Our commitment to value investing

Style is a key discipline in any active management process and when it comes to value investing, we believe that our clients benefit from our adherence to three core principles that underpin how we pursue performance.

We call these principles the ‘3 Cs’ of Value Investing: Conviction, Coverage & Consistency

Value investing at T. Rowe Price

Hear from our investment team as they discuss our time-tested and disciplined approach and our adherence to the ‘3 Cs’ of value investing.

A consistent approach to value

We are committed to delivering ‘true value’ to our clients through the “3 Cs” of value investing:

Conviction

We understand the cycle of investment styles and the importance of patience for value investing. We’ve been managing value portfolios for over 40 years, and have continually nurtured our investment talent and invested in our people and our capabilities throughout the most challenging cycles to help deliver better outcomes for our clients.

Coverage

Our investment teams think independently and have the flexibility to analyse companies across the style spectrum, unconstrained by market definitions of value. This results in a truly active and nimble approach, where our style agnostic analysts can exploit the full breadth and depth of an ever-changing universe of value opportunities.

Consistency

We have a proud history of never compromising our value principles to chase short term market trends. While investment styles may go in and out of favour in the short term, our portfolio managers do not drift from their disciplined and time-tested value approach, meaning our clients know exactly what to expect from us.

A range of active funds to meet your value needs

Our managers have the flexibility to invest across the full range of value styles according to market conditions and the parameters of their strategy. Unlike other asset managers, our range of funds are not constrained by arbitrary classifications of value.

US Large Cap Value Equity Fund

Portfolio Manager: Gabriel Solomon and John Linehan

An actively managed, best ideas portfolio of US large cap companies with hidden value and upside potential that we believe are overlooked by the market.

US Select Value Equity Fund

Portfolio Manager: John Linehan

An actively managed, highly concentrated portfolio of US large cap companies with broad diversification and balanced factor exposures.

Global Value Equity Fund

Portfolio Manager: Sebastien Mallet

An actively managed portfolio that invests globally across the value spectrum aiming to deliver positive excess returns in a wide range of market environments.

Emerging Markets Discovery Equity Fund

Portfolio Manager: Ernest Yeung

An actively managed, go-anywhere EM portfolio that seeks to identify ‘forgotten’ stocks, under-owned and under- researched by mainstream investors.

Capital at risk.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

The listed funds are not an exhaustive list of funds available. Visit www.funds.troweprice.com to see the full range of funds offered by T. Rowe Price, including those that consider environmental and social characteristics as part of their investment process. For up to date information regarding any T. Rowe Price fund's investment strategy, please see the relevant fund KID and prospectus.

The Funds are sub-funds of the T. Rowe Price Funds SICAV, a Luxembourg investment company with variable capital which is registered with Commission de Surveillance du Secteur Financier and which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). Full details of the objectives, investment policies and risks are located in the prospectus which is available with the key investor information documents and/or key information document (KID) in English and in an official language of the jurisdictions in which the Funds are registered for public sale, together with the articles of incorporation and the annual and semi-annual reports (together “Fund Documents”). Any decision to invest should be made on the basis of the Fund Documents which are available free of charge from the local representative, local information/paying agent or from authorised distributors. They can also be found along with a summary of investor rights in English at www.troweprice.com. The Management Company reserves the right to terminate marketing arrangements.

A longstanding conviction in the power of value investing

Deep, fundamental research led by our style agnostic research teams and enhanced by perspectives from our growth and fixed income teams, gives our managers the insight to invest across the value spectrum.

US$211 billion

AUM in value strategies*

1985

Launch of first dedicated value strategy

180

Equity research professionals worldwide (style agnostic)

8

Value portfolio managers

23 years

Average investment experience of our value portfolio managers

*The total value Equity assets managed by T. Rowe Price Associates, Inc. and its investment advisory affiliates

Value stories: The power of style-agnostic, fundamental research

Finding value that’s hidden in plain sight.

