November 2023 / INVESTMENT INSIGHTS

Broad, nuanced, and historically cheap—should value investors keep faith in financials?

While short-term caution is prudent, the longer-term outlook appears more compelling

Key Insights

- For value‑oriented investors, the financials sector remains one of the cheapest in the S&P 500 Index and is trading below its long‑term average valuation.

- Near‑term economic uncertainty and lingering concerns following the crisis in U.S. regional banking in March 2023 are weighing on investor sentiment.

- The broad financials sector comprises a range of underlying industries, each with its own nuances and fundamental influences.

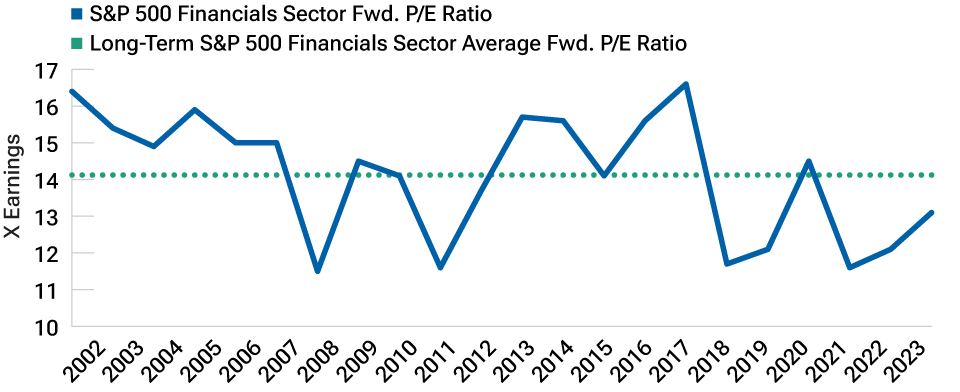

The financials sector remains one of the cheapest sectors in the S&P 500 Index and is also cheap relative to its own historical average valuation level (Fig. 1). Economic uncertainty and the risk of recession are weighing on investor sentiment, while the banking crisis in March 2023 has also raised questions about potential systemic risk. However, while there are clear and obvious near‑term risks, the diverse nature of the financials sector means that there are many good businesses that are trading at seemingly cheap valuations.

U.S. financials are cheap compared with history

(Fig. 1) Near‑term uncertainty is weighing on investor sentiment

As of September 28, 2023.

Forward P/E ratio = Price/12m forward consensus earnings expectations per share.

Source: Refinitiv, data analysis by T. Rowe Price. © 2023 Refinitiv. All rights reserved.

For investors with a deep understanding of the sector’s secular risks and a disciplined valuation focus, there is potential to exploit these mispricing opportunities and be well positioned to benefit from what we believe is a positive longer‑term sector outlook. Our long‑held view is that, over time, the prospects of the financials sector are closely tied to the strength or weakness of the underlying economy it serves. While the impact of rising U.S. interest rates is arguable, a slowdown in the economy, or possible recession, is a key headwind for the sector. Given this economic sensitivity, two questions immediately come to mind when assessing the near‑term sector outlook. First, where are we within the current economic cycle, and second, has the recent banking crisis resulted in any lasting damage to the sector?

Financials closely aligned to economic health

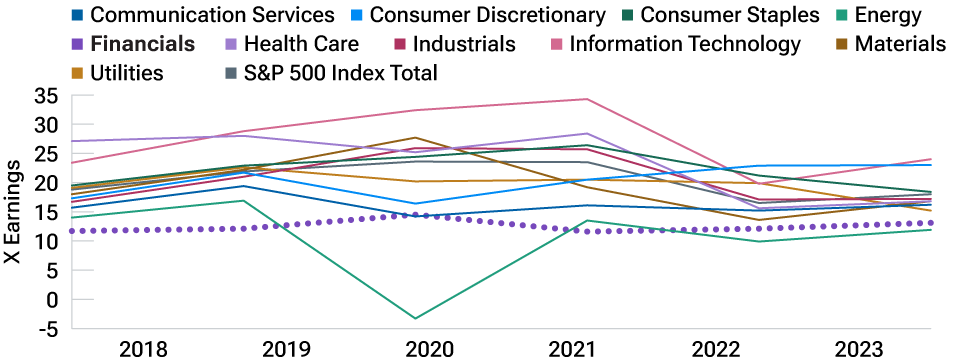

The financials sector is one of the cheapest in the market

(Fig. 2) S&P 500 sector valuations

As of September 28, 2023.

Forward P/E ratio = Price/12m forward consensus earnings expectations per share. “Financials” are represented by the purple dotted line.

Source: Refinitiv, data analysis by T. Rowe Price. © 2023 Refinitiv. All rights reserved.

Of course, any predictions about the economic cycle are ultimately a best estimation. It’s not possible to know exactly how the cycle will evolve, or if the coming months could see a soft landing or an outright recession. However, if we are correct in our view that the U.S. Federal Reserve is close to ending its cycle of interest rate hikes, then this would be broadly positive for financials, and at some point in 2024, we may see bank net interest margins expanding again. Even at the height of the banking crisis in March 2023, we felt comfortable that the economic backdrop had not deteriorated significantly. This gave us confidence that the banking stocks we owned were being overly discounted by the market, based on a too pessimistic view of the contagion spreading through the wider economy. Suffice it to say that, during any period of heightened uncertainty, it pays to go back to the start and reassess every assumption, on each individual stock, in light of the changed conditions.

