Investing during transition

Change is constant, but in some periods it occurs more dramatically than in others. We believe the world is currently undergoing transition at a pace and scale rarely seen before. Technological developments are driving extraordinary innovations in artificial intelligence (AI) and health care. Continuing geopolitical tensions and the probability of higher tariffs globally following the U.S. election will likely lead to the reconfiguration of supply chains, disrupted labor supplies and a strong focus on secure energy transition. At the same time, the global economy is adjusting to a world of higher trend inflation, higher rates, and greater volatility.

Transition at this degree may seem daunting. However, we believe it will bring with it an opportunity set of a breadth and richness not experienced since the aftermath of the global financial crisis (GFC). The nature of this opportunity set will inevitably evolve as markets change, but, in our view, the overall trend will be for earnings growth to broaden beyond a handful of dominant tech stocks, across both sectors and regions.

As we navigate this new equilibrium, our portfolio construction themes argue for greater diversification across asset classes1. Bond yields have been on a roller‑coaster ride as markets have been overly enthusiastic about pricing in bank rate cuts. High yield bonds, bank loans, and emerging markets bonds present income opportunities.

We are likely past the first innings of the AI infrastructure buildout. However, the AI wave is not over—as companies employ AI, we will see an acceleration in speed, productivity, and innovation. At the same time, we believe conditions are in place for a golden age for the health care sector amid a flurry of radical innovations.

We also think it is prudent for investors to consider diversifying into areas that have valuation support and robust fundamentals, such as value and small‑cap stocks. Additionally, there are select opportunities in underappreciated sectors such as energy, financials, and industrials. Countries such as Japan and South Korea could also benefit from structural changes.

The year 2025 is shaping up to be one of transition marked by a clear broadening of investment opportunities. In this evolving world, curiosity is vital. Asking smart questions about new opportunities—within asset classes or major themes such as health care innovation, energy transition, or artificial intelligence—is the best way to source the insights on which smart investment decisions can be made.

Mapping the path from slowdown to recovery

Nikolaj Schmidt, Chief Global Economist

The global economy is likely heading for a growth slowdown in the first few months of 2025 if weaker data from China weigh on the rest of the world. The good news is that central banks, particularly the European Central Bank (ECB), are well positioned to respond swiftly with rate cuts. A manufacturing‑led recovery in the second half of the year is highly plausible—although the precise timing of any such rebound is harder to call.

Monetary policy has been tight since 2022. Until now, however, this has been offset by the lingering impact of generous fiscal support. This has meant two things: first, that the rate hikes have not been as devastating as they might have been in the past; and second, that central banks have been able to hike more than anyone thought possible at the outset of the tightening cycle. Conditions are changing, however, and as fiscal tailwinds fade, the world is beginning to feel the impact of these hikes—and will continue to do so in the first few months of 2025.

Despite China’s recent stimulus injection, the macroeconomic picture there remains uncertain. Any slowdown in China will impact the rest of the world, but it will not affect all other regions equally: Europe’s heavier dependence on manufacturing exports means that China’s growth slump will hit it harder than the U.S.

Recovery will speed up transition to manufacturing‑led growth

High interest rates mean the ECB has the luxury of being able to ease monetary policy rapidly—and this is exactly what we expect it to do. Then, once rates come down meaningfully in Europe, the impact on growth is likely to be seen quickly as European households, which have accumulated a large amount of excess savings since the coronavirus pandemic, are likely to spend more. With some good fortune, the improving outlook for Europe could be further enhanced should there be a thaw in the Russia‑Ukraine conflict.

When it comes, the recovery is likely to hasten the ongoing transition to manufacturing‑led growth, which has been lagging services for several years (Figure 1). We believe there will be three key drivers of this: first, the release of pent‑up demand for interest rate‑sensitive goods consumption; second, a surge in infrastructure spending to meet the global push toward renewable energy and the rise of generative artificial intelligence; and third, the growing trend of companies choosing to shift their manufacturing bases to “friendlier” countries to ease supply chain concerns.

Capex surge will boost international markets

What these drivers have in common is that each of them will require a major injection of capital. The sectors that provide the solutions—including industrials, energy, and materials—are likely to attract enormous flows of investments into physical assets in the years ahead.

These are multiyear developments, but their impact on the global economy is likely to be visible in 2025—particularly in the second half of the year. At that point, we expect monetary easing to have sparked a global economic recovery, albeit inconsistent across regions, characterized by a shift from services to manufacturing.

