April 2024 / INVESTMENT INSIGHTS

For or against? The year in shareholder resolutions—2023

With environmental and social proposals in the spotlight, case‑by‑case insights were key to our decision-making

Executive Summary

This is the fourth year that we have published analysis of our voting results on shareholder resolutions on environmental, social, and political topics.1 Since the 2021 proxy voting season, when these resolutions earned unusually high support, we have observed a bifurcation among proponents of these resolutions, particularly in the U.S. and Canada. Many resolutions are still put forward under a traditional framework of advocating for actions that could increase the value of the corporation or reduce the risks it faces. However, a new approach has taken hold in these markets that we believe is not tethered to value creation for shareholders. We explore the effects of this bifurcation in this year’s report.

Changing dynamics in North America

Amid growing demands on the private sector to align businesses in ways that also address significant societal challenges, shareholder resolutions have long been used as one mechanism to foster dialogue between investors and corporate leaders. However, in the past three years, the utility of such resolutions has deteriorated, from our perspective, particularly in the U.S. and Canada, which together represent 82% of the 527 proposals analyzed in this report.

The primary cause of this deterioration is what we would characterize as misuse of the shareholder proposal vehicle in these markets. Traditionally, the purpose of shareholder‑sponsored resolutions in these markets was understood to be for long‑standing investors to offer nonbinding recommendations for consideration by other shareholders on ways a company might increase shareholder value or reduce risk by improving transparency or oversight of certain practices clearly tied to value creation.

Today, our analysis suggests that proposals of this nature represent less than half of the total. About 45% of resolutions we examined for 2023 fit under the general description of efforts to enhance company performance by improving transparency or operations around a key aspect of the business. To be clear, we often still disagreed with the proponents that additional reporting was necessary for the companies targeted by these resolutions. However, we recognize that these proposals exhibited a basic sense of alignment with the goal of enhancing the long-term performance of the company.

On the other hand, about 55% of proposals in 2023 exhibited no such alignment. These resolutions, in our assessment, were designed to direct the company to change the mix of its business in a meaningful way, to raise awareness of a particular social or environmental issue having no connection to value creation, or to advocate for changes motivated by considerations other than long‑term performance. It is a notable and unfortunate development, in our view, that more than half of shareholder proposals brought in our clients’ portfolios in 2023 can be categorized as either untethered to, or negatively aligned with, economic outcomes for investors.

Comparing effectiveness of engagement versus use of shareholder resolutions

We recognize that, relative to some other asset managers, we have shown a long‑standing tendency to be more selective in the environmental, social, and governance (ESG) shareholder resolutions we support. This is because of our general conclusion that, for large institutional investors such as ourselves, the shareholder resolution vehicle is a much less effective mechanism than direct engagement with the management teams of companies in our portfolios. We believe that the reputation of T. Rowe Price affords us excellent access to the leaders of the companies in which we invest. Where appropriate, we use that access to address matters of concern in the oversight of environmental risks or social matters. In many cases, this obviates the need to support shareholder resolutions in these areas.

Our primary concern with the current state of shareholder resolutions in North America is that a majority of such proposals are initiated and used toward a variety of objectives that have little to do with shareholder value. They are often crafted to raise awareness of a particular social issue, to gain the attention of a management team, to strengthen a proponent’s bargaining power, or to make a political point. The rapid rise of ESG counterproposals illustrates this problem and can be viewed as compounding it. Our analysis of shareholder resolutions does not take these objectives into consideration.

Given the very wide spectrum of social views held by the clients we serve, we have concluded that it is not appropriate to use our clients’ voting power to support actions designed to achieve outcomes that are unrelated to investor returns. We are only inclined to support resolutions that can be directly tied to long-term value creation.

As quantity increases, quality declines

Another notable development in proxy voting trends in recent years is the increase in the number of shareholder‑sponsored resolutions submitted to companies. Over the four years we have been publishing the results of our analysis, the number of resolutions covering environmental, social, and political topics has increased 52% in portfolios managed by T. Rowe Price Associates (TRPA): from 346 votes covered in our 2020 report to 527 in the 2023 edition.

There are multiple reasons for this increase. In the U.S., the main driver was a 2021 decision by the Securities and Exchange Commission (SEC) to adapt its interpretation of what types of resolutions were eligible to be added to a company’s proxy. The SEC allowed more proposals across a wider range of environmental and social topics to move forward. Our observation is that the increase in the volume of proposals was accompanied by a decrease in their overall quality. Since the change in guidance from the SEC, we have consistently observed more inaccuracies in proposals, more poorly targeted resolutions, and more proposals addressing non‑core issues.

