From the Field

- Five reasons muni bonds offer opportunity in evolving markets

- Key Insights

-

- Rates increased to pre-global financial crisis levels, leading to generally attractive yields and improved value in the market.

- Because they’re generally exempt from federal income tax, munis offer tax-focused investors a compelling fixed income option, particularly at these higher yield levels.

- With a history of low defaults and higher credit quality than other fixed income asset classes, demand for munis has improved amid bouts of volatility.

Many investors turn to municipal bonds to add diversification to their portfolio, provide a source of income, and minimize state and federal tax liability. Municipal bonds have also proved resilient in past periods of economic turmoil and should remain a compelling fixed income option for investors.

1. Level of rates

To combat inflation and slow economic growth, the U.S. Federal Reserve (Fed) began raising the federal funds target rate in 2022, and this continued through July 2023. As a result, rates have increased to pre-global financial crisis1 levels. With this higher-for-longer narrative, the yield generated by municipal bonds, in our opinion, will remain attractive (Fig. 1).

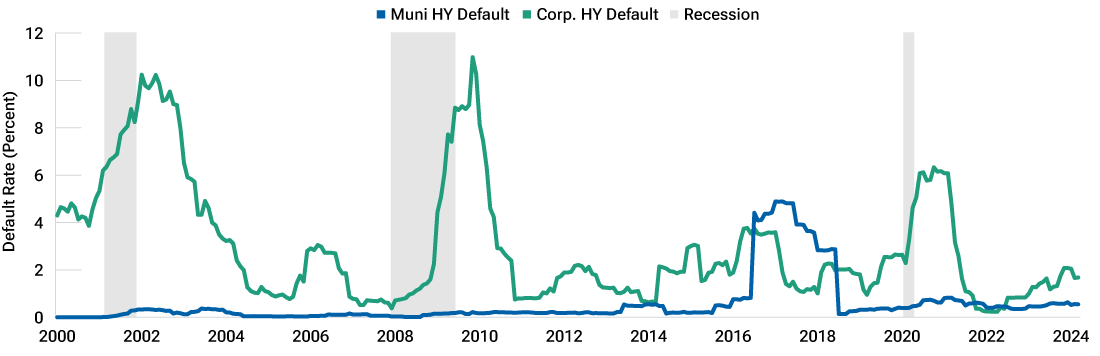

2. Credit quality remains strong

The credit quality of municipal bonds historically has been strong relative to most other fixed income segments with credit risk, and this appears to hold true for 2024 (Fig. 2). Our team remains confident in the overall enduring credit quality of municipal obligors for two primary reasons:

Better fiscal management post-global financial crisis. Since the global financial crisis, states and local municipalities appear to have implemented more fiscally responsible policies. Many states built their reserves via growth in tax revenues and federal aid. These efforts have helped rebuild the trust of investors in the ability of municipal issuers to remain stable and financially healthy. This trust in credit quality should play an integral role in supporting the long-term performance of municipal bonds.

Coronavirus pandemic funds strengthened many municipal bond issuers. Pandemic‑era funding bolstered states, local municipalities, and many related municipal debt issuers, such as hospitals and airports. Many local governments used the money responsibly to shore up important government‑funded programs like state pensions and school systems. Many other municipal issuers have also seen balance sheet improvements due to pandemic-era funding.

Attractive yields vs. history

(Fig. 1) The long-term municipal bond index yield is above the 20-year average yield to worst

From April 1, 2004, to April 30, 2024

Source: Bloomberg Index Services Limited. Past performance cannot guarantee future results.

Index shown is the Bloomberg Municipal Bond Index. For illustrative purposes only. Investors cannot invest directly in an index.

Yield to worst (YTW) represents the minimum yield an investor could receive on a bond, assuming the issuer does not default.

In 2024, governments and other municipal issuers have continued to benefit from the infusion of funding experienced during the onset of the pandemic. This puts a number of muni bond issuers in better fiscal positions than before the pandemic.

3. Tax-advantaged income for investors

In nearly every economic environment, taxes consistently have been a top concern for investors. Due to their preferential tax treatment, municipal bonds have the power to be one of the most impactful tools in building a tax-efficient portfolio.

