personal finance | august 19, 2024

How to help protect your investment portfolio during stock market volatility

Consider these five ways to be better prepared during periods of stock market volatility.

2:10

Key Insights

Thoughtful planning can help investors feel more secure in times of stock market volatility.

Investors can’t control the stock market, but they can control how they prepare and react, no matter their circumstances.

An investor should evaluate their options, knowing that they may need to be more flexible about their plans should the stock market turn.

Judith Ward, CFP®

Thought Leadership Director

Stock market volatility may be caused by numerous factors. Economic uncertainty, inflation, geopolitical conflict, and even a natural disaster have all caused the markets to fluctuate. When market volatility occurs, it can lead to sharp, sudden increases or decreases in value.

Making impulsive investment decisions amid market volatility is not a recipe for success. Instead, planning ahead, being a patient investor, and considering smaller adjustments along the way can help keep your financial goals on track. During times of stock market volatility, it’s important to focus on the things that can be controlled.

Here are five of them:

1. Maintain a long-term perspective

When investing for longer-term goals, understand that whatever is happening in the headlines may not be happening in your account—especially if you have an investment portfolio that is more diversified than a general stock market index.

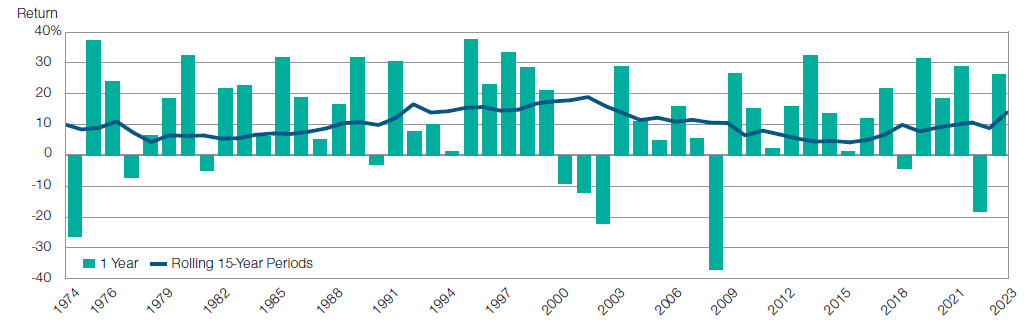

Time smooths out market fluctuations, which can help investors put many concerns into context. For instance, the S&P 500 Index has experienced double-digit annual losses in five of the last 50 years (12/31/73–12/31/23). While one-year returns may fluctuate dramatically, over any cumulative rolling five-year period during that time, the S&P 500 has only experienced double-digit losses three times: the five-year periods ended 1974, 2004, and 2008.

And stocks have never lost ground, double-digit or otherwise, in any rolling 15-calendar year period over the last 50 years. (See “Look at the stock market through a 15-year lens.”) Therefore, for a long-term goal, investors can feel more confident holding on to stocks during periods of market volatility, even if they experience short-term declines. (Past performance cannot guarantee future results. It is not possible to invest directly in an index.)

What can a free consultation do for you?

Speak with a consultant to identify your goals, review your portfolio, and make sure you're on track for the future you've imagined.

Our financial experts are here for you.

Look at the stock market through a 15-year lens

(Fig. 1) Remaining invested through downturns and corrections may allow investors to take advantage of long-term growth potential.

Sources: T. Rowe Price, created with Zephyr StyleADVISOR, and S&P. See Additional Disclosure on last page. Price return calculations include dividends and capital gains. Annual returns began in calendar year 1974. Rolling 15-calendar year annualized returns began calendar year 1960.

Past performance cannot guarantee future results. It is not possible to invest directly in an index. Chart is for illustrative purposes only.

2. Reassess asset allocation to reduce investment risk

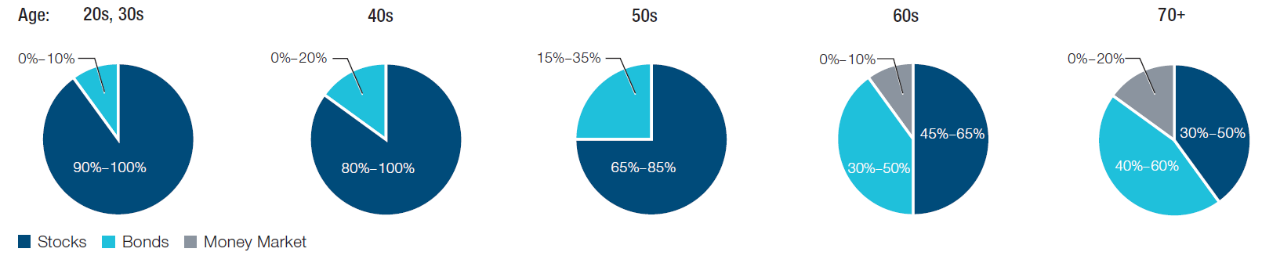

Investors may not be able to control the markets, but they can control their asset allocation. Stocks have the most growth potential over the long term, but they are also more affected by short-term market volatility. When investors are in their 20s, 30s, or even 40s, they have time on their side, which will allow them to withstand and bounce back from volatility. An investment portfolio that’s 80% to 100% stocks could be reasonable. As investors get closer to retirement, they should start to introduce more bonds into the mix. Generally, bonds have provided a buffer to dampen short-term market fluctuations and historical volatility, resulting in a more balanced investment approach.