In addition, we observed a marked increase in the level of prescriptive requests. Proponents have moved swiftly from disclosure‑based requests (seeking additional reporting on ESG matters) to action‑based requests (seeking specific commitments, capital investments, or structural changes from the targeted companies). At the same time, proponents exhibited a lower propensity to negotiate settlements with issuers before taking a proposal to a vote.

The rush by proponents to file proposals advocating an ever-widening set of environmental and social actions has also resulted in increased activity by proponents who disagree with these objectives. These proponents have become prolific filers of resolutions asking companies to unwind their initiatives in the ESG arena or to demonstrate the return on investment of such initiatives. In our first edition of this report, we identified 12 such ESG counterproposals. In 2023, the figure was 77, and we expect that to increase in 2024.

These dramatic shifts in the landscape validate our long‑standing commitment to a common sense approach to assessing shareholder-sponsored proposals of all types. It is more important than ever to understand the company’s overall circumstances, disclosure levels, performance, and material ESG risks before determining whether these proposals are aligned with our clients’ financial best interests.

Key characteristics of proposals outside North America

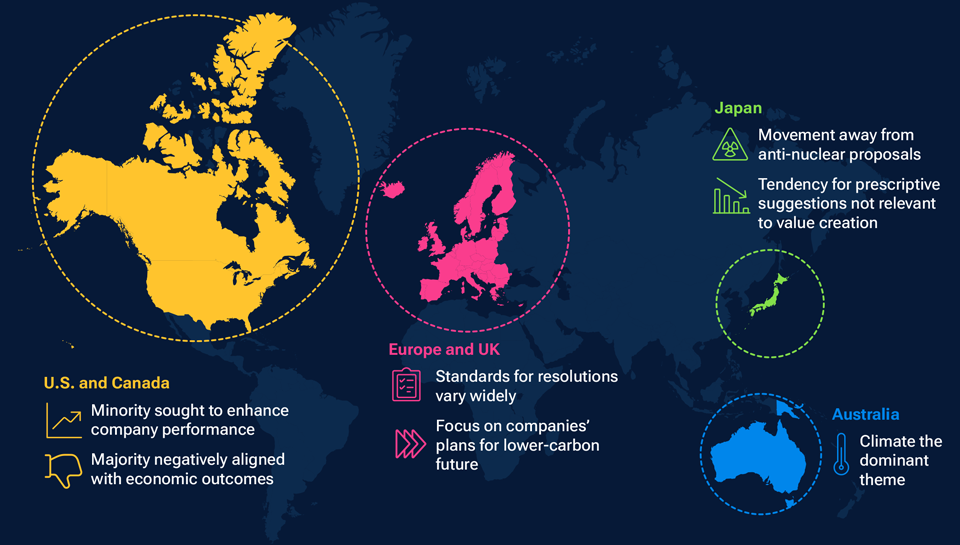

While the geographic breakdown of shareholder proposals analyzed in this report skews heavily toward the U.S. and Canada, 10% of resolutions were in the Asia Pacific region and 8% were brought in Europe and the UK.

In Asia Pacific, proposals are rarely observed outside of two markets: Australia and Japan. In Japan, we have observed a movement away from proposals focused almost exclusively on reducing reliance on nuclear power, a theme that has been dominant in this market since the 2011 Fukushima accident. In 2023, Japanese companies received a mix of proposals addressing climate-related issues and company-specific operational issues. Resolutions in this market are dominated by individual investor proponents offering prescriptive suggestions to companies on matters we do not consider to be relevant to value creation. For this reason, we supported only 7% of proposals in Japan in 2023.

In Australia, climate was the dominant theme of shareholder resolutions. These proposals have largely targeted companies that are already providing comprehensive disclosure of their environmental impact as well as robust climate-transition plans. In these situations, we do not conclude it is prudent to ask companies to adopt a different approach.

Geographic trends in shareholder proposals in 2023 based on TRPA analysis

For Illustrative purposes only. Source: T. Rowe Price.

Across Europe and the UK, the standards for submitting shareholder resolutions vary widely. Most markets do not allow such resolutions at all, while others allow owners of a single share to put forth resolutions. As a result, the topics proposed cover a wide range of issues and it is difficult to categorize this region’s proposals by theme. However, one trend worth noting is that a few dozen companies are now conducting periodic, nonbinding votes to approve their climate strategies. These so-called Say on Climate votes are not covered in this report because they are put on the proxy by the companies themselves, not by shareholders. However, our observation is that the presence of Say on Climate votes has channeled much of the investor/issuer dialogue on climate away from shareholder proposals and toward a more holistic assessment of companies’ plans for a lower-carbon future.