U.S. exceptionalism has not run out of steam

Blerina Uruçi, Chief U.S. Economist, Fixed Income

The ingredients are present for another year of robust growth in the U.S. In recent years, healthy expansion in the U.S. has spilled over to the rest of the world, helping offset the softness in Europe and China. We expect this to continue in 2025.

The U.S.’s economic outperformance over the rest of the world during the past few years was not merely down to consumers “buying stuff.” Nonresidential investment has also been strong in response to incentives put in place by fiscal policy. The continued development of AI‑related technologies and the green energy transition have been important in supporting investment growth and what could be the start of a much‑needed upgrade in the capital stock of the U.S. economy.

The positive fiscal impulse in the U.S. is now fading, but fiscal measures such as the Inflation Reduction Act and the CHIPS and Science Act should ensure further disbursement of tax incentives and industry‑specific grants during the coming years.

Coordinated easing provides supportive backdrop

The recent monetary policy easing will likely provide a more supportive macro backdrop for U.S. and global demand than in 2022–2023. After all, it has been rare to witness such a coordinated and widespread easing of monetary policy and financial conditions outside of a global downturn. This relaxing of financial conditions has already helped boost the wealth and balance sheets of U.S. consumers. Despite this positive backdrop, job creation will likely slow down in 2025 as companies have front‑loaded hiring and are likely to focus on productivity improvements. But without a catalyst for mass layoffs, we expect the unemployment rate to remain low by historical standards. The notable increase in productivity growth in recent quarters should support robust wage gains. Coupled with the downshift in inflation rates, real disposable incomes are likely to be another tailwind to growth.

On the inflation front, raising existing tariffs and/or imposing additional levies on imports could cause a one‑off price shock. The magnitude would depend on the ability of businesses to pass these higher costs along to consumers, which is hard to predict. Another area to watch is the president‑elect’s vow to tighten immigration policies. A tough stance here could result in a negative shock to the supply of workers, tightening U.S. labor markets. Unlike higher tariffs, such a scenario likely would have a more sustained impact on prices.

Improving productivity can boost economy

Improving productivity could also foretell the end of generally lackluster growth after the GFC, excluding the recession at the onset of the coronavirus pandemic and the boom that came following the reopening of the economy. Positive productivity shocks are rare, and it is even rarer to be able to predict them correctly.

However, some of the factors that historically have driven productivity improvements seem to be in place today. Both labor and nonlabor input costs have surged higher, so businesses are looking for ways to deliver the same output levels without hurting profitability (Figure 2). In addition, capital and intellectual property investment have paved the way for significant progress on AI and other technologies that have high capital and low labor intensity, thus leading to higher productivity growth outcomes.

In addition, capital and intellectual property investment have paved the way for significant progress on AI and other technologies that have high capital and low labor intensity, thus leading to higher productivity growth outcomes.

Value and small-caps could power international equities

Justin Thomson, Head of International Equity

The extent to which the inflation and interest rate shocks of 2022 are reshaping the dynamics of international (ex U.S.) equities should become clearer in 2025. We expect there to be more evidence of a broadening opportunity set that favors international stock markets—and, within them, value and small‑cap stocks and countries such as Japan and South Korea.

We are emerging from a highly unusual period in which one market (the U.S.) and one sector (technology) dominated returns—and within that sector, a handful of exceptional firms drove the large bulk of those returns. This dominance has skewed investor positioning and valuations: Many investor portfolios are heavily exposed to U.S. equities while virtually every sector in non‑U.S. equities is currently cheaper than its U.S. equivalent.

Small‑caps appear positioned to deliver strong earnings growth

Valuations alone are not a compelling reason to invest in a particular market or asset class, but they do provide a useful starting point when determining the potential for long‑term returns. Within international markets, value stocks have been trading at a discount to growth stocks. This is likely to change as we expect non‑tech capex (capital expenditure) to surge amid widespread factory automation and the relocation of supply chains. The fastest‑growing firms in the period following the GFC were U.S. tech companies whose business models were built around intangible assets. We expect the period ahead to be marked by a higher‑trend level of demand for tangible assets, supporting sectors such as industrials, energy, and materials, which are typically value oriented.

