July 2024 / INVESTMENT INSIGHTS

The future of portfolio construction: Building effective multi-asset portfolios

The traditional equity and fixed income ‘balanced’ portfolio needs modernisation, in our view

Key Insights

- After a number of years of strong growth, 2022 and 2023 saw net outflows from UK retail mixed asset strategies, reflecting disappointment in overall returns.

- The traditional equity and fixed income ‘balanced’ portfolio has not evolved to reflect today’s investment environment, in our view, and so needs modernisation.

- We set out five key recommendations for constructing multi‑asset portfolios for UK investors that reflect today’s modern investment landscape.

After a number of years of strong growth, both 2022 and 2023 saw retail investors withdraw more money from mixed asset strategies than they invested, according to the Investment Association.1 We believe this reflects investor disappointment with the pattern of returns over recent years for multi‑asset strategies popular in the UK. Many such offerings are biased towards UK assets, have delivered insufficient diversification in periods of market turbulence and have not evolved to reflect the new market environment since the coronavirus pandemic ended the ‘Great Moderation’ of the 2010s. We believe that the traditional equity and fixed income ‘balanced’ portfolio needs modernisation across both of these elements.

In this paper, we set out five key recommendations for constructing multi‑asset portfolios for UK investors that are fit for modern times:

- Improve diversification within global equity markets.

- Invest in global bonds to increase resilience.

- Include safe havens to protect against market uncertainty.

- Align overall portfolio risk with your return requirements.

- Consider new techniques to smooth market volatility.

We believe portfolios built with these principles in mind are designed to increase the likelihood of succeeding in a variety of market environments.

Investing across equities globally to increase diversification

Equity exposure is the strategic cornerstone, and the largest risk exposure, within most multi‑asset portfolios. Unfortunately, we believe many investors are forgoing the benefits of diversification within this vital component by over‑allocating to companies based in the UK. Historically, investors have tended to be biased towards stocks in their own country for reasons of familiarity and ease of implementation. However, it is now just as easy to get exposure to major markets all over the globe.

Focusing a major part of the portfolio’s equity allocation on the UK means constraining it to an increasingly small opportunity set in global terms. UK stocks now make up less than 3.5% of the MSCI All Country World Index (MSCI ACWI), a widely used global equity benchmark. Twenty years ago, UK stocks made up more than 10% of the MSCI ACWI. Back then, the UK provided four of the largest 20 companies in the MSCI ACWI; now, the largest UK company is AstraZeneca, coming in at number 38.2

Concentrating a portfolio in the UK increasingly leaves investors at risk of missing out on some of the key drivers of technological change, which has played a major role in propelling markets higher in recent years.