The role of proxy voting in stewardship

We see proxy voting as a crucial link in the chain of stewardship responsibilities that we execute on behalf of our clients. From our perspective, the vote represents both the privileges and the responsibilities that come with owning a company’s equity instruments. We vote our clients’ shares in a thoughtful, investment‑centered way, considering both high‑level principles of corporate governance and company‑specific circumstances. We take an inclusive approach to these decisions, with involvement from our specialists in Responsible Investing and Governance.

Our overarching objective is to cast votes in support of the path most likely to foster long‑term, sustainable economic performance for the company and its investors.

Our view is that the proxy vote is an asset belonging to the underlying clients of each TRPA investment strategy. This means that our portfolio managers are ultimately responsible for making the voting decisions within the strategies they manage. To fulfill this responsibility, they receive recommendations and support from a range of internal and external resources, including:

- The T. Rowe Price Associates ESG Investing Committee

- Our global industry analysts

- Our specialist Corporate Governance team

- Insights generated from our proprietary Responsible Investing Indicator Model (RIIM) and our Responsible Investing team

- Our external proxy advisory firm, Institutional Shareholder Services (ISS)

Prudent use of our voice

Our proxy voting program is one element of our overall relationship with corporate issuers. We use our voting power in a way that complements the other aspects of our relationship with these companies. For example, other contexts in which we might share our perspectives with an issuer include:

- Regular, ongoing investment diligence meetings

- Engagement with management on ESG issues

- Meetings with members of the Board of Directors or senior management

- Decisions to increase or decrease the weight of an investment in a portfolio

- Decisions to initiate or eliminate an investment

- On occasion, issuing a public statement about a company—either to support the management team or to encourage it to change course in the long‑term best interests of the company

In an environment where large institutional shareholders like TRPA are routinely rated by third parties according to how frequently they vote against Board recommendations, we wish to be clear: It is not our objective to use our vote to create conflict with the companies whose securities are held in our clients’ portfolios.

Voting framework: Principles‑based or case by case

When it comes to proxy voting issues, there is some debate as to the best approach: Is it best to look at each issue individually and consider the company’s circumstances or to apply a set of principles evenly across all companies? In our view, the answer is both.

There are many areas within proxy voting where a principles‑based approach can be implemented effectively. For example, our proxy voting guidelines are designed to promote an appropriate level of Board independence, robust shareholder rights, and a strong link between executives’ compensation and company performance. However, there are other areas where a case‑by‑case approach is necessary in order to achieve full alignment between our guidelines and our voting outcomes. This is very much the case for shareholder resolutions.

The main reason why shareholder resolutions are hard to implement with a principles‑based voting approach is because they are more nuanced than other proxy voting categories, particularly in this era when a majority of proposals do not have value creation or preservation as their objective.

For example, we employ an objective set of indicators to determine a director’s independence. It is a straightforward decision to vote against existing directors and suggest that the company replaces them with independent Board members.

In the case of many shareholder proposals, the message to the company is that it needs to make a change and the proponent prescribes a method to do so. We sometimes agree that a change to a company’s management of an environmental or social issue needs to be made but not with the proponent’s prescribed remedy.

The activities of the anti-ESG movement in the U.S. added complexity to our decision‑making framework in 2023. Because we have built multiple avenues to seek feedback from our global clients, we know that many of them place a high priority on ESG integration or impact investing. However, we have many more clients who express no views on such matters. Some even hold negative views about the potential effects an ESG orientation may have on their investment outcomes or regional economies. Our objective is to ensure we receive a balanced picture of our clients’ priorities and perspectives with regard to the role that ESG considerations play in our investment activities.

It is important to note that our overall approach for integrating ESG factors into the TRPA investment framework—which includes proxy voting—is research-centered. Its purpose is to produce investment insights for our internal teams of analysts and portfolio managers. As a global asset manager serving as a fiduciary for clients with different perspectives, beliefs, time horizons, and investment goals, it is not our objective to build investment strategies to reflect a specific set of values. Instead, our objective is to use different lenses (including environmental, social, governance, and ethical) to deepen our understanding of the investments held in our clients’ portfolios.