International small‑caps (typically represented by the MSCI All Country World ex‑USA Small and Mid Cap Index) usually traded at a premium to large‑caps, but in 2024 this premium disappeared following several years of COVID‑related disruption and supply chain challenges (Figure 3). In our view, international small‑caps offer the potential to deliver stronger earnings per share (EPS) growth than their international large‑cap peers in the period ahead as the economic environment improves. History shows that following periods of earnings decline, earnings growth for small‑caps have typically exceeded large‑caps. We expect this to occur again on this occasion, but this time coming from a point of extreme valuation support for small‑caps that should help compound investor returns.

The bull case for Japan still holds

The world will likely need to get used to a structural downshift in China from the 5% to 6% growth rates seen over the past few decades. A further challenge to Chinese growth may come if U.S. President‑elect Donald Trump delivers on his promise to impose more tariffs on China—although it is not yet clear how far any new measures will go, nor how much scope there is to negotiate a new trade deal between the two countries. In the meantime, the combination of compressed valuations, bottom‑up innovation, and potential for strong countertrend rallies means that opportunities to invest in China will continue to arise.

We believe the medium‑term bull case for Japan still holds as Japanese firms switch focus from market share to profit maximization. Notwithstanding South Korea’s recent political instability, it has sought to emulate Japan’s success in boosting stock valuations with a corporate governance drive. Tax incentives have been offered to businesses that prioritize shareholder returns, while the new “Korea ValueUp Index” will list firms that have improved capital efficiency.These are significant structural opportunities available at attractive prices.

Rate cuts provide opportunities for U.S. small-caps and financials

Stephon Jackson, Head of T. Rowe Price Investment Management

U.S. equity returns were dominated by three themes in 2024: one, the rise of AI and its derivatives; two, the strong performance of rate‑sensitive cyclical stocks in anticipation of Fed cuts; and three, soaring valuations of perceived “safe bets” despite unchanged earnings growth. In 2025, all three of these themes could unwind.

The growth rate of AI infrastructure is likely to slow due to increased competition. Cyclical stocks’ valuations are currently high after strong performance this year, although their risk/reward profile is more mixed for 2025. Many of the stocks are now at or near all‑time high valuations, with low expected growth rates.

Valuations are high across most sectors

Stretched valuations suggest that U.S. stocks will underperform bonds in the medium term (Figure 4). However, a combination of improving earnings and lower rates could result in a soft landing. We believe the Fed will continue to be data‑dependent when determining the speed and extent of the rate‑cutting cycle.

That said, we see a broadening opportunity set in U.S. equity markets, spanning several sectors. Small‑caps, which are trading at a historic discount to large‑caps, should benefit from further rate cuts and any signs of an improving economy. In addition, the current position of the energy cost curve indicates that we could be in for a multiyear regime change of capex and investment spend in energy, which would also benefit small‑cap stocks.

From a sector perspective, financials looks interesting. After Fed rate increases led to such poor performance for banks and real estate investment trusts in 2024, the market is anticipating better performance for this rate‑sensitive group should rate cuts continue into 2025. Energy has also underperformed significantly over the past year, but we see reasonable upside potential in several subsectors. Natural gas is attractive and likely to outperform due to limiting supply from rig count restrictions and pipeline constraints, and there is a longer‑term case for carbon‑based fuels owing to slower technological productivity gains and a delay in peak demand until after 2035.

Broader opportunities signal a stock pickers’ market

We see company‑specific opportunities in industrials given the normalization of markets following the post‑COVID volatility. Most of these are in aerospace, electrical contractors, agriculture, municipal spending, and consumer‑related building products. In health care, the life sciences sector appears likely to benefit from a reacceleration of growth in biopharma production and as early‑stage research picks back up after some major patent expirations among large pharmaceutical firms.

Elsewhere, there are plenty of software firms that were not immediate beneficiaries of AI that have strong earnings growth prospects and are attractively valued. Although utilities have traded higher recently, the sector should benefit from rising demand due to AI, and is therefore likely to deliver faster earnings growth.

Overall, we anticipate a continued expansion of investible opportunities, characterized by historically attractive valuations in certain sectors, the normalization of fundamental trends post‑COVID, and improvement in growth aided by lower interest rates and fiscal support.

Finding income in high yield bonds, bank loans, and emerging markets

Ken Orchard, Head of International Fixed Income

Despite the U.S. Federal Reserve starting its monetary easing cycle in September, yields could move higher if the central bank does not cut as deeply as markets expect. High yield bonds and bank loans remain the two fixed income sectors with the most potential to generate meaningful income in 2025, while emerging market bonds also present solid income opportunities.

