June 2024 / INVESTMENT INSIGHTS

China’s economy enters a new cycle—unveiling fresh opportunities

China’s economy has undergone a deep structural adjustment

Key Insights

- China’s economy has undergone a deep structural adjustment since 2021, bringing about a paradigm shift in its investment markets.

- Amid the prevailing market pessimism, we believe investors have overlooked the positive changes that are happening within many excellent Chinese companies.

- Breaking away from traditional approaches and exploring new growth drivers can help investors capture some of the new investment opportunities in Chinese stocks.

China’s economy enters a new cycle

In recent years, the real estate industry has been in deep contraction while the issue of local government debt pressures has suppressed demand in related sectors. The booming new energy industry from 2021 to 2022 has faced challenges of increased competition and temporary overcapacity. Traditional internet platforms and blue chip consumer companies have also encountered growth slowdowns.

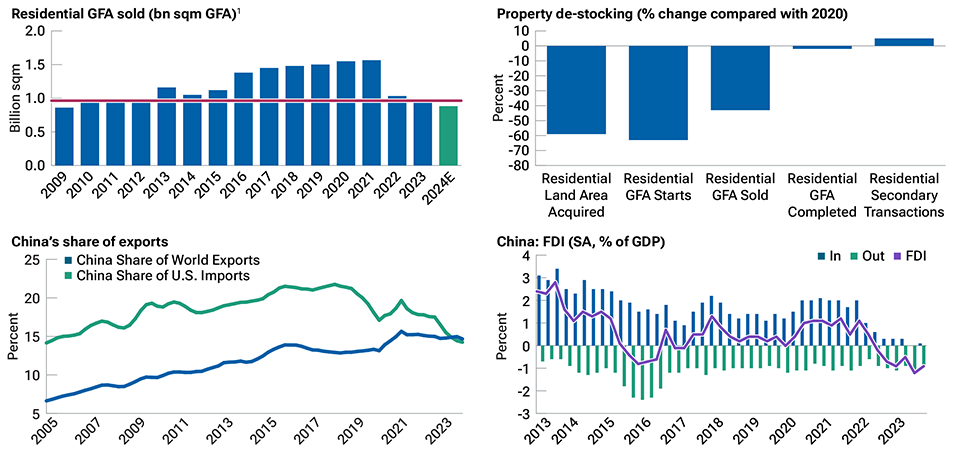

These headwinds are well known and have been extensively analyzed and so should likely be largely discounted in the current market price. Taking the property sector as an example, the government clearly became determined to tackle the issues of excess supply and leverage some two to three years ago. Property, broadly defined, currently accounts for about 20% of gross domestic product (GDP), down from a peak of closer to 30%. Housing new starts have declined by 50% to 60% over the past two to three years, and that has been a very major drag for the overall economy. However, the major part of the decline is likely behind us, and on a sequential basis, residential property appears to be more stable.

The second area that has been a headwind in recent years is geopolitics and the U.S.‑China trade war. Over the past five to six years, China’s share of total U.S. imports has declined meaningfully. But at the global level, China’s market share of global trade has actually held up well. While some manufacturing has moved to Vietnam, Mexico, ASEAN, and other countries or regions, many high‑end components and the more technology‑intensive products are still supplied by China. In some sectors, we are seeing parts of the global supply chain moving out of China, but in the more technology‑intensive, higher value‑added areas, China’s market share has actually been strengthened, not diminished.

Against these headwinds, positive changes are also taking place in China today that should not be ignored by investors. From a bottom‑up perspective, many Chinese companies are continuously exploring new growth drivers through innovation. Chinese companies in aggregate have been enhancing their global competitiveness in high‑end manufacturing. Favorable shifts in supply and demand patterns are occurring in certain traditional industries. In every economic cycle, the market leaders tend to change. This requires investors to break free from path dependency, move beyond index‑weighted stocks, and delve deeper into the new investment opportunities in areas experiencing positive changes. We believe this structural differentiation will continue, and those investors who can keenly adapt to changing dynamics and make informed stock selections are more likely to achieve desirable investment returns.

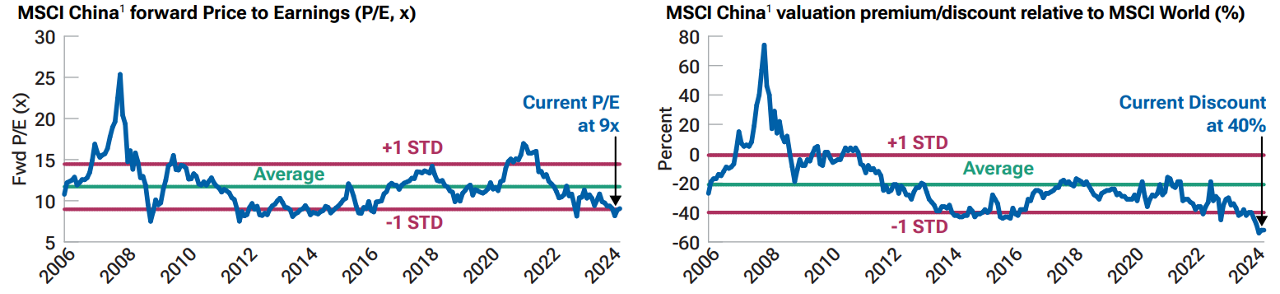

Chinese equities are historically cheap

(Fig. 1) China’s market is trading at an attractive valuation

As of March 31, 2024.