Embraer

Capturing opportunities ahead of the crowd

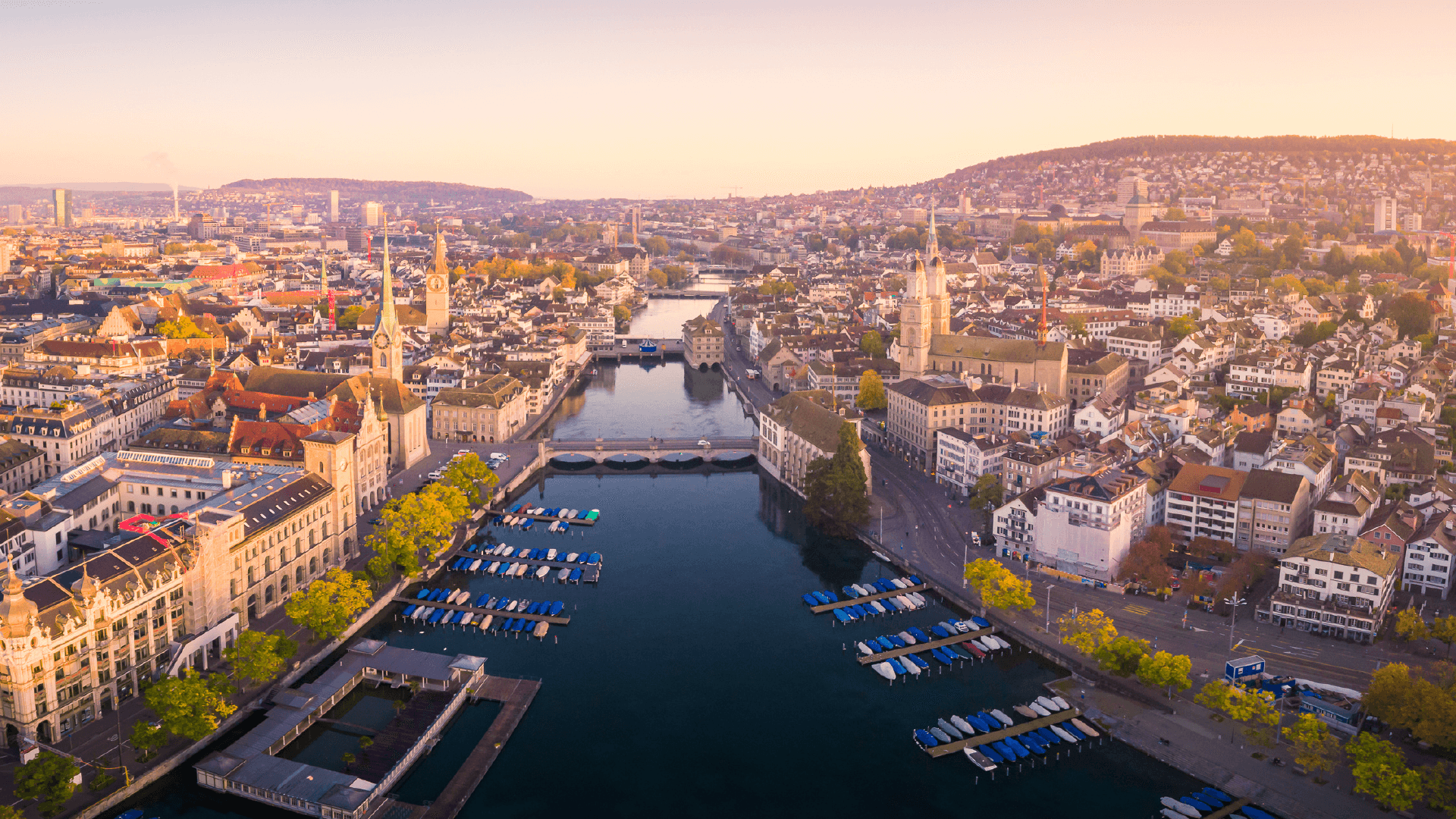

Zurich Insurance

The power of relationships

General Electric

Establishing conviction when others didn’t

Actionable Insights

Our dynamic perspectives on value investing.

The value of a multi-sector diversified income approach for fixed income

The case for value

The Case for Value

202407-3679784