Three Benefits of Emerging Market Corporate Bonds

In a low-yield world, surprisingly few investors have an allocation to one of the most attractive high-yield bond sectors: emerging market (EM) corporates. We believe this will change as investors recognize three of the key benefits: a compelling risk-return trade-off, resilience in falling markets, and inefficiencies that can be a source of durable alpha for active managers.

1. The active opportunity in EM corporates

At a time when passive investing continues to gain market share, emerging market corporate bonds are an asset class that remains inefficient and under-researched enough to reward active security selection, potentially allowing active managers to add value consistently over time.

One source of active opportunity is lack of dedicated sponsorship. Of the roughly US$2.2 trillion EM corporate debt market, only about 5% is owned by dedicated investors—entities that specialize in this asset class and are benchmarked to the JPMorgan CEMBI indices. The rest is held by retail investors, crossover investors (e.g. investment-grade managers dipping into high-yield names to pick up additional yield) and other non-specialists. Non-specialist investors tend to be slower to identify and exploit mis-pricings or dislocations in the market. They can also be more sensitive and likely to sell in response to negative news flow, which may cause them to miss out on longer-term fundamental improvements.

A second source of opportunity is wide dispersion of valuations. For example: the marks in Display 1 show the yields at which new single B rated issues have come to market since 2016. The line in the chart shows the average yield on the B rated portion of the EM corporate index. The yields were widely dispersed, ranging from less than 4% to almost 14%, for a single rating category. This implies that being able to differentiate between good and bad credits is crucial to success in this asset class, and that managers need enough research resources to do so.

The third potential source of active advantage is the research demands of the asset class. Display 2 shows the number of new issuers coming to the EM corporate bond market since 2005—an average of around 70 new names a year for the high-yield segment alone. New issues often come up at short notice. Analysts typically have an underwriting period of three to five days to assess the industry, the management team, perhaps even a new country, and build an analytical model.

We believe one of our credit analysts’ advantages is being able to tap into our firm’s EM equity resources. For example, most EM companies issue shares well before they enter the bond markets, so although a company may be a new bond issuer, our EM equity team may have been covering it for decades.

Our EM credit analysts also sometimes draw on the expertise of our developed-market industry specialists, looking for parallels that can be applied in EM, identifying potential success factors or warning signals.

Having these research resources enables us to be highly selective—we only participate in 10% to 15% of new issues—and to have high conviction in the names we do decide to buy.

Display 1

Wide Dispersion of Valuations

Yields of B-Rated Emerging Market Corporate Bonds

As of 30 September 2019

The chart shows yield to maturity of B-rated bonds issued by emerging market corporates in USD terms. It is a comprehensive universe including issues in or off the J.P. Morgan CEMBI Broad Diversified Index.

Source: Bond Radar, J.P. Morgan Chase & Co.

Display 2:

A Major Research Challenge

Number of New Issuers in the EM Corporate Market

As of 30 September 2019

Source: Bond Radar, J.P. Morgan Chase & Co.

2. A compelling risk-return trade-off

For investors who generally regard emerging market assets as risky and volatile, it often comes as a surprise that EM corporates have delivered equity-like returns, with a fraction of the volatility. They also have less credit risk and interest-rate exposure than many bond sectors.

Credit Quality

By the end of September 2019, default rates for EM high-yield corporates were running at less than 1% a year—comparable to those in developed markets. The J.P. Morgan CEMBI Broad Diversified index had a yield to maturity of 5.1%, with an overall investment-grade rating of BBB-. Investors were earning the bulk of their yield from exposure to the triple B and double B credit categories, accounting for roughly 60% of the index. In most other asset classes, that level of income stream would entail more exposure to frontier or triple-C bonds, neither of which is a big part of the EM corporate index (CCCs are less than 4%).

Return vs. Volatility

Over the past decade, EM corporates have delivered nearly 3% a year more than EM equities, with just over a quarter of the volatility (Display 3) and they have delivered a better risk-return trade-off than most fixed income. EM corporates have returned roughly 2% a year more than euro high yield, at a significantly lower level of annualized volatility, and have been less volatile than US high yield.