There is no guarantee that any forecast made will come to pass.

1Please see the Additional Disclosure page for additional legal notices and disclaimers.

Source: Financial data and analytics provider FactSet. Copyright 2024 FactSet. All Rights Reserved.

Deleveraging a headwind, diversification a plus

(Fig. 2)

As of March 31, 2024.

1GFA = Gross Floor Area; FDI = Foreign Direct Investment; SA = Seasonally Adjusted.

There is no guarantee that any forecast made will come to pass.

Sources: Financial data and analytics provider FactSet. Copyright 2024 FactSet. All Rights Reserved. Citi Research. Wind, China Customs, NBS.

Rise of new growth leaders

Chinese internet platforms, blue chip consumer stocks, and the health care sector have previously brought substantial returns to investors. These companies retain prominent positions in equity indices and investor portfolios. However, as these companies have already expanded greatly in size and face changing external environments, we believe many are entering a stage of growth deceleration. Investors need to reassess the future prospects and valuations of what, until now, have been some of the most popular Chinese growth stocks.

Beyond traditional blue chip stocks, new growth leaders are emerging. Companies leading in areas with lower penetration rates—for example, online recruitment and online music—are experiencing rapid growth through technological innovation. Leading companies in consumer sectors related to services and experiences, such as hotels and shopping centers, benefit from both market expansion and increased market concentration. Moreover, the electrification revolution is not only driving the automotive industry, but it is also rapidly improving the competitiveness of Chinese companies in sectors like engineering machinery, excavators, and landscaping equipment. These structural trends are expected to continue for the next three to five years and are worthy of close attention from investors.

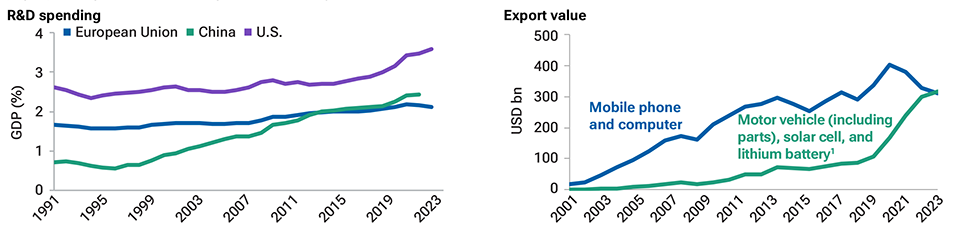

Areas of opportunity: Industrial upgrading

(Fig. 3) Rising R&D spend; surge “new industry” exports

As of March 31, 2024.

1Solar cell data is not available before 2012, while lithium battery data is not available before 2020.

Actual outcomes may differ materially from estimates. Estimates are subject to change.

Sources: General Administration of Customs, Morgan Stanley Research Estimates (E).

Traditional industries enter an upward cycle

Many traditional industries in China have experienced prolonged downward cycles over the past 10 to 15 years. As supply continues to contract, supply and demand rebalancing is gradually occurring in certain sectors. When demand recovers and supply bottlenecks emerge, relevant companies regain some of their bargaining power and are poised to enter a profit growth cycle lasting several years. We can likely observe these favorable supply and demand dynamics in sectors such as shipbuilding, offshore oilfield services, aircraft leasing, and industrial metals (copper and aluminum).

Simultaneously, we believe that Chinese industries, such as railway equipment, ultra‑high‑voltage power grids, and nuclear power, will also accelerate their growth in the coming years. These sectors experienced a trough in the past three to five years but are now being propelled by the growth in end‑market demand, initiating new investment cycles. Equipment suppliers in these areas benefit from high industry concentration and sufficient reserve capacity. We believe the recovery in demand is expected to significantly improve profitability and shareholder returns.

After experiencing a prolonged period of downturn, these traditional sectors have temporarily fallen off investors’ radar screens. Consequently, the market may not fully recognize the positive changes in their fundamentals. We believe that with accelerated growth in demand and improved profitability, the investment value of these sectors is likely to be reevaluated.

