Technology Disrupted

Generative AI: Reshaping investment landscapes

The surge of conversations surrounding artificial intelligence (AI), especially within Silicon Valley’s executive circles, has been impossible to ignore. During our Investment Division’s recent visits to Silicon Valley for their annual Tech Tours, one headline dominated: AI has hit a tipping point and stands poised to revolutionize the market landscape.

The new arms race in the technology sector

Time will tell, but November 30, 2022, could potentially mark a moment as significant in tech history as Steve Jobs’ unveiling of the iPhone in 2007. This pivotal day witnessed the launch of ChatGPT by OpenAI, a San Francisco-based company. ChatGPT quickly gained global attention, thanks to its utilization of natural language processing and generative algorithms. These AI components enabled ChatGPT to gather information from the web, contextualize it within ongoing conversations, and reorganize it to provide responses—a leap beyond previous AI capabilities focused on aiding human comprehension.

ChatGPT’s rapid adoption was unprecedented; within a week of its November 30, 2022 launch, it amassed over 1 million users, and within two months, it reportedly reached 100 million users, outpacing the growth rates of other popular applications like Instagram.

Dom Rizzo, portfolio manager, observed that major tech companies were caught off guard by ChatGPT’s overwhelming consumer response. This triggered what he referred to as an “arms race” among these companies to acquire and refine AI capabilities.

AI: The art of asking the right questions

With Portfolio Manager Dom Rizzo

The core innovations driving generative AI

Our managers have been intensely curious about the potential impacts of AI. And they have closely monitored and invested in several critical innovations crucial for building ChatGPT and other foundational models. These include cloud computing and the accumulation of sheer computing power enabled by ever‑faster chips and processors. Importantly, it also reflects the development of the industry’s “platform” structure, in which companies allow outside developers to build new applications on top of their intellectual property.

Moreover, it’s believed that an array of companies, irrespective of size, stand to benefit from AI application development. AI’s future landscape might comprise a small set of massive foundation models sitting between many more specialized AI models and user interfaces.

“…an array of companies, irrespective of size, stand to benefit from AI application development.”

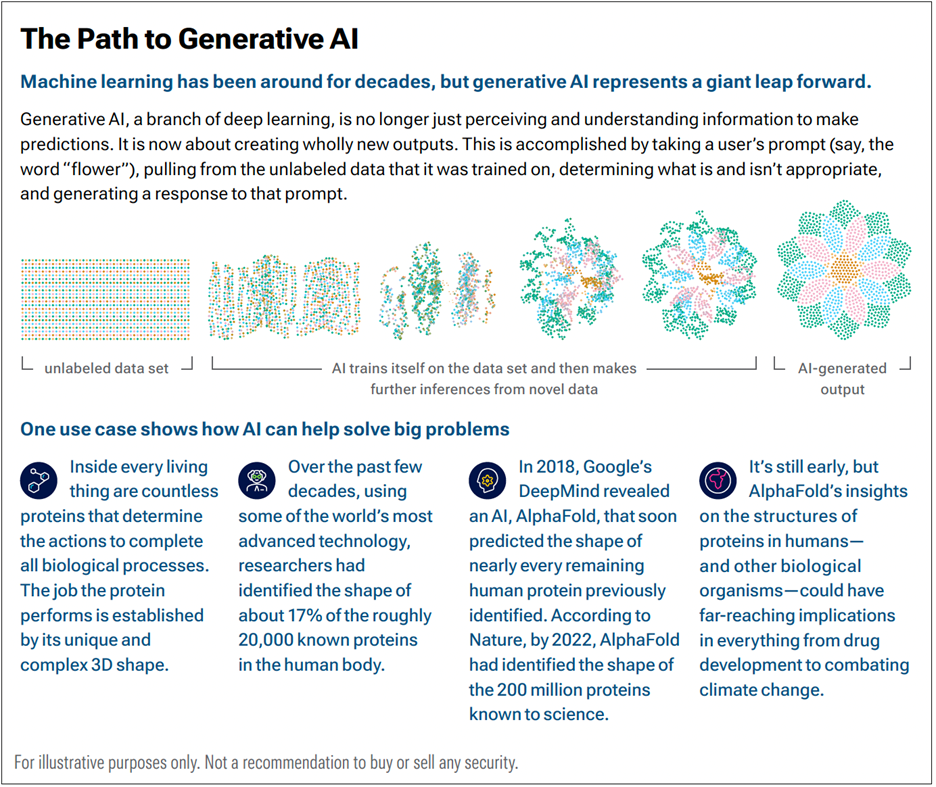

Generative AI’s evolution signifies a shift from mere perception and understanding of data towards the creation of entirely new outputs. This achievement involves analyzing user prompts, retrieving relevant information from its training data, discerning appropriateness, and generating responses—a major leap in machine learning capabilities.

Exploring problem-solving potential

AI’s journey toward generative capabilities finds roots in its deep learning through neural networks, exemplified by DeepMind’s AlphaZero mastering the complex game of “Go” in 2018 by playing millions of games against itself. This marked a significant milestone in machine learning’s advancement.

