February 2021 / INVESTMENT INSIGHTS

Melting Permafrost Poses Challenge For Arctic Companies

Climate change risks are rising for Russian industrial companies

Key Insights

- Melting permafrost weakens the bearing capacity of foundations and stability of infrastructure and may even accelerate climate change.

- Capex investment costs are expected to increase for companies operating in permafrost areas as assets will likely need to be monitored more regularly going forward.

- It is imperative to assess a company’s vulnerability to permafrost thawing and integrate this into the evaluation of bond securities.

Rising global temperatures are causing permafrost—ground that remains frozen at 0 degrees or colder for at least two years consecutively—to thaw. For Russian mining and energy companies that have operations in permafrost areas, this climate change effect presents a material risk as it can weaken foundations and even cause damage to infrastructure. This will likely require additional capital expenditure (capex) going forward to monitor conditions and take remedial action to reinforce assets when necessary. With this in mind, we have undertaken a thorough assessment in the fixed income space and embedded this environmental risk factor into our overall investment thesis for companies that are potentially vulnerable to thawing risk.

Understanding the Thawing Risk

Thawing Permafrost and Climate Change

For several decades now, temperatures in Russia have outpaced the global average, particularly in permafrost regions, which cover more than half the country’s land mass. As a result, permafrost—a permanent layer below the earth’s surface that is a combination of soil, rock, and sand held together by ice—is thawing. This is damaging for two reasons:

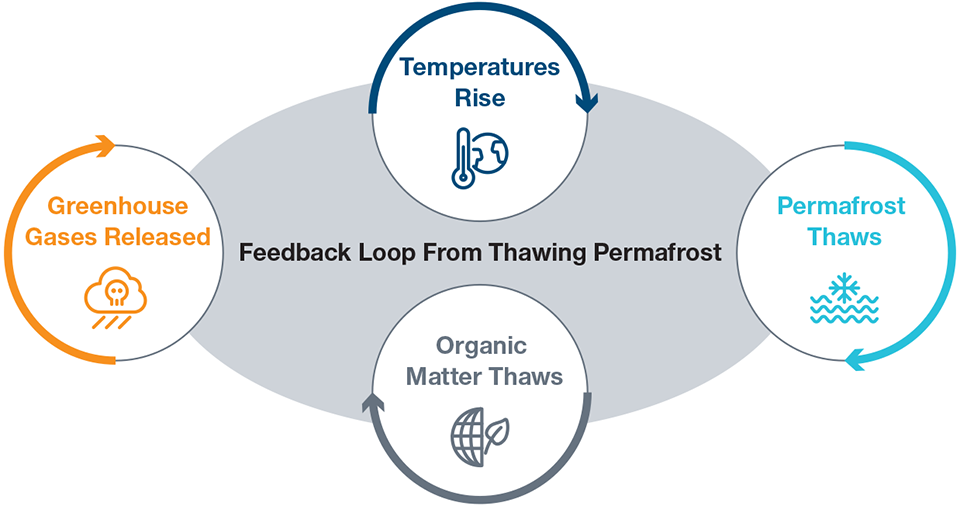

- Greenhouse gases, such as methane and carbon monoxide, are released into the atmosphere, creating a feedback loop that speeds up global warming.

- The bearing capacity of foundations and the stability of infrastructure are weakened.

Thawing permafrost is not a new phenomenon in Russia, but the pace is expected to accelerate in the future due to the persistent rise in temperatures since the 1970s. For companies with operations in permafrost areas, capex costs are likely to increase as assets will need to be monitored more regularly now than in the past. For example, temperature checking of foundations, thermal insulation, and/or cooling systems may be required going forward, which will need to be financed. Stabilizers for infrastructure maintenance and corrective action to reinforce assets could also be necessary, further exacerbating costs for companies.

The risks of not investing or poor monitoring and maintenance by a company could potentially be huge as the probability of their assets rupturing or leaking increases. Not only could this result in a large cleanup bill if an incident occurs, but there’s also a risk of lasting damage to a company’s reputation and credibility given the increased investor attention on climate change and environmental risks. In our view, tail risks have increased for Russian companies vulnerable to permafrost thawing, so it’s imperative to integrate this environmental risk factor together with the likelihood of higher future capex costs into our bottom‑up research process.

Who Is at Risk?

In Russia, a significant portion of industrial activity takes place in permafrost regions, with assets valued at almost USD 250 billion1 potentially exposed to thawing risks. In particular, upstream activities in the oil and gas industry are vulnerable, with production close to 90%2 for gas and 30%2 for oil taking place in permafrost areas that may have already experienced a deterioration in bearing capacity foundations. Further adding to the risks for the gas industry is that it must be processed close to production wells before it can be transported. Companies with midstream activities in the oil and gas industry are also potentially at risk as transportation takes place through rail and pipelines that cross large sections of permafrost.

In the metals and mining space, thawing is most likely to materialize through unstable bearing capacity impacting either production facilities, storage, or a power supply, or as a result of a tailing dam rupturing. Operators of open pit mines are at a greater risk than underground mines because the latter are likely to operate below permafrost levels.

Assessing Company Vulnerability to Permafrost Thawing

(Fig. 1) Incorporating a risk premium for thawing into our bond evaluation

As of January 31, 2021.

Source: T. Rowe Price.

Capturing Thawing Risk in Our Research Process

For companies exposed to thawing risk, we assess three key areas during our fundamental bottom‑up research process:

1. Location of assets

This is important because some areas are more vulnerable than others. For example, companies with assets in the Yamal Peninsula, Pechora, Norilsk, and Yakutia regions are potentially at greater risk because permafrost in those areas consists of ice rather than rock sediment, which typically thaws more easily.

2. State of the assets

Looking at the extent to which bearing capacity has already deteriorated is essential. For some companies, significant deterioration in bearing capacity may already have taken place, while other companies may have experienced very little. Age of assets is also important because a company with a modern asset base is expected to be better at withstanding thawing risks and changes in temperatures compared with companies that operate older asset bases.

3. Ability to absorb higher capex costs

Once the first and second key areas have been assessed, we then evaluate a company’s balance sheet and test whether it can absorb the expected increase in capex investment going forward. Generally speaking, most Russian issuers benefit from solid financial profiles and should be able to absorb extra investment, but in some instances, they may seek to offset the higher costs by cutting dividends or raising funds by issuing new bonds.

To further support our analysis, we also collaborate with our dedicated in‑house responsible investing team, who provide investment research on environmental, social, and governance issues at the issuer level and on thematic topics. They have also built a proprietary Responsible Investing Indicator Model that helps to identify and flag any elevated environmental, social, and ethical risks or positive characteristics at an issuer level. This includes an analysis of climate‑related issues. The dual approach really helps us to identify environmental risks, as well as gauge the potential impact of these risks on the company in the future.

Incorporating a Risk Premium

Assessing these three key concerns enables us to categorize companies by their level of vulnerability, which we then use as a basis for incorporating a risk premium for thawing into our bond evaluation. An illustration of a guide we use in our analysis is provided in Figure 1. Using this guide helps us arrive at a risk‑adjusted fair value bond price for the company that incorporates an appropriate risk premium for their level of vulnerability to thawing.

The impact of climate change on Russian mining and energy companies that have operations in permafrost areas is a material risk that should be incorporated into the research process. This helps us to assess the level of vulnerability and how it might affect a company’s long‑term economic sustainability.

What we're watching next

We are closely watching how the melting of permafrost affects assets and what companies do to mitigate possible adverse impacts. In addition, we are actively engaging with management teams on the issue.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2021 / INVESTMENT INSIGHTS