Discover our story

Is knowing all the answers really that smart? Since our inception, we’ve been committed to asking the right questions and we remain steadfast in that today. Explore some of the moments that have shaped our history and purpose—to help clients thrive in an evolving world.

Is good chemistry as valuable as good data?

Asking the right questions to the right people can help unearth potential that others may miss. High quality data and analysis are invaluable for identifying oppotunities.

Could that plane take us to an FDI boom?

A simple observation on a runway in Belgrade. And a T. Rowe Price analyst’s instinct to dig deeper. Learn how it can help our clients get ahead.

Is that a CEO? Or an unmissable opportunity?

Our early position in AI—and AI integration in our business—is prompted from an unexpected conversation with a tech CEO. View our informed insights on generative AI and opportunities we see for investors.

Get more of our dynamic perspective

Curious about the long-term view? Subscribe to receive the latest insights from our analysts straight to your inbox.

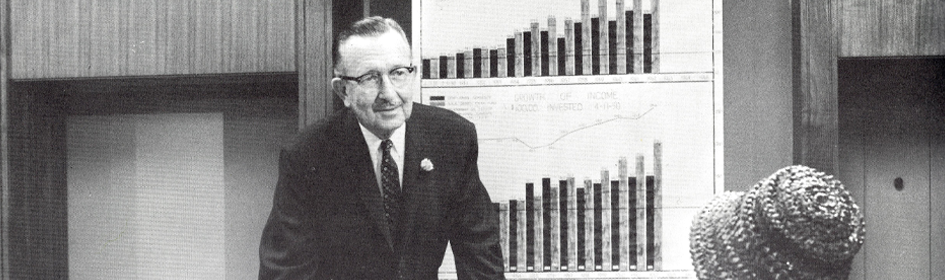

Our active management approach

We have over 525 investment professionals who go out in the field to uncover opportunities. They study them firsthand, asking the right questions. Then use these insights to make investing decisions you can feel confident in.

800+

Total investment professionals around the world

23 years

The average tenure of our portfolio managers

14,000

Investee meetings hosted annually

Put our rigorous curiosity to work for you

T. Rowe Price equity and fixed income strategies delivered higher average annualised returns than their benchmarks over time. And they showed better results in the vast majority of rolling monthly periods over a 20-year span.

Put simply, our strategies delivered more return, more often. That's the T. Rowe Price difference.

Our strategies outperformed their benchmarks 80% of the time

Ten-year periods, rolling monthly, over the last 20 years ended 31/12/23.

Past performance is not an indicator of future performance.

Analysis by T. Rowe Price. Represents a comparison of all marketable institutional equity and fixed income composites compared to the official composite primary benchmark assigned to each. Excludes money market, asset allocation and index/passive composites. In order to avoid double-counting in the analysis, specialized composites viewed as substantially similar to strategies already included (e.g. constrained strategies, ex-single country excluded strategies, etc.) are also excluded. Composite net returns are calculated using the highest applicable separate account fee schedule for institutional clients. All figures in USD. The performance of each T. Rowe Price composite was compared against its official composite primary benchmark using 10-year rolling monthly periods from 1/1/04 to 31/12/23.