Expect modestly wider credit spreads

We anticipate continued volatility in the wake of the U.S. presidential election, leading credit spreads2 to widen from the unusually narrow levels experienced through most of 2024. As a result, all‑in yields in sectors with credit risk would remain attractive even if high‑quality government bond yields decrease as the Fed and other global central banks cut rates.

However, I do not foresee a global recession in the next 12 months, so the spread widening should be relatively modest as rate cuts and lower energy prices continue to support the consumer and economic growth. Credit spreads could tighten again in 2025 as the uncertainty clears and investors become confident in the economy’s health.

Bank loans and high yield bonds are best positioned for income

The non‑investment‑grade sectors—high yield bonds and bank loans—are best positioned to generate income in 2025, in our view. With their floating coupons, we expect loans to perform better than high yield bonds if the Fed easing cycle is shallower than expected and yields increase. Loans are higher in the capital structure than bonds, making them more stable (although they are also less liquid). The bank loan sector also has less exposure to volatile energy prices than non‑investment‑grade bonds.

High yield bonds should also produce attractive income, but thorough credit analysis and selection is even more critical. If short‑term interest rates decrease, creating steeper yield curves, non‑investment‑grade bonds could actually generate more income than floating rate loans. Corporate bonds with the lowest credit ratings in the investment‑grade universe (BBB on the S&P Global Ratings scale) could also produce healthy incomes as a result of their high credit spreads relative to other investment‑grade issues.

Emerging market bonds to benefit from favorable growth

Casting a wider net, emerging market corporate and sovereign bonds should benefit from a favorable growth environment in developing countries, where many central banks are well into their rate‑cutting cycle. Emerging markets are well positioned to generate higher growth than developed European markets, for example. The credit quality of emerging market corporate bonds has steadily moved higher over the past several years.

Global growth could surprise on the upside. In this scenario, markets would likely price in rate hikes to battle inflation, resulting in a steeper yield curve as intermediate‑ and longer‑term yields move higher. The risk of an inflation resurgence is high enough to consider including a small allocation to inflation‑adjusted bonds such as Treasury inflation protected securities in a diversified portfolio.

Weaker growth and lower rates set to open up private markets

David DiPietro, Head of Private Equity, T. Rowe Price & Alan Schrager, Portfolio Manager and Senior Partner, Oak Hill Advisors

We anticipate two developments that should open up private markets for investors in 2025. First, a challenging economic environment will likely fuel demand among borrowers for more complex, bespoke credit solutions; and second, the Fed’s rate‑cutting cycle could deliver conditions conducive to more firms going public and increased mergers and acquisitions (M&A).

Increasing customization to drive the private credit outlook

Capital deployment in private credit rebounded strongly in 2024 as M&A activity increased, driven by a benign macroeconomic environment and pent‑up demand. We expect this to continue in 2025, expanding the role of private credit as the financing source for situations requiring flexibility unavailable in the broadly syndicated loan market.

For borrowers, private credit offers benefits particularly useful for M&A activity, such as speed and certainty of execution, confidentiality, customization, and partnership with fewer lenders. For investors, private credit may provide a spread premium over traditional fixed income, which comes in largely two forms: an illiquidity premium, which should compensate investors for locking up their capital for extended periods of time; and a complexity premium for delivering the benefits to borrowers mentioned above.

We believe the opportunity to capture alpha through complexity could increase if the U.S. economy slows meaningfully in 2025. Private credit is well positioned to deliver bespoke solutions, including liquidity financings and capital structure restructurings, to companies with more challenged debt service requirements. If the broader economy continues to rally, these situational opportunities may be more limited and more conventionally performing private credit will take precedence.

Private equity investors eye end to the IPO drought

The long period of low interest rates following the GFC led to many companies remaining private for longer, even when they became very large. We believe one of the biggest areas of opportunity in private equity is in large private companies, ideally at attractive valuations, before they go public.

However, the three‑year‑long drought in initial public offerings (IPOs) has dampened the opportunity set. This fall in IPOs has been more of a supply problem than a demand problem: Private companies do not want to subject themselves to the price volatility of publicly traded shares, and many firms seek to avoid the heavier quarter‑to‑quarter financial scrutiny that being public involves.

