retirement planning | june 3, 2024

Beyond savings: Why retirement lifestyle planning is important

Steps to help you connect the nonfinancial aspects of retirement to your financial planning.

1:45

Retirement planning goes far beyond finances.

While 74% of people plan financially for retirement, only 35% make a similar effort to plan emotionally for this major life change.

To complete your plan, you need to create your vision for retirement.

What kind of lifestyle do you picture?

Ask yourself, "How and when will I retire? Do I want to retire all at once or ease into it by working part-time?

Where will I live in retirement? Should I downsize? Do I want to move for better weather, a lower cost of living, or to be near friends and family?

How will I spend my time? What activities will bring fulfillment and meaning to my life: traveling, volunteering, pursuing hobbies, connecting with family, or something else?”

Make your retirement vision a reality.

You can take steps now to bring the future you envision to life.

Contact a T. Rowe Price financial consultant to talk about the retirement you imagine.

Key Insights

There is more to retirement planning than the purely financial factors.

Include nonfinancial aspects such as family and health care in your retirement plan.

Start by visualizing the who, what, when, where, and why of your retirement.

Connecting these items to your financial plan can help you make progress toward your goals.

Roger Young, CFP®

Thought Leadership Director

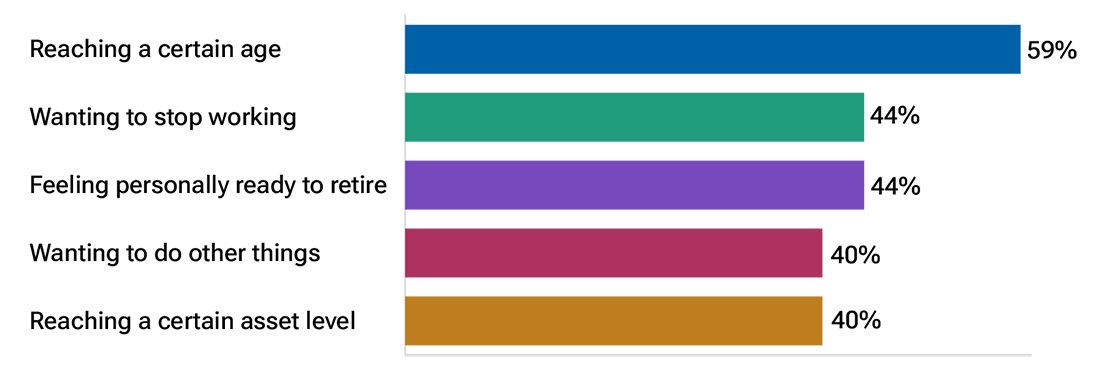

When planning for your retirement, there are various considerations in addition to how much you might be saving. Nonfinancial factors, like the lifestyle you want to live, will play a role, as will changes in your personal goals and priorities once you retire. Studies show that although 74% of preretirees make financial plans for retirement, only 35% prepare emotionally.1 Boost your overall financial well-being by building the nonfinancial aspects of your retirement lifestyle into your plan and determining how they could shape your choices for the future. Along these lines, research has shown that preretirees are generally more motivated to retire based on reaching a personal or emotional milestone rather than reaching a certain savings asset level (see Nonfinancial considerations influence retirement planning).

What can a free consultation do for you?

Speak with a consultant to identify your goals, review your portfolio, and make sure you're on track for the future you've imagined.

Our financial experts are here for you.

Why is retirement lifestyle important?

Overall, retirement lifestyle is important because it shapes your experience during a significant phase of life and influences your overall well-being, happiness, and sense of fulfillment. Key aspects could include:

Quality of Life: Retirement lifestyle directly impacts your quality of life during your golden years. It determines how you’ll spend your time, what activities you’ll engage in, and, ultimately, how happy and fulfilled you’ll feel.

Financial Security: Your retirement lifestyle should align with your financial resources. Planning for retirement involves ensuring you have enough savings or income streams to support your desired lifestyle without financial stress.

Health and Well-Being: Retirement lifestyle choices can significantly impact your health and well-being. Engaging in activities you enjoy, staying socially connected, and maintaining a healthy lifestyle can all contribute to a fulfilling retirement and better overall health.

