July 2024 / INVESTMENT INSIGHTS

Stabilizing China’s housing market is a work in progress

We view China’s latest housing market support plan as a step in the right direction

Key insights

- We view China’s latest housing market support plan as a step in the right direction, although we think gaps in sizing and design specifications remain.

- In our view, further rounds of policy action may be needed to backstop the housing market.

- We believe additional policy support and ongoing attrition in housing supply may help the housing market stabilize at a low equilibrium over the next six to 12 months.

China recently unveiled a housing market support plan that differs from previous efforts as it looks to tackle supply challenges by reducing inventory, rather than just focusing on stabilizing demand. While we view the new plan as a step in the right direction, we believe there are still gaps in its sizing and design specifications. This suggests that the latest program will likely produce modest results.

Getting on the right track

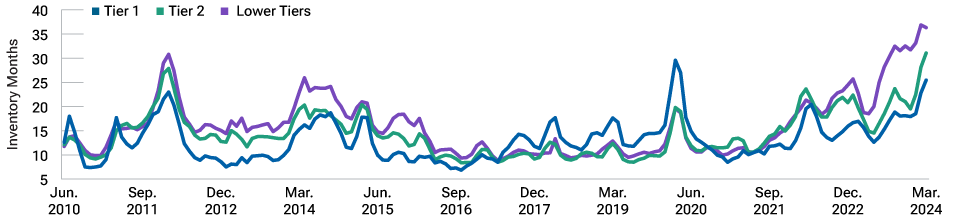

The authorities are aiming to stabilize a sector that had previously built up unsustainable levels of activity but has now overshot to the downside. Across higher‑ and lower‑tier cities, housing inventory measured by months of sales has risen in the past two years (Figure 1).

Housing inventory on the climb

(Fig. 1) Inventory months by city tier

June 2010–March 2024.

Sources: CRIC and UBS Research.

Beijing appears committed to achieving this aim while minimizing spending and maintaining some financial discipline over the property developers and local governments that previously rode on the property market boom. In effect, the authorities look keen to shift real resources out of housing and toward manufacturing, which means they do not want to reignite the property market or pump significant fiscal support into it. It is a tough balancing act.

As a result, rescue efforts have consistently looked underscaled and will likely remain so. Ultimately, we expect an iterative process whereby the authorities are pushed to slowly add resources to backstop the housing market. This, combined with ongoing attrition in housing supply, may see the market stabilize at a low equilibrium over the next six to 12 months.

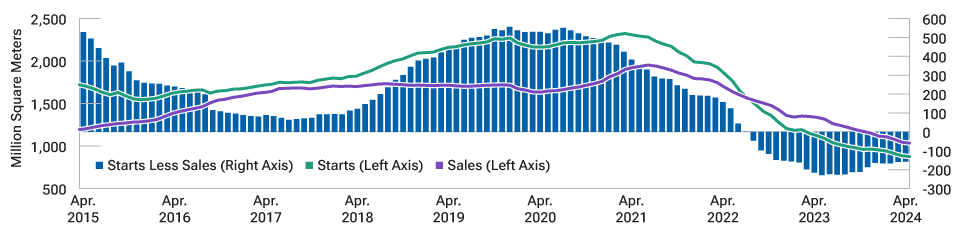

Underbuilding and rebalancing in the market is underway—both housing starts and sales have dropped, with starts falling faster than sales (Figure 2).

China’s residential property activity adjusts

(Fig. 2) Housing starts versus sales (12‑month rolling basis)

April 2015–April 2024.

Source: China National Bureau of Statistics/Haver Analytics, analysis by T. Rowe Price.

A plan with caveats

We expect the latest support plan to underwhelm, which will likely require further rounds of policy action. Three broad reasons underpin our view.

First, officials have tried demand‑side approaches such as mortgage rate cuts before, which generated only short‑term results that quickly faded. We believe mortgage rates are not the key factor curbing demand, so incremental easing will likely have limited effect. Rather, a loss of confidence in developers’ ability to deliver units and low income growth are the more commonly cited factors.

Furthermore, banks’ net interest margins have been under pressure, and they may be reluctant to lower mortgage rates further without a corresponding reduction to their cost of funds. This is particularly so as mortgages tend to be among their more profitable businesses.

Also notable is how the nationwide mortgage rate floor has effectively become less binding recently. More than half of the top 70 cities already qualify for an easing of the floor after experiencing three consecutive months of housing price declines.

Second, the RMB 300 billion PBOC facility appears subscale compared with the size of the housing market challenge. Estimates suggest that a credible inventory clearance plan would likely cost at least RMB 1 trillion, and more likely around RMB 2 trillion to RMB 3 trillion, to be entirely convincing.

We note that the RMB 300 billion facility folds in an existing program worth RMB 100 billion. The government has said that it expects the RMB 300 billion facility to catalyze RMB 500 billion in new lending. If fully utilized, the program may clear an estimated 5% to 10% of inventory, depending on the housing prices involved.

Third, we see other design specifications of the program implying low initial take‑up. The government’s announcements placed emphasis on encouraging banks and local governments to participate, rather than setting inventory clearance as a clear key performance indicator. However, the economic incentives for local governments and SOEs look uncompelling given the low to zero margins between rental yields (around 1.5% to 2.0% by estimates) and the 1.75% PBOC facility rate. On the sellers’ side, developers will likely balk at crystallizing losses at the deep discounts that are likely needed to facilitate the transactions.

