?

Sign up to receive our monthly Global Asset Allocation Viewpoints from our Investment Committee

Each month, our Investment Committee prepare a report revealing the two market themes they are watching, their bull and bear views per region and their latest asset class over and underweights.

It has been designed to aid you in your decision making and client conversations.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward-looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® areregistered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Thisproduct is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing insuch product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.