We believe this pattern of volatility is likely to continue, because the average credit quality of the asset class has increased over time. New issuance has become increasingly dominated by the higher-quality parts of EM, notably Asia investment grade and Asia double B credit.

Interest-Rate Risk

We believe EM corporate debt is a reasonable allocation in a variety of interest-rate environments. In a rising interest-rate environment, it has lower duration than many other credit categories (Display 4), with attractive yield.

In a falling interest-rate environment, particularly when fears of recession are looming, EM corporate debt’s relatively high credit quality should help it to outperform other higher-yielding asset classes, as it has in periods of volatility in the past decade.

Display 3: Attractive Long-Term Return vs. Volatility

Display 4: Attractive Yield vs. Interest-Rate Risk

Past performance is not a reliable indicator of future performance.

As of 30 September 2019. Returns are in US dollars. Volatility refers to annualized standard deviation. EM Sovereign Hard Currency—J.P. Morgan EMBI Global; EM Sovereign Local Currency—J.P. Morgan GBI – EM Global Diversified; EM Corporate—J.P. Morgan CEMBI Broad Diversified; Euro High Yield—Bloomberg Barclays European High Yield; US High Yield—Bloomberg Barclays U.S. High Yield; US Investment Grade—Bloomberg Barclays U.S. Corporate Investment Grade; Euro Investment Grade—Bloomberg Barclays European Corporate Investment Grade; U.S. Treasuries—Bloomberg Barclays U.S. Aggregate—U.S. Treasury; International Bonds—Bloomberg Barclays Global Aggregate ex U.S.; Bunds—Bloomberg Barclays Global Aggregate – German Bund; JGB—Bloomberg Barclays Global Aggregate – Japanese Government Bond; EM Equity—MSCI EM Index. Source: Bloomberg Barclays, J.P. Morgan, MSCI. See Additional Information.

3. When the going gets tough: The downside resilience of EM corporate debt

Some investors view emerging markets in general as risky, and this perception sometimes carries through to EM corporate debt. But the downside experience in this asset class has been remarkably limited.

Display 5 shows the losses suffered by different risk assets in falling markets. EM corporate debt has consistently outperformed EM sovereign debt, EM local currency debt and EM equities during bear markets. We think this pattern is likely to repeat in future, because EM corporates are, on average, an investment-grade credit quality asset class, with a moderate duration (i.e. interest-rate exposure) profile.

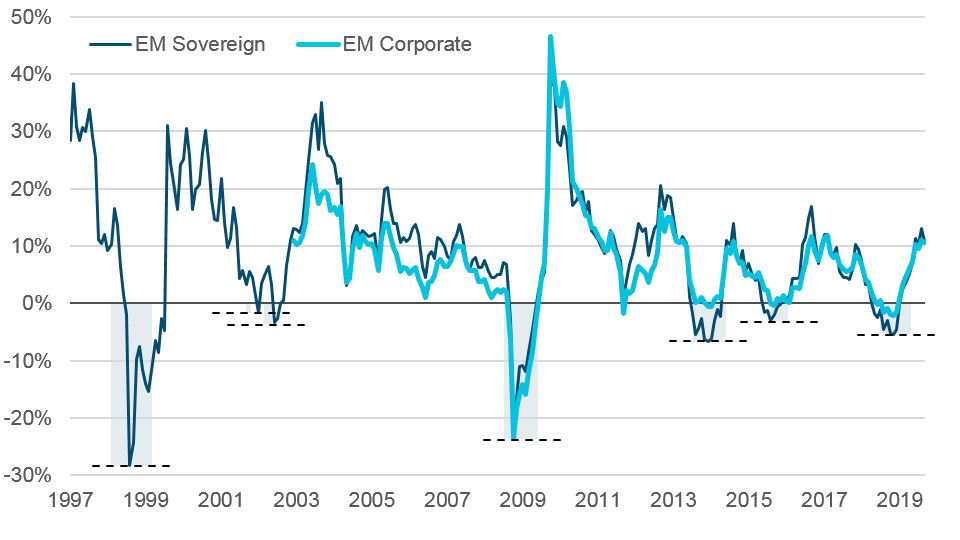

Display 6 shows rolling one-year returns—made up of capital gains/losses and coupon income—for the EM corporate and hard-currency sovereign markets (the return history for corporates starts in 2003).