Another key reason has been the challenge of forecasting revenues and earnings given the widely disparate views of the state of the economy. As the economic outlook becomes clearer and companies are more confident with their projections, private companies should be more comfortable with the decision to go public. Also, with more certainty about the Federal Reserve’s rate‑cutting cycle, equity market volatility could ease in 2025, clearing the way for more IPOs.

Investors can also usually access liquidity from their private investments via M&A activity. Lower interest rates will help loosen up the M&A market by lowering the cost of capital for acquirers. If both IPOs and M&A activity pick up, existing investors in private companies would have two avenues to redeem their cash, potentially at better valuations.

Radical innovations revealing real prospects in health care

Nabil Hanano, Associate Portfolio Manager, Global Focused Growth Equity Strategy

Health care stocks have struggled since the pandemic amid rising costs and falling revenues, but a wave of innovation is transforming the sector’s prospects. A new generation of treatments and technologies are coming to market that deliver radical outcomes, establishing the conditions for what we believe will be a golden age of health care.

The emergence of GLP‑1 drugs targeted at obesity and diabetes has been a seismic development. The investment implications of GLP‑1s are large, not just for the earnings potential of drug developers, but across every part of the health care ecosystem and the wider economy. So far, however, this has not translated into sectorwide outperformance: All health care segments in the S&P 500 have underperformed the broader index over the past two years, and the weighting of the overall health care sector within the index was at its lowest level in 10 years at the end of October (Figure 5). History shows that following periods of declining returns, the weighting of health care within the S&P 500 has typically fallen before recovering.

Leading GLP‑1 manufacturers have still benefited

Despite declining valuations across health care segments, barriers to entry are high in the GLP‑1 space. The leading manufacturers have gained a competitive advantage by amassing huge amounts of clinical data and building production capacity, and they are also developing next generation drugs that are likely to be better than those currently available. These firms are spending billions of dollars on capital expenditure and research and development in aiming to maintain their dominance.

One of the most important innovations is in small‑molecule GLP‑1s that can be taken in pill form rather than the currently available injection. Due to capacity constraints, there will never be enough injectable drugs to reach the number of people who need them, which means that GLP‑1s in pill form are needed to address the global market in obesity treatments.