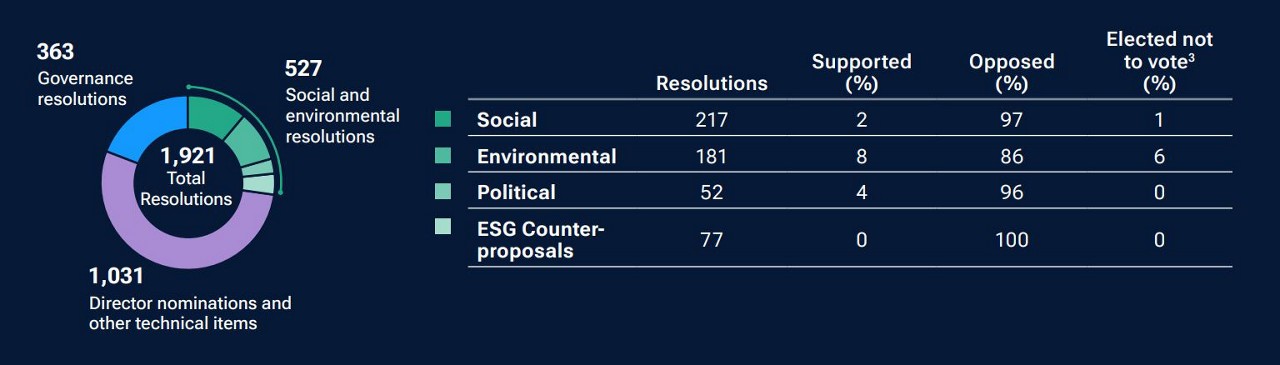

In 2023, TRPA portfolio managers voted on a total 1,921 shareholder‑sponsored items across all markets. Of those, 1,031 were situations where shareholders were nominating directors to a company’s Board or the procedural proposals related to such elections. Another 363 were resolutions asking companies to adopt a specific corporate governance practice.

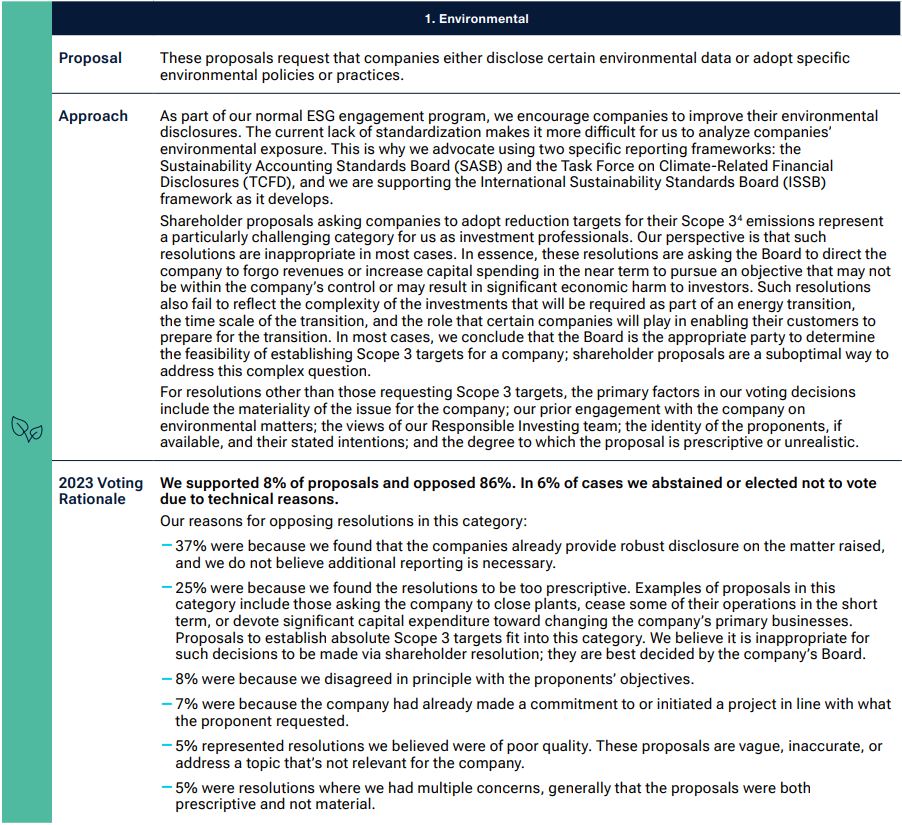

Here, we focus on the 527 remaining proposals that specifically addressed environmental, social, or political matters. We classify these proposals into four distinct categories2 as illustrated in Figure 1.

Shareholder resolutions voted on in 2023

(Fig. 1) Digging deeper into environmental and social resolutions

Chart shows the number of shareholder resolutions we voted on in 2023 by proposal topic. For “Social and environmental resolutions,” we classify the proposals into 4 distinct categories.

As of December 31, 2023.

Source: T. Rowe Price Associates.