Except for double digit falls during the 2008 global financial crisis, EM corporate losses have been moderate. Given the attractive yields available—typically in the 5% to 7% range—if investors had continued to hold the bonds, the coupon income alone would have allowed them to recoup the capital loss even if bond prices had remained flat. Historically, however, prices have often tended to recover quite swiftly, rewarding investors who bought the dips. As shown in the chart, drawdowns were typically followed by double-digit recoveries the following year.

The volatility of EM corporates has become more muted over time, and this has to do with the rising average credit quality of EM debt. Back in the 1990s, this was primarily a high yield asset class, dominated by countries like Argentina, Turkey, Brazil, Russia. Since then, the asset class has transformed. Asia credit has gone from 5% of the market to over 50% of the market. This has deflated the historical volatility of returns.

Conclusion

Emerging markets corporate debt, like any other risk asset, goes through patches of volatility. But in the past decade it has offered investors better compensation for risk than any other EM asset class, and market inefficiencies and information gaps have offered frequent opportunities for active managers to outperform the index. For investors looking for higher yield or emerging markets exposure, we believe that EM corporates have a valuable part to play in long-term portfolio allocation.

Display 5: EM Corporates Resilient at Times of Turbulence

Performance During Market Sell-offs

Past performance is not a reliable indicator of future performance.

As of 30 September 2019

EM Local Currency—J.P. Morgan GBI-EM Global Diversified; EM Sovereign—J.P. Morgan EMBI Global; EM Corporate—J.P. Morgan CEMBI Broad Diversified; US High Yield—Bloomberg Barclays U.S. Corporate High Yield; EM Equity—MSCI Emerging Markets. Returns are in US dollars. Source: Bloomberg Index Services Limited, J.P. Morgan, MSCI. See Additional Information.

Display 6: Trend Towards Less Volatile Returns

Rolling One-Year EM Returns

Past performance is not a reliable indicator of future performance.

Returns in US Dollars. As of 30 September 2019. EM Sovereign—J.P. Morgan EMBI Global Index; EM Corporate—J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified. Source: J.P. Morgan. See Additional Information.

Risks – the following risks are materially relevant to the strategy:

Contingent convertible bond risk – contingent convertible bonds have similar characteristics to convertible bonds with the main exception that their conversion is subject to predetermined conditions referred to as trigger events usually set to capital ratio and which vary from one issue to the other.

Country risk (China) – all investments in China are subject to risks similar to those for other emerging markets investments. In addition, investments that are purchased or held in connection with a QFII licence or the Stock Connect program may be subject to additional risks.

China Interbank Bond Market risk – market volatility and potential lack of liquidity due to low trading volume of certain debt securities in the China Interbank Bond Market may result in prices of certain debt securities traded on such market fluctuating significantly.

Country risk (Russia and Ukraine) – in these countries, risks associated with custody, counterparties and market volatility are higher than in developed countries.

Credit risk – a bond or money market security could lose value if the issuer’s financial health deteriorates.

Default risk – the issuers of certain bonds could become unable to make payments on their bonds.

Derivatives risk – derivatives may result in losses that are significantly greater than the cost of the derivative.

Emerging markets risk – emerging markets are less established than developed markets and therefore involve higher risks.

Frontier markets risk – small market nations that are at an earlier stage of economic and political development relative to more mature emerging markets typically have limited investability and liquidity.

High yield bond risk – a bond or debt security rated below BBB by Standard & Poor’s or an equivalent rating, also termed ‘below investment grade’, is generally subject to higher yields but to greater risks too.

Interest rate risk – when interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

Liquidity risk – any security could become hard to value or to sell at a desired time and price.

Sector concentration risk – the performance of a strategy that invests a large portion of its assets in a particular economic sector (or, for bond strategies, a particular market segment), will be more strongly affected by events affecting that sector or segment of the fixed income market.

Additional Information

Bloomberg Index Services Ltd - Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

JP Morgan - Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2019, J.P. Morgan Chase & Co. All rights reserved.

MSCI - MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

201911-1003102