Sense of Purpose: Many people find a sense of purpose and fulfillment in their work, and transitioning to retirement can sometimes lead to a loss of identity or purpose. Planning a retirement lifestyle that includes meaningful activities, hobbies, or volunteer work can help maintain a sense of purpose and satisfaction.

Family and Relationships: Retirement often provides more opportunities for spending time with family and cultivating relationships with friends and loved ones. Your retirement lifestyle can influence the quality and depth of these connections.

Personal Growth: Retirement can be a time for personal growth and exploration. Whether it’s pursuing new hobbies, traveling, or learning new skills, your retirement lifestyle can contribute to ongoing personal development and fulfillment.

...retirement lifestyle is important because it shapes your experience during a significant phase of life

...retirement lifestyle is important because it shapes your experience during a significant phase of life

Nonfinancial considerations influence retirement planning decisions

(Fig. 1) Preretirees are more likely to expect to retire after reaching a personal or emotional milestone rather than hitting a financial or career goal.

Source: Greenwald & Associates/The Diversified Services Group Retiree Insights 2018 Survey of Consumers Ages 50–59, as of August 2018.

What kind of lifestyle is going to suit you in your golden years?

Visualizing the future helps you create a realistic plan for your retirement. By articulating your vision—the who, what, when, where, and why—you can gain clarity about the retirement lifestyle that is best for you, as well as what may be involved in achieving your goals. Some considerations include:

Who will play a role in your retirement? Is your immediate and extended family nearby? Who will be part of your caretaking support team if you experience health issues? Think about the people you spend the most time with today and how that may change when you retire.

What do you want to do with your time? How do you spend your time today, and how might that change when you retire? What role, if any, will work play in your retirement? Work has become a larger part of people’s retirement lifestyle, both for financial reasons and for the nonfinancial benefits people receive from work, including social engagement.

When do you plan to retire based on your personal definition of retirement? What are the main factors influencing the timing of your retirement? Although it can be difficult to anticipate the right time to retire or what unexpected situations may arise, it’s helpful to set a goal of when you would like to retire.

Where will you live in retirement, and what are the main factors influencing that decision? Are you staying put or considering a move? As you develop your vision, consider whether you want to stay in your home, downsize, and/or relocate.

Why are you going to get out of bed every day in retirement? What provides you with the most fulfillment and meaning in your life today, and how might that change when you retire? You may thrive in retirement, and you may also find your sense of purpose challenged without your work. What will you do next?

Build a personalized action plan

The following steps may be helpful in determining how you’re going to implement your retirement plan:

Coordinate your vision with your spouse or partner. Don’t assume you have the same plan in mind if you haven’t explicitly discussed it. You may also want to involve your children and other family members since your plans can have an impact on their future as well as yours.

Talk about your potential health care needs in retirement. Identify the future care you may need based on your current health and family health history. Talk with family and friends you want on your caregiving and wellness support team about any potential long-term care arrangements, health care directives, and powers of attorney. Be aware that these can be difficult conversations. Planning ahead and understanding roles and responsibilities is important so that everyone knows what is expected.

Talk to your employer about their financial wellness services. More and more, employers recognize the importance of financial wellness in reducing employee financial stress and improving overall worker satisfaction. Investigate the post-career options your employer provides and how they may support your retirement vision.

Now connect these items to your financial plan

Planning for long-term financial success and well-being is an increasingly crucial component for successful retirement outcomes. Be sure to consider these financial aspects of retirement:

Assess your potential spending needs in retirement. Creating your vision for the lifestyle you want can help you understand potential spending needs in retirement. Will your retirement income support your spending needs? Work with your financial professional to determine whether your retirement saving strategy is sufficient to support your vision—which could include buying a second home, traveling, or pursuing a passion project. Be sure to give yourself time to make changes to your saving strategy or adjust your vision before you retire.

Educate yourself on Social Security benefits. It’s important to understand the different approaches for claiming Social Security benefits, including coordinating your claiming strategy with your spouse. Consider how long you each may want to work and what role work might play in your retirement lifestyle. It’s also wise to ensure your timing is aligned and can make the most of your benefits. For example, to maximize the benefit for a surviving spouse, the higher earner could wait until age 70 before claiming benefits. In addition, if you claim Social Security when you’re still working and before your full retirement age, you may incur affects you in the long run.