Machine learning dates back to the ‘50s, while Deep Blue’s victory against chess grandmaster Garry Kasparov in 1997 showcased early machine learning progress. However, these systems relied on substantial human guidance and were designed for specific purposes.

Giants leading the charge in development

Tech giants have made substantial strides in advancing AI’s foundational models. However, the massive costs associated with developing and operating AI applications have soared due to their growing complexity. For instance, training these models incurs significant expenses, with one estimation suggesting OpenAI spends a penny per 30-word answer generated by ChatGPT—a seemingly small sum that adds up quickly when the system has high volumes of users.

Additionally, the escalating expenses of inferencing, or running the model to process user queries, are anticipated to outweigh model training costs in the future, setting AI apart from traditional software models. While this rapid scaling benefits larger corporations, it poses significant financial burdens. Companies like Alphabet, Microsoft, Meta and Amazon may need substantial investments to sustain their AI competitiveness.

Alphabet’s supremacy and potential challenges

Alphabet, despite its innovative AI efforts, faced market scrutiny post-ChatGPT’s launch, partly due to concerns about potential competition for Google’s search dominance.

However, there are signs that Google is adapting by incorporating advanced AI capabilities into its search engine and other products, while leveraging its extensive user base and distribution advantage.

Nevertheless, questions persist regarding the monetization and cost implications of implementing compute-intensive large language models for AI-generated responses. Adapting advertising models while balancing increased cost burdens remains a challenge for Google.

Microsoft’s AI integration and role in AI advancement

Microsoft’s partnership with OpenAI has propelled its strides in AI, integrating chatbots into its Bing search engine and Office suite. CEO Satya Nadella plans to further integrate OpenAI into Microsoft’s software ecosystem. These moves, coupled with Microsoft’s AI history, position it as a formidable player in the AI race.

Investing in the linchpins

As the AI landscape evolves, Rizzo focuses on companies pivotal to AI development, particularly those providing indispensable tools. He compares them to suppliers during the California gold rush, poised to benefit from the AI spending surge.

He highlights semiconductor companies like NVIDIA and AMD as linchpins due to their crucial role in developing AI-powered systems. NVIDIA, renowned for its GPUs initially designed for gaming, has become a leader in AI development. Its parallel processing capability significantly contributes to building complex neural networks essential for rapid data querying.

Furthermore, Advanced Micro Devices (AMD) stands out for its innovative MI300 chip, combining the strengths of both CPUs and GPUs. This breakthrough holds immense promise for advancing AI capabilities.

What makes a company an AI linchpin?

1. Having a technology that is mission critical to the business customer or makes an individual user’s life dramatically better.

2. If the company vanished tomorrow, everyone would notice—and it would matter.

The expanding role of AI in chip technology

AI’s growing demands in computing resources have significantly impacted the chip industry, with AI servers consuming more DRAM and storage than traditional servers. Companies like Taiwan Semiconductor Manufacturing Corporation (TSMC) play a pivotal role in creating smaller process nodes crucial for fitting more transistors on chips. ASML Holding’s extreme ultraviolet (EUV) lithography machines have been instrumental in TSMC’s advancements.

Synopsys, a leader in chip design technology, harnesses AI to design faster and more energy-efficient chips, adding another layer to the complex AI-chip relationship.

Disruption spreads beyond tech

AI’s impact extends far beyond the tech industry, disrupting conventional paradigms. Tools like ChatGPT expedite code writing, potentially creating a new breed of highly productive software developers. This might reduce barriers to software development and alter innovation rates in the industry.

“AI’s impact extends far beyond the tech industry, disrupting conventional paradigms.”

Healthcare has witnessed transformative AI advancements, notably Google’s DeepMind predicting the three-dimensional structure of almost all human proteins. This breakthrough has immense potential in drug development and genomic research, offering insights into disease mechanisms and potential treatments.

Our ongoing analysis

T. Rowe Price’s analysts and managers are actively exploring AI’s implications across various sectors, asking smart questions to get the right answers about this emerging space. The unprecedented pace of AI’s evolution presents uncertainties but also immense opportunities.

The unfolding revolution in AI holds tremendous promise while demanding astute observation, curiosity, and adaptability from investors and industries alike.

You might be interested in

How does AI enhance our investment processes?

AI is transforming the way we work—deepening our insights, sharpening our human decision-making, and creating efficiencies.

Could that plane take us to an FDI boom?

A simple observation on a runway in Belgrade. And a T. Rowe Price analyst’s instinct to dig deeper. Learn how it can help our clients get ahead.

Partner with us?

Contact us

For further information or to arrange a meeting please contact the Relationship Management Team.

Sign in to T. Rowe Price

Sign-in to receive monthly factsheets and a more tailored experience to suit your needs

Not registered yet? Register now

The specific securities identified and described are for informational purposes only and do not represent recommendations.

General Portfolio Risks:

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Environment, social and governance (“ESG”) and sustainability (“SU”) risk—Due to environmental changes, shifting societal views, and an evolving regulatory landscape related to sustainability issues, the earnings and/or profitability of companies that a portfolio invests in may be impacted.

Equity risk—In general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.