The immediate deposit crisis is over

In terms of the banking sector, we believe that the deposit crisis in U.S. banking has been solved with time, but we cannot rule out further deposit runs. The failure of Silicon Valley Bank, Signature Bank, and First Republic Bank in March was undoubtedly a major shock to the financial system. Encouragingly, however, the banking sector has stabilized in the months since the crisis, suggesting a baseline level of resilience and settling of concerns over deposit flight. That said, the failure of three U.S. banks during the recent crisis serves as a stark reminder that no bank is ever completely immune to a potential run on its liquidity.

Also stunning was just how quickly the fear contagion can accelerate in today’s world. Gone are the days when nervous customers would have to drive to a bank branch and potentially wait in line around the block to withdraw their money. Today, the slightest chink in a bank’s armor can spread like wildfire via social media, regardless of how short term or fixable the issue may be. And before the bank can come up with solutions, or the Federal Reserve can act to provide support, customers have already placed their orders online to redeem their accounts.

Is the U.S. banking sector completely fixed?

Looking back to the lowest point of the March 2023 banking crisis, the Federal Reserve made the key decision to create new lending facilities and the Federal Deposit Insurance Corporation (FDIC) expanded its deposit insurance above USD 250,000 in select instances. These decisive actions proved pivotal in helping to restore confidence in the U.S. banking sector. We believe, however, that the modern era of digital banking necessitates the expansion of deposit insurance in order to ensure long‑term confidence in the sector. However, Congress has not yet made any move on the insurance limit or a potential targeted expansion of deposit guarantees.

As a result, the banking sector has had to rely on a less certain and more painful fix, which is simply the passage of time. In hindsight, this has worked, with some of the acute problems easing considerably in the months since March while banks have had time to rebuild their capital bases. However, while immediate concerns have been quelled and the current liquidity crisis is over, unless Congress legislates to raise the deposit insurance limits for U.S. banks, another banking sector crisis cannot be ruled out.

The financials sector is broad and nuanced

The financials sector is one of the largest portions of the S&P 500 Index, comprising a number of underlying industries. While the crisis in the banking sector in March 2023 has understandably focused investors’ minds on this area, it has also resulted in negative sentiment being applied to other financial industries, each with their own nuances, idiosyncrasies, and fundamental influences. As such, there are opportunities to find good businesses that are potentially mispriced. Here we consider some of these underlying industries in more detail.

Banking: Select regional banks look appealing on a valuation basis, and we are overweight this area of banking with a bias toward the Midwest region. Specifically, our focus is toward banks with strong deposit franchises. These businesses have very granular and engaged relationships with their customer bases. Compare this with the failed Silicon Valley Bank, for example, whose customer base was dominated by a relatively small group of “unicorn” depositors who made up a significant proportion of the bank’s total deposits.

More broadly, it is important to factor in the regulatory changes that have been introduced in response to the crisis. In our view, the potential impact on the earnings power of U.S. banks could be notably lower over time, compared with pre‑crisis levels. As such, moving forward, valuations should be weighed against banks’ structurally lower earnings potential.

Credit cards: We have zero exposure to pure‑play credit card businesses. These companies are most exposed to any weakening in the credit environment. The cost of credit card interest has risen to the highest level in decades, leading to increased delinquency levels. As such, we do not believe the current valuations on these stocks adequately discount the associated risk.

Capital markets: We also have zero direct exposure in the capital markets subsector, in areas like investment banks, asset managers, private equity, and trust banks. Our expectation at the start of the year was for a far worse environment for capital markets in 2023 than has actually panned out. The rally in growth stocks has been particularly supportive in the sector. We have some indirect exposure to capital markets through holdings in some of the large money center banks—companies that we feel have superior business models and that offer better valuations.

Insurance: We have been overweight to insurance companies for some time, but the nature of that overweight has evolved more recently. Previously, the overweight was driven by a positive top‑down view, specifically a constructive view of the pricing environment for insurance companies. While the pricing argument is less compelling today, we remain overweight by virtue of bottom‑up stock selection. Particularly in defensive segments, like property and casualty insurance, we are finding opportunities where we believe headline valuations underrepresent a company’s “sum of its parts” true worth.

Onshoring of U.S. industry represents a major tailwind

Another important factor in our positive longer‑term view of the financials sector is the trend of onshoring of U.S. industry that is gathering pace. Driven by the chronic disruption to global supply chains, first due to the coronavirus pandemic and more recently as a result of geopolitical conflict, the onshoring or nearshoring of U.S. business operations and processes is being prioritized. The financials sector is likely to be a key beneficiary of the positive demographic trends associated with bringing these jobs back to the U.S., particularly banks in “middle America.”

The prospect of “higher for longer” rates favors value investing

As we continue to move through the post‑pandemic economic recovery, we believe that the backdrop of persistent U.S. inflation and higher‑level interest rates will remain prevalent for some time. This represents a supportive backdrop for value investing, as investors refocus on the appeal of near‑term profits bought at lower prices. As such, the large and diverse financials sector will continue to present a range of stock‑specific value‑oriented opportunities. However, a cautious approach also seems prudent in the near term as weakening economic output, high inflation, regulatory pressures, and potentially lower earnings ensure ongoing volatility. Longer term, however, the outlook appears more compelling. Ironically, the recent banking crisis highlighted that lessons have been learned over recent decades, resulting in a more resilient, better capitalized, and durable sector overall. As the economic landscape turns more supportive, and the impact of U.S. onshoring is increasingly felt, the financials sector looks set to make good progress, particularly given the current low‑level sector valuation.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.