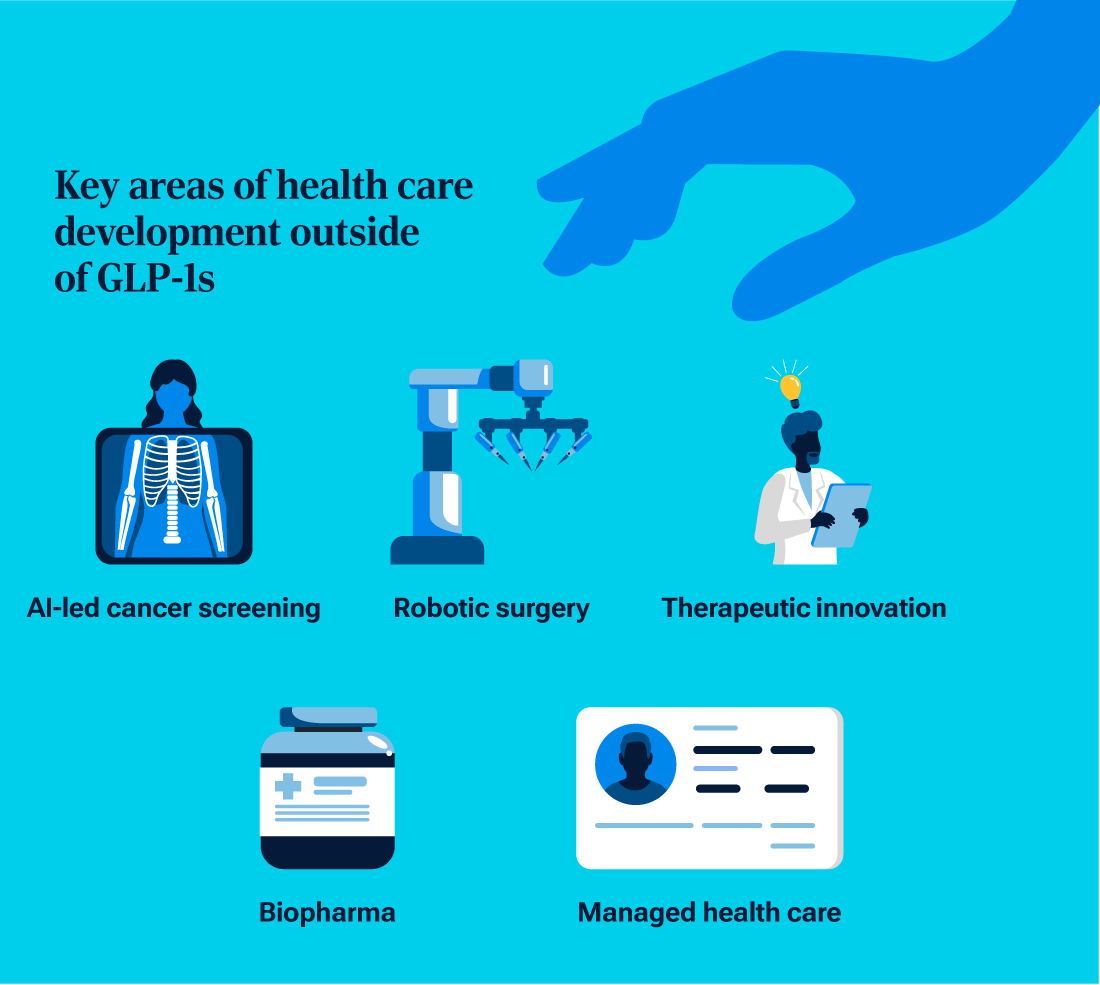

The wave of health care innovation is not just limited to GLP‑1s, however. Technological developments are leading to major breakthroughs in areas such as AI‑led cancer screening and robotic surgery, while therapeutic innovations are poised to accelerate demand for companies that sell the necessary bioprocessing production equipment.

Lower rates and inventory normalization should bring timely boost

Rising interest rates in 2022/2023 hit the earnings potential and valuations of biopharma stocks particularly hard. The return to a lower rate environment—and, with that, funding—should be a major boost for the sector. Further support could come from post‑pandemic inventory normalization as the industry returns to more stable demand patterns.

Elsewhere, managed health care organizations are adapting to external cost pressures and technological advances by delivering more value‑based care (where providers are paid based on patient health outcomes) and remote care. They are also increasingly using AI and machine learning to predict patient health outcomes and guide decision‑making.

Investors seeking to benefit from these changes will need to look beyond traditional financial analysis and gain a deeper understanding of the scientific developments underpinning them. For those able to do this, the extraordinary innovation taking place across many health care sectors, combined with the current low valuations available, provide a compelling opportunity.

AI’s “easy money” era is over, but an abundance of opportunities remain

Dom Rizzo, Portfolio Manager, Global Technology Equity Strategy

The launch of ChatGPT in November 2022 sparked a frenzy around AI stocks, as illustrated by the sevenfold rise in NVIDIA’s stock price in less than two years. The first phase of the AI cycle, which centered on firms providing infrastructure and those with the most direct AI use cases, is nearing an end. However, we still believe AI will prove to be the biggest productivity enhancer for the global economy since electricity and that the technology opportunity set remains a rich one.

Productivity‑enhancing technologies often fuel speculative asset bubbles. During the dot‑com bubble of the 1990s, the NASDAQ Composite Index—home to most newly listed dot‑com firms—rose from a level of around 750 in early 1990 to a peak of more than 5,000 by March 2000. The index then crashed, plunging 78% by October 2002, contributing to a recession in the U.S.

The rise of AI is not the dot‑com bubble revisited

Parallels are often drawn between the dot‑com bubble and the recent surge in AI, but we believe there are important differences between the two. Unlike the dot‑com bubble, this AI cycle has been driven by a surge in earnings rather than by speculation. Back in March 2000, for example, technology giant Cisco was one of the most popular stocks on the U.S. equity market, with a next 12 months (NTM) price‑to‑earnings (P/E) ratio of more than 125x.

By contrast, and as an example, NVIDIA’s NTM P/E at the end of October was 35X (Figure 6). Wall Street’s estimate for NVIDIA’s full‑year 2026 earnings had increased from USD 0.62 in November 2022 to USD 4.07 at the end of September this year, meaning that its sevenfold share price increase was almost entirely driven by earnings growth estimates rather than by market sentiment alone. Rather than seeing AI as a bubble that is about to burst, we regard it as a multiyear investment cycle in which the initial period of incredibly rapid growth is now giving way to a period of moderating, yet still impressive, growth.

AI’s surge is not a repeat of the dot‑com bubble

As of October 31, 2024.