Understanding our voting rationale

We classify environmental and social resolutions into four distinct categories:

The policy formation process at TRPA

Our approach to voting on shareholder resolutions related to sustainability is one small part of our overall responsibilities related to proxy voting. This approach continuously evolves along with the overall corporate backdrop. It is informed by changes in regulation, improvements in corporate disclosure, campaigns by stakeholders, company‑specific events, and our investment professionals’ views on these matters.

The TRPA ESG Investing Committee is made up of experienced investment professionals, including analysts and portfolio managers from our Equity, Fixed Income, and Multi‑Asset Divisions as well as Investment Division leadership. In addition, the membership includes cross‑functional expertise from internal legal counsel, business unit management, and investment operations. The committee is cochaired by our Head of Corporate Governance and our Director of Research for Responsible Investing.

Each year, the committee reviews proxy voting activity from the year before to reassess the suitability of our voting guidelines and to consider adding to or amending the guidelines.

Multiple avenues of accountability for ESG performance

It is important to note that shareholder resolutions are not the only way that our views on environmental and social factors are expressed in the TRPA proxy voting program. For almost every company around the world, directors are reappointed as part of the regular business of the shareholder meeting. Before we vote to reelect them, we assess these directors’ performance across multiple dimensions, including their oversight of environmental and social business issues.

Three specific voting guidelines are examples of how these considerations are factored in to voting decisions:

- Climate Transparency Gap: For companies deemed to be in high‑emitting industries, we generally oppose Board members if the companies fail to disclose sufficient greenhouse gas emissions (GHG) data to enable investors to assess risk.

- Board Diversity: We apply a minimum standard for Boards’ gender diversity in every market globally, with higher standards applied in regions where there is governing regulation or a market standard.

- Shareholder Rights: We generally oppose Board members at seasoned U.S. companies that continue to elect directors in staggered, three‑year terms, as these structures reduce Boards’ accountability to investors.

Voting decision elements

The following table details the specific considerations that we take into account when assessing environmental or social resolutions.

Oversight of governance and responsible investing

Proxy voting is an investment function within T. Rowe Price and is subject to the oversight of the Boards of Directors of the various T. Rowe Price investment advisers (including TRPA and TRPIM). Each adviser has fiduciary responsibilities. Our view is that it is the duty of the advisers to vote shares in portfolio companies solely in the interests of their clients, taking into account factors relevant to a long‑term investor.

TRPA ESG Investing Committee reports annually to all the funds’ (U.S. mutual funds, SICAVs, trusts, and OEICs) Boards of Directors. TRPA provides a detailed overview of year‑over‑year changes in voting patterns, amendments to the voting guidelines, and a discussion of the management of potential conflicts of interest. We also provide a detailed analysis of our votes on environmental, social, and political matters.

In addition to the funds’ Boards, which exercise direct oversight over the investment advisers, T. Rowe Price Group, Inc. (Group), is a publicly traded corporation with a separate Board of Directors. The Group Board also has an interest in ESG matters in that it oversees the corporation’s ESG strategy, environmental footprint, human capital management, risk management, and other related functions.

The ESG capability of the investment advisers is a strategic issue of interest to the Group Board. For this reason, TRPA’s senior ESG leaders provide annual updates to the Group Board. These presentations focus on the firm’s investment in our ESG capabilities: technology resources, talent, tools, training, and products managed under ESG objectives. Our proxy voting activity is generally not part of the discussion because oversight for such investment activities is the responsibility of the funds’ Boards.

Review of alignment between corporate and investment perspectives on climate risk

In response to a request by the Group Board of Directors, in 2023 we completed another review of the firm’s corporate‑level policies, views, and statements on climate change against the proxy voting activities of the firm’s investment advisers. Detailed information on this review, including methodology and findings, is provided as an appendix to this document (Appendix: Climate Risk Alignment Review).

Conclusion

The investment advisers have dedicated significant resources toward building expertise and insight on sustainability and governance matters. Consistent with our active management approach, voting decisions on these matters are made using case‑by‑case analysis, taking into account the company’s particular ESG risks, opportunities, and disclosure.

The quality, intent, and utility of shareholder resolutions on ESG matters are highly variable at this time. Some well‑targeted resolutions are helpful in persuading companies to strengthen their management of certain risks, leading to improved outcomes for investors. In 2023, TRPA found that a majority of resolutions clearly reflected that the objectives of the proponent did not align with economically oriented, long‑term investors. This is why we believe that the most responsible approach to voting such resolutions is to apply the thoughtful, investment‑focused framework we have used consistently over time.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

April 2024 / INVESTMENT INSIGHTS