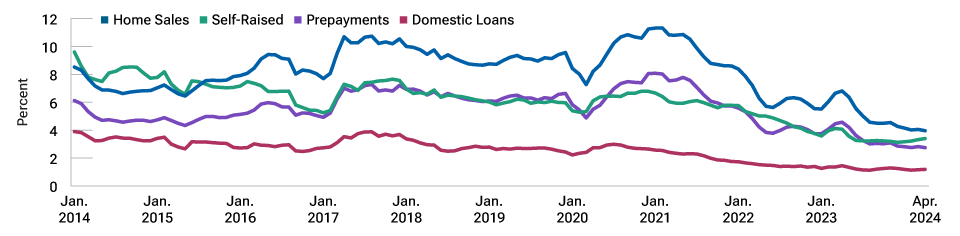

We also expect banks to remain conservative in lending to buyers or projects as they will still be responsible for any losses. To date, this has been a material factor behind their reluctance to provide new lending. Despite the authorities’ multiple efforts to encourage banks to lend to developers, loans to them have fallen, along with other sources of funding (Figure 3).

Developers under funding stress

(Fig. 3) Funding from home sales, self‑raised sources, prepayments, and domestic loans (three‑month percentage of gross domestic product (GDP))

January 2014–April 2024.

Source: China National Bureau of Statistics/Haver Analytics, analysis by T. Rowe Price.

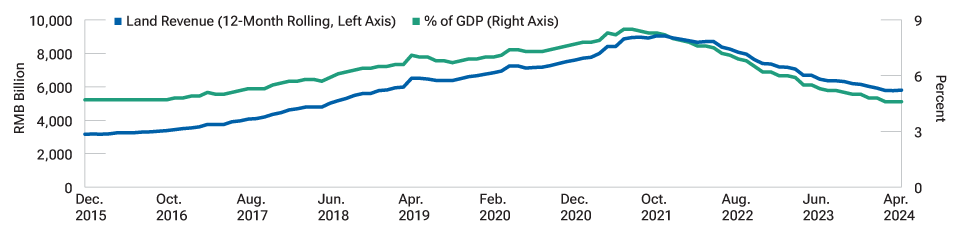

In our view, the land buyback program may similarly see limited usage. Local governments historically relied on land sales as a significant source of financing and have struggled with the drying up of these revenues in recent years (Figure 4). They appear challenged in mobilizing the resources to buy back land at par value.

Local government finances constrained

(Fig. 4) Local government funds—land revenue

December 2015–April 2024.

Source: China Ministry of Finance/Haver Analytics, analysis by T. Rowe Price.

Surveying the macroeconomic implications

We believe property prices will remain under downward pressure for now. When the issues around the program’s sizing, design, and inventory purchase prices are resolved, property prices may begin to stabilize. Home prices finding a floor—even at deep discounts—can potentially mark an important phase in the housing market slump and help consumer confidence to gradually recover from currently depressed levels.

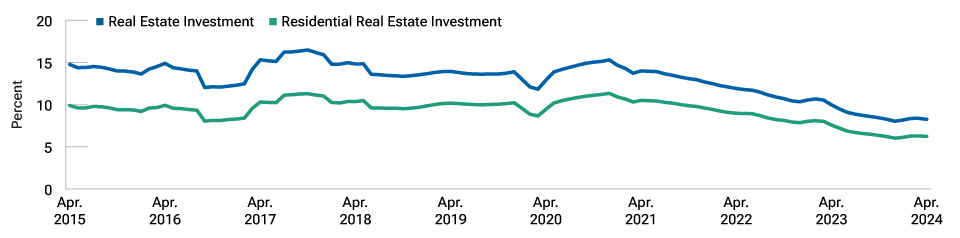

We also expect China’s housing sector to become permanently smaller. Investment in residential real estate as a percentage of gross domestic product has fallen sharply in recent times (Figure 5). That said, it remains higher than average levels in developed markets, and we think China is still building a large volume of homes when it is likely to see declining demographic demand over the long term. We believe the market may need three to six years of underbuilding to return to balance.

China’s shrinking housing market

(Fig. 5) Total and residential real estate investment (three‑month percentage of gross domestic product)

April 2015–April 2024.

Source: China National Bureau of Statistics/Haver Analytics, analysis by T. Rowe Price.

In addition, we foresee a continued reduction in construction demand. Using inventory to meet affordable housing goals should mean less pressure on local governments to build new affordable housing from scratch. Accordingly, the construction industry will likely shrink as a relative share of the economy, which points to lower demand for commodities and building materials from this sector in China.

What are the potential implications for various asset classes? Hypothetically, a plan that successfully underwrites the completion of properties and resolves the inventory overhang should be bullish for risk assets and negative for Chinese government bonds. Disappointing execution should mean the opposite. In our view, the current situation may be an intermediate outcome, with an underwhelming plan offset by a signaling effect indicating that more rescue efforts may be on the table. The expectation of further policy support will likely contain the downside for risk assets and limit any sell‑off in Chinese government bonds.

Looking ahead

The program’s immediate ambition looks to be a reduction in housing inventory, potentially from around 30 months of sales on average to a historic norm in the mid‑teens. Even then, we think this is probably only some way toward full market stabilization, as housing previously bought for investment purposes also returns to the market. We believe Beijing will need to inject incremental resources and tweak the program’s design specifications until it can sufficiently reduce inventory.

More broadly, clearing inventory does not fully resolve the challenge of uncompleted homes. We think the most significant government action that may restore market confidence is to underwrite all unbuilt homes. With local governments cash‑constrained, leveraging the central government and the PBOC’s balance sheets would likely be required to get to a credible financing amount.

In general, we think the plan still leaves much to the discretion of various parties to make use of the facilities on offer. For households, the government appears focused on enticing them to deploy their savings to start purchasing homes. We view the relaxation on second home purchases as a soft signal that buying for investment will be acceptable again. For now, it is unclear if households would be convinced, or if they would want to see the government pumping more support into the sector before taking action.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.