Source: FactSet (see Additional Disclosures).

The specific securities identified and described are for informational purposes only and do not represent recommendations. P/E is price‑to‑earnings ratio and next 12 months earnings are third‑party consensus estimates. Actual outcomes may differ materially from forward estimates.

Another major difference between the AI investment cycle and the dot‑com bubble is the funding source for much of the infrastructure spend. During the 1990s, the fiber infrastructure was primarily debt funded, issued by companies such as WorldCom. Today, NVIDIA’s growth has been driven by selling the linchpin AI technology to some of the most cash flow‑generative companies in history (Microsoft, Google, Amazon, Meta). The key question is whether NVIDIA can retain its dominant status as we potentially go from an estimated USD 45 billion AI chip market in 2023 to an estimated USD 500 billion AI chip market in 20283, or will it be challenged by new competitors.

Innovative linchpin companies offer strongest growth prospects

Investors looking to navigate the next phase of the AI investment cycle responsibly should seek to identify those key linchpin companies that are innovating within secular growth markets. Improving fundamentals are also crucial—firms with accelerating revenues, increasing operating margins, and/or improving free cash flows are worth looking at closely. Finally, it is important to ensure that any valuations paid are reasonable.

When analyzing AI’s impact on the wider global technology field, investors should include the semiconductor industry, where new kinds of semiconductors are being designed for AI applications. Also, AI is being used to improve the existing chip design and manufacturing processes. Among software firms, data infrastructure companies, vertical application vendors, and cybersecurity vendors are well placed to capitalize on the advancements in AI. Finally, in financial technology (fintech), generative AI is being used to improve the customer experience in areas such as personalized banking, fraud detection, and credit risk assessment.

High yield debt, financial stocks offer value amid uncertainty

Tim Murray, Capital Markets Strategist

There is not enough uncertainty priced into markets. While 2025 could certainly turn out to be another year of prosperity, an optimistic outcome is already priced in to almost every asset category, generating sometimes conflicting cross‑asset signals. Against that backdrop, there are two primary questions that will determine the direction of markets in 2025:

1. How long and variable is the lag after Federal Reserve action on monetary policy? If the lag is lengthy, it will take more time for the effects of Fed easing to work through the economy. In this scenario, we should worry more about the labor market (and potentially a recession), not resurgent inflation. If it is short, we should be more concerned about inflation than unemployment.

Our view is that the lag from Fed easing will be relatively short, making us more positive on growth but wary of sticky inflation.

2. Will the hyperscalers maintain the needed very high levels of capital expenditure on artificial intelligence?

The AI revolution drove the 2024 gains in mega‑cap U.S. technology stocks. The durability of hyperscaler (mega‑cap companies that provide cloud computing services) spending on AI will help determine the fate of this group of stocks as well as whether the rally can broaden.

AI spending could be peaking, making 2025 a year of transition. If this is the case, we could see AI enthusiasm take a back seat to other market themes. The economy has also benefited from AI spending—we have essentially had modest growth with an AI kicker that made it look stronger. A capex slowdown would weigh on economic expansion.

Value in non‑investment‑grade debt

High yield bonds and bank loans, which typically have non‑investment‑grade credit ratings, are two segments that offer attractive all‑in yields despite tight credit spreads. High yield bonds and loans feature credit quality that has steadily improved since the global financial crisis, and their current yields more than compensate for their credit risk even if the economy weakens.

Financials expected to benefit from steeper yield curve

In equities, we favor the health care and energy sectors as well as financials, so 2025 could see a resurgence in value stocks over growth companies. Bank stocks in particular should benefit from expanding net interest margins as yield curves steepen with the Fed cutting rates. International small‑caps, with their relatively heavy weights in cyclically sensitive sectors like financials, consumer discretionary, and industrials, also fit this thesis.

Across international markets, Japanese equities stand out even after their strong performance in recent years. Corporate governance in Japan continues to improve. The country has finally succeeded in generating reflation and now needs to manage it effectively, but the level of uncertainty in Japan is meaningfully lower than in other developed markets.