When moving taxable bond allocations into municipal bonds, investors should consider the tax benefits of munis and how those may result in higher after-tax yield potential (Fig. 3). Taxable bonds, such as corporate bonds, may have a higher pretax yield than a muni bond, but it’s important for investors to consider the tax obligations of that bond. Only after accounting for taxes on the taxable bond can investors accurately compare its yield with that on a tax-exempt bond.

Default rate of high yield muni bonds has remained lower than corporate bonds

(Fig. 2) Muni high yield (HY) default (%) vs. corporate high yield default %

From January 31, 2000, through March 31, 2024. Muni data are as of April 1, 2024.

Sources: Bloomberg Finance L.P. and J.P. Morgan. See Additional Disclosures.

The default rate is the percentage of issuers that did not make scheduled payments of interest or principal.

The Muni High Yield Default is based on the Bloomberg Muni High Yield Index. The Corporate High Yield Default is based on research conducted by J.P. Morgan.

Tax impact on bond yields

(Fig. 3) Taxable equivalent yield (TEY) of various municipal bonds

As of April 30, 2024.

Source: Bloomberg Finance L.P.

The credit ratings are based on methodology of Bloomberg using S&P and Moody’s ratings. A rating of “AAA” represents the highest-rated investment-grade rating, and a rating of “A” represents the second-lowest investment-grade rating. Investors cannot invest directly in an index.

Yield shown in yield to worst. Yields are subject to change.

To calculate a municipal bond’s taxable equivalent yield, divide the yield by the quantity of 1.00, minus the federal tax rate, expressed as a decimal.

TEY assumes a 40% tax rate.

Our current view is that taxes are likely going to stay where they are or possibly increase based on the federal deficit.

4. Potential lower rates ahead

While we believe rates will likely stay higher for longer, we do believe we are close to the top of the rate cycle. Going forward, while we are not predicting the timing, it is likely we will see rates come down. Whenever the Fed begins cutting rates, municipal bonds could provide additional price appreciation as rates decline (bond yields and prices move in opposite directions). We view the yield as the base for returns in fixed income, but in this scenario, an investor could see price appreciation on top of the yield.

“History indicates a favorable outlook for municipal bonds as the Fed takes action in 2024.”

Dawn Mueller, Portfolio Specialist

History indicates a favorable outlook for municipal bonds as the Fed takes action in 2024.

5. Pockets of opportunity

Investors seeking exposure to municipal bonds can diversify within the asset class by geography, maturity, coupon level, and issuer (state, city, county). Additionally, by using a disciplined investment process, investors can take advantage of weakness in the markets to add to attractive investments at cheaper prices.

- Revenue bonds are secured by the revenue of the project behind it. Examples of projects backed by revenue bonds include toll roads, not-for-profit hospitals, and airports. These bonds generally offer higher incremental yields than general obligation (GO) bonds, and they tend to be lower rated. Revenue bonds can be further diversified by sector. While credit ratings tend to be lower in revenue bonds than GOs, we believe that conducting underlying research to help select the right bonds can provide additional risk-adjusted yields in portfolios.

- GO bonds are unsecured and backed by the issuing jurisdiction. An example of a project backed by a GO bond is a bike lane. GO bonds tend to trade at richer valuations and lower yield profiles.

The market continues to show volatility amid persistent inflation, a U.S. election cycle, and expected Fed easing. While we believe munis can play a key role in a diversified portfolio, an active approach is necessary to navigate shifting conditions ahead.

Get insights from our experts.

Subscribe to get email updates including article recommendations relating to global fixed income.

1The global financial crisis occurred between mid-2007 and early 2009.

Additional Disclosures

“Bloomberg®” and Bloomberg Indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend this product. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to this product.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2024, J.P. Morgan Chase & Co. All rights reserved.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of July 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements made.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Fixed‑income securities are subject to credit risk, liquidity risk, call risk, and interest‑rate risk. As interest rates rise, bond prices generally fall. Investments in high‑yield bonds involve greater risk of price volatility, illiquidity, and default than higher‑rated debt securities. Income from municipal bonds may be subject to state and local taxes and the federal alternative minimum tax (AMT). Diversification cannot assure a profit or protect against loss in a declining market. All charts and tables are shown for illustrative purposes only.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions which will reduce returns.

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2024 T. Rowe Price. All Rights Reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202408-3763931