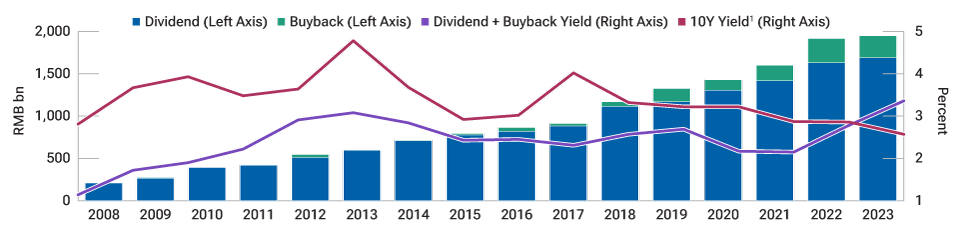

Improved shareholder returns

Another encouraging development in the Chinese market is the significant improvement in shareholder returns in recent years. Dividends and share repurchases for listed Chinese companies on the Hong Kong Stock Exchange and U.S.‑listed Chinese companies with a market capitalization exceeding USD 1 billion1 have increased by over 30% compared with 2019. The cash return rate (dividends or repurchases divided by market capitalization) for overseas‑listed Chinese companies is as high as 4.1%, surpassing mainstream markets such as the United States and Japan.1

The increased focus on shareholder returns and dividends by state‑owned enterprises is a crucial factor driving the improvement in shareholder returns. However, fundamental factors also play a vital role. State‑owned enterprises in various sectors, such as energy, telecommunications, and transportation, have passed through rapid expansion investment cycles. With declining capital expenditures and continued stable cash flows, these companies are positioned to enhance shareholder returns.

The improvement in shareholder returns is not limited to state‑owned enterprises. Internet companies, including small and medium‑sized enterprises, have also achieved remarkable growth in returns. Dividends for listed internet companies in 2023 increased by over 130% compared with 2022, with the total amount of dividends and repurchases reaching USD 33 billion.1 With the stock valuations of many sectors at low levels, the sustained improvement in cash returns presents an effective path for valuation reassessment and value realization.

Chinese companies are paying a higher dividend

(Fig. 4) Use of cash for MSCI China companies (renminbi billions)

As of April 23, 2024.

1Central government bond yield.

Sources: FactSet, Goldman Sachs Global Investment Research.

Conclusion

Although China’s macroeconomic outlook still faces challenges in terms of growth transition and external geopolitical factors, we think investors can still find attractive investment opportunities by identifying new growth leaders, reassessing traditional industries, and considering companies with improving shareholder returns. It is important to stay informed about market dynamics, adapt to changing trends, and conduct thorough company research in order to make successful investment decisions in the Chinese equity market.

With regard to the market outlook for China, what I am most excited about as a portfolio manager is not how fast GDP is growing, but what a deep, liquid market it continues to be, with over 6,000 listed companies with a total market cap of over USD 10 trillion. More importantly, it is one of the least efficient stock markets globally, with retail investors accounting for 70% of A share trading volume with an average holding period of less than 20 days.2 Inefficiencies create opportunities, and from a bottom‑up perspective, we are finding many attractive investment opportunities in China in 2024. It is possible to find good‑quality companies with an average P/E ratio of around 13x and consensus 2024 earnings growth close to 20%.3 The current investor pessimism toward China is already fading, which reinforces my conviction that China is well positioned to provide good potential long‑term returns over time.

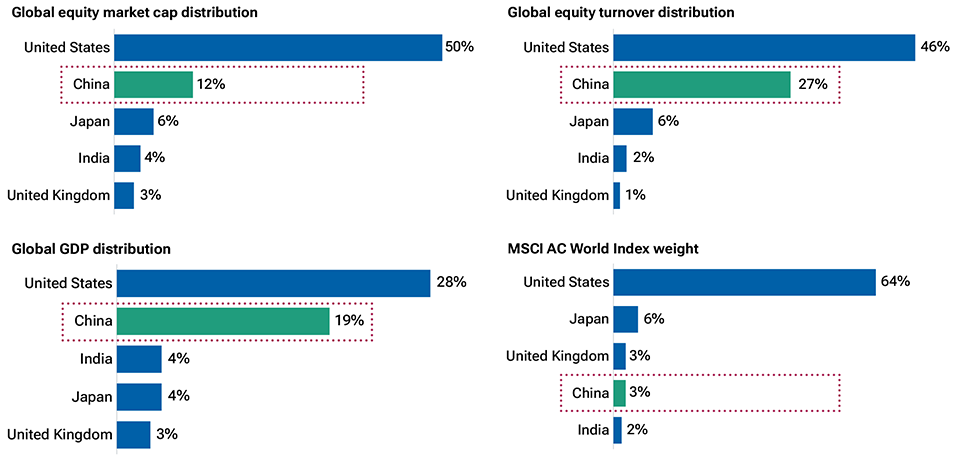

China equity market underrepresented and unloved

(Fig. 5) Chinese stocks structurally underweight in global indices

As of March 31, 2024.

Sources: Goldman Sachs, MSCI, and World Bank/Haver Analytics. Financial data and analytics provider FactSet. Copyright 2024 FactSet. All Rights Reserved.

Please see the Additional Disclosure page for additional legal notices and disclaimers.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2024 / INVESTMENT INSIGHTS

July 2024 / INVESTMENT INSIGHTS