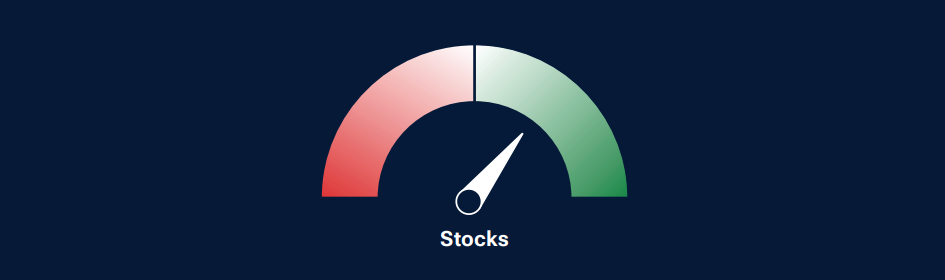

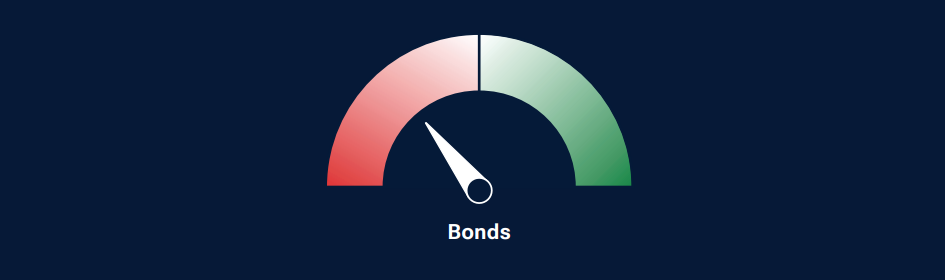

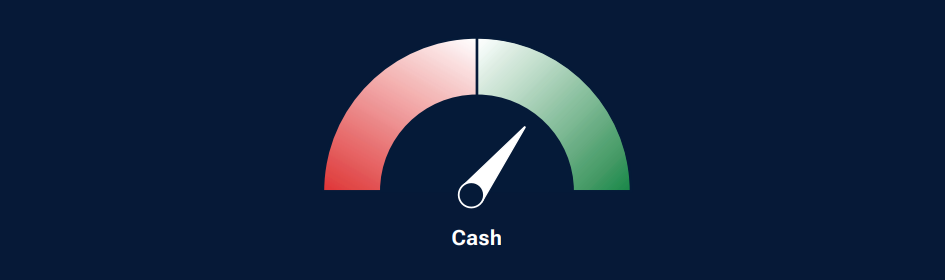

2025 Tactical allocation views

As of 31 October, 2024

Investment professionals from the T. Rowe Price Multi-Asset Division presents their views on the relative attractiveness of asset classes and subclasses over next 6 to 18 months.

1Diversification cannot assure a profit or protect against loss in a declining market.

2Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar‑maturity, high‑quality government security.

3The specific securities identified and described are for informational purposes

only and do not represent recommendations to buy or sell any security.

Source: AMD Advancing AI Event 2024 for 2028 estimates, and AI Chip Market- AMD Data Center and AI Technology Premier for 2023 estimates. Estimates provided are for the AI Chip Total Addressable Market (TAM). TAM is the total potential market for a product or service. There is no guarantee that any forecasts (AMD forecast, October 2024) made will come to pass and actual outcomes may differ materially.

Sign up to receive our monthly Global Asset Allocation Viewpoints from our Investment Committee

Each month, our Investment Committee prepare a report revealing the two market themes they are watching, their bull and bear views per region and their latest asset class over and underweights.

It has been designed to aid you in your decision making and client conversations.

Additional Disclosures

Copyright © 2024, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

The Funds are sub-funds of the T. Rowe Price Funds SICAV, a Luxembourg investment company with variable capital which is registered with Commission de Surveillance du Secteur Financier and which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). Full details of the objectives, investment policies and risks are located in the prospectus which is available with the key investor information documents (KIID) and/or key information document (KID) in English and in an official language of the jurisdictions in which the Funds are registered for public sale, together with the articles of incorporation and the annual and semi-annual reports (together “Fund Documents”). Any decision to invest should be made on the basis of the Fund Documents which are available free of charge from the local representative, local information/paying agent or from authorised distributors. They can also be found along with a summary of investor rights in English at www.troweprice.com. The Management Company reserves the right to terminate marketing arrangements.

EEA – Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

Switzerland - Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. First Independent Fund Services Ltd, Klausstrasse 33, CH-8008 Zurich is Representative in Switzerland. Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zurich is the Paying Agent in Switzerland. For Qualified Investors only.

UK – This material is issued and approved by T. Rowe Price International Ltd, Warwick Court, 5 Paternoster Square, London EC4M 7DX which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.