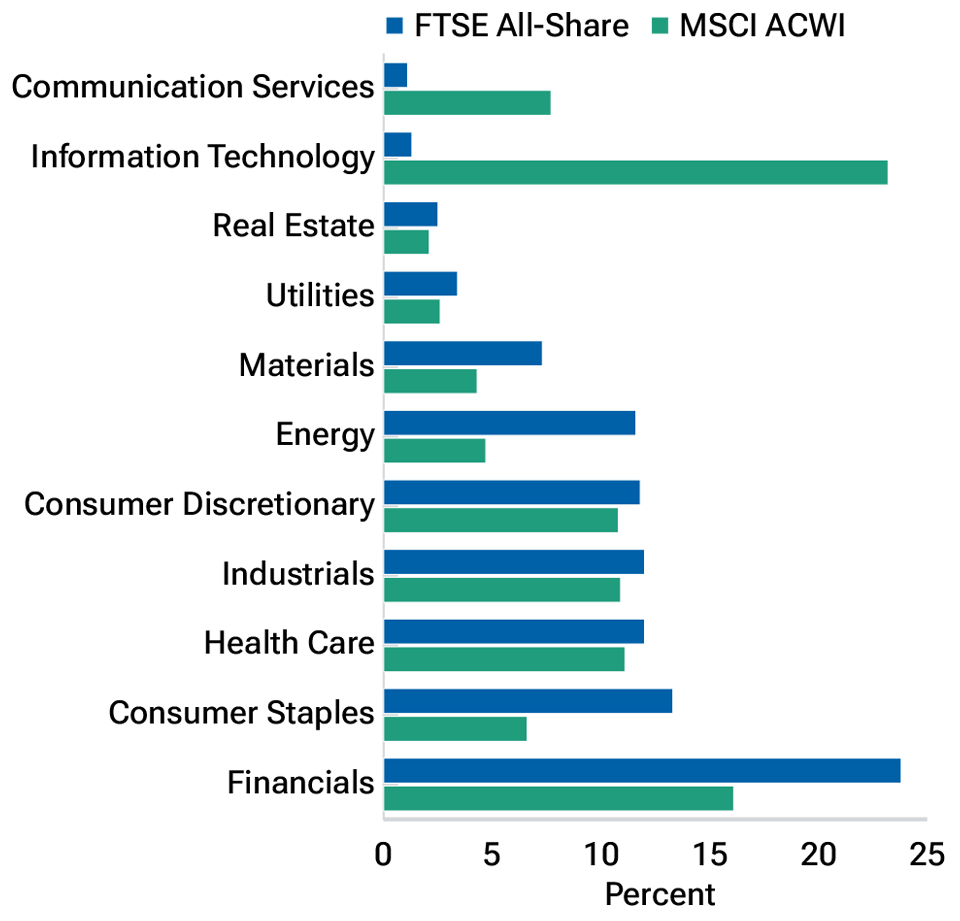

Figure 1 shows the sector mix for the FTSE All-Share Index versus the MSCI ACWI. Sectors such as information technology, communication services and consumer discretionary are much less evident in the UK than globally. The UK has not fully participated in the technological revolution of the last two decades. In contrast, the UK market is more focused on ‘old economy’ stalwarts in areas such as financials, consumer staples and energy.

A concentrated UK equity exposure is potentially limiting

(Fig. 1) Sector weights FTSE All-Share versus MSCI ACWI

As of 30 April 2024.

Indexes: FTSE All-Share Index, MSCI ACWI.

Sources: FTSE/Russell and MSCI (see Additional Disclosures). Analysis by T. Rowe Price.

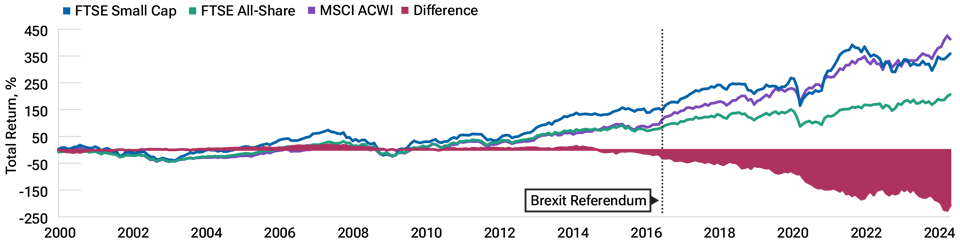

As Figure 2 shows, this focus has seen the UK market lag noticeably in recent years, in particular since the Brexit referendum in 2016.

The UK equity market has lagged global peers

(Fig. 2) UK and global equity total returns

Past performance is not a reliable indicator of future performance.

As of 30 April 2024. For the period January 2000 through April 2024.

Indexes: FTSE Small Cap Index, FTSE All‑Share Index, MSCI ACWI. Difference is FTSE All‑Share Index less MSCI ACWI.

Sources: FTSE/Russell and MSCI (see Additional Disclosures). Analysis by T. Rowe Price.

Investing across global bond markets to increase resilience

After the rise in yields seen since the lows of 2021, we believe government bonds are more attractive in fulfilling their traditional role of diversifiers than they have been for many years. If market sentiment turns negative, particularly if there is a flight to quality because of a sudden economic or geopolitical shock, the ‘return of capital’ appeal of US Treasuries, German bunds or Japanese government bonds is likely to reassert itself. More broadly, tapping the global government bond market, while systematically hedging overseas currency exposure, offers diversification and a wider investment opportunity set while limiting the impact of a shock in any one market on the portfolio.

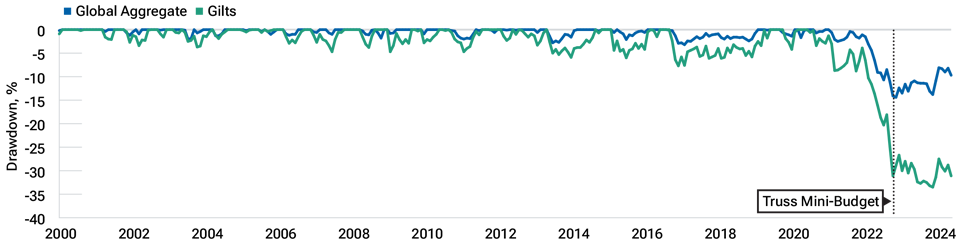

Unfortunately for UK investors, the mini‑budget of October 2022 is the perfect example of just such a country‑specific shock. To illustrate the point, Figure 3 shows the largest peak‑to‑trough fall in value in portfolios of investment‑grade global bonds and UK gilts this century.

