2024 Global Market Outlook Midyear Update

Reaccelerating inflation to make central banks walk tightrope

Inflation

Inflation is notoriously difficult to predict, and it has continued to baffle most forecasters since the onset of the pandemic in 2020. However, it’s becoming clear that inflation isn’t going away, and we see a meaningful risk that it will reaccelerate as U.S. exceptionalism moderates and global growth broadens.

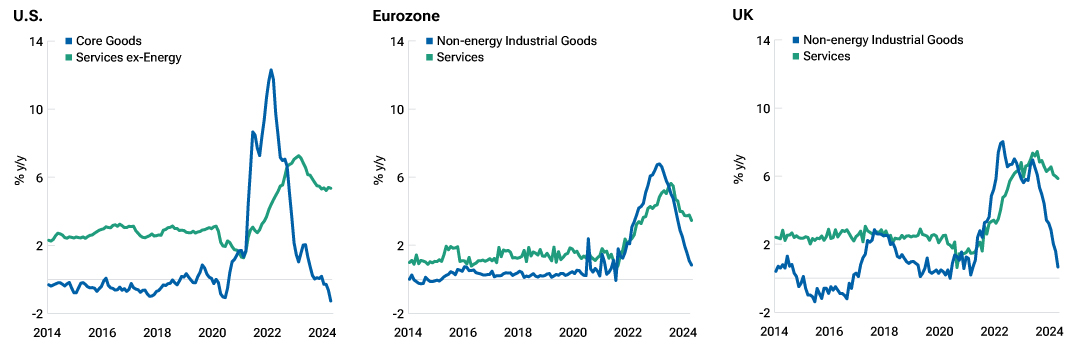

Developed market services inflation is proving sticky

(Fig. 4) Goods inflation is falling much faster

As of April 30, 2024.

y/y=year-over-year.

Source: U.S. Bureau of Labor Statistics, EU Statistical Office of European Communities, UK Office for National Statistics/Haver Analytics.

Several factors drive risk of reaccelerating inflation

The big decrease in global inflation from 2022 to 2023 was due to goods disinflation, which is the easy part of taming inflation. Now services inflation, which is sticky, needs to fall. But for this to happen, the labor market must have space to adjust—wage pressures drive services inflation, and higher unemployment is required to control wage pressures. Artificial intelligence (AI) is one countervailing force that could help tame services sector wage growth, but AI will take time (and expense) to implement, making it a longer‑term factor.

Fiscal spending in an election year will also put upward pressure oninflation, and energy prices—which have been a headline inflation tailwindsince surging in 2022 following Russia’s invasion of Ukraine—are a wildcard that could easily spike again if conflict in the Middle East escalatesor other geopolitical hot spots erupt.

These factors would, of course, make central banks’ difficult balancing act between supporting growth and restraining inflation that much harder.

Because we see renewed upward pressure on inflation, investors may benefit from exposure to real assets such as commodities—including gold and silver—and real estate or to inflation protected government bonds. Real assets tend to hold up well in inflationary environments, while inflation-protected government debt has principal and interest payments that adjust based on inflation data.

Global Market Outlook Midyear Update insights

How central bank policy could impact your portfolio

US stocks face a broadening, not a rotation

International stocks still appear to be good value

Sign up to receive our monthly Global Asset Allocation Viewpoints from our Investment Committee

Each month, our Investment Committee prepare a report revealing the two market themes they are watching, their bull and bear views per region and their latest asset class over and underweights.

It has been designed to aid you in your decision making and client conversations.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward-looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been independently verified. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® areregistered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Thisproduct is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing insuch product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.