The key consideration when determining an asset allocation is how an individual’s investment mix will impact their lifestyle in the near term. Some people may feel the need to take some kind of action following a stock market downturn. But if you have an asset allocation appropriate for your time horizon, the best action may be to be patient.

One way to assess an investor’s current allocations is for them to ask themselves: If my investment portfolio value dropped significantly today, would it impact my current lifestyle? The answer to this question can help investors put together an appropriate asset allocation for their circumstances. For example, for those with many years until retirement, that answer may be “no.” For those closer to or in retirement, a significant drop could be concerning, and they might need to pull back on stocks and add bonds to their investment portfolio.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

3. Adjust saving and spending amid stock volatility

Another factor investors can control is how much they’re saving and spending. In the earlier stages of saving for retirement, a stock market downturn can be their friend, and they should continue investing as much as they’re able since they’re buying shares at lower prices. This may require some discipline and patience, however, as historically, it has taken three to five years for stocks to recover from a bear market, for example. Automating contributions can help investors keep their savings on track by reducing the likelihood that they’ll make sudden changes in response to stock market conditions.

If an investor is planning to retire soon or is already in retirement, their spending is a powerful lever that can help them weather a down stock market. Small spending adjustments could garner a large payoff. Investors should assess their budget and determine where they might be able to cut expenses or put off larger purchases if the markets take a turn.

Sample asset allocations by age

In evaluating equity exposure, consider other assets, income, and investments (e.g., equity in a home, Social Security benefits, individual retirement plan investments, savings accounts, and interests in other qualified and nonqualified plans) in addition to interests in a particular plan or yes individual retirement account (IRA).

These allocations are age-based only and do not take risk tolerance into account. Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed retirement age of 65 and a withdrawal horizon of 30 years. The model asset allocations are based upon analysis that seeks to balance long-term return potential with anticipated short-term volatility. The model reflects our view of appropriate levels of trade-off between potential return and short-term volatility for investors of certain ages or time frames. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash.

Limitations: While the asset allocation models have been designed with reasonable assumptions and methods, the models are based on the needs of hypothetical investors only and has certain limitations: The models do not take into account individual circumstances or preferences, and the models may not align with your accumulation time frame, withdrawal horizon, or view of the appropriate levels of trade-off between potential return and short-term volatility. Investing consistent with a model allocation does not protect against losses or guarantee future results. Please be sure to take other assets, income, and investments into consideration. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

4. Create a cash contingency

Another thing investors might want to consider is the idea of a contingency—starting to build up some money on the side.

You can’t predict future volatility levels of the market, and investments may be impacted at any time by events and factors that are out of your control. Having a cash contingency can help you avoid making impulsive or shortsighted decisions during periods of volatility. For those in the workforce, we typically suggest an amount that’s equal to three to six months of your expenses. Think of it as a personal safety net. Should an investor lose their job or come upon unbudgeted expenses, they won’t have to raid their retirement savings or rack up credit card debt to make ends meet.

For retirees, a cash contingency could be used as an alternative to fund living expenses if there is an extended down stock market. Investors can draw from this account instead of having to sell investments at an inopportune time, locking in a loss. Considering that a 60% stock/40% bond investment portfolio recovered within two years during the last two bear markets, it may be reasonable for retirees to have one to two years of living expenses in a contingent cash account.

5. Be flexible and prepared for future market volatility

It’s important for investors to consider all their options and think of ways in which they’re willing to be more flexible. Should the market turn but they’d planned to retire, could they continue to work for a couple more years? If newly retired, could they find part-time work to supplement their income? And if the market volatility were strong and sustained, leading to greater economic uncertainty, would they be prepared if they were to lose their job? For all these reasons, they should keep up with connections, continue to build a network, and refresh their résumé.

We might not know when market volatility may occur or how long a downturn may persist, but having a plan in place and being willing to make small adjustments can help investors maintain control.

Additional Disclosures

S&P — Copyright © 2024, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including atings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein.

Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

View investment professional background on FINRA's BrokerCheck.

202408-3773288

Next Steps

Learn why Purposeful Asset Allocation Is Key for Long-Term Success.

Contact a Financial Consultant at 1-800-401-1819.