Building resilience through a broad global bond exposure

(Fig. 3) UK gilts and global bonds drawdown

Past performance is not a reliable indicator of future performance.

As of 30 April 2024.

Indexes: Bloomberg Sterling Gilt Index (Gilts), Bloomberg Global Aggregate Index hedged to GBP (Global Aggregate).

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

While 2022 was a difficult year for major government bond markets, the losses endured by investors in gilts were much larger in scale. This reflected the sudden collapse in market confidence in the revenue and spending plans of the government of then‑Prime Minister Liz Truss. As government debt levels remain elevated and economic growth is forecast to lag the long‑term trend, we believe a broader range of exposures is better placed to act as an ‘anchor’ for multi‑asset portfolios.

Including a range of safe havens to protect the portfolio in periods of market uncertainty

Market risk, particularly in fixed income, has increased in the period since the coronavirus pandemic. Given the removal of monetary policy support in most major economies, we believe this is likely to be a structural change. In the decade following the global financial crisis (GFC), central banks have flooded the system with liquidity, soothing investors and mitigating volatility. They are now focused on their traditional role of fighting inflation, and monetary policy is now more unpredictable as a result. This increases the importance of safe‑haven assets in portfolios. However, 2022 was a reminder that high‑quality government bonds, although useful in many periods of market uncertainty, are not a panacea in all situations.

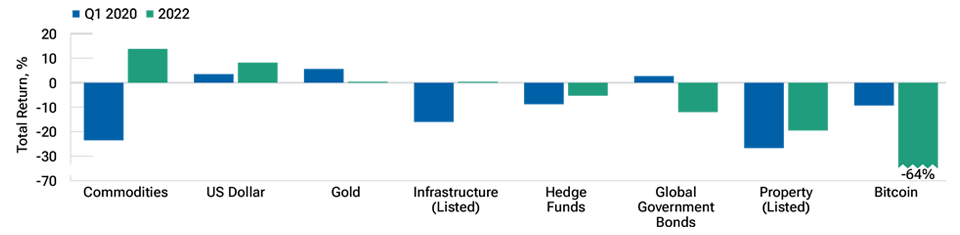

2022 also forced a rethink of what diversification and risk management means in a more uncertain environment; quite simply, there was almost nowhere for investors to hide. As Figure 4 shows, the benefits of some historical safe havens such as high‑quality government bonds and gold were minimal, in contrast to the experience during the early days of the coronavirus pandemic.

Rethinking diversification in times of uncertainty

(Fig. 4) Total returns of selected assets, for the periods Q1 2020 and calendar year 2022

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

As of 30 April 2024. For the periods first quarter 2020 and calendar year 2022.Based on total returns, gross of fees. Calculations are in GBP, except for Gold and Bitcoin in USD and global government bonds, which is shown hedged to GBP.

Sources: Bloomberg Finance L.P., FTSE (see Additional Disclosures), HFRI and Deutsche Bank. Analysis by T. Rowe Price.

In our view, looking to ‘diversify the diversifiers’ is sensible. Allocations to safe‑haven currencies, such as the US dollar, Swiss franc and Japanese yen, may add to portfolio diversification at times of stress. Such exposure may be obtained through tailoring the currency hedging programme within global fixed income mandates, for instance, and minimising UK home bias within equities, therefore allocating more to markets such as the US and to the US dollar.

Market turbulence also creates opportunities for skilful active managers, as prices move away from intrinsic values. In particular, more conservative strategies that focus on genuinely uncorrelated exposure to traditional liquid markets, or even seek out opportunities to offer return streams diversified from these, can show their worth in these environments.

Utilising a mix of high‑quality fixed income, selected ‘risk‑off’ currencies, proven actively managed defensive strategies and uncorrelated assets is more likely to help mitigate drawdowns and shield investors from what may be an increasingly volatile journey to come.

Aligning portfolio risk with investors’ return requirements

A more positive effect of rising bond yields over the last three years has been the resulting increase in expected returns for multi‑asset portfolios. Policy rates are seen as unlikely to reset to the levels seen in the 2010s, driving higher returns on cash and increasing yields on high‑quality government bonds. As a result, investors looking to generate a particular nominal level of return over the long term may now need to allocate less to risky assets.

