June 2024 / INVESTMENT INSIGHTS

Credit investing for today’s evolving markets

Headwinds call for choosing credit solutions with rigorous research

Key Insights

- Credit markets offer a plethora of potential opportunities and can help support investors with a range of goals and risk tolerances.

- Investment‑grade corporate bond strategies may suit investors seeking steady income and high‑quality duration, while those with a higher risk tolerance and longer‑term horizon could find attractive opportunities in high yield corporate bonds at present.

- To help instill confidence about credit investing in the current environment, we believe it’s important to choose an approach that emphasizes deep fundamental research.

Credit markets have the flexibility to support a range of investor goals and risk tolerances. But given the current climate of tight credit spreads, a soft macro environment, and the rising cost of financing, some investors may be apprehensive. To help instill confidence, investors should consider solutions that emphasize deep fundamental credit research. This should help to uncover inefficiencies, manage risks, and confidently navigate uncertain markets.

The credit opportunity, concern, and solution

(Fig. 1) Research can help to instill confidence about credit investing

As of April 30, 2024.

For illustrative purposes only. This is not to be construed as investment advice or a recommendation to buy or sell any security.

Source: T. Rowe Price.

In this third and final piece of our series on credit markets, we are delving into the characteristics of the solutions and how they can align with different investment objectives—including lower volatility, generating higher yield, and capital appreciation.

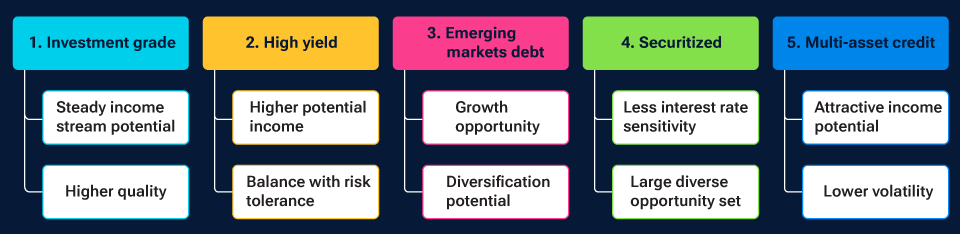

Credit opportunities to consider in today’s uncertain market

(Fig. 2) Investors can find solutions to suit a variety of needs

As of April 30, 2024.

For illustrative purposes only. This is not to be construed to be investment advice or a recommendation to take any particular investment action.

Investments involve risks, including possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market.

Source: T. Rowe Price.

1. Investment‑grade corporate bonds

Investment‑grade corporate bond markets offer a potential combination of consistent income and high‑quality duration. As of the end of March 2024, the average yield in global investment‑grade corporate bonds was around 4.88%—which is well above the average level of 2.94% observed in the last decade.1 This is competitive in absolute terms and relative terms as it offers a yield pickup over traditional government bonds. Compared with other credit segments, yields in investment‑grade corporate bonds are typically lower, however. This reflects lower risk, as companies in this space have a minimum credit rating of BBB‑. In all, the attributes of this credit sector suit an investor seeking stable income but with a lower tolerance for risk.

Within investment‑grade credit, investors can target a particular region, such as the U.S. or Europe, or cast the net wider with a global investment‑grade approach. For investors looking for a sustainability lens, impact bonds are issued by companies and governments to help finance projects seeking to generate positive environmental and/or social impact alongside a financial return.

2. High yield corporate bonds

A long‑term allocation to high yield offers potential income generation from higher coupons and higher distributing yields. The main source of total return in the high yield bond market is from coupon payments, and current levels are attractive particularly if the fundamental environment remains supportive and risk premiums remain stable. As of the end of March 2024, the average yield in global high yield corporate bonds was around 7.63%—which is near multiyear highs.2 That said, the risks are higher than investment‑grade bonds, so investors need to balance the higher yield on offer with their tolerance for risk. Defaults are currently low but expected to rise this year, so individual credit research is essential to help identify companies with elevated risks.

Similar to investment grade, there are options to focus on a particular region’s high yield attributes, including the mature U.S. market. Alternatively, there is Europe. Here the market is younger, with potentially greater opportunities for price and information discovery through prudent research and active management. Global approaches are another option to capture the attractive high yield opportunities worldwide.

3. Emerging markets debt

Emerging markets (EM) debt offers attractive return potential and growth opportunities. This multi‑trillion‑dollar market covers more than 700 companies, 80 countries, and 30 currencies. It is vast, with potential to diversify opportunities uncorrelated to the global cycle.

Progress on bringing down inflation means EM central banks are leading developed markets in this turn of the interest rate cycle. There have already been a number of interest rate cuts in EM this year. In all, EM currently offers an attractive yield premium over developed markets, but the credit risks are higher and must be actively monitored.

EM corporate bonds are typically the most defensive way for investors to access EM return potential as the average credit rating of companies is BBB‑.3 Meanwhile, EM local debt offers the potential to diversify and invest in different interest rate cycles. EM hard currency sovereign bonds, meanwhile, feature a wide range of markets, including higher‑yielding frontier markets. A flexible EM portfolio, alternatively, can typically invest across the full range of EM debt asset classes.

4. Securitized

Securitized credit offers the potential for competitive yields and is typically less sensitive to interest rate changes due to its generally shorter‑duration profile when compared with sovereign or corporate bonds. Securitization is a process in which cash flow‑producing financial assets—such as mortgages, auto loans, or credit cards—are pooled and repackaged. The resulting securities are sold to investors.

The universe of securitized credit is vast, ranging from commercial mortgage‑backed securities (CMBS) that are backed by loans on assets such as shopping malls, office buildings, and warehouses to asset‑backed securities (ABS) that are backed largely by consumer credit, including credit cards, student loans, and auto loans. Securitized credits also span the credit rating segment. The wide‑ranging asset class offers diversification possibilities but also requires careful research. Despite low default rates in aggregate, performance among subsectors and individual credits can have significantly different results.

5. Multi‑asset credit

A multi‑asset credit solution offers the potential for attractive income and diversified returns. Such solutions invest across a variety of credit sectors and can include investment grade, high yield, emerging markets, securitized, and bank loans. This broad reach creates the potential to diversify alpha sources and mitigate volatility. This can be appealing for those seeking yield and lower volatility compared with risk markets, such as equity.

In all, credit markets offer a wide range of opportunities, from generating income to capital appreciation or a combination of the two. It’s vital to choose an approach that prioritizes research, particularly in the current environment of tight credit spreads and heightened geopolitical risks. This can help instill confidence in credit investing and empower investors to take potential advantage of the attractive all‑in yields that are available.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2024 / INVESTMENT INSIGHTS

June 2024 / INVESTMENT INSIGHTS