Learn your options for Medicare. Medicare is the primary health program for retirees, so it’s important to understand and carefully evaluate your options to determine which plans are best suited for your situation. Be sure to consider any underlying health conditions and the potential need for a separate long-term care policy. You can get more information about the options, including premium costs and out-of-pocket expenses, at Medicare.gov. You may also need to explore alternative health care coverage options, including the purchase of coverage through your state’s health care exchange, if you plan on retiring before age 65.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Age-related retirement milestones

(Fig. 2) Keep these important milestones in mind on your path to retirement.

| Age | Milestone |

|---|---|

| Age 59½ | You are now eligible for penalty-free retirement account distributions. Once you reach age 59½ the 10% early withdrawal penalty no longer applies. |

| Age 62-70 | You can start taking Social Security benefits at age 62, but you'll receive the maximum monthly benefit at age 70, with a reduction for each year taken before age 70. |

| Age 65 | You generally become eligible to receive Medicare at age 65 but can enroll either three months before or up to three moths after the month in which you turn age 65. |

| Age 73 | Generally, you must take your first required minimum distribution (RMD) from your tax-deferred retirement accounts by April 1 of the year after you turn age 73. For each year after turning age 73, you must take an RMD by December 31. |

Make your retirement vision a reality

Taking steps now to consider your vision of the future, as well as the financial and nonfinancial components of the years ahead, can help you reduce stress and gain peace of mind—all the better as you work toward your goals. It can take a couple of years for retirees to “settle in” to their new lifestyles, so be sure to give yourself that time.

Personalize your retirement journey

Preparing for and living in retirement is a dynamic journey unique to you. The T. Rowe Price Retirement Advisory Service™ expert advisors are dedicated to helping you achieve clarity and provide sound strategies personalized to your unique financial situation. They work with you to go beyond just the numbers to help ensure your savings today are aligned with your future goals and that living your retirement dreams is close at hand.

For select enrolled retirees and those about to retire, your advisor will leverage our innovative Income Solver™ tool, designed to provide personalized, holistic retirement income strategies, including coordinating Social Security and Medicare.

Explore the newest enhancements to Retirement Advisory Service.™

Know more. Claim more.

According to the Social Security Administration, over 70% of Americans aren’t taking full advantage of their benefits.1 By considering a more purposeful claiming strategy, you may increase your lifetime benefits and secure a more enhanced life in retirement. T. Rowe Price’s Social Security Optimizer analyzes your unique circumstances to help you identify the claiming strategy that works best for you. Learn more about your possible claiming strategies.

The information provided in the Social Security Optimizer tool is for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This tool allows you to explore hypothetical scenarios for claiming Social Security benefits. Results are intended as an aid, are not guaranteed, and should not be your only source of information when making financial decisions. Please consider your own circumstances before deciding which claiming strategy is appropriate, and seek independent legal, financial, and tax advice before making any decisions. Other T. Rowe Price educational tools or advice services may use different assumptions and methods and may yield different results.

1Social Security Administration. Social Security Administration Research, Statistics, and Policy Analysis. Table 6.B5 (n.d.). 2022.

1Retiree Insights 2018 Survey of Consumers Ages 50–59, Greenwald & Associates/The Diversified Services Group.

Important Information

The T. Rowe Price Retirement Advisory Service™ is a nondiscretionary financial planning service and retirement income planning service and a discretionary managed account program provided by T. Rowe Price Advisory Services, Inc., a registered investment adviser, under the Investment Advisers Act of 1940. Brokerage accounts for the Retirement Advisory Service are provided by T. Rowe Price Investment Services, Inc., member FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon company, member NYSE/FINRA/SIPC, which acts as a clearing broker for T. Rowe Price Investment Services, Inc. T. Rowe Price Advisory Services, Inc. and T. Rowe Price Investment Services, Inc. are affiliated companies.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

The views contained herein are those of the author as of April 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates. All investments are subject to market risk, including the possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202405-3581532

Next Steps

Explore all the ways we can help you reach your retirement goals.

Contact a Financial Consultant at 1-800-401-1819.