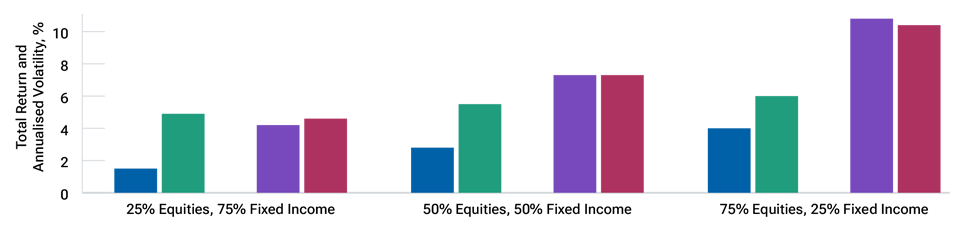

As seen in Figure 5, looking at a portfolio invested in a 50:50 mix of global equities and global fixed income, the expected return for the next five years has moved from less than 3% three years ago to almost 6% in 2024. At the same time, the expected volatility from such a portfolio is almost unchanged. Some investors in this portfolio may now be able to adopt a less risky mix and still have a high likelihood of meeting a particular nominal return goal.

Aligning investor risk and return requirements

(Fig. 5) T. Rowe Price capital market assumptions, five‑year expected returns and volatility, as of start of 2021 and start of 2024

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

As of 30 April 2024. Figures are calculated in GBP. Based on total returns, gross of fees. Based on T. Rowe Price 5‑year capital markets assumptions as of January 2021 and January 2024, respectively. Portfolios used blend of global equities and global aggregate fixed income hedged to GBP. For more information on the methodology of the capital market assumptions, please visit troweprice.com/cma‑methodology.

Source: T. Rowe Price.

Considering new techniques to smooth market volatility

For long‑term investors, investing in equities has been one of the best ways to generate attractive returns. However, to get to the long term, investors need to survive the short term. In periods of uncertainty, elevated equity volatility tends to lead to a much bumpier journey for investors, pushing the volatility of portfolios well outside the expected ranges and often investors’ comfort zone. These jumps in experienced risk are especially troubling in times of market stress. To help smooth the ride, investors should consider techniques that will allow them to retain exposure to shares while keeping changes in portfolio values more in line with expectations.

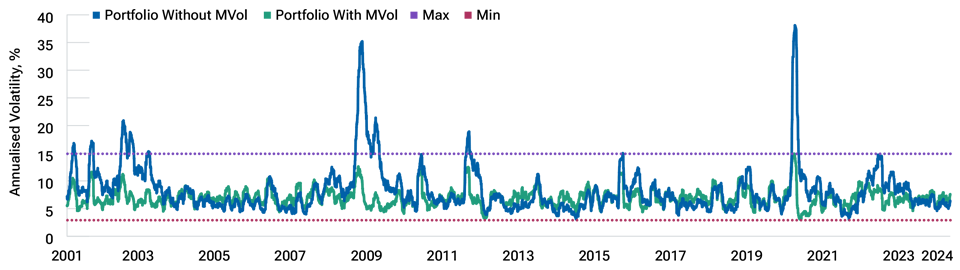

Volatility management techniques are of increased interest as investors see the current elevated levels of economic and geopolitical uncertainty persisting and understand that adopting such techniques involves trading off a portion of portfolio return for a less volatile experience in times of turbulence. Figure 6 illustrates how a managed volatility (MVol) programme can control portfolio volatility, particularly during extraordinary market events, such as the GFC in 2008 and the emergence of the coronavirus pandemic in 2020. Such programmes can be implemented using liquid, exchange‑traded derivatives in a cost‑effective and transparent manner.

Smoothing market volatility

(Fig. 6) Delivering a less volatile experience in times of turbulence

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

As of 30 April 2024. For the period 1 January 2001 through 30 April 2024.The figures refer to simulated past performance. MVol = managed volatility. Rolling 30‑day annualised volatility is based on daily index total returns measured in GBP. The horizonal dotted lines represent the maximum and minimum volatility of the portfolio with MVol. Portfolio: 60% ACWI + 40% Global Aggregate, GBP hedged.

Source: T. Rowe Price.

How should investors rethink their portfolios?

In this paper, we have set out a number of key considerations in building successful multi‑asset portfolios for UK investors. We believe such portfolios should emphasise diversification, taking advantage of the opportunities available for return enhancement and risk reduction from a global approach for both equities and fixed income. Portfolios should include a variety of safe‑haven assets with a view to increasing portfolio resilience in periods of market turbulence. More attractive yields within fixed income markets in particular mean that existing portfolio allocations may need to be revised. Finally, as we look ahead to an uncertain path with the possibility of both geopolitical and economic shocks, it is worth reviewing if tools such as volatility management may have a wider role to play.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.